Tax Return Itemized Tax Deductions on Schedule a 2020

Understanding the ftb 2018 form 541

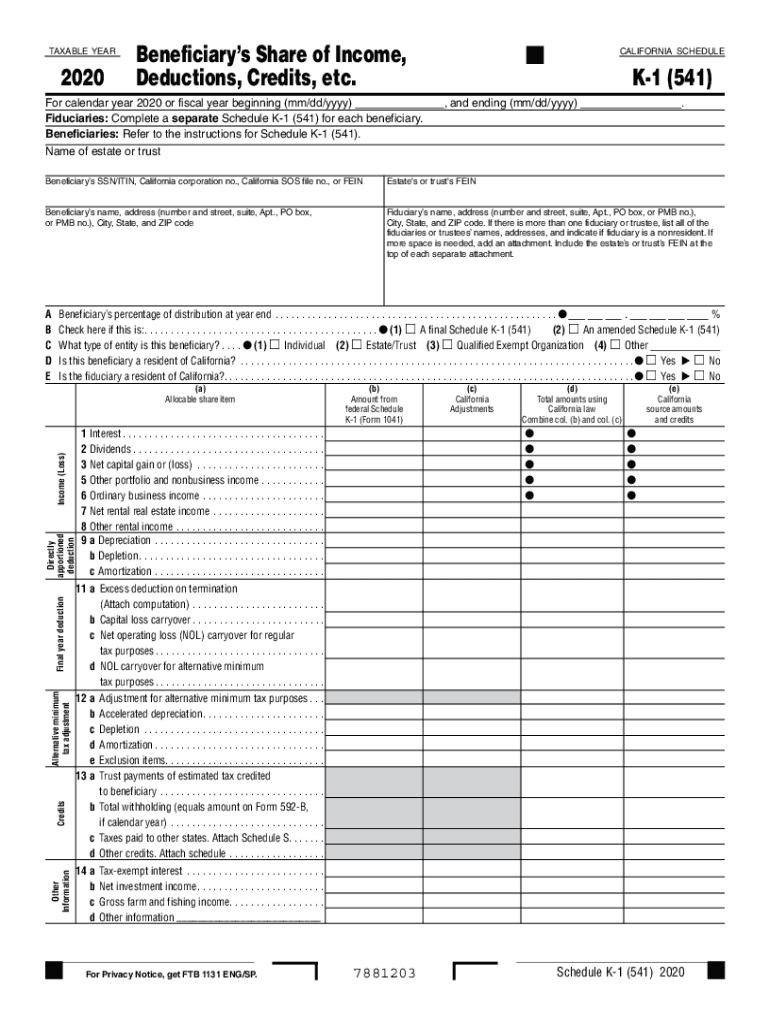

The ftb 2018 form 541 is the California income tax return specifically designed for fiduciaries. This form is utilized by estates and trusts to report income, deductions, and credits. It plays a crucial role in ensuring that fiduciaries comply with state tax laws while accurately reporting the financial activities of the entities they manage.

Steps to complete the ftb 2018 form 541

Completing the ftb 2018 form 541 involves several key steps:

- Gather all necessary financial documents related to the trust or estate, including income statements, expense records, and prior tax returns.

- Fill out the form accurately by providing detailed information about income, deductions, and credits. Ensure that all figures are correct to avoid penalties.

- Review the completed form for accuracy and completeness. It is essential to double-check all entries before submission.

- Sign the form, ensuring that the fiduciary or authorized representative has signed where required.

- Submit the form by the designated deadline, either electronically or via mail, to the appropriate California Franchise Tax Board address.

Required documents for the ftb 2018 form 541

To successfully complete the ftb 2018 form 541, certain documents are necessary:

- Income statements for the estate or trust, including any interest, dividends, and capital gains.

- Receipts or records of deductible expenses, such as administrative costs and distributions to beneficiaries.

- Prior year's tax return, if applicable, to ensure consistency and accuracy in reporting.

- Any relevant K-1 forms that report income distributed to beneficiaries.

Filing deadlines for the ftb 2018 form 541

It is important to be aware of the filing deadlines for the ftb 2018 form 541:

- The due date for filing the form is typically the fifteenth day of the fourth month after the end of the tax year.

- For estates and trusts operating on a calendar year, this means the form is due on April 15.

- Extensions may be available, but it is crucial to file the extension request before the original deadline.

Penalties for non-compliance with the ftb 2018 form 541

Failing to comply with the requirements of the ftb 2018 form 541 can lead to significant penalties:

- Late filing penalties may apply if the form is not submitted by the due date.

- Interest on unpaid taxes can accrue, increasing the total amount owed over time.

- Inaccurate reporting may result in additional penalties, emphasizing the importance of thorough and accurate completion of the form.

Legal use of the ftb 2018 form 541

The ftb 2018 form 541 must be used in accordance with California state tax laws. It is essential for fiduciaries to understand their legal obligations when filing this form:

- The form must be completed truthfully, reflecting all income and deductions accurately.

- Fiduciaries are responsible for ensuring that all tax obligations are met on behalf of the estate or trust.

- Failure to comply with legal requirements can lead to legal repercussions, including audits or penalties from the California Franchise Tax Board.

Quick guide on how to complete 2020 tax return itemized tax deductions on schedule a

Prepare Tax Return Itemized Tax Deductions On Schedule A effortlessly on any device

Digital document management has surged in popularity among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, allowing you to obtain the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without delays. Handle Tax Return Itemized Tax Deductions On Schedule A on any device with the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign Tax Return Itemized Tax Deductions On Schedule A with ease

- Obtain Tax Return Itemized Tax Deductions On Schedule A and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that require printing additional document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and eSign Tax Return Itemized Tax Deductions On Schedule A to ensure exceptional communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct 2020 tax return itemized tax deductions on schedule a

Create this form in 5 minutes!

How to create an eSignature for the 2020 tax return itemized tax deductions on schedule a

The best way to make an eSignature for your PDF file in the online mode

The best way to make an eSignature for your PDF file in Chrome

The way to make an eSignature for putting it on PDFs in Gmail

The way to generate an electronic signature straight from your smartphone

How to make an electronic signature for a PDF file on iOS devices

The way to generate an electronic signature for a PDF document on Android

People also ask

-

What is the ftb 2018 form 541?

The ftb 2018 form 541 is a California tax return form specifically designed for fiduciaries to report income for estates and trusts. It helps ensure compliance with California tax regulations while minimizing tax liabilities for beneficiaries. Completing this form accurately is crucial for fiduciary responsibility.

-

How can airSlate SignNow help with the ftb 2018 form 541?

airSlate SignNow simplifies the process of preparing and submitting the ftb 2018 form 541 by allowing users to eSign documents securely and efficiently. This functionality saves time and reduces the need for physical paperwork, streamlining the tax filing process for fiduciaries. Plus, it's a cost-effective solution for all your document-signing needs.

-

Is there a cost associated with using airSlate SignNow for ftb 2018 form 541?

Yes, airSlate SignNow offers various pricing plans that cater to different needs, ensuring a cost-effective option for completing the ftb 2018 form 541. You'll find plans suitable for individuals, small businesses, and enterprise users, allowing you to select a plan that fits your budget and document-sending frequency.

-

What features does airSlate SignNow offer for eSigning the ftb 2018 form 541?

airSlate SignNow provides essential features for eSigning the ftb 2018 form 541, such as templates for easy document preparation, automated workflows, and secure cloud storage. These features ensure that your forms are filled out correctly and can be signed by all required parties seamlessly, enhancing the eSigning experience.

-

Can I integrate airSlate SignNow with other applications to manage the ftb 2018 form 541?

Absolutely! airSlate SignNow integrates with various applications such as Google Drive, Dropbox, and CRM systems. This allows for efficient management and storage of your documents, including the ftb 2018 form 541, improving overall workflow and productivity within your organization.

-

Are there any security measures in place when using airSlate SignNow for the ftb 2018 form 541?

Yes, airSlate SignNow employs advanced security measures, including encryption and two-factor authentication, to protect your documents, including the ftb 2018 form 541. These security protocols ensure that sensitive information remains confidential and is only accessible to authorized users.

-

How do I access my signed ftb 2018 form 541 through airSlate SignNow?

Once you have eSigned the ftb 2018 form 541 using airSlate SignNow, you can access it directly from your dashboard. All signed documents are securely stored in the cloud, making it easy to retrieve and download your completed forms at any time for your records or future reference.

Get more for Tax Return Itemized Tax Deductions On Schedule A

- Morgan stanley death of account holder form

- A snake charmers story class 5 worksheet with answers form

- Sample registration form for after school program

- Tsu portal form

- Form 16 template

- Chapter 3 careers in health care answer key form

- Pusd substance abuse assessment form

- Retained search agreement pdf form

Find out other Tax Return Itemized Tax Deductions On Schedule A

- eSignature Alaska Government Agreement Fast

- How Can I eSignature Arizona Government POA

- How Do I eSignature Nevada Doctors Lease Agreement Template

- Help Me With eSignature Nevada Doctors Lease Agreement Template

- How Can I eSignature Nevada Doctors Lease Agreement Template

- eSignature Finance & Tax Accounting Presentation Arkansas Secure

- eSignature Arkansas Government Affidavit Of Heirship Online

- eSignature New Jersey Doctors Permission Slip Mobile

- eSignature Colorado Government Residential Lease Agreement Free

- Help Me With eSignature Colorado Government Medical History

- eSignature New Mexico Doctors Lease Termination Letter Fast

- eSignature New Mexico Doctors Business Associate Agreement Later

- eSignature North Carolina Doctors Executive Summary Template Free

- eSignature North Dakota Doctors Bill Of Lading Online

- eSignature Delaware Finance & Tax Accounting Job Description Template Fast

- How To eSignature Kentucky Government Warranty Deed

- eSignature Mississippi Government Limited Power Of Attorney Myself

- Can I eSignature South Dakota Doctors Lease Agreement Form

- eSignature New Hampshire Government Bill Of Lading Fast

- eSignature Illinois Finance & Tax Accounting Purchase Order Template Myself