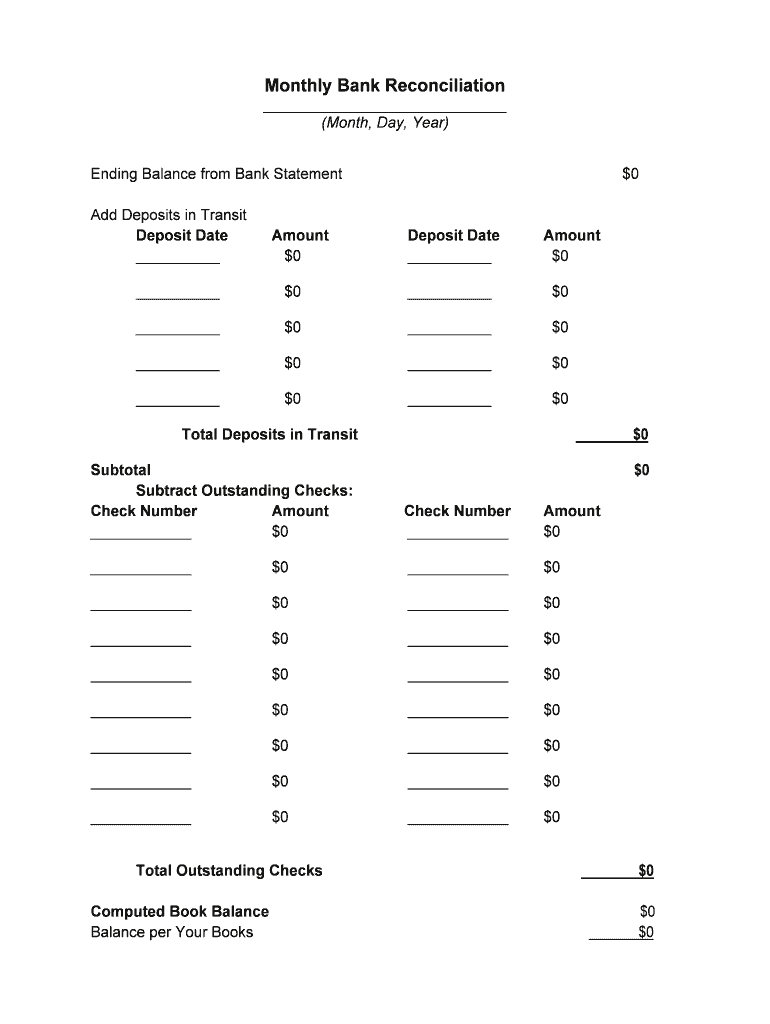

Ending Balance from Bank Statement Form

What is the Ending Balance From Bank Statement

The ending balance from a bank statement represents the total amount of money available in an account at the end of a specific period. This figure is crucial for individuals and businesses, as it provides a snapshot of financial health and aids in budgeting and financial planning. It includes all transactions processed during the statement period, such as deposits, withdrawals, and any fees incurred.

How to Obtain the Ending Balance From Bank Statement

To obtain the ending balance from your bank statement, you can follow these steps:

- Log into your online banking account.

- Navigate to the account summary or statements section.

- Select the specific statement period you wish to review.

- Locate the ending balance, typically found at the bottom of the statement.

If you prefer a physical copy, you can request a printed statement from your bank's customer service or visit a local branch.

Steps to Complete the Ending Balance From Bank Statement

Completing the ending balance from a bank statement form involves several key steps:

- Gather all relevant transaction records for the statement period.

- Review your account transactions to ensure accuracy.

- Calculate the total deposits and withdrawals to verify the ending balance.

- Fill out the form with the calculated ending balance, ensuring all information is accurate.

Double-check your entries before submitting the form to avoid discrepancies.

Legal Use of the Ending Balance From Bank Statement

The ending balance from a bank statement can serve various legal purposes, including loan applications, tax filings, and financial disclosures. It is essential to ensure that the information provided is accurate and up-to-date, as inaccuracies can lead to legal complications or financial penalties. When used in legal contexts, it may need to be accompanied by additional documentation to support its validity.

