IL 941 X, Amended Illinois Withholding Income Tax Return 2020

What is the IL 941 X, Amended Illinois Withholding Income Tax Return

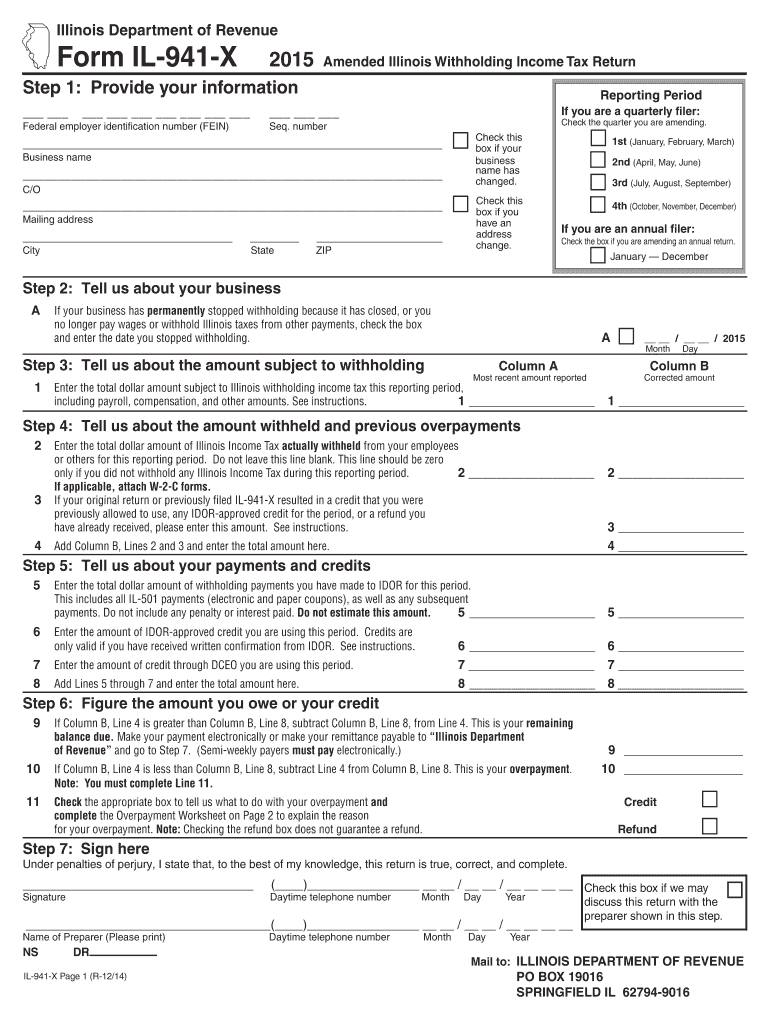

The IL 941 X, Amended Illinois Withholding Income Tax Return, is a form used by employers in Illinois to correct errors on previously submitted Illinois Withholding Income Tax Returns (IL-941). This form allows businesses to amend their withholding tax information for a specific quarter, ensuring that the correct amounts are reported to the Illinois Department of Revenue. It is essential for maintaining compliance with state tax regulations and for ensuring accurate tax records.

Steps to complete the IL 941 X, Amended Illinois Withholding Income Tax Return

Completing the IL 941 X involves several key steps to ensure accuracy and compliance. First, gather all relevant information from the original IL-941 form that needs correction. Next, clearly indicate the specific changes being made in the designated sections of the IL 941 X. Ensure that all calculations are accurate, as errors can lead to further complications. Finally, review the completed form for any discrepancies before submission to avoid delays in processing.

Legal use of the IL 941 X, Amended Illinois Withholding Income Tax Return

The IL 941 X is legally recognized as a valid document for amending withholding tax returns in Illinois. To ensure its legal standing, the form must be completed accurately and submitted within the appropriate timeframe. Employers should retain copies of both the original and amended forms for their records, as these may be required for future audits or inquiries by the Illinois Department of Revenue.

Form Submission Methods for the IL 941 X

The IL 941 X can be submitted through various methods to accommodate different preferences. Employers may choose to file the form electronically through the Illinois Department of Revenue's online portal, which offers a streamlined process. Alternatively, the form can be printed and mailed directly to the department. In-person submissions may also be possible at designated state offices, providing flexibility for those who prefer face-to-face interactions.

Filing Deadlines for the IL 941 X

Filing deadlines for the IL 941 X are crucial for compliance. Employers must submit the amended return within three years of the original filing date or within one year of the date the tax was paid, whichever is later. Missing these deadlines can result in penalties or the inability to make necessary corrections. It is advisable to mark these dates on your calendar to ensure timely submissions.

