Instructions for Form FTB 3586 One Stop, Every Tax Form 2020

Understanding the Instructions for FTB Form 3586

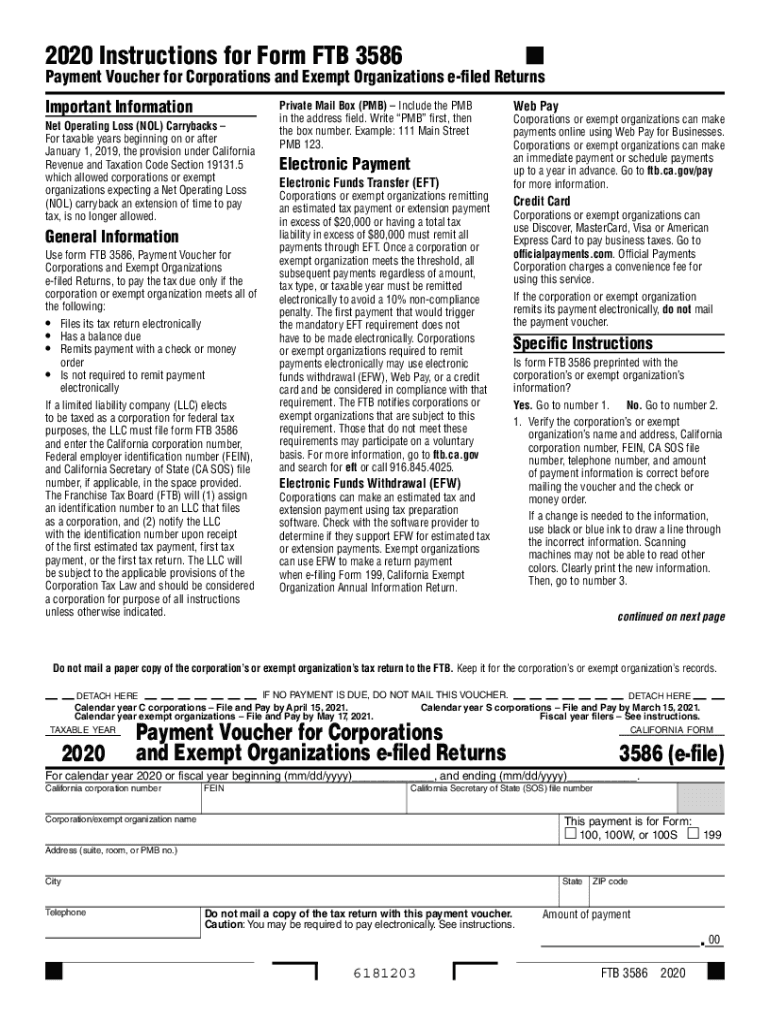

The FTB Form 3586 is essential for California taxpayers, particularly for those who need to report their tax liabilities accurately. This form is used to request a payment plan for unpaid taxes. Understanding the instructions for this form is crucial to ensure compliance with state tax regulations. The instructions provide detailed guidance on how to fill out the form correctly, including the necessary information and documentation required.

Steps to Complete FTB Form 3586

Completing the FTB Form 3586 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements and previous tax returns. Next, carefully fill out each section of the form, ensuring that all information is accurate and complete. Pay particular attention to sections that require specific details about your income and tax liabilities. Once completed, review the form for any errors before submission.

Filing Deadlines for FTB Form 3586

Timely submission of the FTB Form 3586 is crucial to avoid penalties. The filing deadline typically aligns with the state tax return deadlines. For 2018, the form should have been submitted by the tax filing deadline, which is usually April 15 of the following year. If you are submitting the form after the deadline, it is important to check for any potential penalties or interest that may apply to your tax situation.

Form Submission Methods for FTB Form 3586

Taxpayers have multiple options for submitting the FTB Form 3586. The form can be submitted online through the California Franchise Tax Board's website, allowing for a quick and efficient process. Alternatively, taxpayers may choose to mail the completed form to the appropriate FTB address. It is essential to ensure that the form is sent to the correct address to avoid delays in processing.

Legal Use of FTB Form 3586

The FTB Form 3586 is legally recognized for managing tax liabilities in California. When completed and submitted according to the provided instructions, it serves as a formal request for a payment plan. This legal standing ensures that taxpayers can negotiate their tax payments without facing immediate penalties or collection actions, provided they adhere to the terms outlined in the form.