Key Elements of the Ending Balance From Bank Statement

Several key elements contribute to the accuracy and utility of the ending balance from a bank statement:

- Transaction Date: The date each transaction occurred.

- Description: A brief explanation of each transaction.

- Amount: The total of each deposit or withdrawal.

- Fees: Any bank charges that may affect the ending balance.

Understanding these elements helps ensure that users can accurately interpret their financial statements.

Examples of Using the Ending Balance From Bank Statement

The ending balance from a bank statement can be used in various scenarios:

- Applying for a mortgage, where lenders require proof of financial stability.

- Filing taxes, especially for self-employed individuals who need to report income accurately.

- Budgeting for personal or business expenses by tracking available funds.

These examples highlight the importance of maintaining accurate records and understanding how to utilize the ending balance effectively.

Quick guide on how to complete ending balance from bank statement

Effortlessly prepare Ending Balance From Bank Statement on any device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent environmentally friendly substitute for conventional printed and signed documents, as you can access the necessary form and securely keep it online. airSlate SignNow equips you with all the resources you require to create, modify, and eSign your documents swiftly without delays. Handle Ending Balance From Bank Statement on any device using airSlate SignNow Android or iOS applications and enhance any document-oriented process today.

The easiest way to modify and eSign Ending Balance From Bank Statement with ease

- Locate Ending Balance From Bank Statement and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature with the Sign feature, which takes only seconds and holds the same legal validity as a traditional handwritten signature.

- Review the details and click the Done button to save your changes.

- Select how you prefer to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign Ending Balance From Bank Statement while ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the Ending Balance From Bank Statement feature in airSlate SignNow?

The Ending Balance From Bank Statement feature in airSlate SignNow helps users easily integrate their bank statements into the document signing process. This allows for clear visibility of financial information, ensuring accuracy during eSigning and document preparation. By utilizing this feature, businesses can enhance their workflow efficiency and trust in financial transactions.

-

How does airSlate SignNow handle the security of documents related to Ending Balance From Bank Statement?

Security is a top priority for airSlate SignNow, especially when dealing with sensitive information like the Ending Balance From Bank Statement. All documents are encrypted in transit and at rest, ensuring that data is protected from unauthorized access. Additionally, compliant with various regulations, our platform guarantees confidentiality and integrity for all your financial documents.

-

Can I customize documents that include Ending Balance From Bank Statement?

Yes, airSlate SignNow offers robust customization options for documents that include the Ending Balance From Bank Statement. Users can add their branding, create unique templates, and insert fields that capture necessary information. This ensures that your documents are not only functional but also reflect your business's identity.

-

What are the pricing plans for using airSlate SignNow with features related to Ending Balance From Bank Statement?

airSlate SignNow offers several pricing plans designed to accommodate different business needs, including features for managing the Ending Balance From Bank Statement. Each plan provides scalable options, so whether you are a small business or a large enterprise, you can find a cost-effective solution that fits your budget. For detailed pricing, visit our website to explore the best plan for your requirements.

-

Is there a trial period for airSlate SignNow to test the Ending Balance From Bank Statement feature?

Yes, airSlate SignNow offers a free trial period that allows you to test all features, including those related to Ending Balance From Bank Statement. This trial gives users the opportunity to fully explore the platform and assess its benefits before committing to a subscription. Sign up today and experience how easy it is to manage your financial documents.

-

What integrations does airSlate SignNow offer for managing Ending Balance From Bank Statement?

airSlate SignNow integrates with several financial software and systems, making it easier to manage your Ending Balance From Bank Statement. These integrations streamline the process of importing data directly from your accounting software, ensuring that all information is up-to-date and accurate. This flexibility enhances your overall document management experience.

-

How can airSlate SignNow improve collaboration around documents with Ending Balance From Bank Statement?

AirSlate SignNow facilitates collaboration by allowing multiple users to access and eSign documents that include the Ending Balance From Bank Statement. The platform provides real-time updates and notifications, so team members can track changes and stay informed. This collaborative environment enhances efficiency and decision-making in your business processes.

Get more for Ending Balance From Bank Statement

Find out other Ending Balance From Bank Statement

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself