Liquid Fuel Carrier Petroleum Products Report MF 206 Kansas Ksrevenue 2010

What is the Liquid Fuel Carrier Petroleum Products Report MF 206 Kansas Ksrevenue

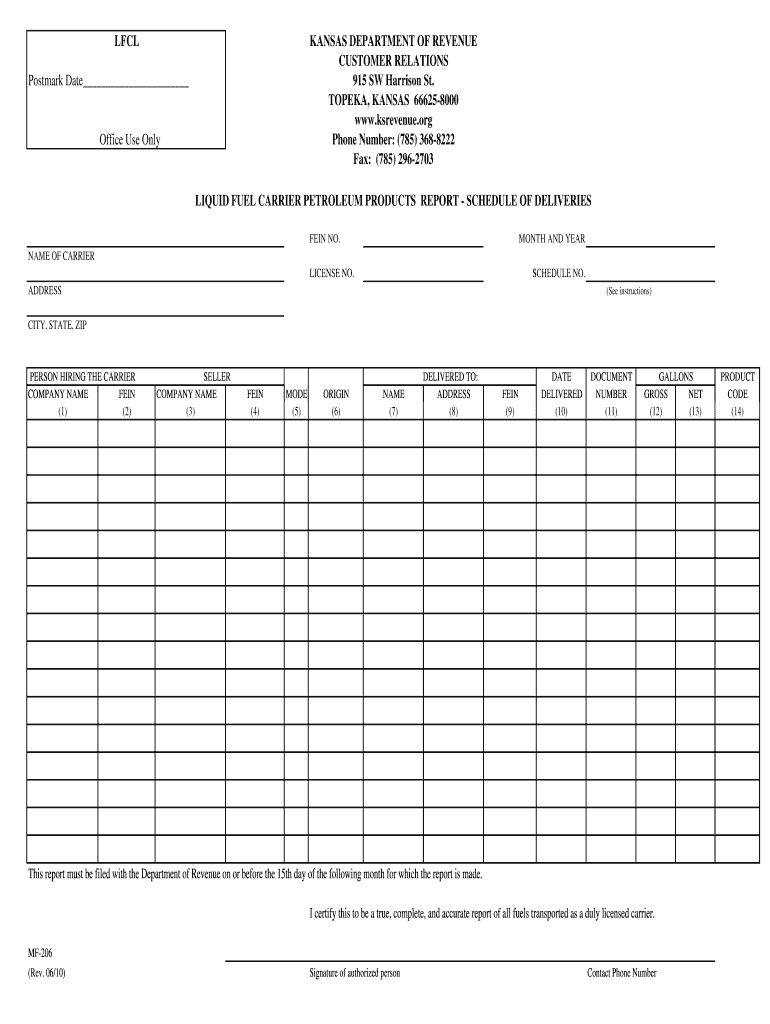

The Liquid Fuel Carrier Petroleum Products Report MF 206 Kansas Ksrevenue is a specialized form used by businesses involved in the transportation of liquid fuel products within the state of Kansas. This report is essential for tracking the movement and taxation of petroleum products, ensuring compliance with state regulations. It provides detailed information regarding the quantities of fuel transported, the types of products, and the respective carriers involved in the transactions. This form plays a critical role in maintaining transparency and accountability in the fuel distribution industry.

How to use the Liquid Fuel Carrier Petroleum Products Report MF 206 Kansas Ksrevenue

Using the Liquid Fuel Carrier Petroleum Products Report MF 206 involves several key steps. First, businesses must accurately gather data on the fuel products they transport. This includes recording the type of fuel, volume, and destination. Once the information is compiled, it should be entered into the designated fields of the form, ensuring that all entries are precise and complete. After filling out the form, it must be submitted to the appropriate state authority, typically the Kansas Department of Revenue, to fulfill regulatory obligations.

Steps to complete the Liquid Fuel Carrier Petroleum Products Report MF 206 Kansas Ksrevenue

Completing the Liquid Fuel Carrier Petroleum Products Report MF 206 requires a systematic approach:

- Gather necessary data on liquid fuel transportation, including type, volume, and carrier information.

- Access the form online or in a printable format.

- Fill in the required fields accurately, ensuring all information is correct and up to date.

- Review the completed form for any errors or omissions.

- Submit the form electronically or via mail to the Kansas Department of Revenue by the specified deadline.

Legal use of the Liquid Fuel Carrier Petroleum Products Report MF 206 Kansas Ksrevenue

The Liquid Fuel Carrier Petroleum Products Report MF 206 is legally required for businesses operating within the petroleum distribution sector in Kansas. Failing to submit this report can result in penalties, including fines or legal action. It is crucial for businesses to understand the legal implications of this form, as it serves to document compliance with state fuel tax laws and regulations. Proper use of the form helps ensure that businesses maintain their legal standing while contributing to state revenue.

Key elements of the Liquid Fuel Carrier Petroleum Products Report MF 206 Kansas Ksrevenue

Key elements of the Liquid Fuel Carrier Petroleum Products Report MF 206 include:

- Identification of the reporting entity, including name and contact information.

- Details of the liquid fuel products transported, including type and quantity.

- Information on the carriers involved in the transportation process.

- Dates of transportation and delivery locations.

- Signature of the responsible party certifying the accuracy of the report.

Filing Deadlines / Important Dates

Filing deadlines for the Liquid Fuel Carrier Petroleum Products Report MF 206 are typically set by the Kansas Department of Revenue. It is important for businesses to be aware of these dates to avoid late submissions and potential penalties. Generally, the report must be filed on a monthly basis, with specific due dates following the end of each reporting month. Keeping a calendar of these deadlines can help ensure timely compliance.

Quick guide on how to complete liquid fuel carrier petroleum products report mf 206 kansas ksrevenue

Your assistance manual on how to prepare your Liquid Fuel Carrier Petroleum Products Report MF 206 Kansas Ksrevenue

If you’re interested in learning how to create and submit your Liquid Fuel Carrier Petroleum Products Report MF 206 Kansas Ksrevenue, here are some brief instructions on how to simplify tax filing.

To begin, all you need to do is register your airSlate SignNow account to revolutionize your online document management. airSlate SignNow is an exceptionally user-friendly and robust document solution that enables you to edit, create, and complete your income tax forms effortlessly. With its editor, you can toggle between text, checkboxes, and eSignatures, and return to modify information as necessary. Streamline your tax handling with advanced PDF editing, eSigning, and seamless sharing.

Follow the steps below to finalize your Liquid Fuel Carrier Petroleum Products Report MF 206 Kansas Ksrevenue in no time:

- Create your account and begin working on PDFs within moments.

- Utilize our directory to locate any IRS tax form; browse through various editions and schedules.

- Click Get form to access your Liquid Fuel Carrier Petroleum Products Report MF 206 Kansas Ksrevenue in our editor.

- Complete the necessary fillable fields with your information (text, numbers, check marks).

- Employ the Sign Tool to affix your legally-binding eSignature (if required).

- Review your document and rectify any errors.

- Save adjustments, print your copy, send it to your recipient, and download it to your device.

Utilize this manual to submit your taxes electronically with airSlate SignNow. Please remember that submitting on paper can lead to return errors and prolong refunds. Certainly, before e-filing your taxes, verify the IRS website for submission rules applicable to your state.

Create this form in 5 minutes or less

Find and fill out the correct liquid fuel carrier petroleum products report mf 206 kansas ksrevenue

Create this form in 5 minutes!

