2350 Form Templates Fillable & Printable Samples for 2024

Understanding the 2 Form

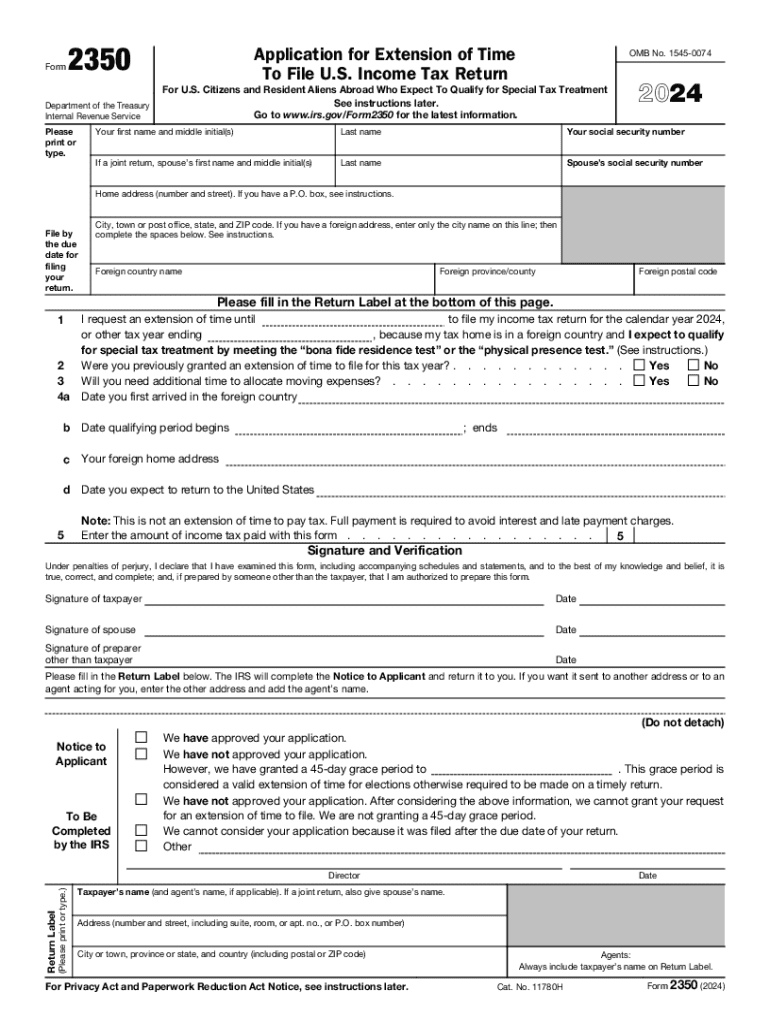

The 2 form is a federal tax extension form used by U.S. citizens and residents who need additional time to file their tax returns. Specifically, this form allows taxpayers to request an extension for filing their income tax returns when they are living or working abroad. It is essential for individuals who may not be able to meet the standard filing deadline due to various circumstances, such as travel or other commitments. Understanding the purpose and requirements of this form can help ensure compliance with IRS regulations.

Steps to Complete the 2 Form

Completing the 2 form involves several key steps:

- Gather necessary information, including your Social Security number, filing status, and details about your income.

- Indicate the specific tax year for which you are requesting an extension.

- Fill in the required sections accurately, ensuring all information is complete and correct.

- Review the form for any errors or omissions before submission.

- Submit the form by the appropriate deadline, either electronically or via mail.

Filing Deadlines for the 2 Form

It is crucial to be aware of the filing deadlines associated with the 2 form. Generally, the deadline for submitting this form coincides with the regular tax filing deadline, which is typically April 15. However, if you are living abroad, you may qualify for an automatic two-month extension, pushing the deadline to June 15. If additional time is needed beyond this date, the 2350 form can be used to request further extensions.

Required Documents for the 2 Form

When preparing to submit the 2 form, certain documents may be required to support your application:

- Proof of residency or employment abroad, such as a work contract or lease agreement.

- Income statements, including W-2s or 1099s, to accurately report your earnings.

- Any previous tax returns that may be relevant to your current filing situation.

IRS Guidelines for the 2 Form

The IRS provides specific guidelines for completing and submitting the 2 form. It is important to follow these guidelines closely to avoid any issues with your tax filing:

- Ensure that all information is filled out clearly and legibly.

- File the form on or before the due date to avoid penalties.

- Keep a copy of the completed form for your records.

Eligibility Criteria for Using the 2 Form

To be eligible to use the 2 form, you must meet certain criteria. Primarily, you should be a U.S. citizen or resident alien who is living or working outside the United States. Additionally, you must have a valid reason for requesting an extension, such as being unable to gather necessary documentation or facing unforeseen circumstances that hinder your ability to file on time. Understanding these criteria can help you determine if this form is appropriate for your situation.

Form Submission Methods for the 2 Form

The 2 form can be submitted through various methods, providing flexibility for taxpayers. You can file electronically using approved tax software or submit a paper form via mail. If you choose to file by mail, it is advisable to send the form via certified mail to ensure it is received by the IRS by the deadline. Each submission method has its own advantages, so consider your preferences and circumstances when deciding how to file.

Create this form in 5 minutes or less

Find and fill out the correct 2350 form templates fillable amp printable samples for

Create this form in 5 minutes!

How to create an eSignature for the 2350 form templates fillable amp printable samples for

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 2018 2350 feature in airSlate SignNow?

The 2018 2350 feature in airSlate SignNow refers to our advanced eSignature capabilities that streamline document signing processes. This feature allows users to send, sign, and manage documents efficiently, ensuring compliance and security. With the 2018 2350, businesses can enhance their workflow and reduce turnaround times.

-

How does pricing work for the 2018 2350 plan?

The pricing for the 2018 2350 plan is designed to be cost-effective, catering to businesses of all sizes. We offer flexible subscription options that allow you to choose a plan that fits your needs. By investing in the 2018 2350 plan, you gain access to premium features that enhance your document management experience.

-

What are the key benefits of using the 2018 2350 solution?

The 2018 2350 solution offers numerous benefits, including increased efficiency, improved document security, and enhanced collaboration. Businesses can save time and resources by utilizing our user-friendly platform for eSigning documents. Additionally, the 2018 2350 ensures that all transactions are legally binding and compliant with industry standards.

-

Can I integrate the 2018 2350 with other software?

Yes, the 2018 2350 can be seamlessly integrated with various software applications, enhancing your existing workflows. Our platform supports integrations with popular tools like CRM systems, cloud storage, and project management software. This flexibility allows businesses to maximize the value of the 2018 2350 solution.

-

Is the 2018 2350 suitable for small businesses?

Absolutely! The 2018 2350 is designed to cater to the needs of small businesses by providing an affordable and efficient eSigning solution. With its intuitive interface and robust features, small businesses can easily manage their document signing processes without the need for extensive training or resources.

-

What types of documents can I sign with the 2018 2350?

With the 2018 2350, you can sign a wide variety of documents, including contracts, agreements, and forms. Our platform supports multiple file formats, ensuring that you can handle all your signing needs in one place. The versatility of the 2018 2350 makes it an ideal choice for any business.

-

How secure is the 2018 2350 eSigning process?

The 2018 2350 eSigning process is highly secure, utilizing advanced encryption and authentication measures to protect your documents. We comply with industry standards to ensure that your data remains confidential and secure throughout the signing process. Trust in the 2018 2350 for a safe and reliable eSigning experience.

Get more for 2350 Form Templates Fillable & Printable Samples For

- Idexx small animal request form

- Errata sheet pdf form

- Borang pelepasan tanggungan form

- South carolina court proof of service form

- Designs form df2a guidance notes designs form df2a guidance notes

- Brass payroll deduction form fill and sign printable

- Application form aviation services icts

- Municipality of monroeville business tax return form

Find out other 2350 Form Templates Fillable & Printable Samples For

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe

- Electronic signature Maine Banking Permission Slip Fast

- eSignature Wyoming Sports LLC Operating Agreement Later

- Electronic signature Banking Word Massachusetts Free

- eSignature Wyoming Courts Quitclaim Deed Later

- Electronic signature Michigan Banking Lease Agreement Computer

- Electronic signature Michigan Banking Affidavit Of Heirship Fast

- Electronic signature Arizona Business Operations Job Offer Free

- Electronic signature Nevada Banking NDA Online

- Electronic signature Nebraska Banking Confidentiality Agreement Myself

- Electronic signature Alaska Car Dealer Resignation Letter Myself

- Electronic signature Alaska Car Dealer NDA Mobile

- How Can I Electronic signature Arizona Car Dealer Agreement

- Electronic signature California Business Operations Promissory Note Template Fast

- How Do I Electronic signature Arkansas Car Dealer Claim

- Electronic signature Colorado Car Dealer Arbitration Agreement Mobile

- Electronic signature California Car Dealer Rental Lease Agreement Fast

- Electronic signature Connecticut Car Dealer Lease Agreement Now