Fair Credit Reporting Act Regulation V and Regulation FF Form

What is the Fair Credit Reporting Act Regulation V And Regulation FF

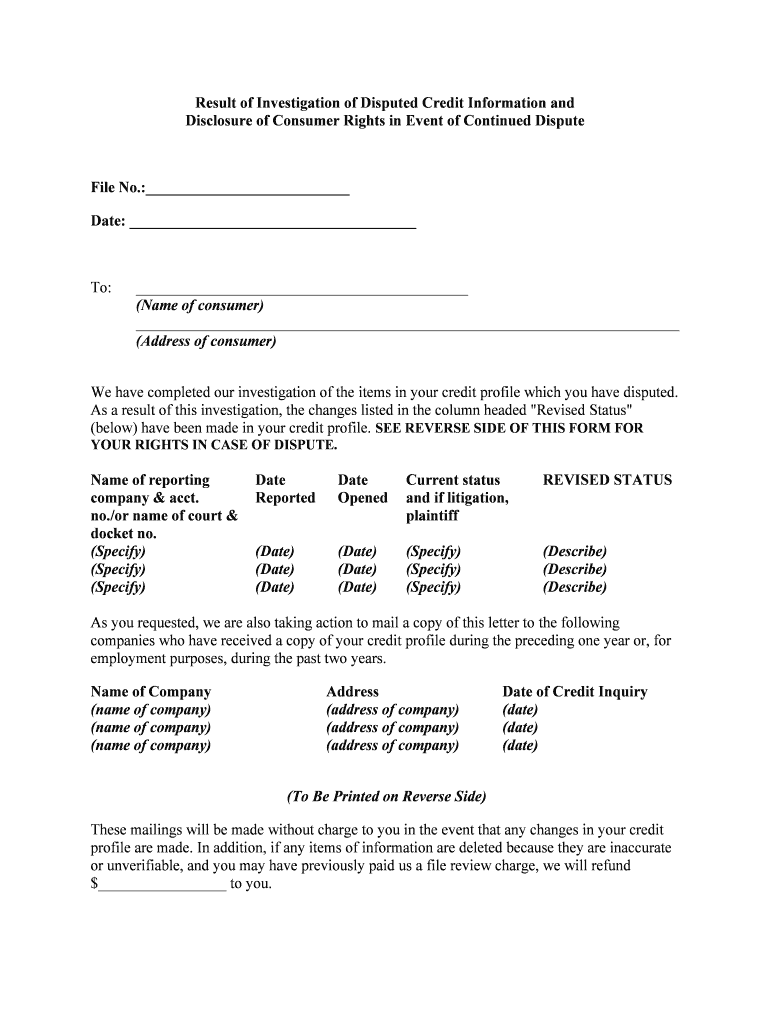

The Fair Credit Reporting Act (FCRA) is a federal law that regulates how consumer reporting agencies collect and use consumer information. Regulation V is a key component of the FCRA, focusing on the accuracy and privacy of consumer credit information. It mandates that consumer reporting agencies ensure the information they provide is accurate and up-to-date, while also granting consumers the right to dispute inaccuracies. Regulation FF, on the other hand, introduces additional protections for consumers, particularly in the context of credit reporting and the use of consumer reports in credit decisions. It aims to enhance transparency and accountability in the credit reporting process, ensuring that consumers have better access to their credit information.

How to use the Fair Credit Reporting Act Regulation V And Regulation FF

Using the Fair Credit Reporting Act Regulation V and Regulation FF involves understanding your rights as a consumer regarding credit reporting. Consumers can request their credit reports from agencies to verify the accuracy of the information. If inaccuracies are found, consumers have the right to dispute these errors with the reporting agency, which must investigate and respond within a specified timeframe. Additionally, Regulation FF provides guidelines for how lenders must inform consumers about their credit reporting practices, ensuring that consumers are aware of how their credit information is being used.

Steps to complete the Fair Credit Reporting Act Regulation V And Regulation FF

Completing the Fair Credit Reporting Act Regulation V and Regulation FF involves several steps to ensure compliance and protection of consumer rights:

- Request your credit report from major credit reporting agencies.

- Review the report for any inaccuracies or outdated information.

- If discrepancies are found, gather supporting documentation to dispute the errors.

- Submit a dispute to the credit reporting agency, including your identification and evidence of the inaccuracies.

- Monitor the status of your dispute and await the agency’s findings.

- Stay informed about your rights under Regulation FF, particularly regarding notifications from lenders.

Key elements of the Fair Credit Reporting Act Regulation V And Regulation FF

Key elements of the Fair Credit Reporting Act Regulation V and Regulation FF include:

- Consumer Rights: Consumers have the right to access their credit reports and dispute inaccuracies.

- Accuracy Requirements: Credit reporting agencies must ensure the accuracy of the information they provide.

- Notification Obligations: Lenders must inform consumers when their credit information is used in decision-making.

- Data Protection: Enhanced measures are in place to protect consumer data from unauthorized access.

Legal use of the Fair Credit Reporting Act Regulation V And Regulation FF

The legal use of the Fair Credit Reporting Act Regulation V and Regulation FF is crucial for both consumers and businesses. Consumers must be aware of their rights to ensure their credit information is handled properly. Businesses, particularly lenders and credit reporting agencies, must comply with these regulations to avoid legal penalties. Compliance includes maintaining accurate records, providing necessary disclosures, and allowing consumers to dispute inaccuracies. Failure to adhere to these regulations can result in significant fines and legal repercussions.

Examples of using the Fair Credit Reporting Act Regulation V And Regulation FF

Examples of using the Fair Credit Reporting Act Regulation V and Regulation FF can be seen in various scenarios:

- A consumer checking their credit report before applying for a mortgage to ensure there are no errors that could affect their loan approval.

- A lender notifying a consumer that their credit report was used to determine their eligibility for a credit card.

- A consumer disputing an incorrect late payment listed on their credit report, prompting an investigation by the credit reporting agency.

Quick guide on how to complete fair credit reporting act regulation v and regulation ff

Easily Prepare Fair Credit Reporting Act Regulation V And Regulation FF on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to quickly create, edit, and eSign your documents without delays. Manage Fair Credit Reporting Act Regulation V And Regulation FF on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related operation today.

Effortlessly Modify and eSign Fair Credit Reporting Act Regulation V And Regulation FF

- Locate Fair Credit Reporting Act Regulation V And Regulation FF and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information using the tools specifically provided by airSlate SignNow.

- Generate your signature with the Sign tool, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Select how you wish to deliver your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choosing. Alter and eSign Fair Credit Reporting Act Regulation V And Regulation FF to ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Fair Credit Reporting Act Regulation V And Regulation FF?

The Fair Credit Reporting Act Regulation V And Regulation FF are federal laws designed to promote the accuracy and privacy of consumer information held by credit reporting agencies. These regulations provide guidelines on how consumer credit data is handled and ensure that consumers have access to their credit information. Understanding these regulations is essential for businesses that handle sensitive consumer data.

-

How does airSlate SignNow comply with the Fair Credit Reporting Act Regulation V And Regulation FF?

AirSlate SignNow ensures compliance with the Fair Credit Reporting Act Regulation V And Regulation FF by implementing robust security measures and data handling practices. Our platform encrypts all documents and provides users with comprehensive audit trails for all eSignatures. This commitment to data protection helps businesses meet their legal obligations while using our services.

-

What features does airSlate SignNow offer that support compliance with Regulation V And Regulation FF?

AirSlate SignNow offers features like advanced security settings, user authentication, and document retention policies that support compliance with Regulation V And Regulation FF. These features help ensure that only authorized users can access sensitive documents and that all signed documents are securely stored. This reduces the risk of data bsignNowes and promotes compliance.

-

Is airSlate SignNow cost-effective for businesses needing compliance with Fair Credit Reporting Act Regulation V And Regulation FF?

Yes, airSlate SignNow is a cost-effective solution for businesses needing compliance with the Fair Credit Reporting Act Regulation V And Regulation FF. Our pricing plans are designed to fit a variety of budgets while providing all the necessary tools for secure document signing and management. This affordability ensures that even small businesses can meet regulatory requirements without overspending.

-

Can airSlate SignNow integrate with other tools for easier compliance with Regulation V And Regulation FF?

Absolutely! AirSlate SignNow seamlessly integrates with various third-party applications, enhancing your compliance efforts with Regulation V And Regulation FF. Whether you use CRM systems, project management tools, or cloud storage solutions, our integrations allow for smooth data flow and efficient document management. This interoperability makes compliance easier for your business.

-

What are the benefits of using airSlate SignNow specifically for compliance with the Fair Credit Reporting Act Regulation V And Regulation FF?

Using airSlate SignNow for compliance with the Fair Credit Reporting Act Regulation V And Regulation FF provides businesses with enhanced document security, audit trails, and user-friendly eSigning capabilities. These benefits streamline your compliance processes and reduce the risk of errors. Additionally, our software helps ensure that your client interactions meet legal expectations efficiently.

-

How can businesses ensure they are using airSlate SignNow in accordance with Regulation V And Regulation FF?

Businesses can ensure they are using airSlate SignNow in accordance with Regulation V And Regulation FF by regularly reviewing their data handling and privacy policies. We recommend conducting compliance training for employees and utilizing our support resources for best practices. By aligning your document practices with these regulations, you can minimize risk and enhance consumer trust.

Get more for Fair Credit Reporting Act Regulation V And Regulation FF

- Theron l form

- East asian languages ampamp cultures mauniversity of illinois form

- Pharmacology and toxicology bsuniversity of wisconsin form

- Secondary applications ucsf medical education form

- Chenyu zhang phd student in molecular ampampamp cellular biology form

- Hill request form

- 2012 2013 financial aid information form quincy college

- Emergency grant in aid stanford financial aid stanford university form

Find out other Fair Credit Reporting Act Regulation V And Regulation FF

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile