Texas Form Ap 204 2 2009

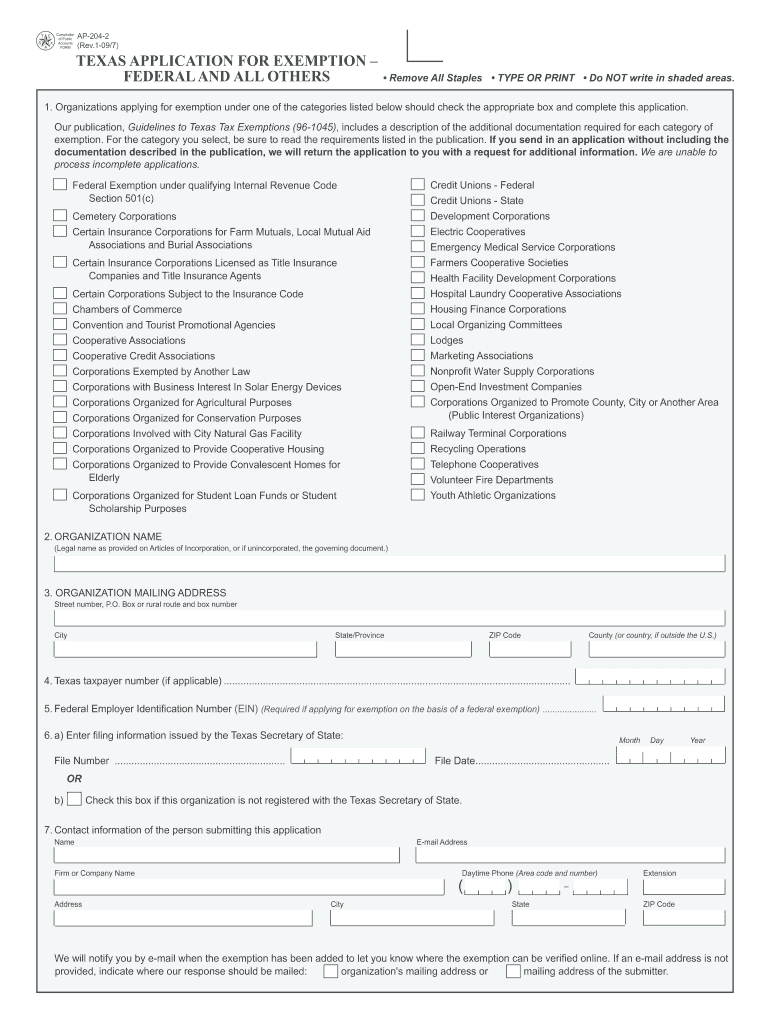

What is the Texas Form Ap 204 2

The Texas Form Ap 204 2 is a specific tax form utilized for reporting and documenting certain financial information to the state of Texas. This form is essential for individuals and businesses who need to comply with state tax regulations. It serves as a means to report various types of income, deductions, and credits, ensuring that taxpayers fulfill their legal obligations. Understanding its purpose is crucial for accurate tax reporting and compliance with Texas tax laws.

How to use the Texas Form Ap 204 2

Using the Texas Form Ap 204 2 involves several steps to ensure proper completion and submission. First, gather all necessary financial documents, including income statements and receipts for deductions. Next, carefully fill out the form, ensuring that all information is accurate and complete. After completing the form, review it for any errors before signing it. Finally, submit the form according to the specified submission methods, which may include online filing, mailing, or in-person delivery.

Steps to complete the Texas Form Ap 204 2

Completing the Texas Form Ap 204 2 requires attention to detail. Start by entering your personal information, such as your name, address, and Social Security number. Follow this by reporting your income, including wages, interest, and other earnings. Next, itemize any deductions you are eligible for, ensuring you have supporting documentation. After filling out all sections, double-check your entries for accuracy. Sign and date the form before submitting it to the appropriate tax authority.

Legal use of the Texas Form Ap 204 2

The Texas Form Ap 204 2 must be used in accordance with state laws and regulations. It is legally binding, meaning that the information provided must be truthful and accurate. Misrepresentation or failure to file this form can result in penalties, including fines or legal action. It is vital to ensure compliance with all filing requirements and deadlines to avoid complications with the Texas Comptroller's office.

Filing Deadlines / Important Dates

Filing deadlines for the Texas Form Ap 204 2 vary depending on the specific type of income being reported. Generally, taxpayers should be aware of the annual filing deadline, which is typically aligned with the federal tax deadline. Additionally, certain extensions may apply, allowing for delayed submission under specific circumstances. Staying informed about these dates is essential for timely and compliant tax reporting.

Required Documents

When preparing to complete the Texas Form Ap 204 2, it is important to gather all required documents. This includes W-2 forms, 1099 forms, and any other relevant income statements. Additionally, retain documentation for deductions, such as receipts for business expenses or charitable contributions. Having these documents on hand will streamline the completion process and help ensure accuracy in your reporting.

Quick guide on how to complete texas form ap 204 2 2009

Your assistance manual on how to prepare your Texas Form Ap 204 2

If you’re wondering how to complete and submit your Texas Form Ap 204 2, here are a few brief pointers on how to make tax reporting simpler.

To begin, you just need to set up your airSlate SignNow account to transform how you manage documents online. airSlate SignNow is an incredibly user-friendly and powerful document solution that allows you to modify, create, and finalize your tax forms with ease. With its editor, you can alternate between text, checkboxes, and eSignatures, and return to amend responses where necessary. Streamline your tax administration with advanced PDF editing, eSigning, and user-friendly sharing.

Follow the steps below to complete your Texas Form Ap 204 2 in no time:

- Establish your account and start working on PDFs within moments.

- Utilize our directory to find any IRS tax form; browse through variations and schedules.

- Hit Get form to launch your Texas Form Ap 204 2 in our editor.

- Enter the necessary fillable fields with your information (text, numbers, checkmarks).

- Utilize the Sign Tool to add your legally-binding eSignature (if necessary).

- Review your document and rectify any mistakes.

- Save alterations, print your version, submit it to your recipient, and download it to your device.

Make the most of this manual to file your taxes electronically with airSlate SignNow. Be aware that filing on paper may elevate errors and delay refunds. Of course, before e-filing your taxes, verify the IRS website for filing regulations in your state.

Create this form in 5 minutes or less

Find and fill out the correct texas form ap 204 2 2009

FAQs

-

How do I fill out an NDA 2 application form?

visit Welcome to UPSC | UPSCclick on apply online option their and select the ndaII option.Its in 2 parts, Fill part 1 and theirafter 2nd as guided on the website their.

-

When do I have to learn how to fill out a W-2 form?

Form W-2 is an obligatory form to be completed by every employer. Form W-2 doesn’t have to be filled out by the employee. It is given to inform the employee about the amount of his annual income and taxes withheld from it.You can find a lot of information here: http://bit.ly/2NjjlJi

-

How do you fill out a W-2 form?

In general, the W-2 form is divided into two parts each with numerous fields to be completed carefully by an employer. The section on the left contains both the employer's and employee`s names and contact information as well social security number and identification number.You can find a lot of information here: http://bit.ly/2NjjlJi

-

How can I make it easier for users to fill out a form on mobile apps?

I’ll tell you a secret - you can thank me later for this.If you want to make the form-filling experience easy for a user - make sure that you have a great UI to offer.Everything boils down to UI at the end.Axonator is one of the best mobile apps to collect data since it offers powerful features bundled with a simple UI.The problem with most of the mobile form apps is that they are overloaded with features that aren’t really necessary.The same doesn’t hold true for Axonator. It has useful features but it is very unlikely that the user will feel overwhelmed in using them.So, if you are inclined towards having greater form completion rates for your survey or any data collection projects, then Axonator is the way to go.Apart from that, there are other features that make the data collection process faster like offline data collection, rich data capture - audio, video, images, QR code & barcode data capture, live location & time capture, and more!Check all the features here!You will be able to complete more surveys - because productivity will certainly shoot up.Since you aren’t using paper forms, errors will drop signNowly.The cost of the paper & print will be saved - your office expenses will drop dramatically.No repeat work. No data entry. Time & money saved yet again.Analytics will empower you to make strategic decisions and explore new revenue opportunities.The app is dirt-cheap & you don’t any training to use the app. They come in with a smooth UI. Forget using, even creating forms for your apps is easy on the platform. Just drag & drop - and it’s ready for use. Anyone can build an app under hours.

-

Why are AP EAMCET forms to be filled out in 2018 when the NEET is compulsory?

AP EAMCET and NEET are two completely different entrance tests. NEET is the National Level entrance test for admission in MBBS/ BDS courses in Medical Institutes all over India.However, AP EAMCET is the entrance exam for admission in Engineering, Bio-Technology, B.Tech(Dairy Technology), B.Tech(Agr.Engg), B.Tech(Food Science and Technology), B.Sc(Ag)/B.Sc.(Hort)/B.V.Sc & A.H/B.F.Sc, B.Pharmacy, Pharm.D courses. Also, through EAMCET you secure admission in University / Private Institutes in Andhra Pradesh.The application form for both NEET and AP EAMCET 2018 are available. So now that you know the key difference, you can decide for which you want to apply for.AP EAMCET 2018: Important Dates, Application Form, sche.ap.gov.inNEET 2018: Exam Date, Application Form Available, Pattern, Admit Card

Create this form in 5 minutes!

How to create an eSignature for the texas form ap 204 2 2009

How to make an eSignature for the Texas Form Ap 204 2 2009 in the online mode

How to generate an electronic signature for the Texas Form Ap 204 2 2009 in Chrome

How to generate an electronic signature for putting it on the Texas Form Ap 204 2 2009 in Gmail

How to create an electronic signature for the Texas Form Ap 204 2 2009 straight from your mobile device

How to generate an electronic signature for the Texas Form Ap 204 2 2009 on iOS devices

How to generate an electronic signature for the Texas Form Ap 204 2 2009 on Android devices

People also ask

-

What is Texas Form Ap 204 2 and how can it be used with airSlate SignNow?

Texas Form Ap 204 2 is a document used for certain tax filings in Texas. With airSlate SignNow, you can easily upload, manage, and eSign your Texas Form Ap 204 2, streamlining the submission process and ensuring compliance with local regulations.

-

How much does it cost to use airSlate SignNow for Texas Form Ap 204 2?

airSlate SignNow offers various pricing plans to accommodate different business needs. Whether you are a small business or a larger organization, you can find a cost-effective solution for managing your Texas Form Ap 204 2 and other documents, ensuring you only pay for the features you need.

-

Can I integrate airSlate SignNow with other software for handling Texas Form Ap 204 2?

Yes, airSlate SignNow seamlessly integrates with various software applications such as CRM systems and cloud storage services. This allows you to efficiently manage your Texas Form Ap 204 2 alongside other essential documents, enhancing your workflow and productivity.

-

What features does airSlate SignNow offer for completing Texas Form Ap 204 2?

airSlate SignNow provides features like document templates, electronic signatures, and real-time tracking to simplify the completion of Texas Form Ap 204 2. These features help ensure that your documents are processed quickly and securely, meeting all necessary requirements.

-

Is it safe to use airSlate SignNow for Texas Form Ap 204 2 submissions?

Absolutely! airSlate SignNow employs advanced security measures, including encryption and secure storage, to protect your sensitive information. You can confidently use airSlate SignNow for Texas Form Ap 204 2 submissions, knowing your data is safeguarded.

-

How can I get help with Texas Form Ap 204 2 using airSlate SignNow?

If you need assistance with Texas Form Ap 204 2 while using airSlate SignNow, our customer support team is available to help. You can access a range of resources, including tutorials and live support, to guide you through the process and address any questions you may have.

-

Can I access Texas Form Ap 204 2 on mobile devices with airSlate SignNow?

Yes, airSlate SignNow is optimized for mobile devices, allowing you to access and manage Texas Form Ap 204 2 on the go. Whether you're in the office or out in the field, you can easily complete and eSign your documents from your smartphone or tablet.

Get more for Texas Form Ap 204 2

- Oregon registry enrollment form

- Emeur form

- Lobbying registration statement state of oregon oregon form

- Nfirs field form

- Wcb request for hearing form 803

- I amendment form for bar application rhode island judiciary courts ri

- Ri dem air pollution inventory mass balance reporting forms 2013

- In service training submittal form vermont

Find out other Texas Form Ap 204 2

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document

- How Can I eSignature Colorado Courts PDF

- Can I eSignature Louisiana Courts Document