Property at Your Death Form

What is the Property At Your Death

The Property At Your Death form is a legal document that outlines how your assets will be distributed after your passing. This form is essential for ensuring that your wishes regarding your property are honored. It typically includes details about your assets, beneficiaries, and any specific instructions you may have. By completing this form, you can help prevent disputes among heirs and ensure a smoother transition of your estate.

Steps to complete the Property At Your Death

Completing the Property At Your Death form involves several critical steps to ensure accuracy and compliance with legal requirements:

- Gather necessary information about your assets, including real estate, bank accounts, and personal property.

- Identify your beneficiaries, specifying who will receive each asset.

- Complete the form with accurate details, ensuring that all information is clear and precise.

- Sign the form in the presence of a witness or notary, as required by your state laws.

- Store the completed form in a secure location and inform your beneficiaries of its existence.

Legal use of the Property At Your Death

The legal use of the Property At Your Death form is to provide a clear directive on how your estate should be managed and distributed after your death. This form is recognized by courts and can help facilitate the probate process, ensuring that your wishes are legally binding. It is important to comply with state-specific laws regarding the execution and witnessing of this form to ensure its validity.

Key elements of the Property At Your Death

Several key elements must be included in the Property At Your Death form to ensure it is comprehensive and legally enforceable:

- Personal Information: Your full name, address, and date of birth.

- Asset Description: Detailed information about each asset, including location and value.

- Beneficiaries: Names and contact information of individuals or entities receiving your assets.

- Specific Instructions: Any particular wishes regarding the distribution of your assets.

- Signature and Date: Your signature and the date of completion, along with witness signatures if required.

State-specific rules for the Property At Your Death

Each state has its own laws and regulations governing the Property At Your Death form. It is essential to be aware of these state-specific rules to ensure compliance. For instance, some states may require notarization or witnesses for the form to be valid. Additionally, laws regarding the distribution of property can vary, affecting how assets are handled in probate. Consulting with a legal professional familiar with your state's requirements can provide clarity and ensure that your form meets all necessary legal standards.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Property At Your Death form can be done through various methods, depending on your preferences and state regulations:

- Online Submission: Some states allow electronic filing of the form through their official websites.

- Mail: You can print the completed form and send it via postal mail to the appropriate court or agency.

- In-Person: Submitting the form in person at your local probate court may be required in certain jurisdictions.

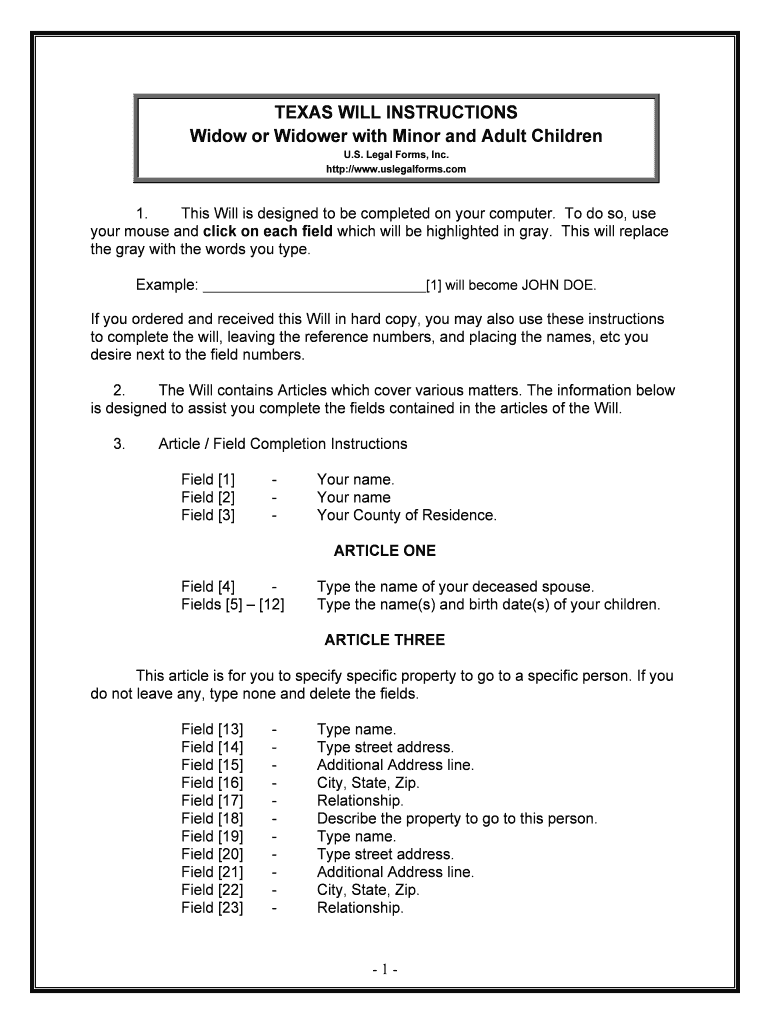

Quick guide on how to complete property at your death

Effortlessly Prepare Property At Your Death on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an excellent eco-conscious substitute for conventional printed and signed documents, as you can access the correct format and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly and without delays. Manage Property At Your Death on any platform with the airSlate SignNow apps for Android or iOS and simplify any document-related task today.

How to Change and Electronically Sign Property At Your Death with Ease

- Locate Property At Your Death and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of the documents or mask sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which only takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any chosen device. Modify and electronically sign Property At Your Death to ensure superior communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is meant by 'Property At Your Death'?

'Property At Your Death' refers to the assets and belongings that a person owns at the time of their passing. Understanding how these properties are managed and transferred can help ensure that your wishes are honored and your loved ones are taken care of.

-

How does airSlate SignNow help with managing Property At Your Death?

airSlate SignNow offers a seamless way to electronically sign and manage documents related to your estate plan, ensuring that your Property At Your Death is distributed according to your intentions. Our platform allows you to easily create, share, and securely store important documents, such as wills and trusts.

-

What features does airSlate SignNow offer for estate planning?

With airSlate SignNow, you can utilize features like template creation for your estate documents, easy document sharing for signature requests, and secure cloud storage to keep your important paperwork safe. These features simplify the management of your Property At Your Death.

-

Are there any costs associated with using airSlate SignNow for Property At Your Death documents?

Yes, airSlate SignNow offers tiered pricing plans that cater to different needs and budgets. Whether you're an individual managing your estate or a business handling multiple clients, you can find a plan that suits your requirements while ensuring effective management of your Property At Your Death.

-

Can I integrate airSlate SignNow with other applications for managing Property At Your Death?

Absolutely! airSlate SignNow can easily be integrated with a variety of applications, such as Dropbox, Google Drive, and various CRM systems. This integration allows for a more streamlined process when managing documents related to your Property At Your Death.

-

Is airSlate SignNow secure for handling sensitive Property At Your Death information?

Yes, airSlate SignNow prioritizes security by utilizing advanced encryption and secure cloud storage. Your sensitive information related to Property At Your Death is protected, ensuring privacy and compliance with industry standards.

-

How can I get started with airSlate SignNow for my Property At Your Death documentation?

Getting started with airSlate SignNow is easy! Simply sign up for an account, choose the appropriate plan, and begin creating or importing your documents related to Property At Your Death. Our user-friendly interface guides you through the process.

Get more for Property At Your Death

- Small claims court state of maine judicial branch form

- Equally per stirpes or form

- New york will instructions form

- Arizona mutual wills package of last us legal forms

- To do so use form

- Florida will instructions form

- This package is for use after you have changed your form

- Control number dc 00llc form

Find out other Property At Your Death

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe