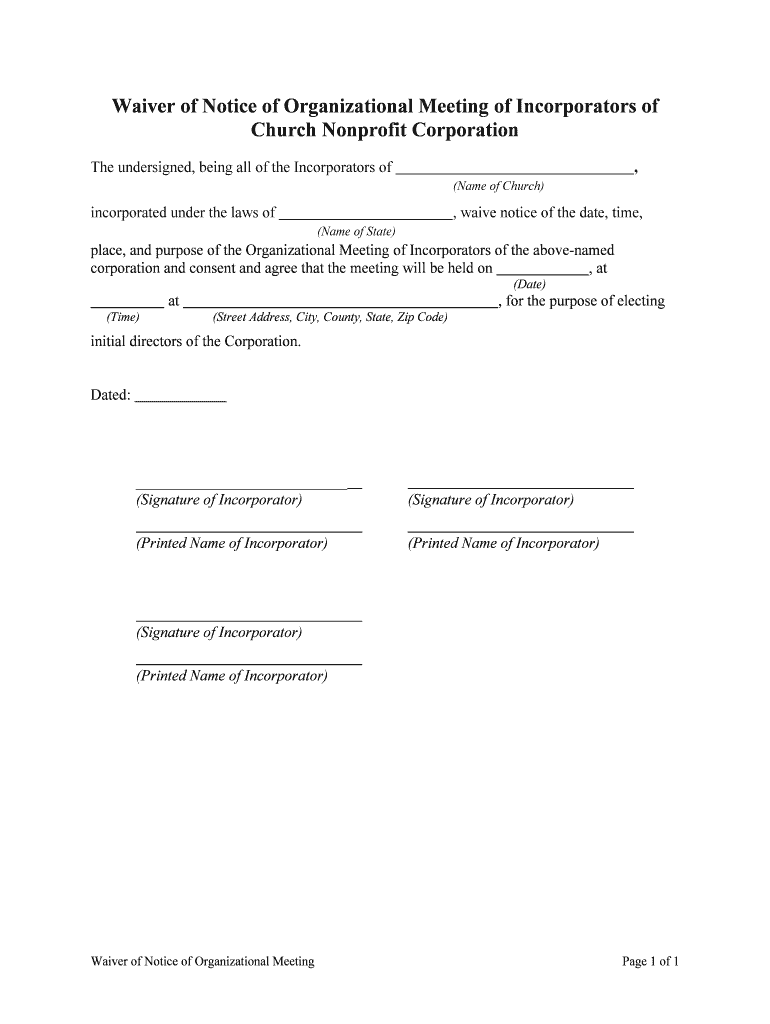

Church Nonprofit Corporation Form

What is the Church Nonprofit Corporation

A Church Nonprofit Corporation is a legal entity that allows religious organizations to operate as nonprofit entities. This structure provides certain legal protections and benefits, such as limited liability for its members and the ability to receive tax-deductible donations. By establishing a nonprofit corporation, churches can effectively manage their resources, engage in fundraising activities, and pursue their religious missions while adhering to state and federal regulations.

Steps to complete the Church Nonprofit Corporation

Completing the Church Nonprofit Corporation form involves several key steps to ensure compliance with legal requirements. First, the organization must choose a unique name that complies with state laws. Next, the church should draft and adopt its bylaws, which outline the governance structure and operational procedures. After that, the church must file the Articles of Incorporation with the appropriate state authority, typically the Secretary of State. Once the form is submitted, it may take several weeks for approval. After receiving confirmation, the church should apply for an Employer Identification Number (EIN) from the IRS to facilitate tax-exempt status applications.

Legal use of the Church Nonprofit Corporation

The legal use of a Church Nonprofit Corporation is governed by both state and federal laws. This structure allows churches to operate tax-exempt under Internal Revenue Code Section 501(c)(3), provided they meet specific criteria. These include being organized and operated exclusively for religious purposes, ensuring that no part of the net earnings benefits any private individual, and refraining from political campaigning. Compliance with these legal standards is essential to maintain the nonprofit status and protect the organization from potential penalties.

Required Documents

To establish a Church Nonprofit Corporation, several documents are necessary. These typically include the Articles of Incorporation, which detail the church's name, purpose, and structure. Additionally, the church must prepare bylaws that govern its operations and management. It is also essential to gather documentation for the IRS application for tax-exempt status, such as the Form 1023 or Form 1023-EZ, depending on the organization's size and complexity. Lastly, obtaining an EIN is crucial for tax reporting and compliance.

IRS Guidelines

The IRS provides specific guidelines for churches seeking nonprofit status. To qualify, a church must demonstrate that it operates primarily for religious purposes, maintains a distinct legal existence, and is recognized as a nonprofit entity by the state. The IRS also requires churches to adhere to regulations regarding donations, fundraising, and financial reporting. Understanding these guidelines is vital for ensuring compliance and maintaining tax-exempt status.

Eligibility Criteria

Eligibility criteria for forming a Church Nonprofit Corporation primarily focus on the organization's purpose and structure. The church must be organized for religious purposes, with a clear mission statement that aligns with this goal. Additionally, it should have a governing body, such as a board of directors, to oversee its operations. The organization must also comply with state laws regarding nonprofit corporations, including filing requirements and operational guidelines.

Form Submission Methods (Online / Mail / In-Person)

Submitting the Church Nonprofit Corporation form can typically be done through various methods, depending on state regulations. Many states offer online submission options, allowing for a quicker and more efficient filing process. Alternatively, organizations can submit the form by mail, ensuring that all required documents are included. In some cases, in-person submissions may also be accepted, providing an opportunity for immediate feedback from state officials. It is important to check specific state requirements to determine the most suitable submission method.

Quick guide on how to complete church nonprofit corporation

Complete Church Nonprofit Corporation effortlessly on any device

Digital document management has become widely adopted by companies and individuals alike. It offers a fantastic eco-friendly substitute for traditional printed and signed documents, as you can find the right template and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your files quickly and efficiently. Handle Church Nonprofit Corporation on any device using airSlate SignNow's Android or iOS applications and enhance any document-oriented process today.

The simplest way to adjust and eSign Church Nonprofit Corporation with ease

- Find Church Nonprofit Corporation and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant parts of your documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional ink signature.

- Review the details and click the Done button to preserve your changes.

- Choose how you’d like to send your form—by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign Church Nonprofit Corporation and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Church Nonprofit Corporation?

A Church Nonprofit Corporation is a legal entity recognized by the state, allowing religious organizations to operate as nonprofits. This designation provides liability protection and tax exemptions, which are essential for churches looking to maintain financial stability while serving their communities.

-

What are the benefits of forming a Church Nonprofit Corporation?

Forming a Church Nonprofit Corporation offers several benefits including legal protection for your church's assets, eligibility for grants, and the ability to enter into contracts. Additionally, it helps establish credibility and fosters trust within the community, ensuring your church can effectively fulfill its mission.

-

How can airSlate SignNow assist my Church Nonprofit Corporation?

airSlate SignNow provides an easy-to-use platform for your Church Nonprofit Corporation to streamline document management and e-signatures. This enhances communication and allows for faster execution of important documents, such as donation agreements and volunteer forms, all while maintaining compliance with legal standards.

-

What features does airSlate SignNow offer for nonprofit organizations?

airSlate SignNow offers features such as customizable templates, document tracking, and secure electronic signatures, which are essential for Church Nonprofit Corporations. These tools enhance efficiency and organization, ensuring your church operates smoothly while managing important documentation.

-

Is airSlate SignNow affordable for small Church Nonprofit Corporations?

Yes, airSlate SignNow is a cost-effective solution specifically designed for organizations like small Church Nonprofit Corporations. With various pricing plans, it ensures that even churches with limited budgets can access essential tools for e-signatures and document management without compromising quality.

-

Can airSlate SignNow integrate with other tools used by Church Nonprofit Corporations?

Absolutely! airSlate SignNow seamlessly integrates with various tools and platforms that Church Nonprofit Corporations might already use, such as CRM systems and email marketing tools. This ensures that your church can maintain a cohesive workflow without interrupting existing processes.

-

How secure is airSlate SignNow for Church Nonprofit Corporations?

Security is a top priority for airSlate SignNow, especially for Church Nonprofit Corporations managing sensitive information. The platform employs industry-standard encryption and compliance with privacy regulations, ensuring that all data remains safe and secure throughout the document signing process.

Get more for Church Nonprofit Corporation

Find out other Church Nonprofit Corporation

- Sign Utah Business Operations LLC Operating Agreement Computer

- Sign West Virginia Business Operations Rental Lease Agreement Now

- How To Sign Colorado Car Dealer Arbitration Agreement

- Sign Florida Car Dealer Resignation Letter Now

- Sign Georgia Car Dealer Cease And Desist Letter Fast

- Sign Georgia Car Dealer Purchase Order Template Mobile

- Sign Delaware Car Dealer Limited Power Of Attorney Fast

- How To Sign Georgia Car Dealer Lease Agreement Form

- How To Sign Iowa Car Dealer Resignation Letter

- Sign Iowa Car Dealer Contract Safe

- Sign Iowa Car Dealer Limited Power Of Attorney Computer

- Help Me With Sign Iowa Car Dealer Limited Power Of Attorney

- Sign Kansas Car Dealer Contract Fast

- Sign Kansas Car Dealer Agreement Secure

- Sign Louisiana Car Dealer Resignation Letter Mobile

- Help Me With Sign Kansas Car Dealer POA

- How Do I Sign Massachusetts Car Dealer Warranty Deed

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter