The Art of Forming a New Nonprofit Utah Nonprofits

What is the Art of Forming a New Nonprofit in Utah?

The Art of Forming a New Nonprofit in Utah refers to the comprehensive process of establishing a nonprofit organization within the state. This involves understanding the legal requirements, drafting necessary documents, and ensuring compliance with state and federal regulations. Nonprofits in Utah are typically formed to serve charitable, educational, or social purposes, and they must adhere to specific guidelines set forth by the state government.

Steps to Complete the Art of Forming a New Nonprofit in Utah

Creating a nonprofit organization in Utah involves several key steps:

- Choose a Name: Select a unique name that reflects the mission of your organization and complies with state naming regulations.

- Draft Bylaws: Prepare bylaws that outline the governance structure and operational procedures of your nonprofit.

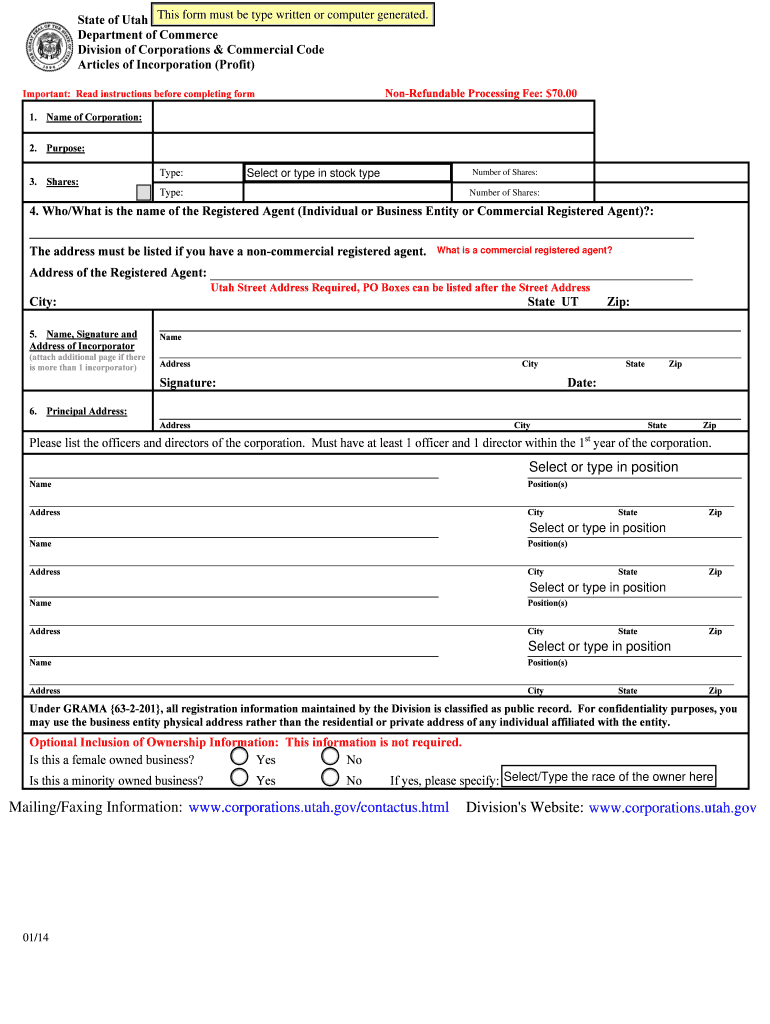

- File Articles of Incorporation: Submit the Articles of Incorporation with the Utah Division of Corporations, including necessary information about your organization.

- Obtain an EIN: Apply for an Employer Identification Number (EIN) from the IRS, which is essential for tax purposes.

- Apply for Tax-Exempt Status: Complete and submit IRS Form 1023 or Form 1023-EZ to gain federal tax-exempt status.

- Register for State Taxes: If applicable, register with the Utah State Tax Commission for state tax exemptions.

- Establish a Board of Directors: Appoint a board that meets the state requirements and is committed to the mission of the nonprofit.

Legal Use of the Art of Forming a New Nonprofit in Utah

To ensure the legal validity of your nonprofit organization in Utah, it is crucial to comply with various legal requirements. This includes adhering to state laws regarding nonprofit governance, maintaining accurate records, and fulfilling reporting obligations. Additionally, nonprofits must operate in accordance with their stated mission and purpose to maintain their tax-exempt status. Noncompliance can result in penalties or loss of tax-exempt status.

Required Documents for Forming a Nonprofit in Utah

Several documents are essential for forming a nonprofit in Utah:

- Articles of Incorporation: This document officially establishes the nonprofit and includes information about its name, purpose, and structure.

- Bylaws: Bylaws detail the rules governing the organization, including board structure and meeting procedures.

- IRS Form 1023 or 1023-EZ: This application for federal tax exemption is critical for nonprofits seeking 501(c)(3) status.

- Employer Identification Number (EIN): Required for tax purposes and to open a bank account.

State-Specific Rules for the Art of Forming a New Nonprofit in Utah

Utah has specific regulations that govern the formation and operation of nonprofit organizations. These include requirements for maintaining a registered agent, filing annual reports, and ensuring compliance with state tax laws. It is important for founders to familiarize themselves with the Utah Nonprofit Corporation Act and any other relevant state statutes to ensure compliance throughout the lifecycle of the organization.

