Nevada Living Trust for Individual Who is Single, Divorced or Wwidow or Widower with No Children Form

What is the Nevada Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children

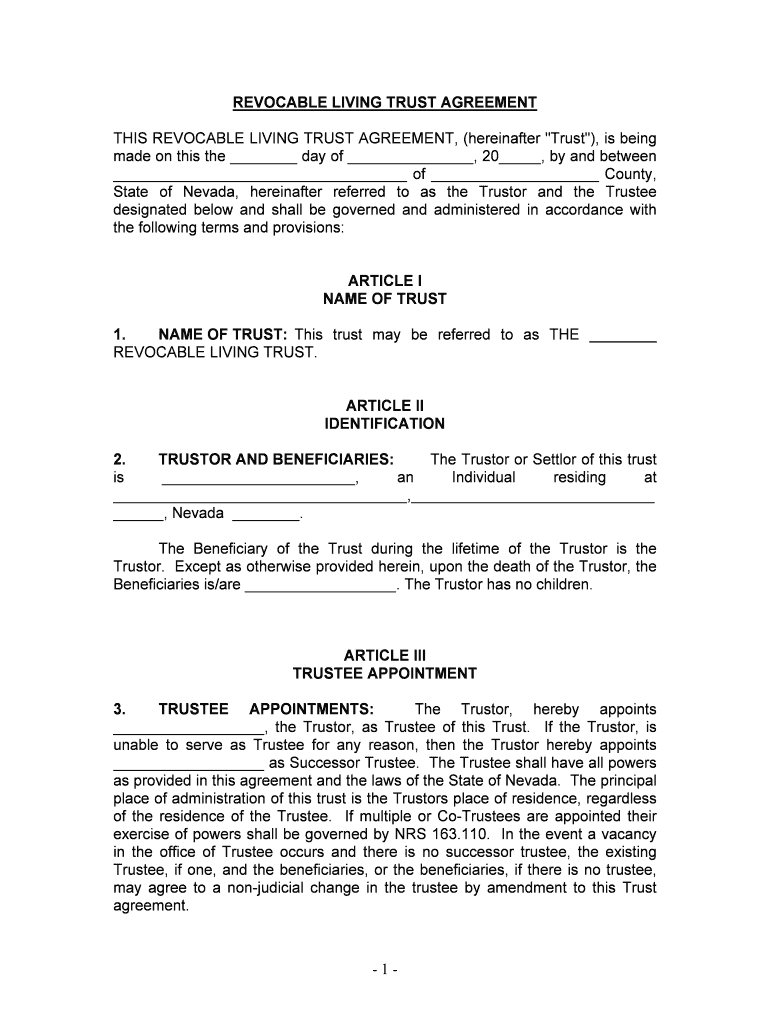

The Nevada Living Trust for individuals who are single, divorced, or widowed without children is a legal document that allows a person to manage their assets during their lifetime and dictate how those assets will be distributed after their death. This type of trust is particularly beneficial for individuals without children, as it provides a clear plan for asset distribution, avoiding the complexities of probate court. It can help ensure that your wishes are honored regarding who receives your property and how it is managed.

Key Elements of the Nevada Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children

Several key elements define the Nevada Living Trust for individuals in this demographic. These include:

- Grantor: The individual creating the trust, who retains control over the assets.

- Trustee: The person or institution responsible for managing the trust. The grantor can also serve as the trustee.

- Beneficiaries: Individuals or entities designated to receive the trust assets upon the grantor's death.

- Terms of Distribution: Specific instructions on how and when the assets should be distributed to beneficiaries.

How to Use the Nevada Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children

Using the Nevada Living Trust involves several steps. First, the individual must gather all relevant financial information, including assets, liabilities, and any specific wishes regarding asset distribution. Next, they can create the trust document, either independently or with legal assistance, ensuring that it complies with Nevada laws. Once established, the individual should fund the trust by transferring ownership of their assets into it. This step is crucial, as it ensures that the trust operates effectively upon the grantor's passing.

Steps to Complete the Nevada Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children

Completing the Nevada Living Trust involves the following steps:

- Gather necessary financial documents and asset information.

- Decide on the structure of the trust, including the trustee and beneficiaries.

- Create the trust document, ensuring it meets legal requirements.

- Sign the document in the presence of a notary public.

- Transfer assets into the trust, updating titles and deeds as necessary.

Legal Use of the Nevada Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children

The legal use of the Nevada Living Trust is to provide a clear and enforceable plan for asset distribution. This trust bypasses the probate process, which can be lengthy and costly. It is essential that the trust document is executed properly, with the necessary signatures and notary acknowledgment, to ensure its validity. Additionally, the trust must comply with Nevada state laws to be recognized in court.

State-Specific Rules for the Nevada Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children

In Nevada, specific rules govern the creation and management of living trusts. These include:

- The trust must be in writing and signed by the grantor.

- It must clearly identify the grantor, trustee, and beneficiaries.

- Trusts can be revocable or irrevocable, depending on the grantor's wishes.

- Assets must be properly funded into the trust to ensure they are managed according to the trust's terms.

Quick guide on how to complete nevada living trust for individual who is single divorced or wwidow or widower with no children

Complete Nevada Living Trust For Individual Who Is Single, Divorced Or Wwidow or Widower With No Children effortlessly on any device

Online document management has gained signNow traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed papers, enabling you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without delays. Manage Nevada Living Trust For Individual Who Is Single, Divorced Or Wwidow or Widower With No Children on any device through the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to alter and electronically sign Nevada Living Trust For Individual Who Is Single, Divorced Or Wwidow or Widower With No Children with ease

- Obtain Nevada Living Trust For Individual Who Is Single, Divorced Or Wwidow or Widower With No Children and click Get Form to begin.

- Utilize the tools available to complete your form.

- Emphasize pertinent sections of your documents or hide confidential information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Put an end to lost or mislaid documents, tedious form searches, or errors that require reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Nevada Living Trust For Individual Who Is Single, Divorced Or Wwidow or Widower With No Children and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Nevada Living Trust For Individual Who Is Single, Divorced Or Widow or Widower With No Children?

A Nevada Living Trust for individuals who are single, divorced, or widowed without children is a legal document that allows you to manage your assets during your lifetime and dictate how they will be distributed after your death. It offers flexibility and control over your estate, ensuring your wishes are honored. This kind of trust is particularly beneficial for those without immediate heirs, making the estate settlement process more straightforward.

-

How does a Nevada Living Trust differ from a will?

A Nevada Living Trust provides advantages over a traditional will, especially for individuals who are single, divorced, or widowed without children. Unlike a will, a trust allows for assets to bypass probate, which can save time and money. Additionally, with a trust, you can control the distribution of your assets while you're alive, which isn't possible with a will.

-

What are the benefits of setting up a Nevada Living Trust for individuals without children?

Establishing a Nevada Living Trust for individuals who are single, divorced, or widowed without children offers several advantages, including privacy, as the trust does not go through probate. It can also simplify the management of your estate and provide clarity on your financial intentions. Furthermore, it allows for appointed trustees to manage your assets on your behalf if you become incapacitated.

-

What is the typical cost to create a Nevada Living Trust?

The cost to create a Nevada Living Trust can vary based on the complexity of your assets and the professionals you choose to assist you. While legal fees can range from a few hundred to several thousand dollars, using airSlate SignNow offers a cost-effective solution for creating a Nevada Living Trust for individuals who are single, divorced, or widowed without children. Overall, investing in a trust can ultimately save you money by avoiding probate fees later.

-

How can airSlate SignNow assist in setting up a Nevada Living Trust?

airSlate SignNow streamlines the process of setting up a Nevada Living Trust for individuals who are single, divorced, or widowed without children by offering an easy-to-use digital platform for document creation and eSigning. Our solution empowers you to manage your trust documents efficiently and securely, reducing the stress typically associated with estate planning. Plus, our user-friendly features ensure that you can easily customize your trust to fit your specific needs.

-

Can I modify my Nevada Living Trust after it's created?

Yes, one of the key advantages of a Nevada Living Trust for individuals who are single, divorced, or widowed without children is the ability to modify it at any time while you're alive. This flexibility allows you to adapt the trust terms and beneficiary designations as your life circumstances change. It's advisable to review and potentially update your trust periodically to ensure it reflects your current intentions.

-

Is a notary required for a Nevada Living Trust?

While not all states require a notary for a Nevada Living Trust, having your trust documents signNowd can add an extra layer of authenticity and can help prevent challenges to the validity of the trust later on. For individuals who are single, divorced, or widowed without children, ensuring that your Nevada Living Trust is properly executed is crucial to upholding your wishes. airSlate SignNow provides guidance on this if you choose to create your trust digitally.

Get more for Nevada Living Trust For Individual Who Is Single, Divorced Or Wwidow or Widower With No Children

- Rule 51 instructions to the jury objections preserving a form

- French drug co inc v jones 1978 supreme court of form

- Page v columbia natural resources inc198 w va 378 form

- The court instructs the jury that should you find from a preponderance of the evidence form

- By and through hisher attorneys form

- Administratrix of the form

- Useful terms in motor vehicle accident lawsuit settlement or form

- By and through hisher form

Find out other Nevada Living Trust For Individual Who Is Single, Divorced Or Wwidow or Widower With No Children

- Electronic signature Alaska Medical Records Release Mobile

- Electronic signature California Medical Records Release Myself

- Can I Electronic signature Massachusetts Medical Records Release

- How Do I Electronic signature Michigan Medical Records Release

- Electronic signature Indiana Membership Agreement Easy

- How Can I Electronic signature New Jersey Medical Records Release

- Electronic signature New Mexico Medical Records Release Easy

- How Can I Electronic signature Alabama Advance Healthcare Directive

- How Do I Electronic signature South Carolina Advance Healthcare Directive

- eSignature Kentucky Applicant Appraisal Form Evaluation Later

- Electronic signature Colorado Client and Developer Agreement Later

- Electronic signature Nevada Affiliate Program Agreement Secure

- Can I Electronic signature Pennsylvania Co-Branding Agreement

- Can I Electronic signature South Dakota Engineering Proposal Template

- How Do I Electronic signature Arizona Proforma Invoice Template

- Electronic signature California Proforma Invoice Template Now

- Electronic signature New York Equipment Purchase Proposal Now

- How Do I Electronic signature New York Proforma Invoice Template

- How Can I Electronic signature Oklahoma Equipment Purchase Proposal

- Can I Electronic signature New Jersey Agreement