Required Documents for FTB Form 3586

To successfully complete the FTB Form 3586, certain documents are required. Taxpayers should prepare their most recent tax return, proof of income, and any relevant financial statements that reflect their current financial situation. These documents help the FTB assess the taxpayer's ability to pay and determine an appropriate payment plan.

Quick guide on how to complete instructions for form ftb 3586 one stop every tax form

Effortlessly Prepare Instructions For Form FTB 3586 One Stop, Every Tax Form on Any Device

Managing documents online has gained popularity among companies and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed materials, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents promptly without delays. Manage Instructions For Form FTB 3586 One Stop, Every Tax Form on any device with the airSlate SignNow Android or iOS applications and enhance any document-focused process today.

The easiest way to modify and eSign Instructions For Form FTB 3586 One Stop, Every Tax Form seamlessly

- Find Instructions For Form FTB 3586 One Stop, Every Tax Form and click Get Form to begin.

- Use the tools we provide to complete your form.

- Highlight relevant parts of the documents or mask sensitive details with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and then click on the Done button to save your changes.

- Choose your preferred method to submit your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, monotonous form searching, or errors that require printing new document copies. airSlate SignNow satisfies all your document management needs in just a few clicks from a device of your choosing. Modify and eSign Instructions For Form FTB 3586 One Stop, Every Tax Form and ensure stellar communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct instructions for form ftb 3586 one stop every tax form

Create this form in 5 minutes!

How to create an eSignature for the instructions for form ftb 3586 one stop every tax form

The best way to make an eSignature for your PDF in the online mode

The best way to make an eSignature for your PDF in Chrome

The way to generate an electronic signature for putting it on PDFs in Gmail

The way to generate an electronic signature from your smart phone

How to make an electronic signature for a PDF on iOS devices

The way to generate an electronic signature for a PDF file on Android OS

People also ask

-

What is the CA Form 3586 for 2018, and why is it important?

The CA Form 3586 for 2018 is a tax form used by California taxpayers to report certain incomes and deductions. It's crucial for ensuring compliance with state tax regulations and can help avoid penalties. Understanding how to properly fill out the CA Form 3586 for 2018 is essential for accurate financial reporting.

-

How can airSlate SignNow help with signing the CA Form 3586 for 2018?

airSlate SignNow streamlines the process of signing documents, including the CA Form 3586 for 2018. Our platform allows users to eSign the form securely and efficiently, reducing the time it takes to complete necessary filings. With airSlate SignNow, you can ensure your documents are legally binding.

-

Is airSlate SignNow compatible with CA Form 3586 for 2018 if I need to integrate it with accounting software?

Yes, airSlate SignNow offers seamless integrations with various accounting software. This compatibility makes it easy to manage documents like the CA Form 3586 for 2018 directly within your existing systems. You can enhance your workflow and maintain accuracy in your tax documentation.

-

What are the pricing options for airSlate SignNow for handling documents like CA Form 3586 for 2018?

airSlate SignNow provides flexible pricing plans tailored to different business needs. Whether you're a small business or a large enterprise needing to manage the CA Form 3586 for 2018, there’s a suitable plan for you. Our solutions are designed to be cost-effective while ensuring you have all the necessary features.

-

Can I track changes made to the CA Form 3586 for 2018 using airSlate SignNow?

Absolutely! airSlate SignNow allows users to track all changes and activity made to documents like the CA Form 3586 for 2018. With our comprehensive audit trail feature, you can see who signed the document and any modifications made, ensuring transparency and accountability.

-

How does airSlate SignNow ensure the security of my CA Form 3586 for 2018 documents?

Security is a top priority at airSlate SignNow. We use advanced encryption methods to protect your documents, including the CA Form 3586 for 2018. Additionally, our platform complies with the highest security standards, giving you peace of mind when managing sensitive data.

-

What benefits does airSlate SignNow provide for businesses dealing with the CA Form 3586 for 2018?

By using airSlate SignNow, businesses can save time and money when managing documents like the CA Form 3586 for 2018. Our software simplifies the signing process, reduces paper waste, and improves overall efficiency. This enhances productivity while ensuring compliance with tax regulations.

Get more for Instructions For Form FTB 3586 One Stop, Every Tax Form

Find out other Instructions For Form FTB 3586 One Stop, Every Tax Form

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors