Qualified Subchapter S Trust for Benefit of Child with Crummey Trust Agreement Form

What is the Qualified Subchapter S Trust For Benefit Of Child With Crummey Trust Agreement

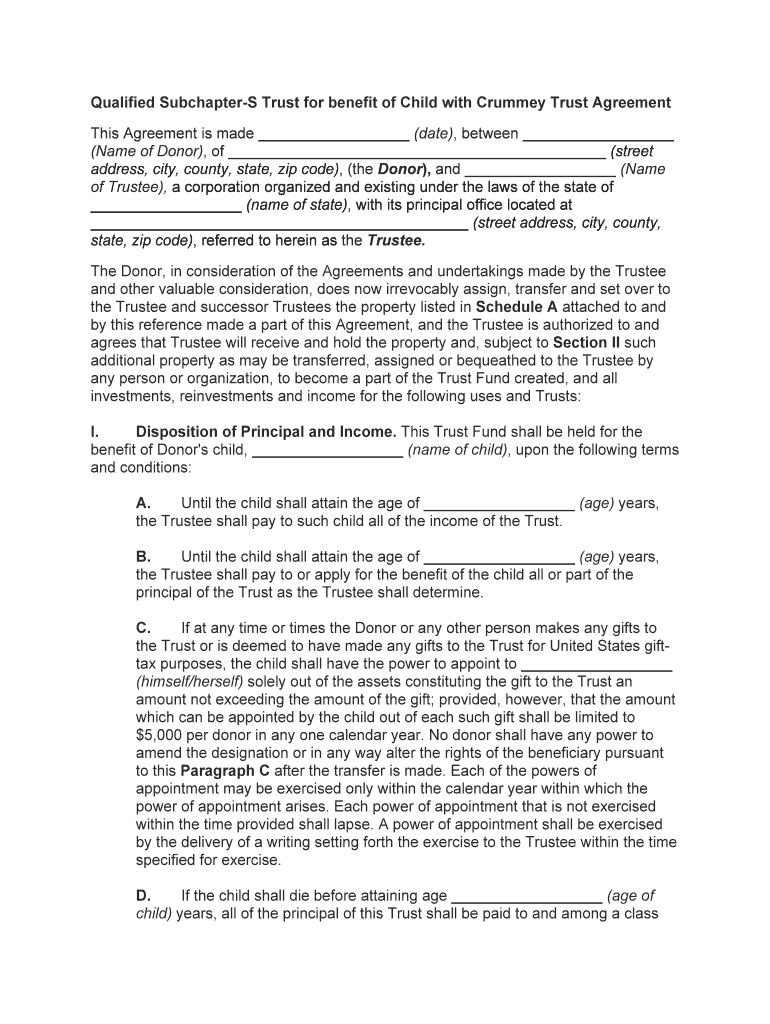

The Qualified Subchapter S Trust for Benefit of Child with Crummey Trust Agreement is a specialized legal structure designed to provide financial benefits to a child while allowing for tax advantages under Subchapter S of the Internal Revenue Code. This trust enables the child to receive distributions from the trust, which can be used for educational or other expenses. The Crummey provision allows contributions to the trust to qualify for the annual gift tax exclusion, making it a strategic tool for estate planning. By utilizing this trust, parents can effectively manage their child's inheritance while minimizing tax liabilities.

How to use the Qualified Subchapter S Trust For Benefit Of Child With Crummey Trust Agreement

Using the Qualified Subchapter S Trust involves several steps to ensure compliance with legal requirements and optimal benefits. Initially, the trust must be established with clear terms outlining the beneficiary's rights and the trustee's responsibilities. Contributions can then be made to the trust, which must include a Crummey provision allowing the child to withdraw funds within a specified period. This provision is crucial for maintaining the tax benefits associated with the trust. Regular monitoring and management of the trust assets are essential to ensure they align with the intended financial goals for the child.

Steps to complete the Qualified Subchapter S Trust For Benefit Of Child With Crummey Trust Agreement

Completing the Qualified Subchapter S Trust requires careful attention to detail. The following steps outline the process:

- Determine the trust's purpose and the specific needs of the child.

- Draft the trust agreement, including the Crummey provision.

- Choose a reliable trustee to manage the trust assets.

- Fund the trust with contributions, ensuring compliance with gift tax regulations.

- Notify the child of their withdrawal rights under the Crummey provision.

- Regularly review and update the trust as necessary to reflect changes in circumstances.

Key elements of the Qualified Subchapter S Trust For Benefit Of Child With Crummey Trust Agreement

Several key elements define the Qualified Subchapter S Trust for Benefit of Child with Crummey Trust Agreement:

- Beneficiary Rights: The child must have the right to withdraw contributions within a certain timeframe.

- Trustee Responsibilities: The trustee must manage the assets prudently and in the best interest of the beneficiary.

- Tax Compliance: The trust must adhere to IRS guidelines to maintain its qualified status.

- Distribution Terms: Clear terms should outline how and when distributions can be made to the child.

