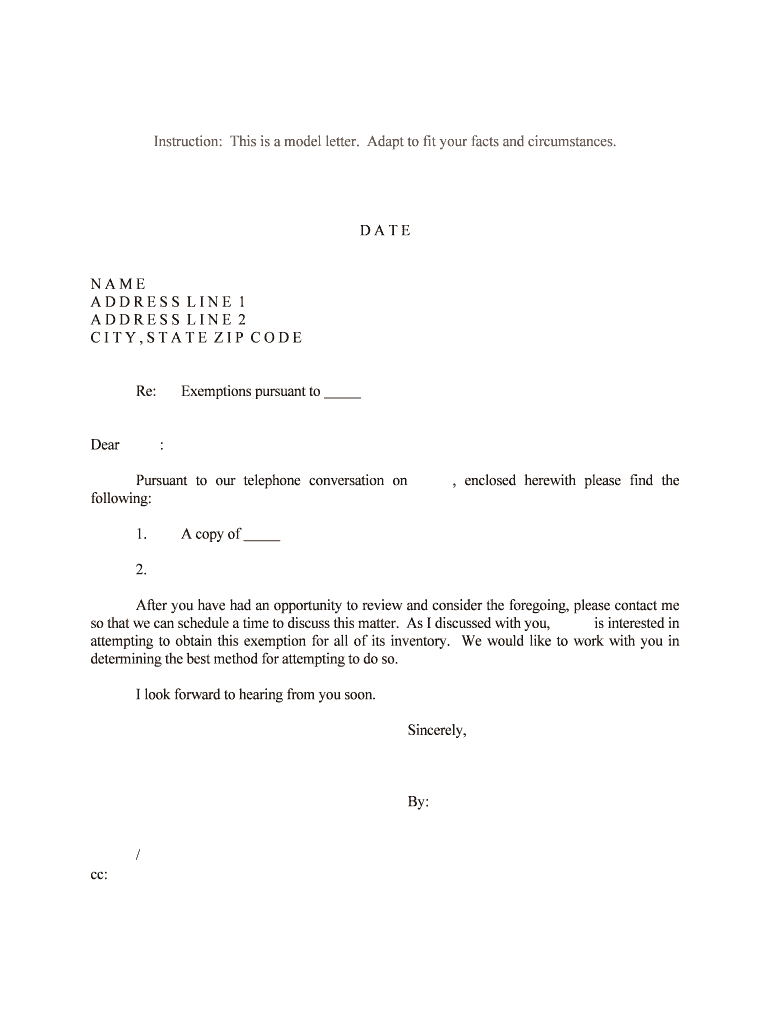

Exemptions Pursuant to Form

What is the Exemptions Pursuant To

The term "Exemptions Pursuant To" refers to specific provisions within tax law or regulations that allow individuals or entities to qualify for certain exemptions from standard requirements. These exemptions can be critical in reducing tax liabilities or fulfilling compliance obligations. Understanding the nuances of these exemptions is essential for taxpayers and businesses alike, as they can significantly impact financial outcomes.

Steps to complete the Exemptions Pursuant To

Completing the Exemptions Pursuant To form involves several key steps to ensure accuracy and compliance. Begin by gathering all necessary documentation that supports your claim for exemption. This may include financial records, identification information, and any relevant legal documents. Next, fill out the form carefully, ensuring that all fields are completed accurately. Review the form for any errors or omissions before submission. Finally, submit the form through the appropriate channel, whether online, by mail, or in person, depending on the specific requirements of your jurisdiction.

Legal use of the Exemptions Pursuant To

The legal use of the Exemptions Pursuant To form is governed by specific regulations and guidelines set forth by tax authorities. To ensure that the form is legally binding, it must be completed in accordance with these regulations. This includes providing accurate information and supporting documentation. Additionally, the form must be signed and dated as required, which may involve using a digital signature solution that complies with the ESIGN Act and UETA. Understanding these legal requirements is crucial for maintaining compliance and avoiding potential penalties.

Eligibility Criteria

Eligibility for exemptions pursuant to specific regulations often depends on various factors, including income level, business type, and specific circumstances surrounding the taxpayer. For example, certain exemptions may be available to non-profit organizations, educational institutions, or individuals meeting specific income thresholds. It is important to review the eligibility criteria carefully to determine if you qualify for any exemptions before completing the form.

Required Documents

When preparing to submit the Exemptions Pursuant To form, several documents may be required to substantiate your claim. Commonly required documents include proof of income, tax returns, identification, and any supporting materials that demonstrate eligibility for the exemption. Having these documents ready can streamline the process and help ensure that your application is processed without delays.

Filing Deadlines / Important Dates

Filing deadlines for the Exemptions Pursuant To form can vary based on the specific exemption and jurisdiction. It is essential to be aware of these deadlines to avoid late submissions, which can lead to penalties or loss of eligibility. Typically, deadlines align with tax filing seasons or specific regulatory timelines. Staying informed about these important dates is crucial for timely compliance.

Examples of using the Exemptions Pursuant To

Examples of using the Exemptions Pursuant To form can include scenarios such as a small business applying for a tax exemption based on its non-profit status, or an individual claiming an exemption due to low income. Each example highlights how different entities can leverage these exemptions to reduce their tax burden or fulfill compliance requirements. Understanding these practical applications can provide valuable insights into how to effectively utilize the form.

Quick guide on how to complete exemptions pursuant to

Complete Exemptions Pursuant To effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Exemptions Pursuant To on any device using airSlate SignNow's Android or iOS applications and enhance any document-based procedure today.

The simplest way to adjust and electronically sign Exemptions Pursuant To without hassle

- Find Exemptions Pursuant To and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Highlight important sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and carries the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from a device of your choice. Modify and electronically sign Exemptions Pursuant To and ensure outstanding communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What are Exemptions Pursuant To applicable in electronic signatures?

Exemptions pursuant to electronic signatures often pertain to specific legal requirements that allow certain documents not to require eSignatures. Understanding these exemptions is crucial when using airSlate SignNow, as it helps ensure compliance with regulations. We recommend consulting with legal advisors to clarify which documents may fall under these exemptions.

-

How does airSlate SignNow ensure compliance with Exemptions Pursuant To?

airSlate SignNow incorporates robust compliance features, ensuring that all eSigned documents meet the necessary legal standards. Our platform provides advanced tracking and audit trails that can support claims of compliance with exemptions pursuant to specific regulations. By using airSlate SignNow, you can maintain assurance in the legality of your digital agreements.

-

Are there pricing options for services related to Exemptions Pursuant To?

Yes, airSlate SignNow provides flexible pricing plans that accommodate various business needs, including services related to exemptions pursuant to electronic signatures. Our tiered pricing structure allows you to choose a plan that suits your volume of documents and specific compliance needs. Contact our sales team to customize a solution that meets your requirements.

-

What features does airSlate SignNow offer for understanding Exemptions Pursuant To?

airSlate SignNow offers several features designed to help you navigate exemptions pursuant to signing regulations. These include extensive document templates, customizable workflows, and compliance checklists that guide users through the necessary steps. Additionally, our comprehensive resources provide valuable insights into legal exemptions.

-

Can I integrate airSlate SignNow with other tools to manage Exemptions Pursuant To?

Absolutely! airSlate SignNow seamlessly integrates with popular business tools and software, allowing for streamlined management of documents and compliance with exemptions pursuant to electronic signatures. By connecting your preferred systems, you can enhance productivity and ensure all necessary documents remain compliant with your operational requirements.

-

What are the benefits of using airSlate SignNow for managing Exemptions Pursuant To?

Using airSlate SignNow for managing exemptions pursuant to electronic signatures can signNowly reduce paperwork and enhance efficiency in your workflows. Our cost-effective solution allows businesses to eSign documents quickly while ensuring compliance with relevant exemptions. This ultimately leads to faster transaction completion and improved operational flow.

-

Is airSlate SignNow suitable for businesses unfamiliar with Exemptions Pursuant To?

Yes, airSlate SignNow is designed to be user-friendly and approachable, making it suitable for businesses that may be unfamiliar with exemptions pursuant to electronic signature laws. Our platform includes educational materials and customer support to assist users in navigating the complexities of electronic signature compliance. Getting started is easy, even if you're new to eSigning.

Get more for Exemptions Pursuant To

Find out other Exemptions Pursuant To

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer

- How To Electronic signature Missouri Lawers Job Description Template

- Electronic signature Lawers Word Nevada Computer

- Can I Electronic signature Alabama Legal LLC Operating Agreement

- How To Electronic signature North Dakota Lawers Job Description Template

- Electronic signature Alabama Legal Limited Power Of Attorney Safe

- How To Electronic signature Oklahoma Lawers Cease And Desist Letter

- How To Electronic signature Tennessee High Tech Job Offer

- Electronic signature South Carolina Lawers Rental Lease Agreement Online

- How Do I Electronic signature Arizona Legal Warranty Deed

- How To Electronic signature Arizona Legal Lease Termination Letter

- How To Electronic signature Virginia Lawers Promissory Note Template

- Electronic signature Vermont High Tech Contract Safe