Delaware Business Trust Certificate Form

What is the Delaware Business Trust Certificate

The Delaware Business Trust Certificate is a legal document that establishes a business trust in the state of Delaware. This certificate outlines the trust's purpose, structure, and the rights and responsibilities of the trustees and beneficiaries. It serves as a foundational document for businesses operating as trusts, providing clarity on governance and operational procedures. The certificate must comply with Delaware law to ensure its validity and enforceability.

How to obtain the Delaware Business Trust Certificate

To obtain a Delaware Business Trust Certificate, businesses must file the appropriate documentation with the Delaware Division of Corporations. This process typically involves submitting a completed certificate form that includes essential details such as the trust's name, the names of trustees, and the purpose of the trust. Businesses may also need to pay a filing fee and ensure compliance with any specific state regulations that apply to business trusts.

Steps to complete the Delaware Business Trust Certificate

Completing the Delaware Business Trust Certificate involves several key steps:

- Gather necessary information, including the trust's name, trustee details, and business purpose.

- Complete the certificate form accurately, ensuring all required fields are filled.

- Review the document for compliance with Delaware state laws and regulations.

- Submit the completed certificate along with any required fees to the Delaware Division of Corporations.

- Obtain confirmation of filing from the state, which serves as proof of the trust's legal establishment.

Legal use of the Delaware Business Trust Certificate

The Delaware Business Trust Certificate is legally binding once filed with the state. It provides the necessary legal framework for the operation of the trust, allowing it to engage in business activities, enter contracts, and hold assets. Compliance with state laws is crucial, as failure to adhere to the regulations governing business trusts can result in penalties or the invalidation of the trust.

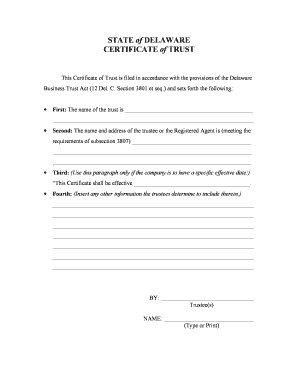

Key elements of the Delaware Business Trust Certificate

Key elements of the Delaware Business Trust Certificate include:

- Trust Name: The official name of the business trust.

- Trustees: Names and addresses of the individuals or entities serving as trustees.

- Business Purpose: A clear statement outlining the purpose and activities of the trust.

- Duration: The intended duration of the trust, whether it is perpetual or for a specified term.

- Signatures: Signatures of the trustees or authorized representatives to validate the certificate.

State-specific rules for the Delaware Business Trust Certificate

Delaware has specific rules governing the formation and operation of business trusts. These include requirements for filing, maintaining records, and compliance with tax obligations. It is essential for businesses to familiarize themselves with Delaware's laws to ensure that their business trust operates within the legal framework and meets all regulatory obligations.

Quick guide on how to complete delaware business trust certificate

Prepare Delaware Business Trust Certificate effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals alike. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct template and securely save it online. airSlate SignNow provides all the resources you require to create, modify, and electronically sign your documents quickly and without delays. Manage Delaware Business Trust Certificate on any platform using airSlate SignNow's Android or iOS applications and enhance any document-driven workflow today.

How to modify and eSign Delaware Business Trust Certificate with ease

- Locate Delaware Business Trust Certificate and then click Get Form to initiate the process.

- Utilize the tools available to fill out your document.

- Emphasize pertinent sections of the paperwork or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your electronic signature using the Sign feature, which takes only seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all details and then click on the Done button to save your changes.

- Select your preferred method of sending your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors necessitating the printing of new copies. airSlate SignNow fulfills all your document management needs with just a few clicks from any device you choose. Modify and eSign Delaware Business Trust Certificate to ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Delaware Business Trust Certificate?

A Delaware Business Trust Certificate is a legal document that establishes a business trust in Delaware, providing legal recognition and flexibility for business operations. This certificate serves as proof of the trust's existence and is essential for conducting business activities, such as entering contracts and holding assets.

-

How can airSlate SignNow help with my Delaware Business Trust Certificate?

AirSlate SignNow provides a user-friendly platform for electronically signing and managing documents, including your Delaware Business Trust Certificate. By using our service, you can streamline the process of signing and sharing this important document, ensuring compliance and saving valuable time.

-

What are the benefits of using a Delaware Business Trust Certificate?

Using a Delaware Business Trust Certificate allows for greater asset protection and flexibility in structuring your business. It can help minimize personal liability and provide tax advantages, making it an attractive option for many entrepreneurs seeking to optimize their business operations.

-

What are the costs associated with obtaining a Delaware Business Trust Certificate?

The costs for obtaining a Delaware Business Trust Certificate typically include state filing fees and any legal assistance you may require. Utilizing airSlate SignNow can further reduce overhead by streamlining document management processes, ultimately contributing to cost savings in your overall business setup.

-

Can I integrate airSlate SignNow with my existing business systems for my Delaware Business Trust Certificate?

Yes, airSlate SignNow offers various integrations with popular business applications to help manage your Delaware Business Trust Certificate and related documents efficiently. Our platform ensures seamless integration with tools you already use, enhancing your workflow and document management experience.

-

Is it easy to manage documents related to my Delaware Business Trust Certificate using airSlate SignNow?

Absolutely! airSlate SignNow is designed to make document management simple and intuitive. You can easily upload, sign, and share your Delaware Business Trust Certificate within moments, making it a perfect solution for busy professionals.

-

How long does it take to receive my Delaware Business Trust Certificate?

The processing time for your Delaware Business Trust Certificate can vary, but with airSlate SignNow, you can quickly prepare and send required documents for signature. Once the documents are signed and submitted, you can expect to receive your certificate within the standard timeframe set by the state.

Get more for Delaware Business Trust Certificate

- Mutual wills containing last will and testaments for unmarried persons with no children california form

- Mutual wills package of last wills and testaments for unmarried persons living together with adult children california form

- Mutual wills or last will and testaments for unmarried persons living together with minor children california form

- California cohabitation form

- California paternity form

- Ca paternity form

- Bill of sale in connection with sale of business by individual or corporate seller california form

- Office lease agreement california form

Find out other Delaware Business Trust Certificate

- How To eSignature Michigan Banking Job Description Template

- eSignature Missouri Banking IOU Simple

- eSignature Banking PDF New Hampshire Secure

- How Do I eSignature Alabama Car Dealer Quitclaim Deed

- eSignature Delaware Business Operations Forbearance Agreement Fast

- How To eSignature Ohio Banking Business Plan Template

- eSignature Georgia Business Operations Limited Power Of Attorney Online

- Help Me With eSignature South Carolina Banking Job Offer

- eSignature Tennessee Banking Affidavit Of Heirship Online

- eSignature Florida Car Dealer Business Plan Template Myself

- Can I eSignature Vermont Banking Rental Application

- eSignature West Virginia Banking Limited Power Of Attorney Fast

- eSignature West Virginia Banking Limited Power Of Attorney Easy

- Can I eSignature Wisconsin Banking Limited Power Of Attorney

- eSignature Kansas Business Operations Promissory Note Template Now

- eSignature Kansas Car Dealer Contract Now

- eSignature Iowa Car Dealer Limited Power Of Attorney Easy

- How Do I eSignature Iowa Car Dealer Limited Power Of Attorney

- eSignature Maine Business Operations Living Will Online

- eSignature Louisiana Car Dealer Profit And Loss Statement Easy