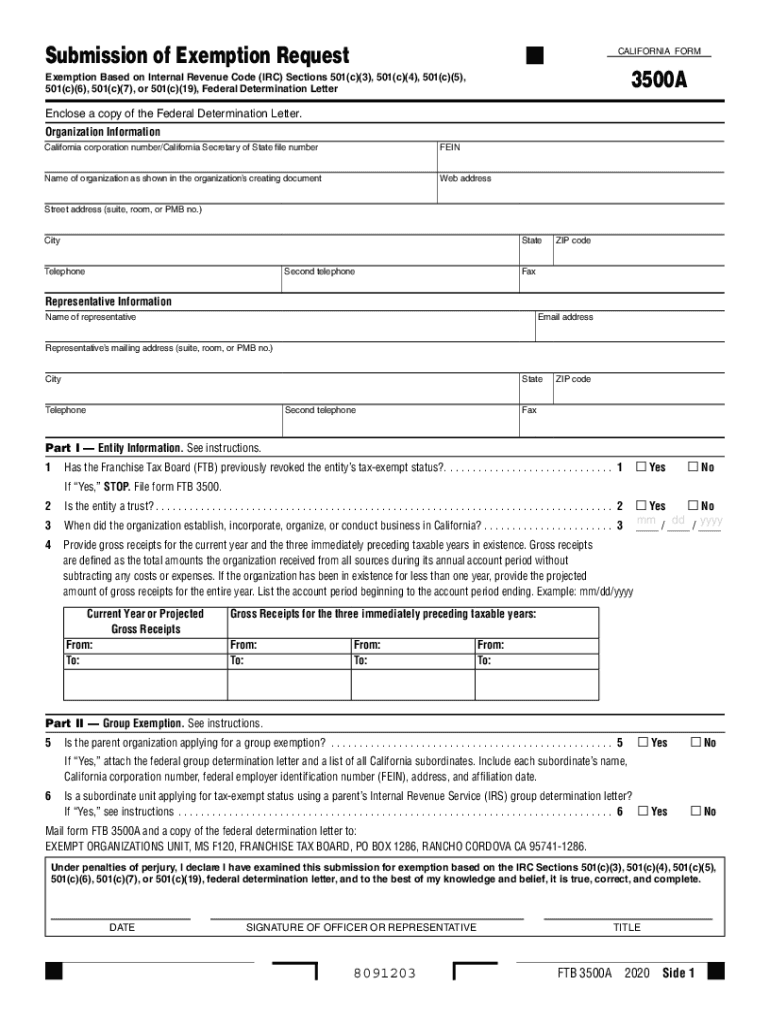

California Form 3500 A, Submission of Exemption Request California Form 3500A, Submission of Exemption Request 2020

What is the California Form 3500A?

The California Form 3500A is a tax exemption application used by organizations seeking exemption from state income tax. This form is primarily utilized by nonprofit organizations, charities, and other entities that qualify for tax-exempt status under California law. By submitting the form, applicants can request a determination of their tax-exempt status from the California Franchise Tax Board (FTB). Understanding the nuances of this form is crucial for organizations aiming to operate without the burden of state taxes.

Steps to Complete the California Form 3500A

Completing the California Form 3500A involves several key steps to ensure accuracy and compliance. Here’s a concise guide:

- Gather Required Information: Collect all necessary documentation, including your organization’s mission statement, bylaws, and financial statements.

- Fill Out the Form: Complete each section of the form accurately, providing detailed information about your organization’s activities and structure.

- Review for Accuracy: Double-check all entries to avoid errors that could delay processing.

- Submit the Form: Choose your preferred submission method, whether online, by mail, or in person, and ensure all required documents are included.

Legal Use of the California Form 3500A

The California Form 3500A is legally binding once submitted and approved by the FTB. It is essential for organizations to understand the legal implications of the form, as it serves as the official request for tax-exempt status. Compliance with state regulations is critical, as failure to adhere to the guidelines can result in penalties or denial of the exemption request. Organizations must ensure that they meet all eligibility criteria outlined by the FTB to maintain their tax-exempt status.

Eligibility Criteria for the California Form 3500A

To qualify for tax exemption using the California Form 3500A, organizations must meet specific eligibility criteria. Generally, these include:

- The organization must be established for charitable, educational, or religious purposes.

- It must operate primarily in California and serve the public interest.

- The organization should not engage in activities that benefit private interests or individuals.

Meeting these criteria is essential for a successful application, and organizations should provide clear documentation to support their claims when completing the form.

Form Submission Methods

The California Form 3500A can be submitted through various methods to accommodate different preferences. Organizations can choose to:

- Submit Online: Utilize the FTB’s online portal for a faster processing time.

- Mail the Form: Send a physical copy of the completed form along with any required attachments to the designated FTB address.

- In-Person Submission: Deliver the form directly to a local FTB office for immediate processing.

Each method has its advantages, and organizations should select the one that best fits their operational needs.

Key Elements of the California Form 3500A

Understanding the key elements of the California Form 3500A is vital for successful completion. The form typically includes sections for:

- Organization Information: Basic details about the organization, including name, address, and contact information.

- Purpose of the Organization: A clear description of the organization’s mission and activities.

- Financial Information: Required financial statements that demonstrate the organization’s operations and funding sources.

Providing comprehensive and accurate information in these sections is crucial for the approval of the exemption request.

Quick guide on how to complete california form 3500 a submission of exemption request california form 3500a submission of exemption request

Effortlessly prepare California Form 3500 A, Submission Of Exemption Request California Form 3500A, Submission Of Exemption Request on any device

The management of online documents has surged in popularity among both businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents quickly and without delays. Manage California Form 3500 A, Submission Of Exemption Request California Form 3500A, Submission Of Exemption Request on any platform with the airSlate SignNow apps for Android or iOS and enhance any document-driven process today.

How to edit and eSign California Form 3500 A, Submission Of Exemption Request California Form 3500A, Submission Of Exemption Request with ease

- Locate California Form 3500 A, Submission Of Exemption Request California Form 3500A, Submission Of Exemption Request and click Get Form to begin.

- Use the tools we offer to fill out your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select how you wish to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, time-consuming form searches, or errors that require new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Edit and eSign California Form 3500 A, Submission Of Exemption Request California Form 3500A, Submission Of Exemption Request to ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct california form 3500 a submission of exemption request california form 3500a submission of exemption request

Create this form in 5 minutes!

How to create an eSignature for the california form 3500 a submission of exemption request california form 3500a submission of exemption request

The best way to make an eSignature for a PDF file in the online mode

The best way to make an eSignature for a PDF file in Chrome

The way to create an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature right from your smartphone

How to make an eSignature for a PDF file on iOS devices

The way to generate an electronic signature for a PDF on Android

People also ask

-

What is the FTB 3500A form?

The FTB 3500A form is a California tax form used for requesting a waiver of penalties for underpayment of tax due to reasonable cause. Understanding this form is crucial for individuals and businesses looking to manage their tax obligations effectively.

-

How can airSlate SignNow help with the FTB 3500A form?

airSlate SignNow streamlines the process of filling out and submitting the FTB 3500A form by providing an intuitive eSigning solution. Our platform allows you to complete the form digitally, ensuring faster submission and reduced paperwork.

-

Is there a cost associated with using airSlate SignNow for the FTB 3500A form?

Yes, airSlate SignNow offers various pricing plans tailored to meet your needs, including options for individuals and businesses. Our cost-effective solution enables you to manage documents like the FTB 3500A form without breaking the bank.

-

Can I integrate airSlate SignNow with other applications for managing my FTB 3500A form?

Absolutely! airSlate SignNow offers seamless integrations with popular applications such as Google Drive, Dropbox, and many CRMs. This flexibility allows you to manage your FTB 3500A form effortlessly alongside your other business tools.

-

What are the benefits of using airSlate SignNow for the FTB 3500A form?

Using airSlate SignNow for the FTB 3500A form provides numerous benefits, including enhanced efficiency, reduced turnaround times, and improved accuracy. Our platform ensures that your documents are securely signed and stored, streamlining your tax processes.

-

How do I get started with airSlate SignNow for the FTB 3500A form?

Getting started with airSlate SignNow is simple! Just sign up for an account, explore our user-friendly interface, and begin creating or uploading your FTB 3500A form to start eSigning. It only takes a few minutes to begin enjoying the benefits.

-

What security measures does airSlate SignNow offer for the FTB 3500A form?

airSlate SignNow prioritizes the security of your documents, including the FTB 3500A form. We utilize encryption and secure cloud storage to protect your information, ensuring compliance with industry standards and safeguarding your sensitive data.

Get more for California Form 3500 A, Submission Of Exemption Request California Form 3500A, Submission Of Exemption Request

Find out other California Form 3500 A, Submission Of Exemption Request California Form 3500A, Submission Of Exemption Request

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement

- How Do I Electronic signature New Hampshire Legal LLC Operating Agreement