Wisconsin Beneficiary Form

What is the Wisconsin Beneficiary Form

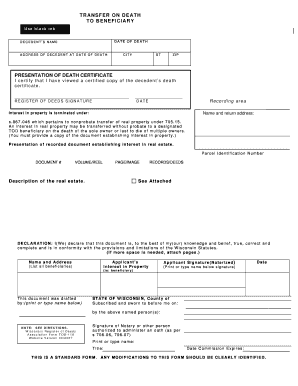

The Wisconsin Beneficiary Form, often referred to as the WI TOD form, is a legal document that allows individuals to designate beneficiaries for their assets upon their death. This form is crucial for ensuring that a person's property, such as real estate or financial accounts, is transferred directly to the named beneficiaries without going through probate. The TOD (Transfer on Death) designation provides a streamlined process, allowing for a more efficient transfer of assets while minimizing legal complications.

How to use the Wisconsin Beneficiary Form

Using the Wisconsin Beneficiary Form involves several steps to ensure proper completion and legal validity. First, individuals must obtain the form from a reliable source, such as a legal professional or official state resources. Next, the form should be filled out with accurate information regarding the asset and the designated beneficiaries. It is essential to provide clear identification of the beneficiaries, including full names and contact information. Once completed, the form must be signed and dated in the presence of a witness or notary, depending on state requirements, to ensure its legality.

Steps to complete the Wisconsin Beneficiary Form

Completing the Wisconsin Beneficiary Form requires careful attention to detail. Follow these steps:

- Obtain the form from a trusted source.

- Clearly identify the asset you wish to transfer upon death.

- List the beneficiaries with their full names and contact information.

- Sign and date the form in the presence of a witness or notary.

- Store the completed form in a safe place and inform the beneficiaries of its existence.

Legal use of the Wisconsin Beneficiary Form

The legal use of the Wisconsin Beneficiary Form is governed by state laws that dictate how assets can be transferred upon death. To be legally binding, the form must meet specific requirements, such as being signed and witnessed according to Wisconsin statutes. This ensures that the transfer of assets is recognized by courts and financial institutions. Additionally, the form must be filed appropriately with relevant entities, such as banks or property registries, to ensure that the TOD designation is honored.

Key elements of the Wisconsin Beneficiary Form

Several key elements must be included in the Wisconsin Beneficiary Form to ensure its effectiveness:

- Asset Description: A clear description of the asset being transferred.

- Beneficiary Information: Full names, addresses, and contact details of the beneficiaries.

- Signatures: Signatures of the individual completing the form and any required witnesses or notaries.

- Date: The date on which the form is signed.

State-specific rules for the Wisconsin Beneficiary Form

Wisconsin has specific rules regarding the use of the Beneficiary Form, particularly concerning the requirements for signatures and witnessing. It is important to adhere to these regulations to ensure the form is legally valid. For instance, the form must be signed in the presence of a notary public or a witness who is not a beneficiary. Additionally, the form should be filed with the appropriate county register of deeds if it pertains to real estate assets, ensuring that the designation is officially recorded and recognized.

Quick guide on how to complete wisconsin beneficiary form

Complete Wisconsin Beneficiary Form effortlessly on any device

Managing documents online has become increasingly popular with businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed papers, allowing you to obtain the right format and securely save it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents quickly without delays. Handle Wisconsin Beneficiary Form on any device using airSlate SignNow Android or iOS applications and streamline any document-related process today.

How to modify and eSign Wisconsin Beneficiary Form easily

- Find Wisconsin Beneficiary Form and select Get Form to begin.

- Make use of the tools we offer to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools provided by airSlate SignNow specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal weight as a conventional wet ink signature.

- Verify all the information and click on the Done button to save your changes.

- Choose how you want to deliver your form, via email, SMS, or invite link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form navigation, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign Wisconsin Beneficiary Form and ensure excellent communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Wisconsin beneficiary form?

A Wisconsin beneficiary form is a legal document that designates the individuals or entities entitled to receive benefits in the event of a policyholder's death. This form is important for ensuring your assets go to the intended recipients without complications. airSlate SignNow allows you to create and eSign Wisconsin beneficiary forms quickly and efficiently.

-

How does airSlate SignNow help with Wisconsin beneficiary forms?

airSlate SignNow provides an easy-to-use platform for creating, sending, and eSigning Wisconsin beneficiary forms. With our intuitive interface, you can streamline the process and eliminate the need for paper documents. This results in faster processing times and a seamless experience for you and your beneficiaries.

-

Are there any costs associated with using airSlate SignNow for Wisconsin beneficiary forms?

Yes, airSlate SignNow offers flexible pricing plans that cater to different business needs. Our pricing is designed to be cost-effective, ensuring you can manage Wisconsin beneficiary forms without breaking the bank. You can choose a plan that fits your requirements and budget.

-

Can I integrate airSlate SignNow with other applications?

Absolutely! airSlate SignNow offers integrations with various third-party applications, enhancing your ability to manage Wisconsin beneficiary forms effectively. By integrating with your existing tools, you can streamline your workflows and improve productivity.

-

What are the benefits of using airSlate SignNow for eSigning forms?

Using airSlate SignNow for eSigning Wisconsin beneficiary forms provides numerous benefits, such as faster turnaround times, enhanced security, and legal compliance. Our platform ensures that all signatures are valid and securely stored, giving you peace of mind. Additionally, eSigning reduces the environmental impact of paper usage.

-

Is it secure to use airSlate SignNow for Wisconsin beneficiary forms?

Yes, airSlate SignNow prioritizes the security of your documents, including Wisconsin beneficiary forms. We employ encryption and secure storage solutions to protect sensitive information. Rest assured that your forms are kept confidential and secure throughout the signing process.

-

Can multiple people eSign a Wisconsin beneficiary form with airSlate SignNow?

Yes, airSlate SignNow allows multiple signers to eSign a Wisconsin beneficiary form seamlessly. You can invite all relevant parties to sign, ensuring that the form is completed promptly and accurately. This feature simplifies the process, making it easier for everyone involved.

Get more for Wisconsin Beneficiary Form

- Termination lease tenant 481373078 form

- Notice written cure form

- Maryland commercial rental lease application questionnaire form

- Affidavit survivor form

- Md note form

- Maryland general power attorney form

- Maryland satisfaction release or cancellation of deed of trust by corporation form

- Maryland will form

Find out other Wisconsin Beneficiary Form

- How To Sign Connecticut Police Arbitration Agreement

- Sign Utah Real Estate Quitclaim Deed Safe

- Sign Utah Real Estate Notice To Quit Now

- Sign Hawaii Police LLC Operating Agreement Online

- How Do I Sign Hawaii Police LLC Operating Agreement

- Sign Hawaii Police Purchase Order Template Computer

- Sign West Virginia Real Estate Living Will Online

- How Can I Sign West Virginia Real Estate Confidentiality Agreement

- Sign West Virginia Real Estate Quitclaim Deed Computer

- Can I Sign West Virginia Real Estate Affidavit Of Heirship

- Sign West Virginia Real Estate Lease Agreement Template Online

- How To Sign Louisiana Police Lease Agreement

- Sign West Virginia Orthodontists Business Associate Agreement Simple

- How To Sign Wyoming Real Estate Operating Agreement

- Sign Massachusetts Police Quitclaim Deed Online

- Sign Police Word Missouri Computer

- Sign Missouri Police Resignation Letter Fast

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement