Irrevocable Standby Letter of Credit Application and Letter of Form

What is the Irrevocable Standby Letter Of Credit Application And Letter Of

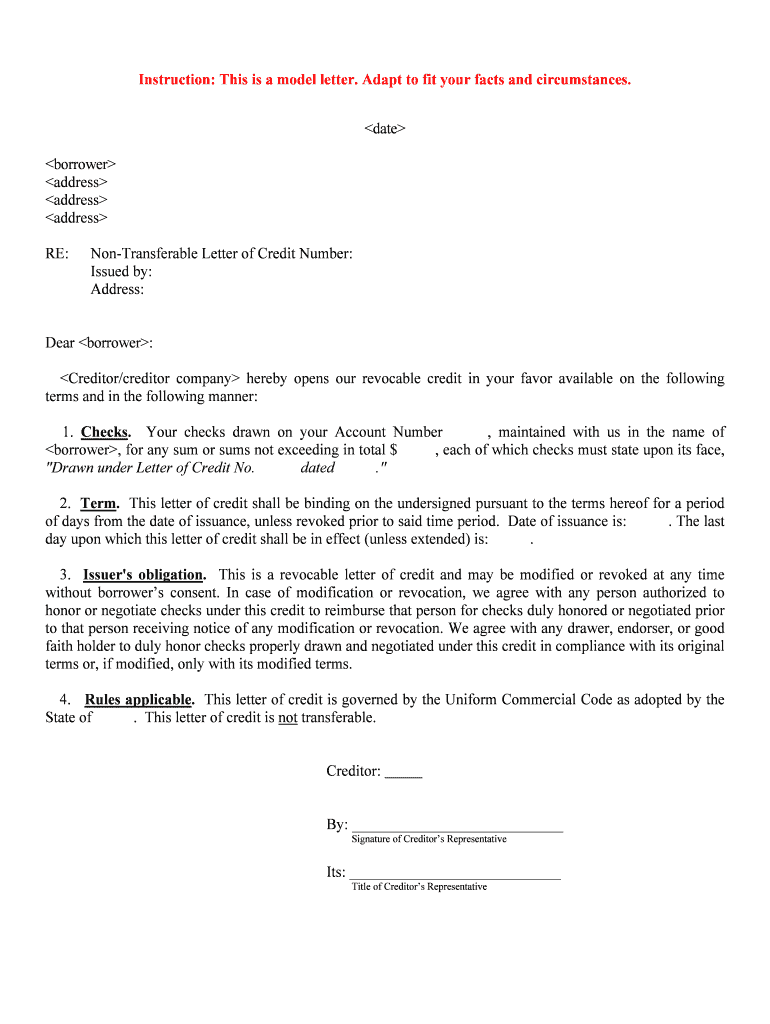

The Irrevocable Standby Letter of Credit Application and Letter of serves as a financial instrument issued by a bank, guaranteeing payment to a beneficiary under specific conditions. This document is often utilized in international trade and various business transactions to ensure that obligations are met. Unlike other forms of credit, this standby letter is irrevocable, meaning it cannot be altered or canceled without the consent of all parties involved. It provides a layer of security for both the issuer and the beneficiary, as it assures the beneficiary that they will receive payment if the applicant defaults on their obligations.

Steps to complete the Irrevocable Standby Letter Of Credit Application And Letter Of

Completing the Irrevocable Standby Letter of Credit Application and Letter of involves several key steps to ensure accuracy and compliance. Start by gathering necessary information, including the applicant's details, beneficiary information, and the terms of the credit. Next, accurately fill out the application form, ensuring that all fields are completed as required. Review the terms and conditions carefully, paying close attention to the expiration date and any specific requirements for drawing on the letter of credit. Finally, submit the application to the issuing bank, ensuring that all required documentation is included for processing.

Legal use of the Irrevocable Standby Letter Of Credit Application And Letter Of

The legal use of the Irrevocable Standby Letter of Credit Application and Letter of is governed by various laws and regulations, including the Uniform Commercial Code (UCC) in the United States. This legal framework establishes the rights and responsibilities of the parties involved. It is essential to ensure that the application complies with these regulations to avoid disputes. Additionally, the application must contain clear terms regarding the conditions under which the beneficiary can draw on the letter of credit, ensuring that all parties understand their obligations and rights.

Key elements of the Irrevocable Standby Letter Of Credit Application And Letter Of

Several key elements are essential in the Irrevocable Standby Letter of Credit Application and Letter of. These include the applicant's name and address, the beneficiary's name and address, the amount of credit being issued, and the specific terms and conditions under which the credit can be drawn. Additionally, the expiration date of the letter of credit and any special instructions for payment should be clearly stated. These elements ensure that the document is comprehensive and legally binding, providing protection for all parties involved.

How to obtain the Irrevocable Standby Letter Of Credit Application And Letter Of

To obtain the Irrevocable Standby Letter of Credit Application and Letter of, individuals or businesses typically need to contact their bank or financial institution. Most banks provide templates or forms that can be filled out either in person or online. It is advisable to consult with a banking representative to ensure that all necessary information is included and that the application meets the bank's requirements. Additionally, understanding the fees associated with issuing the letter of credit is crucial, as these can vary by institution.

Examples of using the Irrevocable Standby Letter Of Credit Application And Letter Of

Examples of using the Irrevocable Standby Letter of Credit Application and Letter of include situations where a business is entering into a contract for the purchase of goods from an overseas supplier. In this case, the supplier may request a standby letter of credit to ensure that they will be paid upon delivery of the goods. Another example is in real estate transactions, where a buyer may use a standby letter of credit to assure the seller that funds are available for closing costs. These examples illustrate the versatility and importance of this financial instrument in various business dealings.

Quick guide on how to complete irrevocable standby letter of credit application and letter of

Complete Irrevocable Standby Letter Of Credit Application And Letter Of effortlessly on any device

Digital document management has gained traction with businesses and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely save it online. airSlate SignNow provides all the resources necessary to generate, edit, and eSign your documents swiftly without any hold-ups. Manage Irrevocable Standby Letter Of Credit Application And Letter Of on any device using the airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to modify and eSign Irrevocable Standby Letter Of Credit Application And Letter Of without any hassle

- Locate Irrevocable Standby Letter Of Credit Application And Letter Of and click Get Form to begin.

- Utilize the tools available to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred way to share your form, whether by email, SMS, invite link, or download it to your computer.

Forget about lost or mislaid documents, monotonous form searching, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in a few clicks from any device of your choice. Modify and eSign Irrevocable Standby Letter Of Credit Application And Letter Of and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an Irrevocable Standby Letter Of Credit Application And Letter Of?

An Irrevocable Standby Letter Of Credit Application And Letter Of is a financial instrument that guarantees payment to a seller if the buyer fails to meet the contractual obligations. This letter provides assurance to the seller, minimizing risks and enabling smoother business transactions.

-

How can I submit my Irrevocable Standby Letter Of Credit Application And Letter Of using airSlate SignNow?

You can easily submit your Irrevocable Standby Letter Of Credit Application And Letter Of through the airSlate SignNow platform. Simply upload your document, fill in the necessary details, and use our eSignature feature for a quick and secure submission process.

-

What are the benefits of using airSlate SignNow for my Irrevocable Standby Letter Of Credit Application And Letter Of?

Using airSlate SignNow for your Irrevocable Standby Letter Of Credit Application And Letter Of streamlines the documentation process, enhances security, and reduces turnaround time. You can also track the status of your application in real-time, ensuring a smooth workflow.

-

Are there any costs associated with the Irrevocable Standby Letter Of Credit Application And Letter Of process on airSlate SignNow?

Yes, there are costs involved in using airSlate SignNow for your Irrevocable Standby Letter Of Credit Application And Letter Of. However, our plans are designed to be cost-effective, offering various pricing tiers to accommodate different business needs without compromising on features.

-

Is it easy to integrate airSlate SignNow with other financial software for processing an Irrevocable Standby Letter Of Credit Application And Letter Of?

Absolutely! airSlate SignNow offers seamless integrations with several financial and accounting platforms. This integration allows you to manage your Irrevocable Standby Letter Of Credit Application And Letter Of alongside your existing workflows, enhancing efficiency and productivity.

-

What features does airSlate SignNow provide to streamline the Irrevocable Standby Letter Of Credit Application And Letter Of process?

airSlate SignNow provides robust features such as customizable templates, automated workflows, and secure electronic signatures to facilitate your Irrevocable Standby Letter Of Credit Application And Letter Of process. These features help ensure accuracy and compliance while saving you time.

-

Can I track the status of my Irrevocable Standby Letter Of Credit Application And Letter Of after submission?

Yes, airSlate SignNow allows you to track the status of your Irrevocable Standby Letter Of Credit Application And Letter Of after submission. You will receive notifications about any updates, making it easier to stay informed throughout the approval process.

Get more for Irrevocable Standby Letter Of Credit Application And Letter Of

- California form 3500 a submission of exemption request california form 3500a submission of exemption request

- Fillable online nws noaa national weather service manual form

- Fill free fillable substitute for form w 2 wage and tax

- 2020 form 541 california fiduciary income tax return 2020 form 541 california fiduciary income tax return

- Instructions for form ftb 3586 one stop every tax form

- California publication 1006 california tax forms and

- 2020 tax return itemized tax deductions on schedule a form

- 2020 form 3521 low income housing credit 2020 form 3521 low income housing credit

Find out other Irrevocable Standby Letter Of Credit Application And Letter Of

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself