Il1120 Form 2019

What is the Il1120 Form

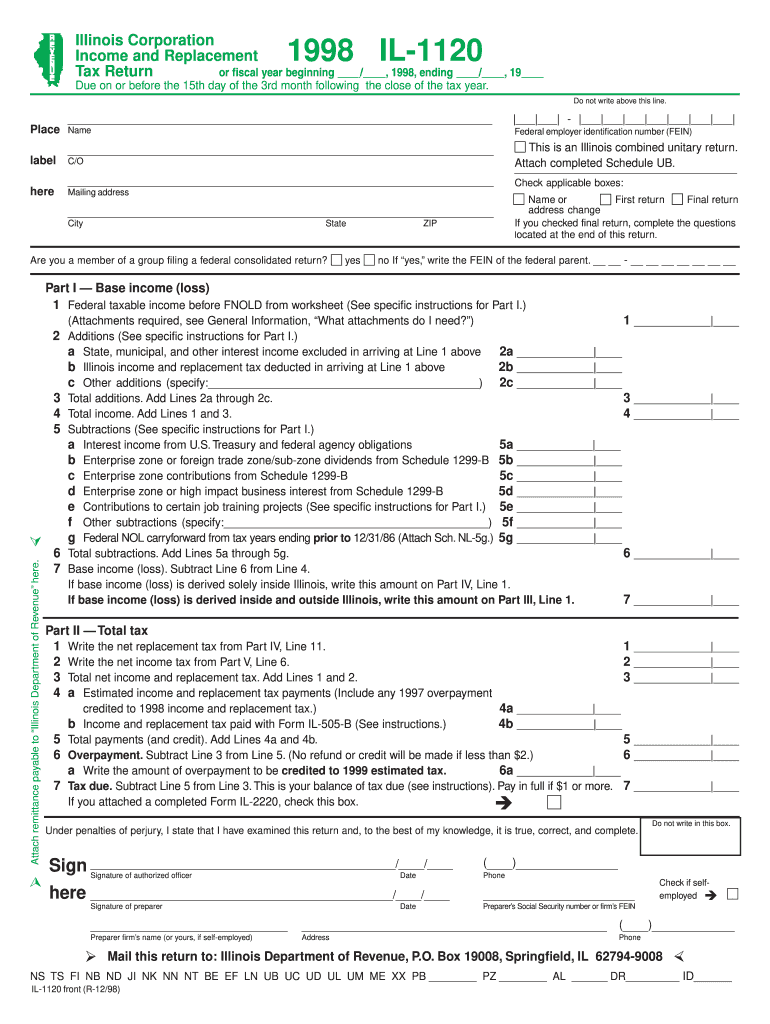

The Il1120 Form is a tax document used by corporations in Illinois to report their income, calculate their tax liability, and provide necessary financial information to the state. This form is essential for ensuring compliance with state tax regulations and is typically filed annually. Corporations must accurately complete this form to avoid penalties and ensure that they fulfill their tax obligations effectively.

How to use the Il1120 Form

To use the Il1120 Form, corporations must gather all relevant financial data, including income, expenses, and deductions. The form requires detailed reporting of various financial aspects, such as gross receipts, cost of goods sold, and other income. Once the necessary information is compiled, businesses can fill out the form, ensuring all sections are completed accurately. After completion, the form must be submitted to the Illinois Department of Revenue by the designated deadline.

Steps to complete the Il1120 Form

Completing the Il1120 Form involves several key steps:

- Gather financial records, including income statements and balance sheets.

- Fill out the form, starting with basic information about the corporation, such as name and address.

- Report total income, including sales and other revenue sources.

- Deduct allowable expenses to determine taxable income.

- Calculate the tax due based on the applicable rates.

- Review the form for accuracy and completeness before submission.

Filing Deadlines / Important Dates

Corporations must adhere to specific deadlines when filing the Il1120 Form. The standard deadline for submission is typically the 15th day of the third month following the end of the corporation's fiscal year. For corporations operating on a calendar year, this means the form is due by March 15. Extensions may be available, but it is crucial to file any requests for extensions before the original deadline to avoid penalties.

Legal use of the Il1120 Form

The Il1120 Form is legally binding and must be filled out according to the regulations set forth by the Illinois Department of Revenue. Accurate reporting on this form is essential for compliance with state tax laws. Failure to submit the form or providing false information can result in penalties, including fines and potential audits. It is important for corporations to understand their obligations and ensure that the form is completed truthfully and accurately.

Required Documents

To complete the Il1120 Form, certain documents are necessary. These include:

- Income statements detailing revenue and expenses.

- Balance sheets showing assets, liabilities, and equity.

- Previous tax returns for reference and consistency.

- Supporting documentation for any deductions claimed.

Having these documents readily available will facilitate a smoother and more accurate filing process.

Quick guide on how to complete il1120 1998 form

Complete Il1120 Form effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents swiftly without delays. Manage Il1120 Form on any platform using airSlate SignNow’s Android or iOS applications and simplify any document-based task today.

The easiest way to modify and electronically sign Il1120 Form without hassle

- Obtain Il1120 Form and click on Get Form to begin.

- Use the tools provided to complete your form.

- Emphasize relevant sections of the documents or obscure sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Modify and electronically sign Il1120 Form and ensure superb communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct il1120 1998 form

Create this form in 5 minutes!

How to create an eSignature for the il1120 1998 form

How to generate an electronic signature for a PDF in the online mode

How to generate an electronic signature for a PDF in Chrome

The way to create an eSignature for putting it on PDFs in Gmail

The best way to generate an eSignature straight from your smart phone

How to make an eSignature for a PDF on iOS devices

The best way to generate an eSignature for a PDF document on Android OS

People also ask

-

What is the Il1120 Form and why is it important?

The Il1120 Form is a tax document used by corporations to report their income, deductions, and tax liability to the IRS. It is essential for compliance with federal tax regulations and helps ensure that businesses remain in good standing. By accurately filing the Il1120 Form, corporations can avoid penalties and take advantage of available deductions.

-

How can airSlate SignNow help with the Il1120 Form?

airSlate SignNow simplifies the process of signing and sending the Il1120 Form by providing a user-friendly platform for e-signatures. With its secure and efficient service, businesses can complete and submit their tax documents quickly, ensuring timely compliance. This reduces the risk of errors and delays associated with traditional paper forms.

-

Is airSlate SignNow a cost-effective solution for managing the Il1120 Form?

Yes, airSlate SignNow offers a cost-effective solution tailored for businesses that need to manage important documents like the Il1120 Form. With flexible pricing plans, users can choose a package that fits their budget, while still receiving the features necessary for efficient document management. This ultimately saves money on paper, printing, and mailing costs.

-

What features does airSlate SignNow offer for the Il1120 Form?

airSlate SignNow provides features such as custom signing workflows, template creation, and multi-user collaboration specifically for documents like the Il1120 Form. These tools streamline the signing process and help ensure that all parties involved can easily contribute to completing the form. The platform also allows for storing documents securely for future reference.

-

Are there integrations available with airSlate SignNow for the Il1120 Form?

Absolutely, airSlate SignNow integrates with various third-party applications that businesses commonly use, making it easy to manage the Il1120 Form alongside other tools. Whether it's accounting software or project management systems, these integrations enhance workflow efficiency and ensure seamless document handling. Users can easily transfer data between platforms, reducing the need for double entry.

-

Can I track the status of my Il1120 Form with airSlate SignNow?

Yes, one of the key benefits of using airSlate SignNow is the ability to track the status of your Il1120 Form in real-time. Users receive notifications and updates whenever the document is viewed, signed, or completed. This transparency helps businesses stay informed about their document processing activities and ensures that important deadlines are met.

-

Is airSlate SignNow secure for handling the Il1120 Form?

airSlate SignNow prioritizes security, using advanced encryption protocols to safeguard your sensitive information, including the Il1120 Form. The platform complies with industry standards and regulations, providing businesses with peace of mind that their data is protected throughout the document lifecycle. Regular security audits further enhance the platform's reliability.

Get more for Il1120 Form

Find out other Il1120 Form

- Can I eSignature Tennessee Car Dealer Limited Power Of Attorney

- eSignature Utah Car Dealer Cease And Desist Letter Secure

- eSignature Virginia Car Dealer Cease And Desist Letter Online

- eSignature Virginia Car Dealer Lease Termination Letter Easy

- eSignature Alabama Construction NDA Easy

- How To eSignature Wisconsin Car Dealer Quitclaim Deed

- eSignature California Construction Contract Secure

- eSignature Tennessee Business Operations Moving Checklist Easy

- eSignature Georgia Construction Residential Lease Agreement Easy

- eSignature Kentucky Construction Letter Of Intent Free

- eSignature Kentucky Construction Cease And Desist Letter Easy

- eSignature Business Operations Document Washington Now

- How To eSignature Maine Construction Confidentiality Agreement

- eSignature Maine Construction Quitclaim Deed Secure

- eSignature Louisiana Construction Affidavit Of Heirship Simple

- eSignature Minnesota Construction Last Will And Testament Online

- eSignature Minnesota Construction Last Will And Testament Easy

- How Do I eSignature Montana Construction Claim

- eSignature Construction PPT New Jersey Later

- How Do I eSignature North Carolina Construction LLC Operating Agreement