Key elements of the IL 941 X, Amended Illinois Withholding Income Tax Return

Key elements of the IL 941 X include the identification of the employer, the specific quarter being amended, and detailed explanations of the changes being made. Additionally, the form requires accurate calculations of the amended withholding amounts. Providing thorough and precise information in these sections is essential for the successful processing of the amendment.

Quick guide on how to complete 2019 il 941 x amended illinois withholding income tax return

Complete IL 941 X, Amended Illinois Withholding Income Tax Return effortlessly on any device

Online document management has gained immense popularity with businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources needed to create, modify, and eSign your documents quickly and without hassle. Handle IL 941 X, Amended Illinois Withholding Income Tax Return on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign IL 941 X, Amended Illinois Withholding Income Tax Return seamlessly

- Obtain IL 941 X, Amended Illinois Withholding Income Tax Return and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or obscure confidential information with features that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign tool, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your adjustments.

- Choose how you wish to send your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searching, or errors that require new document copies. airSlate SignNow fulfills your document management needs within just a few clicks from any device you prefer. Modify and eSign IL 941 X, Amended Illinois Withholding Income Tax Return and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2019 il 941 x amended illinois withholding income tax return

Create this form in 5 minutes!

How to create an eSignature for the 2019 il 941 x amended illinois withholding income tax return

How to generate an electronic signature for a PDF online

How to generate an electronic signature for a PDF in Google Chrome

The way to create an eSignature for signing PDFs in Gmail

The best way to generate an eSignature straight from your smartphone

How to make an eSignature for a PDF on iOS

The best way to generate an eSignature for a PDF document on Android

People also ask

-

What is the purpose of the IL 941 X, Amended Illinois Withholding Income Tax Return?

The IL 941 X, Amended Illinois Withholding Income Tax Return, allows taxpayers to correct any errors made on their original withholding tax return. This ensures that your withholding records are accurate, which is crucial for compliance with Illinois tax regulations.

-

How can airSlate SignNow help with submitting the IL 941 X, Amended Illinois Withholding Income Tax Return?

airSlate SignNow provides a streamlined solution for electronically signing and sending your IL 941 X, Amended Illinois Withholding Income Tax Return. This user-friendly platform simplifies the entire process, ensuring your amended returns are filed promptly and securely.

-

What are the costs associated with using airSlate SignNow for IL 941 X, Amended Illinois Withholding Income Tax Return?

airSlate SignNow offers cost-effective pricing plans that cater to businesses of all sizes. By using our platform to handle your IL 941 X, Amended Illinois Withholding Income Tax Return, you can save on traditional mailing costs while ensuring quicker processing times.

-

What features does airSlate SignNow offer for managing IL 941 X, Amended Illinois Withholding Income Tax Return?

AirSlate SignNow includes features such as document templates, real-time tracking, and secure storage, which enhance the experience of managing your IL 941 X, Amended Illinois Withholding Income Tax Return. These features ensure that your documents are organized, easily accessible, and securely signed.

-

Is it easy to integrate airSlate SignNow with other applications for IL 941 X, Amended Illinois Withholding Income Tax Return?

Yes, airSlate SignNow seamlessly integrates with various business applications, making it easy to incorporate the IL 941 X, Amended Illinois Withholding Income Tax Return into your existing workflow. This ensures a smooth transition and enhances overall efficiency for users.

-

Can airSlate SignNow help ensure compliance with Illinois tax laws when filing IL 941 X?

Absolutely. By using airSlate SignNow to manage your IL 941 X, Amended Illinois Withholding Income Tax Return, you benefit from features that promote compliance. Our platform guides you through the necessary steps to ensure that your returns meet all Illinois tax obligations.

-

What support does airSlate SignNow offer for questions about IL 941 X, Amended Illinois Withholding Income Tax Return?

airSlate SignNow provides comprehensive customer support that is available to assist with any inquiries related to the IL 941 X, Amended Illinois Withholding Income Tax Return. Our team is trained to answer your questions and guide you through the process efficiently.

Get more for IL 941 X, Amended Illinois Withholding Income Tax Return

Find out other IL 941 X, Amended Illinois Withholding Income Tax Return

- How To eSignature West Virginia Police POA

- eSignature Rhode Island Real Estate Letter Of Intent Free

- eSignature Rhode Island Real Estate Business Letter Template Later

- eSignature South Dakota Real Estate Lease Termination Letter Simple

- eSignature Tennessee Real Estate Cease And Desist Letter Myself

- How To eSignature New Mexico Sports Executive Summary Template

- Can I eSignature Utah Real Estate Operating Agreement

- eSignature Vermont Real Estate Warranty Deed Online

- eSignature Vermont Real Estate Operating Agreement Online

- eSignature Utah Real Estate Emergency Contact Form Safe

- eSignature Washington Real Estate Lease Agreement Form Mobile

- How Can I eSignature New York Sports Executive Summary Template

- eSignature Arkansas Courts LLC Operating Agreement Now

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online