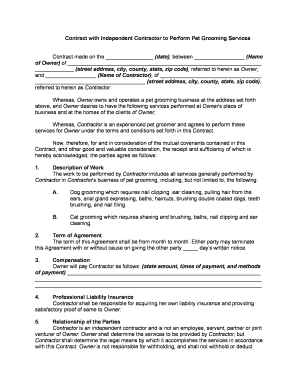

Independent Contractor Form

What is the Independent Contractor

An independent contractor is a self-employed individual who provides services to clients under a contract. Unlike employees, independent contractors maintain control over how they perform their work, often working on a project basis. This arrangement allows for flexibility in work schedules and locations, making it an appealing option for many professionals. Independent contractors are responsible for their own taxes, benefits, and insurance, distinguishing them from traditional employees.

Key elements of the Independent Contractor

Understanding the key elements of an independent contractor is essential for both the contractor and the hiring entity. Key elements include:

- Contractual Agreement: A formal contract outlines the scope of work, payment terms, and duration of the engagement.

- Control: Independent contractors have the freedom to determine how to complete their tasks, unlike employees who follow specific directives from their employers.

- Tax Responsibilities: Contractors must manage their own taxes, including self-employment tax, and are typically required to file quarterly tax payments.

- Liability: Independent contractors are generally responsible for any liabilities arising from their work, which may include insurance coverage.

Steps to complete the Independent Contractor

Completing the contractor form statement involves several important steps to ensure accuracy and compliance. Follow these steps for effective completion:

- Gather Necessary Information: Collect all relevant details, such as personal identification, business information, and tax identification numbers.

- Fill Out the Form: Carefully enter the required information into the contractor form statement, ensuring all fields are completed accurately.

- Review the Form: Double-check all entries for errors or omissions before submission.

- Submit the Form: Depending on the requirements, submit the completed form online, by mail, or in person as instructed.

Legal use of the Independent Contractor

The legal use of independent contractors is governed by various laws and regulations. It is crucial for both parties to understand their rights and obligations. Key legal considerations include:

- Classification: Properly classifying a worker as an independent contractor rather than an employee is essential to avoid legal issues.

- Compliance: Ensure compliance with federal and state labor laws, including tax regulations and labor standards.

- Contractual Obligations: Both parties must adhere to the terms outlined in the contract to maintain a legally binding relationship.

IRS Guidelines

The Internal Revenue Service (IRS) provides specific guidelines for independent contractors. Understanding these guidelines is vital for tax compliance. Key points include:

- Form 1099-MISC: Independent contractors typically receive Form 1099-MISC from clients, reporting income earned during the year.

- Self-Employment Tax: Contractors must pay self-employment tax on their earnings, which covers Social Security and Medicare taxes.

- Business Expenses: Contractors can deduct certain business-related expenses on their tax returns, which can help reduce taxable income.

Required Documents

When engaging as an independent contractor, several documents may be required to ensure compliance and facilitate the contracting process. Commonly required documents include:

- Contract Agreement: A signed contract detailing the scope of work and payment terms.

- W-9 Form: This form provides the contractor's taxpayer identification number to the hiring entity.

- Insurance Certificates: Proof of liability insurance may be necessary, depending on the nature of the work.

Quick guide on how to complete independent contractor

Easily Prepare Independent Contractor on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can access the necessary form and securely save it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents swiftly and without delays. Handle Independent Contractor on any device using airSlate SignNow’s apps for Android or iOS, and enhance any document-related process today.

How to Modify and Electronically Sign Independent Contractor Effortlessly

- Obtain Independent Contractor and click on Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Emphasize relevant sections of the documents or redact sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature using the Sign feature, which takes just seconds and has the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and electronically sign Independent Contractor to ensure effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a contractor form statement and how does it work?

A contractor form statement is a document that outlines the essential details and terms of a contract between contractors and their clients. It helps to formalize agreements and clarify the expectations of both parties. Using airSlate SignNow, you can easily create, send, and eSign contractor form statements, streamlining your workflow.

-

What features does airSlate SignNow offer for contractor form statements?

airSlate SignNow provides a variety of features to enhance your contractor form statement process. You can create customized templates, utilize in-app collaboration tools, and track document progress in real-time. These features ensure that signing contractor form statements is efficient and error-free.

-

How does airSlate SignNow handle pricing for contractor form statements?

We offer flexible pricing plans designed to accommodate various business needs for managing contractor form statements. You can choose from a range of plans based on the number of users and features needed. This way, you can find an affordable solution that fits your budget while ensuring effective management of contractor form statements.

-

Can I integrate airSlate SignNow with other tools for managing contractor form statements?

Yes, airSlate SignNow can be easily integrated with a variety of applications, enhancing your ability to manage contractor form statements effectively. Popular integrations include CRM systems, project management tools, and cloud storage services. This flexibility allows for a seamless workflow when handling your contractor form statements.

-

What are the benefits of using airSlate SignNow for contractor form statements?

Using airSlate SignNow for contractor form statements offers numerous benefits, including increased efficiency and reduced paperwork. The ability to send and sign documents electronically minimizes delays and ensures that contracts are executed promptly. Moreover, it enhances security and compliance, safeguarding your contractor form statements.

-

Is it easy to use airSlate SignNow for creating contractor form statements?

Absolutely! airSlate SignNow is designed to be user-friendly, making it easy to create contractor form statements even for those without extensive technical knowledge. The intuitive interface allows you to drag and drop elements, customize templates, and quickly generate professional documents.

-

How secure is airSlate SignNow when handling contractor form statements?

airSlate SignNow takes security seriously, employing advanced encryption and authentication measures to protect your contractor form statements. Our platform complies with industry standards to ensure the confidentiality and integrity of your documents. This level of security gives you peace of mind when managing sensitive contractor information.

Get more for Independent Contractor

- Group title pinellas news title pinellas news march 18 form

- Venable llp city of baltimore consent decree form

- The laws of the state of form

- Indiana commercial lease agreement form id5dfbd72c5076a

- Federal tax id number form

- Do you intend to reside here indefinitely form

- Please provide the following information in reference to hisher employment

- Following materials and procedures form

Find out other Independent Contractor

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word