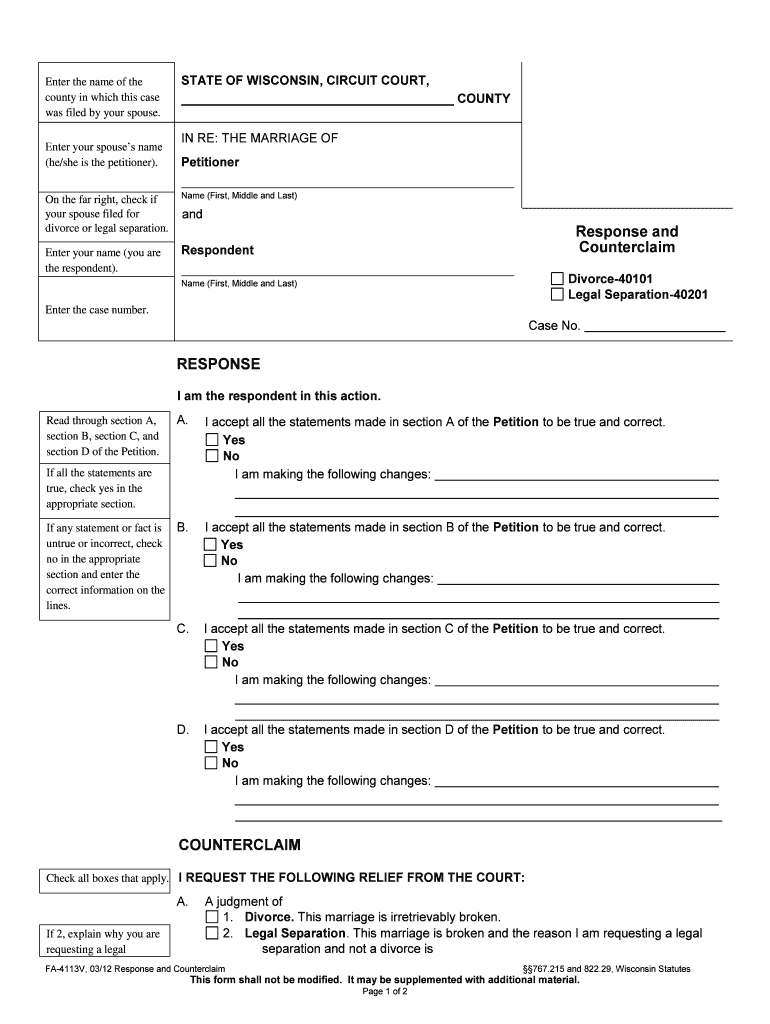

Was Filed by Your Spouse Form

What is the Was Filed By Your Spouse

The "Was Filed By Your Spouse" form is a crucial document used primarily in tax situations where one spouse has filed a joint tax return on behalf of both partners. This form serves as an acknowledgment of the filing, clarifying the responsibilities and liabilities of each spouse regarding the submitted tax return. It is essential for ensuring that both parties are aware of the tax obligations and any potential refunds or liabilities that may arise from the filing.

How to use the Was Filed By Your Spouse

Using the "Was Filed By Your Spouse" form involves several steps to ensure it is completed accurately. First, gather all necessary information, including both spouses' names, Social Security numbers, and details of the tax return filed. Next, fill out the form with this information, ensuring that it reflects the accurate filing status. Once completed, both spouses should review the form for accuracy before signing it. This ensures that both parties are in agreement about the information provided and the responsibilities outlined.

Steps to complete the Was Filed By Your Spouse

Completing the "Was Filed By Your Spouse" form requires careful attention to detail. Follow these steps:

- Collect personal information for both spouses, including names and Social Security numbers.

- Identify the tax year for which the form is being completed.

- Fill out the form accurately, ensuring all details match the filed tax return.

- Review the completed form together to confirm accuracy.

- Both spouses should sign and date the form to validate it.

Legal use of the Was Filed By Your Spouse

The "Was Filed By Your Spouse" form has legal implications, particularly in tax matters. It serves as a formal acknowledgment that one spouse has filed a tax return on behalf of both. This can protect both parties in case of audits or disputes with the IRS. It is essential for both spouses to understand their rights and obligations under the law, as signing this form indicates consent to the filing and acceptance of any associated liabilities.

Key elements of the Was Filed By Your Spouse

Several key elements are essential when filling out the "Was Filed By Your Spouse" form:

- Identification Information: Names and Social Security numbers of both spouses.

- Tax Year: The specific year for which the tax return was filed.

- Filing Status: Indication of whether the return was filed jointly or separately.

- Signatures: Both spouses must sign to confirm their agreement and understanding of the filing.

Filing Deadlines / Important Dates

Understanding the deadlines associated with the "Was Filed By Your Spouse" form is crucial for compliance. Typically, tax returns must be filed by April fifteenth of the following year. If additional time is needed, an extension can be requested, but the form must still be submitted by the original deadline to avoid penalties. Keeping track of these dates helps ensure that both spouses fulfill their tax obligations in a timely manner.

Quick guide on how to complete was filed by your spouse

Complete Was Filed By Your Spouse effortlessly on any device

Digital document management has become prevalent among businesses and individuals alike. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the necessary tools to create, modify, and electronically sign your documents quickly and without any delays. Manage Was Filed By Your Spouse on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Was Filed By Your Spouse without hassle

- Locate Was Filed By Your Spouse and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select your preferred method for sending your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to misplaced or lost files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Was Filed By Your Spouse and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What should I do if my divorce petition was filed by my spouse?

If your divorce petition was filed by your spouse, it is important to understand your rights and the implications of this decision. You should consider seeking legal counsel to discuss how you can respond to the petition and what steps to take next. Utilize airSlate SignNow to quickly eSign any necessary documents to expedite your case.

-

How does airSlate SignNow help with documents that were filed by my spouse?

airSlate SignNow offers a seamless way to manage and eSign documents related to cases where a divorce was filed by your spouse. The platform allows you to review and sign important legal documents securely and efficiently. This ensures that you can keep track of all necessary paperwork without any hassle.

-

Can I use airSlate SignNow if my spouse filed for divorce in another state?

Yes, you can still use airSlate SignNow even if your spouse filed for divorce in another state. The platform's secure eSignature feature allows you to sign documents from anywhere, regardless of geographical boundaries. This flexibility is especially useful when dealing with long-distance legal matters.

-

What is the cost of using airSlate SignNow when dealing with divorce papers filed by my spouse?

airSlate SignNow offers cost-effective pricing plans that cater to your document management needs, especially when handling divorce papers filed by your spouse. The service is designed to be budget-friendly, making it an ideal choice for individuals navigating financial decisions during a divorce.

-

What features does airSlate SignNow provide for managing legal documents?

airSlate SignNow provides features such as secure eSigning, document templates, and an intuitive user interface to streamline the process of managing legal documents. These capabilities are particularly beneficial when handling cases where a divorce was filed by your spouse, allowing you to collaborate efficiently.

-

How can I ensure my documents are secure if my spouse filed for divorce?

With airSlate SignNow, your documents are protected through robust security measures such as encryption and access controls. This security is crucial when handling sensitive information, especially if a divorce was filed by your spouse. Rest assured, you can manage your documents without compromising your privacy.

-

Does airSlate SignNow integrate with other tools for divorce document management?

Yes, airSlate SignNow integrates with various applications that can enhance your divorce document management experience. Whether you need to sync with your email or employ other legal software, these integrations can simplify your workflow, especially if your divorce was filed by your spouse.

Get more for Was Filed By Your Spouse

- Ohio civil service application pdf 2008 form

- Ohio civil service application for state and county agencies 2008 form

- Pde 353a 2008 form

- Sample active employee certificate of agreement tngov form

- Title 32 rehabilitation and disabilities part 22 office of form

- Online wage claim form vermont department of labor

- Rental lease agreement templates residential eforms

- How much notice is required in a month to month tenancy form

Find out other Was Filed By Your Spouse

- Sign Virginia Legal Last Will And Testament Mobile

- How To Sign Vermont Legal Executive Summary Template

- How To Sign Vermont Legal POA

- How Do I Sign Hawaii Life Sciences Business Plan Template

- Sign Life Sciences PPT Idaho Online

- Sign Life Sciences PPT Idaho Later

- How Do I Sign Hawaii Life Sciences LLC Operating Agreement

- Sign Idaho Life Sciences Promissory Note Template Secure

- How To Sign Wyoming Legal Quitclaim Deed

- Sign Wisconsin Insurance Living Will Now

- Sign Wyoming Insurance LLC Operating Agreement Simple

- Sign Kentucky Life Sciences Profit And Loss Statement Now

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free

- Sign California Non-Profit Living Will Easy

- Sign California Non-Profit IOU Myself

- Sign California Non-Profit Lease Agreement Template Free

- Sign Maryland Life Sciences Residential Lease Agreement Later

- Sign Delaware Non-Profit Warranty Deed Fast