Application Process & Approval Time for Nonprofits in Utah

The application process for forming a nonprofit in Utah typically involves several stages. After submitting the Articles of Incorporation, the approval time can vary. Generally, it may take a few weeks to receive confirmation from the Utah Division of Corporations. Once the nonprofit is established, obtaining federal tax-exempt status can take additional time, often several months, depending on the complexity of the application and the IRS's current processing times.

Quick guide on how to complete the art of forming a new nonprofit utah nonprofits

Complete The Art Of Forming A New Nonprofit Utah Nonprofits effortlessly on any gadget

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally-friendly alternative to conventional printed and signed papers, allowing you to locate the appropriate template and securely keep it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage The Art Of Forming A New Nonprofit Utah Nonprofits on any gadget using airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The easiest method to alter and electronically sign The Art Of Forming A New Nonprofit Utah Nonprofits with ease

- Obtain The Art Of Forming A New Nonprofit Utah Nonprofits and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal significance as a traditional handwritten signature.

- Review all the details and then click the Done button to save your changes.

- Decide how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Modify and electronically sign The Art Of Forming A New Nonprofit Utah Nonprofits and ensure effective communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is 'The Art Of Forming A New Nonprofit Utah Nonprofits'?

'The Art Of Forming A New Nonprofit Utah Nonprofits' is a comprehensive guide that outlines the necessary steps and best practices for establishing a nonprofit organization in Utah. It includes legal requirements, funding opportunities, and community resources to help you succeed in your mission.

-

How can airSlate SignNow assist in forming a nonprofit in Utah?

airSlate SignNow simplifies the process of forming a nonprofit by providing an easy-to-use platform for signing important documents electronically. With features tailored for forming Utah nonprofits, you can streamline paperwork and focus on your organization's goals.

-

What are the pricing options for airSlate SignNow?

airSlate SignNow offers various pricing plans that cater to different needs, making it a cost-effective solution for 'The Art Of Forming A New Nonprofit Utah Nonprofits.' Depending on the features you require, you can choose a plan that fits your budget while ensuring efficient document management.

-

What features does airSlate SignNow provide for new nonprofits?

airSlate SignNow offers features like electronic signatures, document templates, and secure cloud storage, all vital for 'The Art Of Forming A New Nonprofit Utah Nonprofits.' These tools help ensure that your documents are managed efficiently and securely, allowing you to concentrate on your nonprofit’s mission.

-

What are the benefits of using airSlate SignNow for my nonprofit?

Using airSlate SignNow allows for faster document turnaround times, reducing the time spent on administrative tasks. With secure and compliant eSigning, your nonprofit can operate more efficiently, aligning perfectly with 'The Art Of Forming A New Nonprofit Utah Nonprofits.'

-

Is there a free trial available for airSlate SignNow?

Yes, airSlate SignNow offers a free trial that allows you to explore the platform's features and see how it aligns with 'The Art Of Forming A New Nonprofit Utah Nonprofits.' This is a great way to assess the tool’s capabilities before making a financial commitment.

-

Can airSlate SignNow integrate with other tools and software?

Absolutely! airSlate SignNow integrates seamlessly with various third-party applications, making it easy to incorporate into your existing workflow for 'The Art Of Forming A New Nonprofit Utah Nonprofits.' You can connect it with CRM systems, cloud storage services, and more to enhance your nonprofit’s operations.

Get more for The Art Of Forming A New Nonprofit Utah Nonprofits

- On site field guide emergency response plan form

- 2018 2019 verification worksheet tracking group v4 custom form

- Concurrent enrollment permission request form uiwedu

- Journal of education and training studies vol 3 no 5 form

- Texas uil form

- Informed consent template winston salem state university

- Psychology department majors and minorsmarietta college form

- How to build a salad table mississippi state university form

Find out other The Art Of Forming A New Nonprofit Utah Nonprofits

- eSign Delaware Shareholder Agreement Template Now

- eSign Wyoming Shareholder Agreement Template Safe

- eSign Kentucky Strategic Alliance Agreement Secure

- Can I eSign Alaska Equipment Rental Agreement Template

- eSign Michigan Equipment Rental Agreement Template Later

- Help Me With eSignature Washington IOU

- eSign Indiana Home Improvement Contract Myself

- eSign North Dakota Architectural Proposal Template Online

- How To eSignature Alabama Mechanic's Lien

- Can I eSign Alabama Car Insurance Quotation Form

- eSign Florida Car Insurance Quotation Form Mobile

- eSign Louisiana Car Insurance Quotation Form Online

- Can I eSign Massachusetts Car Insurance Quotation Form

- eSign Michigan Car Insurance Quotation Form Online

- eSign Michigan Car Insurance Quotation Form Mobile

- eSignature Massachusetts Mechanic's Lien Online

- eSignature Massachusetts Mechanic's Lien Free

- eSign Ohio Car Insurance Quotation Form Mobile

- eSign North Dakota Car Insurance Quotation Form Online

- eSign Pennsylvania Car Insurance Quotation Form Mobile