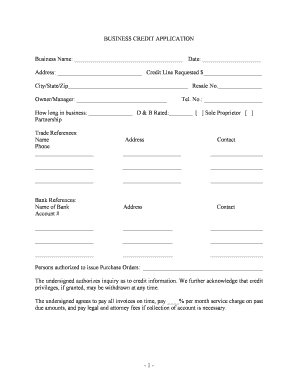

Business Credit Form

Understanding Business Credit

Business credit refers to the creditworthiness of a company, which is essential for securing financing and managing cash flow. It is separate from personal credit and is based on the business's financial history, credit utilization, and payment behavior. Establishing strong business credit can lead to better loan terms, higher credit limits, and improved relationships with suppliers. It allows businesses to access funds without relying on personal assets or guarantees.

Steps to Complete the Business Credit Application

Completing a business credit application involves several key steps to ensure accuracy and compliance. First, gather essential information about your business, including its legal structure, ownership details, and financial statements. Next, fill out the application form accurately, providing all requested details, such as business revenue and expenses. It's important to review the application for any errors before submission. Finally, submit the application through the designated method, whether online or by mail, and keep a copy for your records.

Required Documents for Business Credit

When applying for business credit, specific documents are typically required to verify your business's financial status. Commonly needed documents include:

- Business tax returns for the past two years

- Financial statements, including balance sheets and income statements

- Business plan outlining your operations and financial projections

- Proof of business ownership, such as articles of incorporation

- Personal financial statements of the business owners

Having these documents ready can streamline the application process and improve your chances of approval.

Eligibility Criteria for Business Credit

Eligibility for business credit often depends on several factors, including the business's credit history, revenue, and time in operation. Lenders may require that the business has been operational for a minimum period, typically at least six months to a year. Additionally, a good credit score, both personal and business, can significantly influence eligibility. Lenders may also assess the business's debt-to-income ratio and overall financial health before granting credit.

Legal Use of Business Credit

Understanding the legal implications of business credit is crucial for compliance and risk management. Businesses must ensure that they use credit responsibly and in accordance with applicable laws. This includes adhering to fair lending practices and accurately reporting financial information. Misuse of business credit can lead to legal penalties, damaged relationships with lenders, and negative impacts on credit ratings. It is advisable to maintain transparency and integrity in all financial dealings.

Application Process and Approval Time

The application process for business credit can vary depending on the lender. Generally, it involves submitting the completed application along with required documents. After submission, lenders will review the application, which may take anywhere from a few days to several weeks. Factors influencing approval time include the lender's workload, the complexity of the application, and the thoroughness of the documentation provided. Being prepared with all necessary information can expedite the process.

Quick guide on how to complete business credit

Complete Business Credit effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly substitute for conventional printed and signed paperwork, allowing you to locate the correct form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, alter, and eSign your documents swiftly without interruptions. Manage Business Credit on any device using airSlate SignNow's Android or iOS applications and enhance any document-related task today.

How to modify and eSign Business Credit with ease

- Find Business Credit and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive data with tools that airSlate SignNow supplies specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to deliver your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow manages all your document handling needs in just a few clicks from any device you choose. Edit and eSign Business Credit to ensure effective communication at every stage of your document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What features does airSlate SignNow offer for handling a credit form online?

airSlate SignNow provides a variety of features for managing a credit form online, including customizable templates, automated workflows, and real-time tracking. These tools help streamline the signing process, making it easy for both senders and recipients to manage documents efficiently. Plus, with advanced security measures, you can ensure that your data remains protected.

-

How does airSlate SignNow ensure the security of my credit form online?

Security is a priority at airSlate SignNow when you’re dealing with a credit form online. We employ top-tier encryption methods and comply with industry standards to safeguard your sensitive data. Additionally, our platform offers audit trails and user authentication to provide you with peace of mind.

-

Is there a free trial available for using the credit form online feature?

Yes, airSlate SignNow offers a free trial that allows you to explore the credit form online feature without any commitment. This trial period enables you to experience our user-friendly interface and comprehensive tools. You can see firsthand how airSlate SignNow can simplify your document processes.

-

Can I integrate airSlate SignNow with other applications for my credit form online needs?

Absolutely! airSlate SignNow supports integrations with a variety of applications to enhance your credit form online workflow. You can connect with popular tools like Google Drive, Salesforce, and Zapier, ensuring seamless data transfer and improved efficiency across your business processes.

-

What should I know about pricing for using the credit form online feature?

airSlate SignNow offers competitive pricing options to accommodate various business needs when utilizing the credit form online feature. You can choose from different plans based on the scale and requirements of your organization. Each plan is designed to provide excellent value while ensuring you have access to all essential functionalities.

-

How does airSlate SignNow simplify the process of completing a credit form online?

airSlate SignNow simplifies the completion of a credit form online by providing an intuitive interface that guides users through each step. The platform allows you to fill out, customize, and eSign documents easily from any device. This reduces the hassle and time often associated with traditional paperwork.

-

What are the benefits of using airSlate SignNow for my credit form online?

Using airSlate SignNow for your credit form online offers numerous benefits, such as increased efficiency, reduced turnaround times, and enhanced tracking capabilities. By digitizing your forms, you minimize errors and improve compliance, all while providing a better experience for your customers and clients.

Get more for Business Credit

Find out other Business Credit

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors