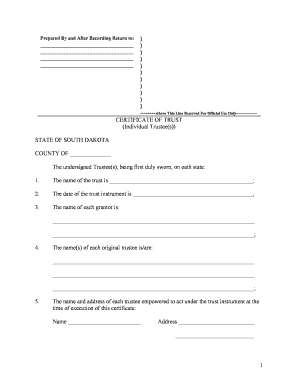

South Dakota Trust Form

What is the South Dakota Trust

The South Dakota Trust is a legal framework that allows individuals and entities to establish trusts within the state of South Dakota. This type of trust is particularly popular due to the state's favorable laws regarding asset protection, privacy, and tax benefits. South Dakota has become a leading jurisdiction for trust formation, attracting individuals seeking to manage and protect their assets effectively. The South Dakota Trust can be utilized for various purposes, including estate planning, wealth management, and charitable giving.

How to use the South Dakota Trust

Using the South Dakota Trust involves several steps to ensure proper establishment and management. First, individuals must decide on the type of trust they wish to create, such as a revocable or irrevocable trust. Next, they should consult with a legal professional experienced in South Dakota trust law to draft the necessary documents. Once the trust is established, assets can be transferred into it, providing benefits such as protection from creditors and potential tax advantages. Regular reviews and updates to the trust may be necessary to adapt to changing circumstances.

Key elements of the South Dakota Trust

Several key elements define the South Dakota Trust, making it an attractive option for asset management. These include:

- Asset Protection: South Dakota law provides robust protections against creditors, ensuring that trust assets remain secure.

- Privacy: Trusts in South Dakota are not required to be publicly recorded, maintaining the confidentiality of the trust's terms and beneficiaries.

- Tax Benefits: South Dakota offers favorable tax treatment for trusts, including no state income tax on trust earnings.

- Flexible Terms: Trust creators can establish customized terms and conditions, allowing for tailored management of assets.

Steps to complete the South Dakota Trust

Completing the South Dakota Trust involves several important steps:

- Consultation: Engage with a qualified attorney to discuss your goals and understand the implications of creating a trust.

- Drafting the Trust Document: Work with your attorney to draft the trust agreement, outlining the terms, conditions, and beneficiaries.

- Funding the Trust: Transfer assets into the trust, which may include real estate, investments, or other valuable property.

- Ongoing Management: Regularly review and manage the trust to ensure it aligns with your objectives and any changes in law.

Legal use of the South Dakota Trust

The legal use of the South Dakota Trust is governed by state laws that outline how trusts must be established and managed. Trust creators must adhere to specific legal requirements, such as clearly defining beneficiaries and the purpose of the trust. Additionally, the trust must be properly funded and maintained to ensure its legitimacy and effectiveness. Legal compliance is crucial to protect the trust's assets and ensure that it serves its intended purpose.

Eligibility Criteria

Eligibility to create a South Dakota Trust generally requires the trust creator to be an individual or entity with legal capacity. This includes being of legal age and sound mind. Additionally, there may be specific requirements regarding the types of assets that can be placed in the trust and the residency of the trust creator or beneficiaries. Consulting with a legal professional can clarify any eligibility concerns and ensure compliance with state laws.

Quick guide on how to complete south dakota trust

Complete South Dakota Trust effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal eco-friendly substitute to traditional printed and signed documents, allowing you to acquire the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly and without interruptions. Manage South Dakota Trust on any platform with airSlate SignNow's Android or iOS applications and streamline any document-related tasks today.

The easiest way to edit and eSign South Dakota Trust effortlessly

- Obtain South Dakota Trust and then click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight relevant portions of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Select your preferred method to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worries of missing or lost documents, tedious form searches, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs within a few clicks from any device of your choice. Edit and eSign South Dakota Trust and ensure exceptional communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a South Dakota trust and why should I consider it?

A South Dakota trust is a legal arrangement that allows you to manage your assets, providing you with greater control over your financial future. It offers unique benefits, such as privacy and asset protection, making it an attractive option for individuals and businesses seeking effective estate planning solutions.

-

How can airSlate SignNow facilitate the management of South Dakota trusts?

airSlate SignNow simplifies the process of drafting, signing, and managing trust documents related to your South Dakota trust. With our easy-to-use platform, you can securely eSign vital documents and keep them organized, ensuring compliance and ease of access at all times.

-

What are the costs associated with setting up a South Dakota trust?

The costs of setting up a South Dakota trust can vary based on the complexity of your estate and the services you choose. Using airSlate SignNow, you can leverage a cost-effective solution to handle your documentation needs without the burden of high legal fees, making the setup process much more affordable.

-

Can I manage multiple South Dakota trusts with airSlate SignNow?

Yes, airSlate SignNow allows you to manage multiple South Dakota trusts efficiently from a single platform. You can create, store, and access documents for various trusts, streamlining your workflow and ensuring that all your trust-related paperwork is kept securely in one place.

-

What features does airSlate SignNow offer for South Dakota trusts?

airSlate SignNow provides a variety of features tailored for managing South Dakota trusts, including eSigning, document templates, and secure cloud storage. These tools help you save time, enhance collaboration with trustees, and maintain accurate records of all transactions related to your trust.

-

Are there integrations available with airSlate SignNow for South Dakota trusts?

Absolutely! airSlate SignNow integrates with numerous applications that can help streamline your South Dakota trust management process. Whether you need to sync financial software or CRM systems, our platform offers seamless integrations to ensure that all your tools work harmoniously together.

-

How does airSlate SignNow ensure the security of my South Dakota trust documents?

Security is a top priority at airSlate SignNow. We utilize advanced encryption technologies and secure access controls to protect your South Dakota trust documents, ensuring that your sensitive information remains confidential and safeguarded from unauthorized access.

Get more for South Dakota Trust

- Grantor does hereby grant and convey with all warranty covenants form

- In in said county on the day of 19 before me personally form

- Mechanics lien rights in rhode island national law review form

- The grantors do hereby covenant that they are residents of the state of rhode island in compliance form

- Section 44 30 71 form

- Notice of possible mechanics lien corporation form

- Under rhode island law an equine professional unless he or she can be shown to form

- Or her claim and lien to who shall hereafter form

Find out other South Dakota Trust

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template