Il Tax Forms 2019

What is the Il Tax Forms

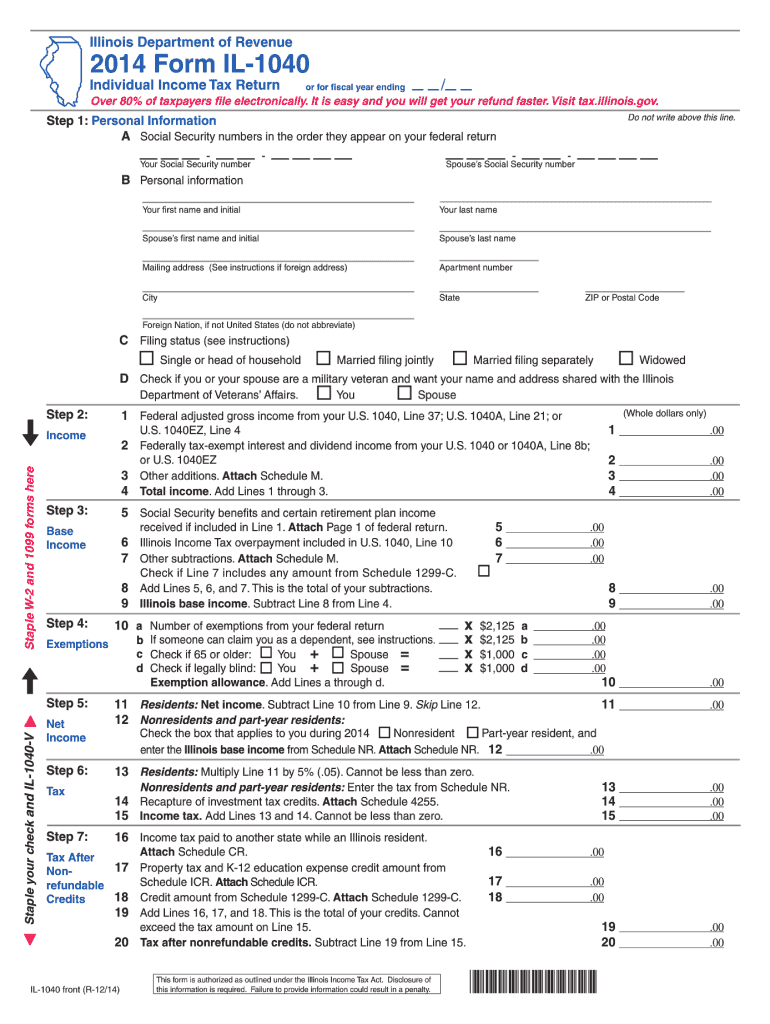

The Il Tax Forms are essential documents used by individuals and businesses in Illinois to report income, claim deductions, and calculate tax liabilities. These forms are crucial for complying with state tax laws and ensuring accurate reporting to the Illinois Department of Revenue. Various types of Il Tax Forms cater to different taxpayers, including individuals, corporations, and partnerships, each serving specific purposes in the tax filing process.

How to use the Il Tax Forms

Using the Il Tax Forms involves several steps to ensure accurate completion and submission. Begin by selecting the appropriate form based on your tax situation, such as the IL-1040 for individual income tax or the IL-1120 for corporate income tax. After obtaining the correct form, gather all necessary financial documents, including W-2s, 1099s, and any relevant receipts for deductions. Follow the instructions carefully to fill out the form, ensuring that all information is accurate and complete before submission.

Steps to complete the Il Tax Forms

Completing the Il Tax Forms requires a systematic approach:

- Identify the correct form based on your filing status.

- Gather necessary documents, including income statements and deduction records.

- Carefully fill out the form, ensuring accuracy in all entries.

- Review the completed form for any errors or omissions.

- Submit the form by the designated deadline, either electronically or via mail.

Legal use of the Il Tax Forms

The legal use of the Il Tax Forms is governed by state tax laws, which require that all submitted forms be truthful and complete. Providing false information can lead to penalties, including fines and interest on unpaid taxes. It is essential to understand the legal implications of filing these forms, as they serve as official records of income and tax obligations. Compliance with all applicable laws ensures that taxpayers avoid legal issues and maintain good standing with the Illinois Department of Revenue.

Filing Deadlines / Important Dates

Filing deadlines for the Il Tax Forms vary depending on the type of form and the taxpayer's situation. Generally, individual income tax returns are due on April 15 each year, while corporate tax returns may have different deadlines based on the fiscal year. It is important to stay informed about these dates to avoid late filing penalties. Mark your calendar with any relevant deadlines to ensure timely submission of your tax forms.

Form Submission Methods (Online / Mail / In-Person)

There are several methods for submitting Il Tax Forms, providing flexibility for taxpayers. Forms can be submitted electronically through the Illinois Department of Revenue's online portal, which is often the fastest and most efficient method. Alternatively, taxpayers can mail their completed forms to the appropriate address or submit them in person at designated locations. Each method has its own processing times and requirements, so it is advisable to choose the one that best suits your needs.

Quick guide on how to complete il tax forms 2014

Complete Il Tax Forms effortlessly on any device

Managing documents online has gained popularity among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to acquire the proper form and securely store it in the cloud. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Handle Il Tax Forms on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

How to modify and eSign Il Tax Forms with ease

- Locate Il Tax Forms and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools designed specifically for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to share your form, whether by email, text message (SMS), invite link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in a few clicks from any device you prefer. Alter and eSign Il Tax Forms and guarantee effective communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct il tax forms 2014

Create this form in 5 minutes!

How to create an eSignature for the il tax forms 2014

How to generate an electronic signature for a PDF document in the online mode

How to generate an electronic signature for a PDF document in Chrome

The way to generate an eSignature for putting it on PDFs in Gmail

The best way to generate an electronic signature right from your mobile device

How to make an eSignature for a PDF document on iOS devices

The best way to generate an electronic signature for a PDF on Android devices

People also ask

-

What are Il Tax Forms and why are they important?

Il Tax Forms are essential documents that taxpayers must file to report their income and calculate their taxes owed. These forms help ensure compliance with tax regulations and can lead to potential refunds or liabilities. Understanding Il Tax Forms is crucial for individuals and businesses alike to avoid penalties and streamline their tax processes.

-

How does airSlate SignNow facilitate signing Il Tax Forms?

AirSlate SignNow simplifies the signing process of Il Tax Forms by providing an intuitive platform that allows users to electronically sign documents securely. With features like templates and mobile accessibility, you can easily complete and send your Il Tax Forms without the hassle of printing or mailing. This efficiency saves time and ensures your forms are filed promptly.

-

What pricing options does airSlate SignNow offer for Il Tax Forms solutions?

AirSlate SignNow offers competitive pricing plans tailored to meet various business needs for managing Il Tax Forms. Plans are designed to accommodate small businesses to large enterprises, ensuring affordability without compromising on features. You can select a plan that aligns with your organization’s signing volume and requirements.

-

Are there any integrations available for managing Il Tax Forms with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications such as Google Drive, Salesforce, and Zapier, making it easy to manage Il Tax Forms in your existing workflow. These integrations enhance productivity by allowing you to automate the signing process and easily retrieve documents. You can sync your data and keep everything organized effortlessly.

-

What are the key benefits of using airSlate SignNow for Il Tax Forms?

Using airSlate SignNow for Il Tax Forms offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced security. Users can leverage features like audit trails, templates, and reminders to manage their forms effectively. Moreover, the cost-effective nature of the solution helps businesses save on printing and postage.

-

Is airSlate SignNow compliant with tax regulations for Il Tax Forms?

Yes, airSlate SignNow adheres to the highest security standards and complies with relevant regulations for electronic signatures on Il Tax Forms. Our platform incorporates advanced encryption technologies to protect sensitive information during transactions. This compliance ensures that your electronically signed forms are valid and recognized by tax authorities.

-

Can I track the status of my Il Tax Forms with airSlate SignNow?

Absolutely! AirSlate SignNow offers real-time tracking features that allow you to monitor the status of your Il Tax Forms. You will receive notifications when documents are viewed, signed, or completed, ensuring you stay updated throughout the process. This transparency helps you manage your tax filing efficiently.

Get more for Il Tax Forms

Find out other Il Tax Forms

- eSignature Maryland Roommate Rental Agreement Template Free

- How Do I eSignature California Lodger Agreement Template

- eSignature Kentucky Lodger Agreement Template Online

- eSignature North Carolina Lodger Agreement Template Myself

- eSignature Alabama Storage Rental Agreement Free

- eSignature Oregon Housekeeping Contract Computer

- eSignature Montana Home Loan Application Online

- eSignature New Hampshire Home Loan Application Online

- eSignature Minnesota Mortgage Quote Request Simple

- eSignature New Jersey Mortgage Quote Request Online

- Can I eSignature Kentucky Temporary Employment Contract Template

- eSignature Minnesota Email Cover Letter Template Fast

- How To eSignature New York Job Applicant Rejection Letter

- How Do I eSignature Kentucky Executive Summary Template

- eSignature Hawaii CV Form Template Mobile

- eSignature Nevada CV Form Template Online

- eSignature Delaware Software Development Proposal Template Now

- eSignature Kentucky Product Development Agreement Simple

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now