Colorado Colorado Installments Fixed Rate Promissory Note Secured by Personal Property Form

What is the Colorado Colorado Installments Fixed Rate Promissory Note Secured By Personal Property

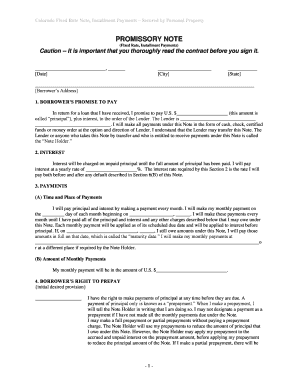

The Colorado Colorado Installments Fixed Rate Promissory Note Secured By Personal Property is a legal document that outlines the terms of a loan agreement where the borrower promises to repay a specific amount over time at a fixed interest rate. This note is secured by personal property, meaning that the lender has a claim against the borrower's assets in case of default. This form is commonly used in various financial transactions, providing clarity and legal protection for both parties involved.

How to use the Colorado Colorado Installments Fixed Rate Promissory Note Secured By Personal Property

To effectively use the Colorado Colorado Installments Fixed Rate Promissory Note Secured By Personal Property, both the lender and borrower must understand the terms outlined in the document. The borrower should fill in the necessary details, including the loan amount, interest rate, repayment schedule, and any collateral information. Once completed, both parties should sign the document, ensuring that it is legally binding. Utilizing digital platforms for eSigning can streamline this process and enhance security.

Key elements of the Colorado Colorado Installments Fixed Rate Promissory Note Secured By Personal Property

Several key elements are essential in the Colorado Colorado Installments Fixed Rate Promissory Note Secured By Personal Property. These include:

- Loan Amount: The total amount being borrowed.

- Interest Rate: The fixed rate at which interest will accrue on the loan.

- Payment Schedule: The timeline for repayments, including due dates and amounts.

- Collateral Description: Details about the personal property securing the loan.

- Default Terms: Conditions under which the lender can claim the collateral if the borrower fails to repay.

Steps to complete the Colorado Colorado Installments Fixed Rate Promissory Note Secured By Personal Property

Completing the Colorado Colorado Installments Fixed Rate Promissory Note Secured By Personal Property involves several steps:

- Gather necessary information, including personal details of both parties and loan specifics.

- Fill out the form accurately, ensuring all required fields are completed.

- Review the document for accuracy and clarity.

- Both parties should sign the document, either physically or electronically.

- Store the signed document securely for future reference.

Legal use of the Colorado Colorado Installments Fixed Rate Promissory Note Secured By Personal Property

The legal use of the Colorado Colorado Installments Fixed Rate Promissory Note Secured By Personal Property is governed by state laws and regulations. To ensure its enforceability, the document must meet specific legal requirements, including proper execution and adherence to relevant lending laws. Using a trusted platform for eSigning can help maintain compliance with these legal standards, ensuring that the agreement is recognized by courts and financial institutions.

State-specific rules for the Colorado Colorado Installments Fixed Rate Promissory Note Secured By Personal Property

Each state may have unique rules governing promissory notes, including the Colorado Colorado Installments Fixed Rate Promissory Note Secured By Personal Property. In Colorado, it is essential to comply with state laws regarding interest rates, disclosure requirements, and the rights of both lenders and borrowers. Familiarizing oneself with these regulations can help avoid legal issues and ensure that the note is valid and enforceable.

Quick guide on how to complete colorado colorado installments fixed rate promissory note secured by personal property

Complete Colorado Colorado Installments Fixed Rate Promissory Note Secured By Personal Property effortlessly on any device

Digital document management has become increasingly favored by companies and individuals alike. It serves as an excellent environmentally-friendly alternative to conventional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow provides you with all the resources necessary to create, amend, and electronically sign your documents quickly without any delays. Manage Colorado Colorado Installments Fixed Rate Promissory Note Secured By Personal Property on any device using airSlate SignNow Android or iOS applications and enhance any document-based procedure today.

The easiest way to modify and eSign Colorado Colorado Installments Fixed Rate Promissory Note Secured By Personal Property seamlessly

- Obtain Colorado Colorado Installments Fixed Rate Promissory Note Secured By Personal Property and then click Get Form to begin.

- Make use of the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with the specific tools that airSlate SignNow offers for such tasks.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the information and then click the Done button to save your modifications.

- Choose how you would prefer to distribute your form, whether by email, SMS, or invitation link, or download it to your computer.

Put aside concerns about lost or misplaced files, tedious form searches, or errors that necessitate printing new copies of documents. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Alter and eSign Colorado Colorado Installments Fixed Rate Promissory Note Secured By Personal Property and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Colorado Colorado Installments Fixed Rate Promissory Note Secured By Personal Property?

A Colorado Colorado Installments Fixed Rate Promissory Note Secured By Personal Property is a legal document that outlines the terms of a loan, including repayment installments and fixed interest rates, while being secured against personal property. This type of note protects lenders by guaranteeing repayment through collateral.

-

How does the Colorado Colorado Installments Fixed Rate Promissory Note Secured By Personal Property work?

The Colorado Colorado Installments Fixed Rate Promissory Note Secured By Personal Property establishes a clear repayment schedule and fixed interest rates agreed upon by both parties. The borrower makes regular payments until the loan is fully repaid, with the personal property serving as collateral to mitigate the lender's risk.

-

What are the benefits of using a Colorado Colorado Installments Fixed Rate Promissory Note Secured By Personal Property?

Using a Colorado Colorado Installments Fixed Rate Promissory Note Secured By Personal Property provides borrowers with predictable payments and interest rates, ensuring financial planning is easier. For lenders, it offers security through collateral, which can encourage borrowers to meet their payment obligations.

-

Are there any costs associated with the Colorado Colorado Installments Fixed Rate Promissory Note Secured By Personal Property?

Yes, there may be costs associated with establishing a Colorado Colorado Installments Fixed Rate Promissory Note Secured By Personal Property, such as legal fees and document preparation costs. However, the overall cost is typically lower compared to other financing options due to the fixed rates and structured installments.

-

Can I customize my Colorado Colorado Installments Fixed Rate Promissory Note Secured By Personal Property?

Absolutely! The Colorado Colorado Installments Fixed Rate Promissory Note Secured By Personal Property can be tailored to meet the specific needs of the lender and borrower. You can adjust terms such as payment frequency, interest rate, and collateral details to better fit your financial situation.

-

Is the Colorado Colorado Installments Fixed Rate Promissory Note Secured By Personal Property legally binding?

Yes, a properly executed Colorado Colorado Installments Fixed Rate Promissory Note Secured By Personal Property is legally binding. Both parties must sign the document, and it holds up in court, providing a clear framework for enforcement should any disputes arise.

-

How do I ensure compliance when using a Colorado Colorado Installments Fixed Rate Promissory Note Secured By Personal Property?

To ensure compliance with a Colorado Colorado Installments Fixed Rate Promissory Note Secured By Personal Property, it is recommended to consult with a legal professional familiar with Colorado’s laws. They can help you draft or review the note to ensure that it meets all legal requirements and accurately reflects your agreement.

Get more for Colorado Colorado Installments Fixed Rate Promissory Note Secured By Personal Property

- Louisiana individual form

- La motion form

- Operating llc form

- Warranty deed to child reserving a life estate in the parents louisiana form

- Discovery interrogatories from plaintiff to defendant with production requests louisiana form

- Discovery interrogatories from defendant to plaintiff with production requests louisiana form

- Louisiana proceeding form

- Notice contract form

Find out other Colorado Colorado Installments Fixed Rate Promissory Note Secured By Personal Property

- How To Sign Indiana Insurance Document

- Can I Sign Illinois Lawers Form

- How To Sign Indiana Lawers Document

- How To Sign Michigan Lawers Document

- How To Sign New Jersey Lawers PPT

- How Do I Sign Arkansas Legal Document

- How Can I Sign Connecticut Legal Document

- How Can I Sign Indiana Legal Form

- Can I Sign Iowa Legal Document

- How Can I Sign Nebraska Legal Document

- How To Sign Nevada Legal Document

- Can I Sign Nevada Legal Form

- How Do I Sign New Jersey Legal Word

- Help Me With Sign New York Legal Document

- How Do I Sign Texas Insurance Document

- How Do I Sign Oregon Legal PDF

- How To Sign Pennsylvania Legal Word

- How Do I Sign Wisconsin Legal Form

- Help Me With Sign Massachusetts Life Sciences Presentation

- How To Sign Georgia Non-Profit Presentation