Legal use of the Qualified Subchapter S Trust For Benefit Of Child With Crummey Trust Agreement

The legal use of the Qualified Subchapter S Trust is governed by specific IRS regulations and state laws. It is essential to ensure that the trust is properly structured to meet the requirements for Subchapter S treatment, which includes having eligible shareholders and adhering to the rules regarding distributions. Additionally, the Crummey provision must be correctly implemented to qualify for the annual gift tax exclusion. Legal counsel is often advisable to navigate these complexities and ensure compliance with all applicable laws.

IRS Guidelines

The IRS provides specific guidelines that govern the operation of the Qualified Subchapter S Trust for Benefit of Child with Crummey Trust Agreement. These guidelines include requirements for the trust's formation, the treatment of contributions, and the tax implications of distributions. Trust creators should familiarize themselves with IRS regulations regarding gift tax exclusions and the necessary documentation to support the trust's qualified status. Staying informed about any changes in tax laws is also crucial for maintaining compliance and maximizing benefits.

Quick guide on how to complete qualified subchapter s trust for benefit of child with crummey trust agreement

Prepare Qualified Subchapter S Trust For Benefit Of Child With Crummey Trust Agreement effortlessly on any device

Online document management has grown increasingly favored by businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed documents, enabling you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, modify, and electronically sign your documents swiftly without delays. Manage Qualified Subchapter S Trust For Benefit Of Child With Crummey Trust Agreement on any platform with airSlate SignNow's Android or iOS applications and enhance any document-centric operation today.

How to modify and eSign Qualified Subchapter S Trust For Benefit Of Child With Crummey Trust Agreement with ease

- Find Qualified Subchapter S Trust For Benefit Of Child With Crummey Trust Agreement and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Mark important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign feature, which only takes seconds and holds the same legal validity as a conventional handwriting signature.

- Review the details and click on the Done button to save your updates.

- Choose how you wish to submit your form, via email, text message (SMS), or invite link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, exhaustive form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any chosen device. Edit and eSign Qualified Subchapter S Trust For Benefit Of Child With Crummey Trust Agreement and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Qualified Subchapter S Trust For Benefit Of Child With Crummey Trust Agreement?

A Qualified Subchapter S Trust For Benefit Of Child With Crummey Trust Agreement is a specialized trust structure that allows for tax advantages under Subchapter S of the Internal Revenue Code while benefiting a child. It provides flexibility in asset management and can enhance financial security for beneficiaries. This arrangement is designed to comply with tax regulations and ensure that contributions to the trust qualify for annual gift tax exclusions.

-

How does a Qualified Subchapter S Trust For Benefit Of Child With Crummey Trust Agreement work?

This type of trust allows the grantor to allocate S Corporation shares to the trust for the benefit of a child while granting Crummey powers to the child. The Crummey powers enable the child to withdraw contributions during a specified period, making it easier to qualify for gift tax exclusions. Thus, it functions as an efficient estate planning tool focused on maximizing tax benefits and inheritance for the next generation.

-

What are the primary benefits of setting up a Qualified Subchapter S Trust For Benefit Of Child With Crummey Trust Agreement?

The primary benefits include tax benefits, asset protection, and the ability to control distributions. This trust arrangement can help minimize estate taxes while ensuring that a child's financial interests are kept safe and secure. Additionally, flexibility in terms of contribution and withdrawal enhances its attractiveness for estate planning.

-

Is airSlate SignNow compatible with the management of Qualified Subchapter S Trust For Benefit Of Child With Crummey Trust Agreement documents?

Yes, airSlate SignNow provides a convenient platform for managing and electronically signing documents related to a Qualified Subchapter S Trust For Benefit Of Child With Crummey Trust Agreement. With its user-friendly interface, you can easily send, sign, and store trust-related documents securely. This streamlines the administrative processes associated with managing trusts and provides a hassle-free experience for users.

-

What is the pricing structure for using airSlate SignNow for trust documentation related to a Qualified Subchapter S Trust?

airSlate SignNow offers flexible pricing plans that can accommodate various business sizes and needs. This includes monthly and annual subscription options, providing a cost-effective solution for managing your Qualified Subchapter S Trust For Benefit Of Child With Crummey Trust Agreement documents. The value delivered, including advanced features for document management, far outweighs the cost.

-

Are there specific features in airSlate SignNow that benefit users of Qualified Subchapter S Trusts?

Yes, airSlate SignNow offers features such as document templates, customized workflows, and secure eSigning, which are particularly beneficial for managing Qualified Subchapter S Trust For Benefit Of Child With Crummey Trust Agreement documents. These features simplify the process of creating, distributing, and tracking trust documents, ensuring compliance and efficiency. The software also provides integration options with other platforms to enhance your operational capabilities.

-

Can I collaborate with legal advisors using airSlate SignNow for my Qualified Subchapter S Trust?

Absolutely! airSlate SignNow allows for real-time collaboration with legal advisors when dealing with Qualified Subchapter S Trust For Benefit Of Child With Crummey Trust Agreement documents. You can share documents, receive feedback, and make edits collaboratively, ensuring that you stay aligned with legal advice throughout the trust management process. This can enhance the decision-making process and promote effective trust administration.

Get more for Qualified Subchapter S Trust For Benefit Of Child With Crummey Trust Agreement

Find out other Qualified Subchapter S Trust For Benefit Of Child With Crummey Trust Agreement

- Can I eSignature Oklahoma Courts Word

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF