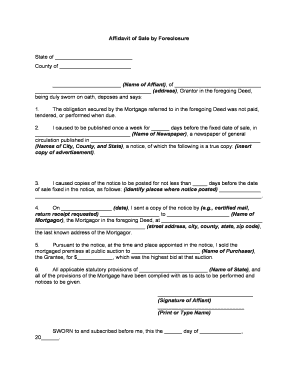

Foreclosure Form

What is the foreclosure agreement?

A foreclosure agreement is a legal document that outlines the terms and conditions under which a lender can take possession of a property due to the borrower's failure to meet the mortgage obligations. This agreement typically includes details such as the amount owed, the timeline for foreclosure proceedings, and the rights of both the borrower and the lender. Understanding this document is crucial for homeowners facing financial difficulties, as it can significantly impact their financial future and housing situation.

Key elements of the foreclosure agreement

Several essential components make up a foreclosure agreement. These include:

- Loan details: Information about the original loan, including the amount borrowed, interest rate, and payment schedule.

- Default conditions: Specific circumstances that constitute a default, such as missed payments or failure to maintain the property.

- Notice requirements: Procedures for notifying the borrower of default and the impending foreclosure process.

- Redemption rights: The borrower's right to reclaim the property by paying off the debt within a specified period.

- Sale terms: Information regarding how and when the property will be sold, including auction details.

Steps to complete the foreclosure agreement

Completing a foreclosure agreement involves several steps to ensure that all legal requirements are met. These steps generally include:

- Reviewing the mortgage: Homeowners should carefully examine their mortgage documents to understand their rights and obligations.

- Consulting with a legal professional: Seeking advice from an attorney who specializes in foreclosure can provide valuable insights and help navigate the process.

- Filling out the foreclosure application: This document must be completed accurately, providing all required information and supporting documentation.

- Submitting the agreement: The completed agreement should be submitted to the appropriate lender or court, following local regulations.

- Awaiting confirmation: Homeowners should keep track of the submission and await confirmation of receipt and any further actions required.

Legal use of the foreclosure agreement

The legal use of a foreclosure agreement is governed by state and federal laws, which dictate how the process should be carried out. For the agreement to be enforceable, it must comply with regulations such as the Fair Debt Collection Practices Act and the applicable state laws regarding foreclosure. Understanding these legal frameworks is essential for both borrowers and lenders to ensure that their rights are protected throughout the foreclosure process.

Required documents for the foreclosure agreement

When preparing a foreclosure agreement, several documents may be required to support the application. Commonly needed documents include:

- Loan agreement: The original mortgage or loan agreement detailing the terms of the loan.

- Payment history: Records of payments made and any missed payments that led to default.

- Property deed: Documentation proving ownership of the property in question.

- Financial statements: Current financial statements that outline the homeowner's financial situation.

- Correspondence with the lender: Any communication with the lender regarding missed payments or attempts to modify the loan.

State-specific rules for the foreclosure agreement

Foreclosure laws vary significantly from state to state, affecting how foreclosure agreements are structured and executed. Each state has its own regulations regarding notification periods, redemption rights, and the foreclosure process itself. It is vital for homeowners to familiarize themselves with their specific state's rules to ensure compliance and protect their rights during the foreclosure process.

Quick guide on how to complete foreclosure 481374444

Manage Foreclosure effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to easily locate the appropriate form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly and without delays. Handle Foreclosure on any device using airSlate SignNow Android or iOS applications and simplify any document-based task today.

How to modify and electronically sign Foreclosure with ease

- Obtain Foreclosure and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Mark important sections of the documents or obscure sensitive information with the tools that airSlate SignNow specifically provides for that purpose.

- Create your electronic signature with the Sign feature, which takes seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to share your form, whether by email, text message (SMS), or invite link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow meets your requirements in document management in just a few clicks from any chosen device. Edit and electronically sign Foreclosure and ensure excellent communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a foreclosure agreement?

A foreclosure agreement is a legal document that outlines the terms and conditions under which a lender can repossess a property due to borrower default. It's essential for both borrowers and lenders to understand its implications fully. Utilizing airSlate SignNow can streamline the signing process of such agreements, ensuring all parties are aligned.

-

How does airSlate SignNow simplify the process of signing a foreclosure agreement?

airSlate SignNow simplifies the signing process of a foreclosure agreement by providing a user-friendly platform that facilitates electronic signatures. This ensures quick and efficient document turnaround, allowing you to focus on important matters without delays. The secure cloud storage also protects your legal documents, giving peace of mind.

-

What features does airSlate SignNow offer for managing a foreclosure agreement?

airSlate SignNow offers features such as document templates, automated reminders, and real-time tracking to manage a foreclosure agreement effectively. Users can customize templates to fit their specific needs, which speeds up the signing process. Additionally, the platform's integration with other tools enhances workflow and collaboration.

-

Is airSlate SignNow a cost-effective solution for managing foreclosure agreements?

Yes, airSlate SignNow is a cost-effective solution for managing foreclosure agreements. With affordable pricing plans and no hidden fees, businesses can save money while ensuring compliance. The platform eliminates the costs associated with paper documents, making it an economical choice for signing legal agreements.

-

Can I use airSlate SignNow to create a foreclosure agreement template?

Absolutely! airSlate SignNow allows users to create customizable templates for foreclosure agreements. By leveraging these templates, you can ensure consistency across documents and reduce the time spent on drafting every new agreement. This feature enhances efficiency, making it easier to handle multiple transactions.

-

Are there integrations available with airSlate SignNow for foreclosure agreements?

Yes, airSlate SignNow offers various integrations with popular applications that support the management of foreclosure agreements. You can easily connect it with your CRM systems, cloud storage solutions, and other tools. This leads to a seamless workflow, enabling you to manage documents effectively.

-

What benefits does eSigning a foreclosure agreement provide?

eSigning a foreclosure agreement through airSlate SignNow offers numerous benefits, including speed, security, and convenience. The technology ensures that agreements are signed promptly and securely, reducing the risk of errors or disputes. It also allows for remote signing, making the process more accessible for all parties involved.

Get more for Foreclosure

- Nature whether known or unknown in law or equity that i or child ever had or may have arising from form

- Waiver release consent form egs 2018 new jersey new

- Skate park liability waiver and release of liability form

- Blogliability waiver form part 4

- Consent waiver and release form wordpresscom

- Hereinafter referred to as child hereby waive and release indemnify hold harmless and form

- The christian center sports waiver the christian center in form

- Full text of ampquoteric ed131541 1975 state education legislation form

Find out other Foreclosure

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document