Texas Revocable Transfer on Death Deed Legal Form

Understanding the Texas Revocable Transfer On Death Deed

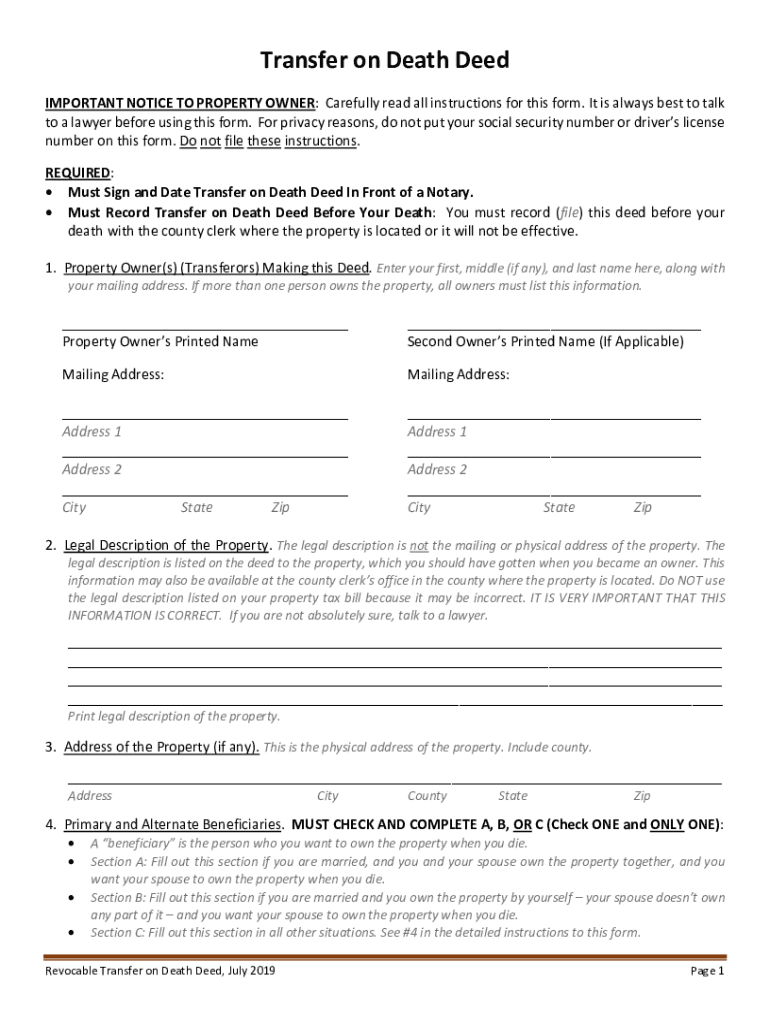

The Texas Revocable Transfer On Death Deed is a legal document that allows an individual to transfer real property to designated beneficiaries upon their death. This form is particularly advantageous as it bypasses the probate process, making the transfer of property simpler and more efficient. It is essential to understand that this deed can be revoked or altered at any time before the individual's death, providing flexibility in estate planning.

Steps to Complete the Texas Revocable Transfer On Death Deed

Completing the Texas Revocable Transfer On Death Deed involves several key steps:

- Identify the property you wish to transfer.

- Designate one or more beneficiaries who will receive the property upon your death.

- Fill out the deed form accurately, ensuring all required information is included.

- Sign the deed in the presence of a notary public to validate it.

- File the completed deed with the county clerk's office where the property is located.

Following these steps ensures that the deed is legally binding and effective in transferring property upon death.

Key Elements of the Texas Revocable Transfer On Death Deed

Several critical components must be included in the Texas Revocable Transfer On Death Deed to ensure its validity:

- Grantor Information: The name and address of the individual creating the deed.

- Beneficiary Information: Names and addresses of the individuals who will inherit the property.

- Property Description: A clear and accurate description of the property being transferred.

- Signature and Notarization: The grantor's signature, along with notarization, to confirm authenticity.

Inclusion of these elements is crucial for the deed to be recognized legally and to ensure proper execution of the property transfer.

Legal Use of the Texas Revocable Transfer On Death Deed

The legal use of the Texas Revocable Transfer On Death Deed is governed by Texas law, which allows individuals to transfer property outside of probate. This deed must be executed while the grantor is alive and competent. It is important to note that the deed only takes effect upon the death of the grantor, and the beneficiaries must survive the grantor to inherit the property. Additionally, the deed can be revoked or modified at any time before the grantor's death, ensuring that the grantor retains control over their property during their lifetime.

Obtaining the Texas Revocable Transfer On Death Deed

To obtain the Texas Revocable Transfer On Death Deed, individuals can access the form through various sources:

- Visit the Texas Secretary of State's website for downloadable forms.

- Contact a local attorney specializing in estate planning for assistance.

- Check with county clerk offices, which may provide the form and additional guidance.

Having the correct form is essential to ensure that all legal requirements are met when creating the deed.

State-Specific Rules for the Texas Revocable Transfer On Death Deed

Texas has specific regulations governing the use of the Revocable Transfer On Death Deed. These include:

- The deed must be recorded in the county where the property is located to be effective.

- Beneficiaries must be clearly identified, and the property description must be precise.

- There are no limits on the number of beneficiaries that can be named.

Understanding these state-specific rules is vital for ensuring that the deed is executed correctly and legally recognized.

Quick guide on how to complete texas revocable transfer on death deed legal form

Complete Texas Revocable Transfer On Death Deed Legal Form effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly option to conventional printed and signed materials, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Texas Revocable Transfer On Death Deed Legal Form on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest method to modify and eSign Texas Revocable Transfer On Death Deed Legal Form seamlessly

- Locate Texas Revocable Transfer On Death Deed Legal Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click the Done button to preserve your changes.

- Choose your preferred method of delivering your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets your document management needs within a few clicks from any device you prefer. Modify and eSign Texas Revocable Transfer On Death Deed Legal Form to maintain effective communication at every step of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a deed in Texas?

A deed in Texas is a legal document that transfers ownership of property from one party to another. It is essential for recording property ownership and can include different types, such as warranty deeds and quitclaim deeds. Understanding the nuances of each type is crucial for proper real estate transactions in Texas.

-

How can airSlate SignNow help me eSign a deed in Texas?

AirSlate SignNow provides a seamless platform for eSigning deeds in Texas. With its user-friendly interface, you can easily send, sign, and manage your deeds securely online. This not only saves time but ensures compliance with legal standards in Texas.

-

What are the pricing options for using airSlate SignNow for deeds in Texas?

AirSlate SignNow offers various pricing plans designed to meet the needs of individuals and businesses that need to handle deeds in Texas. Each plan is cost-effective, enabling users to choose an option that fits their budget while accessing essential features for managing and signing deeds.

-

Are there any integrations available with airSlate SignNow for managing deeds in Texas?

Yes, airSlate SignNow integrates with numerous applications that can assist in managing deeds in Texas. This includes CRM systems and cloud storage options, allowing for streamlined workflows and easier document management. These integrations can enhance your overall experience in handling real estate transactions.

-

What benefits does airSlate SignNow provide for signing deeds in Texas?

Using airSlate SignNow to sign deeds in Texas offers several benefits, including enhanced security, ease of use, and rapid processing times. Signers can quickly access documents from any device, ensuring a convenient signing experience. Additionally, electronic signatures are legally recognized in Texas, making the solution both efficient and compliant.

-

Is airSlate SignNow legally compliant for eSigning deeds in Texas?

Absolutely, airSlate SignNow is compliant with the Electronic Signatures in Global and National Commerce Act (ESIGN) and Texas law regarding electronic signatures. This compliance ensures that your eSigned deeds hold up in court and meet all legal requirements. Trust airSlate SignNow to handle your documents properly.

-

How can I track the status of my deeds when using airSlate SignNow?

AirSlate SignNow offers robust tracking features that allow you to monitor the status of your deeds in Texas. You can see whether documents have been viewed, signed, or require further action, giving you complete visibility throughout the signing process. This transparency minimizes delays and keeps your transactions on schedule.

Get more for Texas Revocable Transfer On Death Deed Legal Form

- Ohio job family services state form

- Wwwicc cpiint sites defaultcase information sheet international criminal court

- Participant information sheets ampamp informed consent forms

- Isdup membership instructions form

- Membership application daughters of utah pioneers form

- Georgia rigbys entertainment complex form

- Submission of mitigating circumstances forms notes of guidance

- London met mitigating circumstances form

Find out other Texas Revocable Transfer On Death Deed Legal Form

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed

- Electronic signature Virginia Police Quitclaim Deed Secure

- How Can I Electronic signature West Virginia Police Letter Of Intent

- How Do I Electronic signature Washington Police Promissory Note Template

- Electronic signature Wisconsin Police Permission Slip Free

- Electronic signature Minnesota Sports Limited Power Of Attorney Fast

- Electronic signature Alabama Courts Quitclaim Deed Safe

- How To Electronic signature Alabama Courts Stock Certificate

- Can I Electronic signature Arkansas Courts Operating Agreement

- How Do I Electronic signature Georgia Courts Agreement