How to create an eSignature for the liquid fuel carrier petroleum products report mf 206 kansas ksrevenue

How to generate an eSignature for your Liquid Fuel Carrier Petroleum Products Report Mf 206 Kansas Ksrevenue in the online mode

How to create an eSignature for the Liquid Fuel Carrier Petroleum Products Report Mf 206 Kansas Ksrevenue in Google Chrome

How to create an eSignature for signing the Liquid Fuel Carrier Petroleum Products Report Mf 206 Kansas Ksrevenue in Gmail

How to create an eSignature for the Liquid Fuel Carrier Petroleum Products Report Mf 206 Kansas Ksrevenue right from your smart phone

How to generate an eSignature for the Liquid Fuel Carrier Petroleum Products Report Mf 206 Kansas Ksrevenue on iOS devices

How to create an electronic signature for the Liquid Fuel Carrier Petroleum Products Report Mf 206 Kansas Ksrevenue on Android devices

People also ask

-

What is the Liquid Fuel Carrier Petroleum Products Report MF 206 Kansas Ksrevenue?

The Liquid Fuel Carrier Petroleum Products Report MF 206 Kansas Ksrevenue is a crucial document required by businesses involved in the transportation of liquid fuel in Kansas. This report includes comprehensive data regarding the volume and type of petroleum products transported to ensure compliance with state regulations. Completing this report accurately is vital for maintaining operational licenses.

-

How can airSlate SignNow help with the Liquid Fuel Carrier Petroleum Products Report MF 206 Kansas Ksrevenue?

airSlate SignNow simplifies the process of completing and signing the Liquid Fuel Carrier Petroleum Products Report MF 206 Kansas Ksrevenue. Our platform allows for easy document creation, sharing, and eSigning, ensuring that your reports are filled out correctly and submitted on time. This streamlines your workflow and enhances compliance with state regulations.

-

Is there a cost associated with using airSlate SignNow for the Liquid Fuel Carrier Petroleum Products Report MF 206 Kansas Ksrevenue?

Yes, airSlate SignNow offers a variety of pricing plans tailored to meet the needs of businesses handling the Liquid Fuel Carrier Petroleum Products Report MF 206 Kansas Ksrevenue. Our plans are designed to be cost-effective while providing the essential features you need for document management and eSigning. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for managing the Liquid Fuel Carrier Petroleum Products Report MF 206 Kansas Ksrevenue?

airSlate SignNow provides a range of features that enhance the management of the Liquid Fuel Carrier Petroleum Products Report MF 206 Kansas Ksrevenue. Key features include customizable templates, secure eSigning, document tracking, and cloud storage. These tools help ensure that your reports are accurate and easily accessible.

-

Can I integrate airSlate SignNow with other software for the Liquid Fuel Carrier Petroleum Products Report MF 206 Kansas Ksrevenue?

Yes, airSlate SignNow offers seamless integrations with various software solutions to streamline your workflow related to the Liquid Fuel Carrier Petroleum Products Report MF 206 Kansas Ksrevenue. Integrate with popular tools like CRM systems, ERP software, and cloud storage services to enhance data management and improve efficiency.

-

How does airSlate SignNow ensure the security of my Liquid Fuel Carrier Petroleum Products Report MF 206 Kansas Ksrevenue?

Security is a top priority at airSlate SignNow. We employ advanced encryption protocols and secure cloud storage to protect your Liquid Fuel Carrier Petroleum Products Report MF 206 Kansas Ksrevenue and other sensitive documents. Our platform also includes user authentication features to ensure that only authorized personnel have access to critical information.

-

What are the benefits of using airSlate SignNow for the Liquid Fuel Carrier Petroleum Products Report MF 206 Kansas Ksrevenue?

Using airSlate SignNow for the Liquid Fuel Carrier Petroleum Products Report MF 206 Kansas Ksrevenue offers numerous benefits, including increased efficiency, reduced paperwork, and enhanced compliance with state regulations. Our user-friendly platform simplifies the documentation process, allowing businesses to focus on their core operations while ensuring timely and accurate report submissions.

Get more for Liquid Fuel Carrier Petroleum Products Report MF 206 Kansas Ksrevenue

Find out other Liquid Fuel Carrier Petroleum Products Report MF 206 Kansas Ksrevenue

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors