TX DO 2 Form

What is the TX DO 2

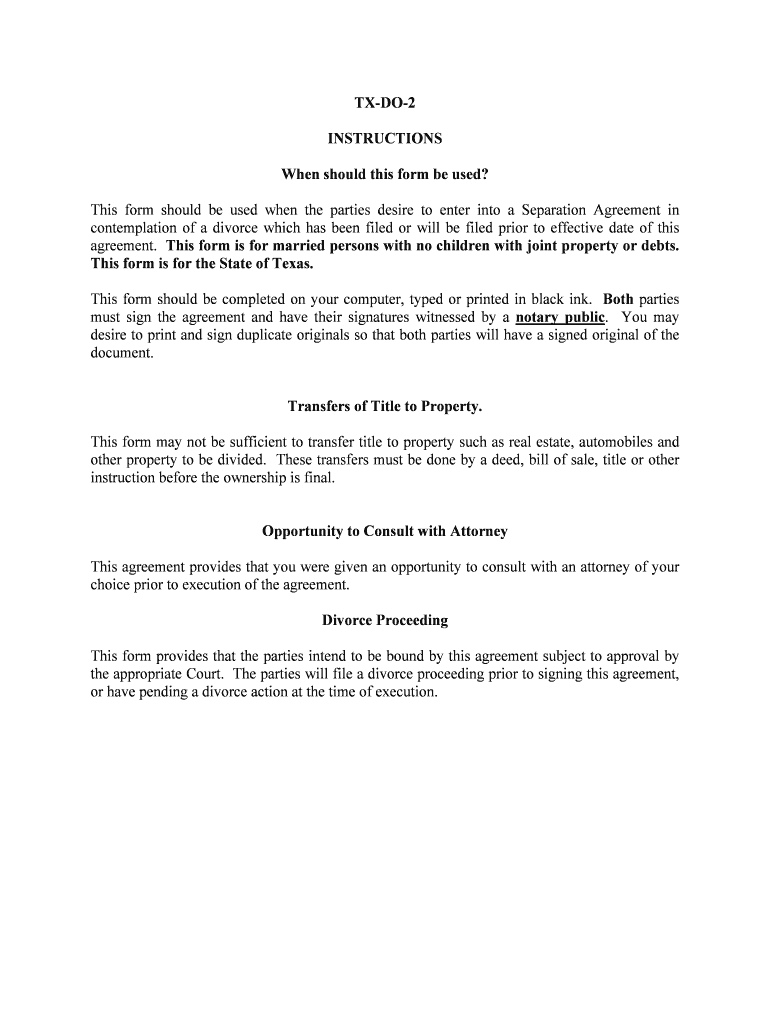

The TX DO 2 form is a specific document used in the state of Texas for various legal and administrative purposes. It is often associated with requests for information or documentation required by state agencies. Understanding the purpose and requirements of the TX DO 2 is essential for individuals and businesses to ensure compliance with local regulations.

How to use the TX DO 2

Using the TX DO 2 form involves several steps. First, gather all necessary information that may be required to complete the form accurately. This may include personal identification details, business information, or specific data related to the request. Next, fill out the form carefully, ensuring that all fields are completed as required. Once the form is completed, it can be submitted through the appropriate channels, whether online, by mail, or in person, depending on the specific instructions provided for the form.

Steps to complete the TX DO 2

Completing the TX DO 2 form requires attention to detail. Follow these steps for a smooth process:

- Review the form for clarity on what information is needed.

- Gather all required documents and information.

- Fill out the form, ensuring accuracy in all entries.

- Double-check for any errors or omissions.

- Submit the form according to the specified method.

Legal use of the TX DO 2

The TX DO 2 form must be used in accordance with Texas laws and regulations. It is important to ensure that the form is filled out correctly and submitted on time to avoid any legal repercussions. The use of electronic signatures is permitted, provided that they comply with the relevant eSignature laws, ensuring that the document remains legally binding and enforceable.

Required Documents

When completing the TX DO 2 form, certain documents may be required to support your submission. These documents could include:

- Proof of identity, such as a driver's license or state ID.

- Business registration documents, if applicable.

- Any additional paperwork specified in the form instructions.

Having these documents ready can streamline the process and help prevent delays.

Form Submission Methods

The TX DO 2 form can typically be submitted in several ways, depending on the specific requirements outlined by the issuing authority. Common submission methods include:

- Online submission through designated state portals.

- Mailing the completed form to the appropriate agency address.

- Submitting in person at designated offices or agencies.

It is essential to choose the method that best suits your needs and complies with the submission guidelines provided with the form.

Quick guide on how to complete tx do 2

Handle TX DO 2 effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents promptly without any holdups. Manage TX DO 2 on any device using airSlate SignNow's Android or iOS applications and enhance your document-centric workflows today.

How to adjust and eSign TX DO 2 with ease

- Obtain TX DO 2 and click Get Form to begin.

- Utilize the tools available to fill out your form.

- Highlight pertinent sections of the documents or redact confidential information using features that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional ink signature.

- Review all entered data and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searching, or mistakes that necessitate printing additional copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choosing. Revise and eSign TX DO 2 to ensure outstanding communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is TX DO 2 and how does it relate to airSlate SignNow?

TX DO 2 is a feature within airSlate SignNow that allows businesses in Texas to streamline their document signing processes. It helps simplify workflows, ensuring that contracts and agreements are executed quickly and securely. This feature is particularly valuable for organizations looking to enhance efficiency while adhering to Texas regulations.

-

What are the pricing options for airSlate SignNow with TX DO 2?

airSlate SignNow offers competitive pricing plans that include access to TX DO 2. Customers can choose from monthly or annual subscriptions based on their organization's needs. Each plan is designed to be cost-effective, catering to businesses of all sizes in Texas.

-

What features does TX DO 2 offer?

TX DO 2 includes various features such as customizable templates, in-person signing, and advanced authentication options. These features ensure that the document signing process is not only efficient but also secure and compliant. Users can easily manage their documents with intuitive tools provided by airSlate SignNow.

-

How does TX DO 2 benefit businesses in Texas?

TX DO 2 empowers Texas businesses by reducing the time and costs associated with manual document signing. It enhances productivity by automating the signing workflow, allowing employees to focus on core tasks. The use of TX DO 2 also leads to quicker turnaround times for contracts and agreements.

-

Can TX DO 2 integrate with other software?

Yes, TX DO 2 seamlessly integrates with various software applications, including CRM and project management tools. These integrations simplify the workflow and ensure that signed documents are automatically stored in the appropriate platforms. This enhances overall operational efficiency for businesses using airSlate SignNow.

-

Is TX DO 2 legally compliant for e-signatures in Texas?

Yes, TX DO 2 is fully compliant with Texas laws regarding electronic signatures. It adheres to legal standards ensuring that all e-signatures are valid and enforceable. Businesses can confidently use airSlate SignNow with TX DO 2 for their document signing needs.

-

How can customers support their use of TX DO 2?

Customers using TX DO 2 can access comprehensive support through airSlate SignNow. Whether it’s troubleshooting issues or exploring advanced features, the support team is available to assist. Additionally, customers can find helpful resources and tutorials on airSlate SignNow’s website.

Get more for TX DO 2

Find out other TX DO 2

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online

- eSignature New York Web Hosting Agreement Mobile

- eSignature North Carolina Web Hosting Agreement Secure

- How Do I eSignature Utah Web Hosting Agreement

- eSignature Connecticut Joint Venture Agreement Template Myself