New Hampshire Assumption Agreement of Mortgage and Release of Original Mortgagors Form

What is the New Hampshire Assumption Agreement Of Mortgage And Release Of Original Mortgagors

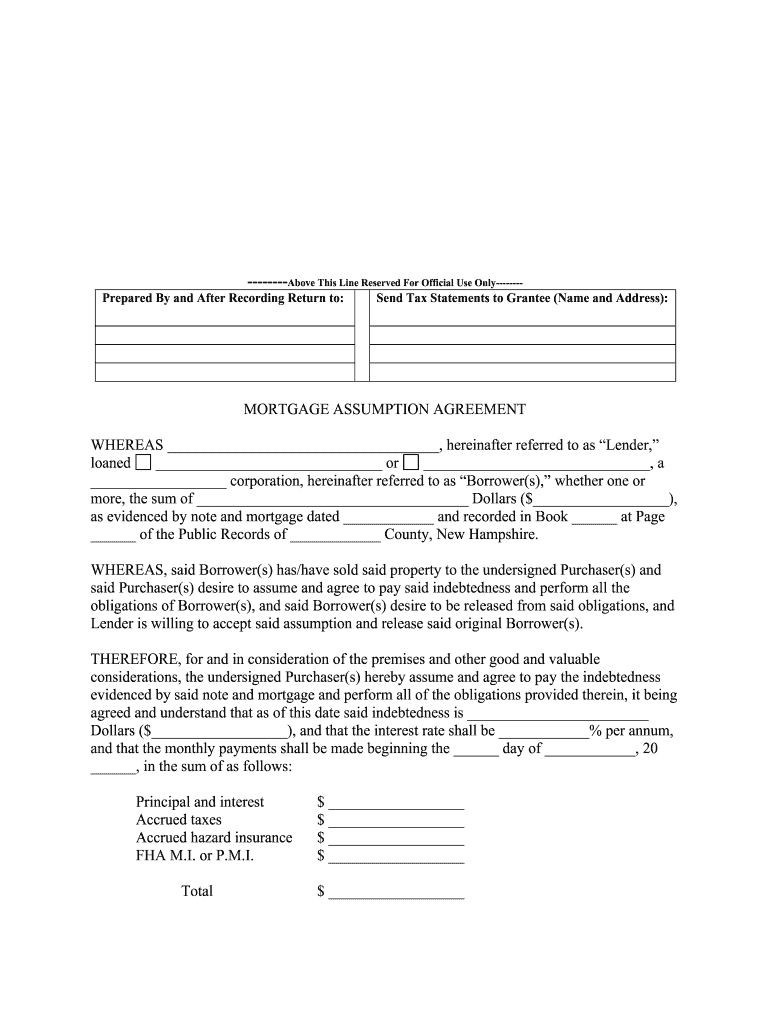

The New Hampshire Assumption Agreement of Mortgage and Release of Original Mortgagors is a legal document that allows a new borrower to assume the mortgage obligations of the original mortgagor. This agreement typically involves the transfer of property ownership and the responsibilities associated with the mortgage from the original borrower to the new borrower. The document ensures that the original mortgagors are released from their obligations under the mortgage, providing legal clarity and protection for all parties involved.

Key elements of the New Hampshire Assumption Agreement Of Mortgage And Release Of Original Mortgagors

Several key elements are essential in the New Hampshire Assumption Agreement of Mortgage and Release of Original Mortgagors. These include:

- Identification of Parties: Clearly stating the names and addresses of the original mortgagors and the new borrower.

- Property Description: Providing a detailed description of the property subject to the mortgage.

- Mortgage Details: Including the original mortgage amount, interest rate, and terms.

- Assumption Terms: Outlining the conditions under which the new borrower assumes the mortgage.

- Release Clause: A clause that formally releases the original mortgagors from their obligations.

Steps to complete the New Hampshire Assumption Agreement Of Mortgage And Release Of Original Mortgagors

Completing the New Hampshire Assumption Agreement of Mortgage and Release of Original Mortgagors involves several important steps:

- Gather Information: Collect all necessary information about the mortgage, property, and parties involved.

- Draft the Agreement: Prepare the agreement using clear and concise language, ensuring all key elements are included.

- Review the Document: Have all parties review the agreement for accuracy and completeness.

- Sign the Agreement: Ensure that all parties sign the document in the presence of a notary public, if required.

- File the Agreement: Submit the signed agreement to the appropriate local government office to record the change in mortgage obligations.

Legal use of the New Hampshire Assumption Agreement Of Mortgage And Release Of Original Mortgagors

The New Hampshire Assumption Agreement of Mortgage and Release of Original Mortgagors is legally binding when executed according to state laws. It is essential to ensure compliance with all legal requirements, including proper signing and notarization. This agreement serves to protect the rights of both the original mortgagors and the new borrower, establishing clear responsibilities and obligations under the mortgage.

How to use the New Hampshire Assumption Agreement Of Mortgage And Release Of Original Mortgagors

Using the New Hampshire Assumption Agreement of Mortgage and Release of Original Mortgagors involves understanding its purpose and properly executing the document. The agreement is primarily used when a property owner wishes to transfer their mortgage obligations to another party. It is crucial to ensure that all terms are clearly defined and agreed upon by all parties to avoid future disputes. Once executed, the agreement should be filed with the local recording office to ensure its enforceability.

State-specific rules for the New Hampshire Assumption Agreement Of Mortgage And Release Of Original Mortgagors

In New Hampshire, specific rules govern the execution and use of the Assumption Agreement of Mortgage and Release of Original Mortgagors. These may include requirements for notarization, the need for specific disclosures, and adherence to state mortgage laws. It is advisable to consult with a legal professional familiar with New Hampshire real estate law to ensure compliance with all applicable regulations and to address any unique circumstances related to the property or mortgage.

Quick guide on how to complete new hampshire assumption agreement of mortgage and release of original mortgagors

Complete New Hampshire Assumption Agreement Of Mortgage And Release Of Original Mortgagors effortlessly on any device

Online document management has gained popularity among organizations and individuals alike. It serves as an ideal environmentally friendly substitute for traditional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and electronically sign your documents promptly without any delays. Handle New Hampshire Assumption Agreement Of Mortgage And Release Of Original Mortgagors on any platform with airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

The easiest method to modify and electronically sign New Hampshire Assumption Agreement Of Mortgage And Release Of Original Mortgagors without hassle

- Locate New Hampshire Assumption Agreement Of Mortgage And Release Of Original Mortgagors and then click Get Form to commence.

- Utilize the tools we offer to complete your document.

- Emphasize relevant parts of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your electronic signature using the Sign tool, which takes mere seconds and carries the same legal authority as a traditional ink signature.

- Review all the details and then click on the Done button to preserve your modifications.

- Choose your preferred method of form delivery, through email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tiresome form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign New Hampshire Assumption Agreement Of Mortgage And Release Of Original Mortgagors to ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a New Hampshire Assumption Agreement Of Mortgage And Release Of Original Mortgagors?

A New Hampshire Assumption Agreement Of Mortgage And Release Of Original Mortgagors is a legal document that allows a new borrower to assume the mortgage obligations of the original mortgagor while releasing the original party from those obligations. It is crucial for ensuring clarity in debt responsibilities during property transfers.

-

How can airSlate SignNow help with a New Hampshire Assumption Agreement Of Mortgage And Release Of Original Mortgagors?

airSlate SignNow provides an easy-to-use platform for creating, sending, and eSigning a New Hampshire Assumption Agreement Of Mortgage And Release Of Original Mortgagors. Our solution simplifies the process, ensuring you can handle these agreements efficiently with legally binding electronic signatures.

-

What are the pricing options for airSlate SignNow’s services related to mortgage agreements?

airSlate SignNow offers various pricing tiers that cater to different business needs, including monthly and annual plans. Our cost-effective solution ensures that you can manage a New Hampshire Assumption Agreement Of Mortgage And Release Of Original Mortgagors without breaking the bank.

-

Are electronic signatures on a New Hampshire Assumption Agreement Of Mortgage And Release Of Original Mortgagors legally binding?

Yes, electronic signatures on a New Hampshire Assumption Agreement Of Mortgage And Release Of Original Mortgagors are legally binding and compliant with federal and state laws. AirSlate SignNow utilizes advanced security features to ensure the validity of your signed documents.

-

What features does airSlate SignNow provide for managing mortgage documents?

airSlate SignNow offers a variety of features for managing your New Hampshire Assumption Agreement Of Mortgage And Release Of Original Mortgagors, including templates, custom workflows, and tracking capabilities. These tools streamline document management and enhance productivity for your team.

-

Can I integrate airSlate SignNow with other software tools?

Yes, airSlate SignNow integrates seamlessly with a variety of software tools, including CRM and document management systems. This flexibility allows you to incorporate the New Hampshire Assumption Agreement Of Mortgage And Release Of Original Mortgagors into your existing workflows effortlessly.

-

What are the benefits of using airSlate SignNow for mortgage agreements?

Using airSlate SignNow for a New Hampshire Assumption Agreement Of Mortgage And Release Of Original Mortgagors offers numerous benefits, including increased efficiency, reduced processing time, and enhanced security. Our platform empowers businesses to manage documents with confidence and ease.

Get more for New Hampshire Assumption Agreement Of Mortgage And Release Of Original Mortgagors

- South carolina legislature mobile form

- Apology for misconduct employee to business form

- Letter of acceptance format for political appointment

- Steps for terminating a property management agreement form

- Invention disclosure form associate of corporate counsel

- Scheduling order united states bankruptcy court for the form

- How to write a sales letter edward lowe foundation form

- Tax rules for hiring resident property managersnolo form

Find out other New Hampshire Assumption Agreement Of Mortgage And Release Of Original Mortgagors

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors