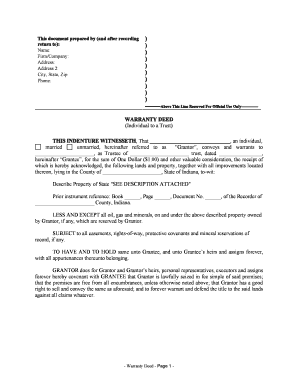

Indiana Trust Form

What is the Indiana Trust

The Indiana Trust is a legal arrangement that allows individuals to manage and protect their assets for the benefit of designated beneficiaries. This type of trust can be established for various purposes, including estate planning, asset protection, and tax efficiency. In Indiana, trusts are governed by state laws that outline the rights and responsibilities of trustees and beneficiaries. Understanding the fundamentals of the Indiana Trust is essential for anyone looking to secure their financial future and ensure their wishes are honored.

How to use the Indiana Trust

Using the Indiana Trust involves several steps, including drafting the trust document, selecting a trustee, and funding the trust with assets. The trust document outlines the terms and conditions under which the trust operates, including how assets are managed and distributed. It is crucial to choose a trustee who is trustworthy and capable of fulfilling their duties. Once the trust is established, assets such as real estate, investments, and bank accounts can be transferred into the trust to ensure they are managed according to the trust's terms.

Steps to complete the Indiana Trust

To complete the Indiana Trust, follow these key steps:

- Determine the purpose: Identify why you want to create a trust, such as for estate planning or asset protection.

- Draft the trust document: Work with a legal professional to create a comprehensive trust document that outlines the terms and conditions.

- Select a trustee: Choose a reliable individual or institution to manage the trust.

- Fund the trust: Transfer assets into the trust to ensure they are managed according to your wishes.

- Review and update: Periodically review the trust to ensure it remains aligned with your goals and circumstances.

Legal use of the Indiana Trust

The legal use of the Indiana Trust is defined by state law, which provides guidelines for establishing and managing trusts. Trusts can be used for various legal purposes, including avoiding probate, minimizing taxes, and protecting assets from creditors. It is important to comply with Indiana's legal requirements when creating and managing a trust to ensure it is valid and enforceable. Consulting with a legal expert can help navigate these regulations effectively.

Key elements of the Indiana Trust

Several key elements define the Indiana Trust, including:

- Trustee: The individual or entity responsible for managing the trust and its assets.

- Beneficiaries: The individuals or organizations entitled to receive benefits from the trust.

- Trust property: The assets placed into the trust, which can include cash, real estate, and investments.

- Trust document: The legal document that outlines the terms, conditions, and purposes of the trust.

State-specific rules for the Indiana Trust

Indiana has specific rules governing the establishment and operation of trusts. These rules dictate how trusts are created, managed, and terminated, as well as the rights of trustees and beneficiaries. For example, Indiana law requires that trusts be created in writing and that trustees act in the best interests of the beneficiaries. Understanding these state-specific rules is essential for ensuring compliance and protecting the interests of all parties involved.

Quick guide on how to complete indiana trust

Complete Indiana Trust effortlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Indiana Trust on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The easiest way to modify and eSign Indiana Trust without any hassle

- Locate Indiana Trust and click on Get Form to commence.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the information and click on the Done button to save your modifications.

- Choose your preferred method of delivering your form, whether by email, SMS, invitation link, or downloading it to your computer.

Say goodbye to lost or misfiled documents, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow handles all your document management needs in just a few clicks from any device you prefer. Edit and eSign Indiana Trust and ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a deed trust in Indiana?

A deed trust in Indiana is a legal document that allows a third party to hold the title of a property on behalf of the borrower until the loan obligation is fulfilled. This arrangement helps protect both the lender's and borrower's rights. Understanding the basics of deed trust Indiana is crucial for anyone looking to secure a real estate transaction.

-

How does airSlate SignNow assist with deed trusts in Indiana?

airSlate SignNow simplifies the process of creating, sending, and eSigning deed trusts in Indiana. Our platform offers templates designed specifically for Indiana's deed trust requirements, ensuring compliance and ease of use. By using airSlate SignNow, users can efficiently manage their real estate documents without the hassle of traditional paperwork.

-

What are the pricing options for using airSlate SignNow for deed trusts in Indiana?

airSlate SignNow offers various pricing plans tailored to fit the needs of different users dealing with deed trusts in Indiana. Our plans are designed to be cost-effective while providing essential features for document management. You can choose a plan that best suits your volume and usage requirements, making it a budget-friendly option for individuals and businesses alike.

-

Is airSlate SignNow secure for managing deed trusts in Indiana?

Yes, airSlate SignNow prioritizes security, ensuring that all documents, including deed trusts in Indiana, are protected through advanced encryption and secure cloud storage. Users can trust that their sensitive information is safe and compliant with legal standards. Our commitment to security means you can focus on your transactions without worrying about data bsignNowes.

-

Can I integrate airSlate SignNow with other tools for managing deed trusts in Indiana?

Absolutely! airSlate SignNow offers integrations with various third-party applications that can enhance your workflow when dealing with deed trusts in Indiana. Whether you use CRM systems, project management tools, or cloud storage services, our platform seamlessly connects with them, streamlining your document management process.

-

What are the benefits of using airSlate SignNow for deed trusts in Indiana?

The benefits of using airSlate SignNow for deed trusts in Indiana include increased efficiency, reduced paperwork, and faster turnaround times for document signing. Our user-friendly platform allows you to create, send, and track your deed trusts effortlessly. By choosing airSlate SignNow, you save time and enhance the overall experience of your real estate transactions.

-

How can I signNow customer support for issues regarding deed trusts in Indiana?

To address any issues or inquiries related to deed trusts in Indiana, you can easily signNow our customer support team through various channels. We offer live chat, email support, and an extensive help center with resources and FAQs to assist you. Our dedicated team is ready to help you navigate any challenges you may face while using airSlate SignNow.

Get more for Indiana Trust

- Alabama husband wife 497296184 form

- Al quitclaim form

- Alabama quitclaim deed form

- Deed with survivorship form

- Alabama warranty deed 497296188 form

- Warranty deed from one individual to three individuals as tenants in common alabama form

- Warranty deed life estate form

- Warranty deed husband and wife to two individuals alabama form

Find out other Indiana Trust

- eSignature New Jersey Last Will and Testament Online

- eSignature Pennsylvania Last Will and Testament Now

- eSign Arkansas Software Development Agreement Template Easy

- eSign Michigan Operating Agreement Free

- Help Me With eSign Nevada Software Development Agreement Template

- eSign Arkansas IT Consulting Agreement Computer

- How To eSignature Connecticut Living Will

- eSign Alaska Web Hosting Agreement Computer

- eSign Alaska Web Hosting Agreement Now

- eSign Colorado Web Hosting Agreement Simple

- How Do I eSign Colorado Joint Venture Agreement Template

- How To eSign Louisiana Joint Venture Agreement Template

- eSign Hawaii Web Hosting Agreement Now

- eSign New Jersey Joint Venture Agreement Template Online

- eSign Missouri Web Hosting Agreement Now

- eSign New Jersey Web Hosting Agreement Now

- eSign Texas Deposit Receipt Template Online

- Help Me With eSign Nebraska Budget Proposal Template

- eSign New Mexico Budget Proposal Template Now

- eSign New York Budget Proposal Template Easy