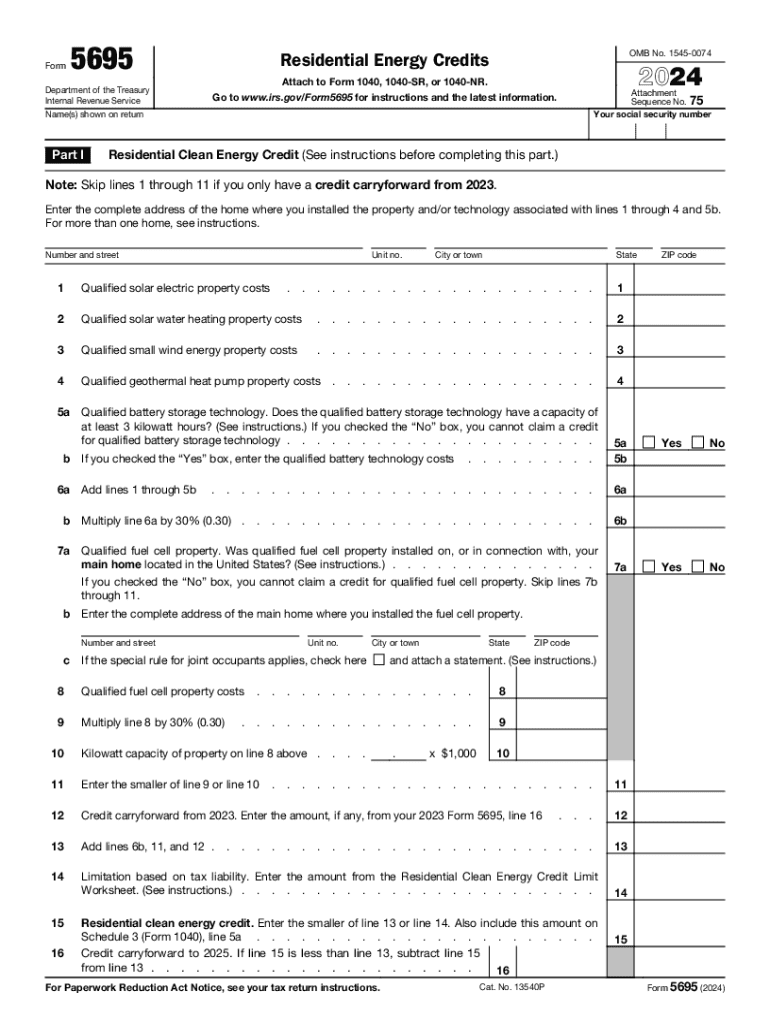

Form 5695 Residential Energy Credits 2024

What is the Form 5695 Residential Energy Credits

The IRS Form 5695 is a tax form used to claim residential energy credits. These credits are designed to incentivize homeowners to invest in energy-efficient improvements to their residences. By completing this form, taxpayers can potentially reduce their tax liability by claiming credits for various energy-saving measures, such as solar energy systems, energy-efficient windows, and insulation upgrades. Understanding the purpose of Form 5695 is essential for homeowners looking to maximize their tax benefits related to energy efficiency.

How to use the Form 5695 Residential Energy Credits

Using Form 5695 involves several steps to ensure that you accurately claim your residential energy credits. First, gather all necessary documentation related to your energy-efficient improvements. This may include receipts, invoices, and manufacturer certifications. Next, complete the form by providing personal information, detailing the energy-efficient upgrades made, and calculating the total credits you are eligible for. Once completed, include Form 5695 with your federal tax return to claim the credits. It is advisable to keep copies of all documents for your records.

Steps to complete the Form 5695 Residential Energy Credits

Completing Form 5695 requires careful attention to detail. Follow these steps:

- Step 1: Gather all necessary documentation, including receipts and certifications for energy-efficient products.

- Step 2: Fill out your personal information at the top of the form.

- Step 3: Complete Part I for the Residential Energy Efficient Property Credit, detailing the specific improvements made.

- Step 4: Complete Part II for the Nonbusiness Energy Property Credit, if applicable, by listing qualifying improvements.

- Step 5: Calculate the total credits and ensure accuracy before submitting.

Eligibility Criteria

To qualify for the credits claimed on Form 5695, specific eligibility criteria must be met. Homeowners must have made qualifying energy-efficient improvements to their primary residence. The improvements must meet the standards set by the IRS, which often include energy-efficient heating and cooling systems, insulation, and windows. Additionally, the improvements must have been installed during the tax year for which the credits are being claimed. It is important to review the latest IRS guidelines to confirm eligibility.

Required Documents

When completing Form 5695, certain documents are necessary to substantiate your claims. Required documents typically include:

- Receipts and invoices for energy-efficient products and installations.

- Manufacturer certifications for qualifying products.

- Any additional documentation that verifies the installation and performance of the improvements.

Having these documents readily available will facilitate the completion of the form and ensure compliance with IRS requirements.

Filing Deadlines / Important Dates

Filing deadlines for Form 5695 align with the annual tax return deadlines. Generally, individual taxpayers must submit their federal tax returns by April 15 of the following year. However, if you require an extension, you can file for an extension, which typically allows for an additional six months. It is crucial to keep track of these dates to avoid penalties and ensure timely submission of your claims for energy credits.

Handy tips for filling out Form 5695 Residential Energy Credits online

Quick steps to complete and e-sign Form 5695 Residential Energy Credits online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We know how stressing filling out documents could be. Obtain access to a HIPAA and GDPR compliant solution for optimum efficiency. Use signNow to e-sign and send Form 5695 Residential Energy Credits for collecting e-signatures.

Create this form in 5 minutes or less

Find and fill out the correct form 5695 residential energy credits 767976040

Create this form in 5 minutes!

How to create an eSignature for the form 5695 residential energy credits 767976040

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is IRS Form 5695?

IRS Form 5695 is a tax form used to claim the Residential Energy Credits. This form allows taxpayers to receive credits for certain energy-efficient home improvements. Understanding how to fill out IRS Form 5695 can help you maximize your tax benefits.

-

How can airSlate SignNow help with IRS Form 5695?

airSlate SignNow provides a seamless way to eSign and send IRS Form 5695 electronically. With our user-friendly platform, you can easily manage your documents and ensure they are signed and submitted on time. This streamlines the process of filing for energy credits.

-

Is there a cost associated with using airSlate SignNow for IRS Form 5695?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Our plans are designed to be cost-effective while providing all the necessary features to manage documents like IRS Form 5695 efficiently. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for IRS Form 5695?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking. These features make it easy to prepare and submit IRS Form 5695 while ensuring compliance and security. Our platform simplifies the entire document management process.

-

Can I integrate airSlate SignNow with other software for IRS Form 5695?

Absolutely! airSlate SignNow offers integrations with various software applications, enhancing your workflow for IRS Form 5695. Whether you use accounting software or CRM systems, our integrations ensure that your document processes are streamlined and efficient.

-

What are the benefits of using airSlate SignNow for IRS Form 5695?

Using airSlate SignNow for IRS Form 5695 provides numerous benefits, including time savings, enhanced security, and improved accuracy. Our platform allows you to complete and sign documents quickly, reducing the risk of errors and ensuring timely submissions. This can lead to faster tax refunds.

-

Is airSlate SignNow secure for handling IRS Form 5695?

Yes, airSlate SignNow prioritizes security and compliance, making it a safe choice for handling IRS Form 5695. We use advanced encryption and secure storage to protect your sensitive information. You can trust us to keep your documents safe throughout the signing process.

Get more for Form 5695 Residential Energy Credits

Find out other Form 5695 Residential Energy Credits

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile

- Electronic signature Pennsylvania Business Operations Promissory Note Template Later

- Help Me With Electronic signature North Dakota Charity Resignation Letter

- Electronic signature Indiana Construction Business Plan Template Simple

- Electronic signature Wisconsin Charity Lease Agreement Mobile

- Can I Electronic signature Wisconsin Charity Lease Agreement

- Electronic signature Utah Business Operations LLC Operating Agreement Later

- How To Electronic signature Michigan Construction Cease And Desist Letter

- Electronic signature Wisconsin Business Operations LLC Operating Agreement Myself

- Electronic signature Colorado Doctors Emergency Contact Form Secure

- How Do I Electronic signature Georgia Doctors Purchase Order Template

- Electronic signature Doctors PDF Louisiana Now

- How To Electronic signature Massachusetts Doctors Quitclaim Deed