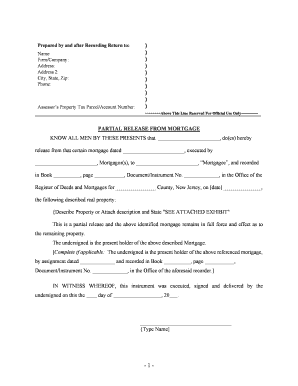

Nj Property Mortgage Form

What is the NJ Property Mortgage?

The NJ property mortgage is a legal document that outlines the terms and conditions under which a borrower secures financing to purchase real estate in New Jersey. This form serves as a contract between the lender and the borrower, detailing the loan amount, interest rate, repayment schedule, and any other pertinent conditions. It is essential for individuals looking to buy property in New Jersey, as it formalizes the borrowing process and provides the lender with a security interest in the property.

How to Obtain the NJ Property Mortgage

To obtain the NJ property mortgage, borrowers typically need to follow a series of steps. First, they should assess their financial situation to determine how much they can afford to borrow. Next, it is advisable to shop around for lenders to find the best mortgage rates and terms. Once a lender is chosen, the borrower will need to complete a mortgage application, providing necessary documentation such as income verification, credit history, and details about the property. After the application is submitted, the lender will conduct a thorough review and may require an appraisal of the property before finalizing the mortgage agreement.

Steps to Complete the NJ Property Mortgage

Completing the NJ property mortgage involves several key steps:

- Gather Documentation: Collect necessary documents, including proof of income, tax returns, and credit reports.

- Fill Out the Application: Complete the mortgage application form accurately, providing all requested information.

- Submit the Application: Send the completed application along with supporting documents to the lender.

- Review Loan Terms: Once approved, carefully review the loan terms and conditions before signing.

- Sign the Mortgage Document: Sign the NJ property mortgage form electronically or in person, ensuring all signatures are valid.

- Finalize the Transaction: Complete any remaining steps, such as closing costs and title transfers, to finalize the mortgage.

Legal Use of the NJ Property Mortgage

The NJ property mortgage is legally binding once signed by both parties. It is essential that the document complies with state laws and federal regulations, including the requirements set forth by the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). These laws ensure that electronic signatures are recognized as valid, provided that certain criteria are met, such as the intent to sign and consent to conduct transactions electronically.

Key Elements of the NJ Property Mortgage

Several key elements must be included in the NJ property mortgage for it to be considered valid:

- Borrower and Lender Information: Full names and addresses of both parties.

- Loan Amount: The total amount being borrowed.

- Interest Rate: The rate at which interest will accrue on the loan.

- Repayment Terms: Details regarding the repayment schedule, including due dates and payment amounts.

- Property Description: A legal description of the property being mortgaged.

- Signatures: Signatures of all parties involved, confirming their agreement to the terms.

State-Specific Rules for the NJ Property Mortgage

New Jersey has specific rules governing property mortgages that borrowers should be aware of. These include regulations regarding disclosure requirements, the timeline for processing applications, and the rights of borrowers in foreclosure situations. It is important for borrowers to familiarize themselves with these state-specific rules to ensure compliance and protect their rights throughout the mortgage process.

Quick guide on how to complete nj property mortgage

Complete Nj Property Mortgage effortlessly on any device

Web-based document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documentation, allowing you to easily locate the right form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and electronically sign your documents quickly without delays. Handle Nj Property Mortgage on any device using the airSlate SignNow apps for Android or iOS, and streamline any document-centric task today.

The easiest way to edit and eSign Nj Property Mortgage with minimal effort

- Acquire Nj Property Mortgage and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Craft your signature using the Sign tool, which only takes seconds and carries the same legal authority as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method for sharing your form, whether by email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device of your choosing. Edit and eSign Nj Property Mortgage to ensure exceptional communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an NJ property mortgage?

An NJ property mortgage is a loan used to purchase or refinance real estate in New Jersey. It allows borrower to leverage their property’s value to secure financing while often offering competitive interest rates and terms tailored to local market conditions.

-

How can airSlate SignNow assist with NJ property mortgage documentation?

airSlate SignNow streamlines the process of signing and managing NJ property mortgage documents electronically. With features like templates and real-time collaboration, it simplifies the paperwork needed for mortgage applications, making it an efficient solution for both lenders and borrowers.

-

What are the costs associated with using airSlate SignNow for NJ property mortgage signing?

The pricing for using airSlate SignNow depends on the plan you select, which caters to various needs and budgets. Typically, you can save costs by opting for an annual subscription, making it a cost-effective option for managing NJ property mortgage documents without compromising functionality.

-

What features does airSlate SignNow offer for NJ property mortgage processing?

airSlate SignNow provides key features such as electronic signatures, document templates, and automated workflows specifically designed for NJ property mortgage processes. These features enhance efficiency and accuracy, ensuring that all parties involved can complete transactions swiftly.

-

How does airSlate SignNow ensure security for NJ property mortgage documents?

Security is a top priority for airSlate SignNow, especially for sensitive documents like NJ property mortgages. The platform uses advanced encryption and complies with industry standards to protect your information, ensuring that all signatures and documents are securely stored and transmitted.

-

Can I integrate airSlate SignNow with other tools for NJ property mortgage management?

Yes, airSlate SignNow offers seamless integrations with various CRM and document management systems, facilitating smoother NJ property mortgage workflows. This compatibility enhances productivity by allowing users to manage their mortgage documents alongside other business applications.

-

What are the benefits of using airSlate SignNow for NJ property mortgage transactions?

Using airSlate SignNow for NJ property mortgages signNowly speeds up the signing process, reduces paper waste, and improves the overall customer experience. Its user-friendly interface allows for quick navigation, making it ideal for busy professionals handling multiple transactions.

Get more for Nj Property Mortgage

- Please serve upon the respondent the following documents form

- You the respondent are hereby summoned to answer the petition in this action which is form

- City state zip code phone number email address wife co form

- Notice of intent to claim paternity putative father registry form

- Notice of withdrawal of paternity acknowledgment form

- Educationelementarysecondary form

- Csed paternity information for parents csed paternity information for parents

- Changing a minor childs name mt judicial branch form

Find out other Nj Property Mortgage

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed

- eSignature Arizona Banking Moving Checklist Secure