Form 541 California Fiduciary Income Tax Return , Form 541, California Fiduciary Income Tax Return 2020

What is the Form 541 California Fiduciary Income Tax Return

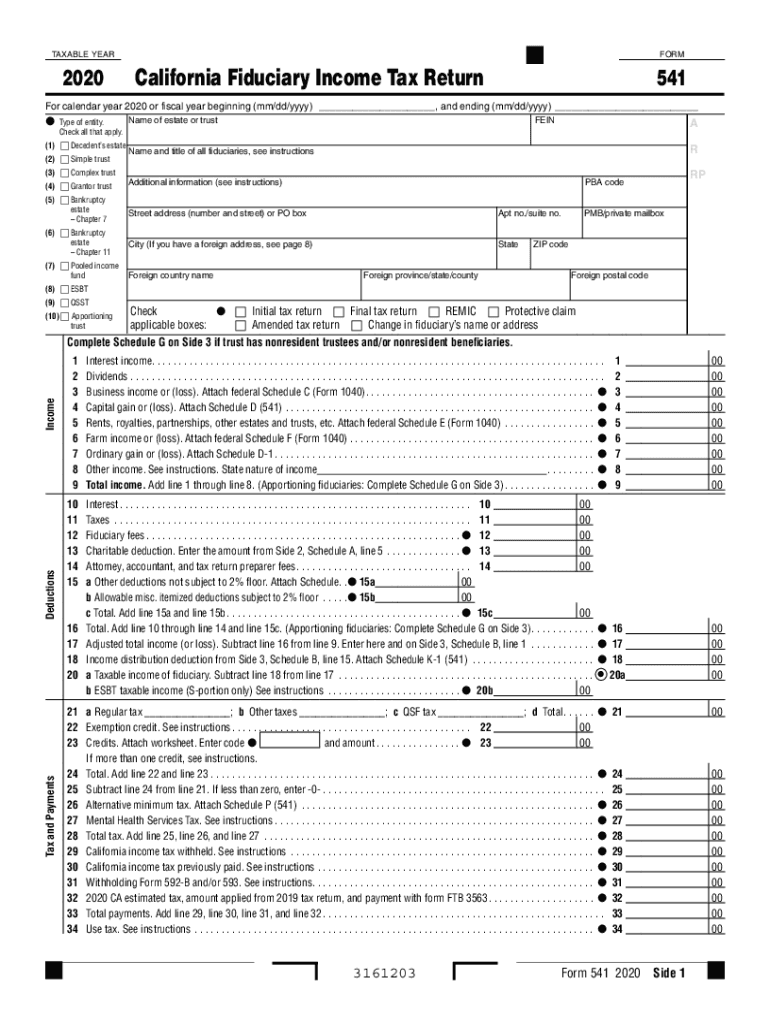

The Form 541 is the California Fiduciary Income Tax Return, designed for estates and trusts that generate income in California. This form is essential for reporting the income, deductions, and credits of the fiduciary entity. It ensures that any income generated by the estate or trust is accurately reported to the California Franchise Tax Board (FTB). The fiduciary is responsible for filing this return on behalf of the estate or trust, ensuring compliance with state tax laws.

Steps to complete the Form 541 California Fiduciary Income Tax Return

Completing the Form 541 involves several key steps to ensure accurate reporting. Begin by gathering all necessary financial documents, including income statements, receipts for deductions, and any relevant tax forms. Next, fill out the form by entering the estate or trust's income, deductions, and credits as required. It's crucial to review the instructions provided by the FTB for specific line items. After completing the form, ensure that all signatures are in place before submitting it to the FTB by the designated deadline.

Filing Deadlines / Important Dates

The deadline for filing the Form 541 typically aligns with the federal tax return due date. For most estates and trusts, this means the form is due on the fifteenth day of the fourth month following the end of the taxable year. If the fiduciary entity operates on a calendar year basis, the deadline would be April 15. Extensions may be available, but it is essential to file the extension request on time to avoid penalties.

Legal use of the Form 541 California Fiduciary Income Tax Return

The legal use of the Form 541 is critical for compliance with California tax regulations. This form serves as a formal declaration of income and tax obligations for estates and trusts. Properly completing and submitting the form ensures that the fiduciary entity meets its legal obligations, thereby avoiding potential penalties or legal issues. The form must be signed by the fiduciary, affirming that the information provided is accurate and complete.

Key elements of the Form 541 California Fiduciary Income Tax Return

Key elements of the Form 541 include sections for reporting income, deductions, and credits specific to the estate or trust. Important components include the identification of the fiduciary, the total income earned, and any applicable deductions such as administrative expenses or distributions to beneficiaries. Additionally, the form requires detailed information about any tax credits the fiduciary entity may claim, which can significantly impact the overall tax liability.

How to obtain the Form 541 California Fiduciary Income Tax Return

The Form 541 can be obtained directly from the California Franchise Tax Board's website. It is available for download in PDF format, allowing fiduciaries to print and complete the form manually. Additionally, the form may be available through tax preparation software that supports California tax filings. Ensuring that you have the most current version of the form is vital for compliance.

Quick guide on how to complete 2020 form 541 california fiduciary income tax return 2020 form 541 california fiduciary income tax return

Easily Prepare Form 541 California Fiduciary Income Tax Return , Form 541, California Fiduciary Income Tax Return on Any Device

Digital document management has become popular among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can access the necessary form and securely save it online. airSlate SignNow provides you with all the resources needed to create, edit, and eSign your documents swiftly and without interruptions. Manage Form 541 California Fiduciary Income Tax Return , Form 541, California Fiduciary Income Tax Return on any device using the airSlate SignNow Android or iOS applications and enhance any document-based process today.

The Most Effective Way to Edit and eSign Form 541 California Fiduciary Income Tax Return , Form 541, California Fiduciary Income Tax Return Effortlessly

- Obtain Form 541 California Fiduciary Income Tax Return , Form 541, California Fiduciary Income Tax Return and then click Get Form to commence.

- Utilize the tools we provide to complete your document.

- Emphasize vital parts of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for such tasks.

- Generate your signature using the Sign tool, which takes seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tiresome form searches, or errors that require reprinting new document copies. airSlate SignNow caters to your document management needs in just a few clicks from any device you choose. Edit and eSign Form 541 California Fiduciary Income Tax Return , Form 541, California Fiduciary Income Tax Return to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 form 541 california fiduciary income tax return 2020 form 541 california fiduciary income tax return

Create this form in 5 minutes!

How to create an eSignature for the 2020 form 541 california fiduciary income tax return 2020 form 541 california fiduciary income tax return

The best way to make an eSignature for your PDF online

The best way to make an eSignature for your PDF in Google Chrome

The way to generate an electronic signature for signing PDFs in Gmail

The way to generate an electronic signature from your smartphone

How to make an electronic signature for a PDF on iOS

The way to generate an electronic signature for a PDF file on Android

People also ask

-

What is form 541, and how can airSlate SignNow help with it?

Form 541 is a tax return form used by certain entities in the United States. With airSlate SignNow, you can easily create, sign, and manage form 541 documents electronically, ensuring compliance and streamlining the filing process.

-

How much does it cost to use airSlate SignNow for form 541?

The pricing for airSlate SignNow varies depending on your needs, but it offers flexible plans that cater to different business sizes. Each plan provides access to features necessary for handling documents like form 541, ensuring cost-effectiveness.

-

Can I customize template forms, like form 541, with airSlate SignNow?

Yes, airSlate SignNow allows you to customize templates for form 541 according to your specific requirements. This flexibility helps ensure that your documents are tailored to meet any regulatory demands or organizational preferences.

-

What features does airSlate SignNow offer for managing form 541?

airSlate SignNow provides a user-friendly interface, document tracking, and secure eSignature options for form 541 management. These features enhance workflow efficiency and improve collaboration when dealing with important tax documents.

-

Is it easy to integrate airSlate SignNow with other software for handling form 541?

Absolutely! airSlate SignNow seamlessly integrates with various applications, including accounting and CRM systems, aiding in the efficient management of form 541. This integration simplifies data transfer and ensures that all your processes are interconnected.

-

What are the benefits of using airSlate SignNow for form 541 over traditional methods?

Using airSlate SignNow to manage form 541 offers numerous benefits, including reduced paperwork, faster processing times, and increased security through encrypted signatures. These advantages lead to a more efficient and less error-prone filing process.

-

How does airSlate SignNow ensure the security of my form 541 documents?

airSlate SignNow employs advanced security measures, including SSL encryption and secure cloud storage, to protect your form 541 documents. This commitment to security ensures that your sensitive tax information remains confidential and protected.

Get more for Form 541 California Fiduciary Income Tax Return , Form 541, California Fiduciary Income Tax Return

- Msf 4201 revalidation application form pdf

- Oklahoma temporary paper id template form

- Injury release form

- Kcse mathematics paper 2 marking scheme form

- My little dog fountas and pinnell form

- Toastmasters timer sheet form

- You amp your aging parents form

- You youreaging parents family approach to life form

Find out other Form 541 California Fiduciary Income Tax Return , Form 541, California Fiduciary Income Tax Return

- Sign Kansas Insurance Rental Lease Agreement Mobile

- Sign Kansas Insurance Rental Lease Agreement Free

- Sign Kansas Insurance Rental Lease Agreement Fast

- Sign Kansas Insurance Rental Lease Agreement Safe

- How To Sign Kansas Insurance Rental Lease Agreement

- How Can I Sign Kansas Lawers Promissory Note Template

- Sign Kentucky Lawers Living Will Free

- Sign Kentucky Lawers LLC Operating Agreement Mobile

- Sign Louisiana Lawers Quitclaim Deed Now

- Sign Massachusetts Lawers Quitclaim Deed Later

- Sign Michigan Lawers Rental Application Easy

- Sign Maine Insurance Quitclaim Deed Free

- Sign Montana Lawers LLC Operating Agreement Free

- Sign Montana Lawers LLC Operating Agreement Fast

- Can I Sign Nevada Lawers Letter Of Intent

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast