Ca Seller Form

What is the Ca Seller

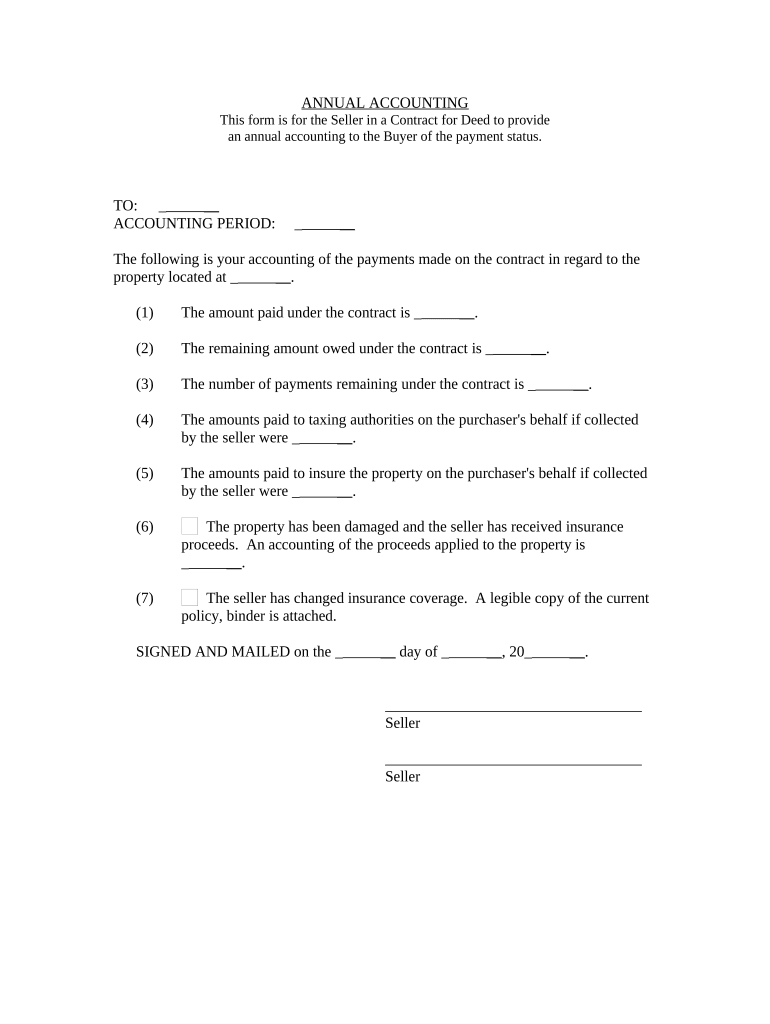

The California seller form, commonly referred to as the ca seller, is a crucial document for individuals and businesses engaged in sales transactions within the state. This form is used to report sales tax obligations and ensure compliance with California tax regulations. It serves as a declaration of sales made and taxes collected, which is essential for maintaining accurate financial records and fulfilling state requirements.

How to use the Ca Seller

Utilizing the California seller form involves several straightforward steps. First, gather all necessary sales records, including transaction details and tax collected. Next, fill out the form accurately, ensuring that all information is complete and correct. After completing the form, submit it to the appropriate tax authority, either online or through traditional mail. Using a reliable eSignature solution can streamline this process, allowing for secure and efficient submission.

Steps to complete the Ca Seller

Completing the California seller form requires careful attention to detail. Follow these steps for successful completion:

- Collect all relevant sales data, including dates, amounts, and tax rates.

- Access the ca seller form through the appropriate state website or platform.

- Fill in your business information, including name, address, and seller's permit number.

- Report total sales and the corresponding sales tax collected.

- Review the form for accuracy and completeness.

- Submit the form electronically or via mail, ensuring you keep a copy for your records.

Legal use of the Ca Seller

The legal use of the California seller form is governed by state tax laws. It is essential to ensure that the form is filled out accurately to avoid penalties or legal issues. The form must be submitted within the specified deadlines to remain compliant with California tax regulations. Using a trusted eSignature service can further enhance the legal standing of your submission, providing a digital certificate that verifies the authenticity of the document.

Eligibility Criteria

To be eligible to use the California seller form, individuals or businesses must possess a valid seller's permit issued by the California Department of Tax and Fee Administration. This permit allows sellers to collect sales tax on taxable sales. Additionally, businesses must maintain accurate records of sales and tax collected to ensure compliance when completing the form.

Required Documents

When preparing to complete the California seller form, gather the following documents:

- Seller's permit number.

- Records of all sales transactions, including invoices and receipts.

- Documentation of sales tax collected during the reporting period.

- Any previous tax filings that may be relevant for reference.

Form Submission Methods

The California seller form can be submitted through various methods, providing flexibility for users. Options include:

- Online submission via the California Department of Tax and Fee Administration's website.

- Mailing a physical copy of the form to the designated tax office.

- In-person submission at local tax offices, if preferred.

Quick guide on how to complete ca seller

Complete Ca Seller effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an excellent environmentally-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Handle Ca Seller on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The easiest way to edit and eSign Ca Seller without hassle

- Find Ca Seller and click on Get Form to start.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes seconds and holds the same legal validity as a standard wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form navigation, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choice. Modify and eSign Ca Seller and maintain effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What features does airSlate SignNow offer for a CA seller?

AirSlate SignNow provides a range of features tailored for a CA seller, including eSigning documents, customizable templates, and real-time collaboration. These tools streamline the process of managing contracts and agreements, making it easier to close deals quickly and efficiently. Additionally, the platform ensures compliance with legal standards, which is crucial for any CA seller.

-

How does airSlate SignNow benefit a CA seller?

For a CA seller, airSlate SignNow offers signNow benefits such as reduced turnaround time for document signing, enhanced workflow efficiency, and improved client satisfaction. With features that automate routine tasks, a CA seller can focus more on building client relationships rather than getting bogged down in paperwork. The user-friendly interface also makes it easy for clients to sign documents without confusion.

-

What are the pricing options for CA sellers using airSlate SignNow?

AirSlate SignNow offers competitive pricing plans that cater to the needs of CA sellers, starting with a free trial and moving to tiered subscription options. These plans are designed to fit various business sizes and needs, ensuring that a CA seller can find an option that works within their budget. The transparent pricing structure allows users to easily understand the costs involved without any hidden fees.

-

Can airSlate SignNow integrate with other software platforms for CA sellers?

Yes, airSlate SignNow integrates seamlessly with various software platforms that a CA seller may already be using, such as CRM systems, cloud storage services, and accounting tools. This integration capability enhances workflow efficiency by enabling automatic data transfer between systems. As a result, a CA seller can maintain accurate records without the hassle of manual data entry.

-

Is airSlate SignNow compliant with legal standards for CA sellers?

Absolutely, airSlate SignNow is designed to meet legal compliance requirements for electronic signatures, making it a reliable choice for a CA seller. The platform adheres to regulations such as ESIGN and UETA, ensuring that eSignatures are legally binding. This compliance is key for a CA seller who needs assurance that their documents will hold up in a legal context.

-

How user-friendly is airSlate SignNow for CA sellers?

AirSlate SignNow is highly user-friendly, which is essential for busy CA sellers who may not be tech-savvy. The intuitive interface allows even those with limited technical skills to navigate the platform with ease. This simplicity translates into faster adoption and less time spent on training, enabling a CA seller to get started quickly.

-

What kind of customer support is available for CA sellers using airSlate SignNow?

AirSlate SignNow offers robust customer support for CA sellers, including live chat, email assistance, and a comprehensive help center. The support team is equipped to address various queries related to the platform's functionalities, ensuring that CA sellers can resolve issues promptly. This level of support enhances user experience, particularly for those who may encounter challenges during implementation.

Get more for Ca Seller

- Letter from tenant to landlord containing notice to landlord to cease retaliatory threats to evict or retaliatory eviction 497323045 form

- Letter from landlord to tenant returning security deposit less deductions oklahoma form

- Letter from tenant to landlord containing notice of failure to return security deposit and demand for return oklahoma form

- Letter from tenant to landlord containing notice of wrongful deductions from security deposit and demand for return oklahoma form

- Letter from tenant to landlord containing request for permission to sublease oklahoma form

- Letter from landlord to tenant that sublease granted rent paid by subtenant but tenant still liable for rent and damages 497323050 form

- Letter from landlord to tenant that sublease granted rent paid by subtenant old tenant released from liability for rent oklahoma form

- Ok landlord 497323052 form

Find out other Ca Seller

- Can I eSign Colorado Business Insurance Quotation Form

- Can I eSign Hawaii Certeficate of Insurance Request

- eSign Nevada Certeficate of Insurance Request Now

- Can I eSign Missouri Business Insurance Quotation Form

- How Do I eSign Nevada Business Insurance Quotation Form

- eSign New Mexico Business Insurance Quotation Form Computer

- eSign Tennessee Business Insurance Quotation Form Computer

- How To eSign Maine Church Directory Form

- How To eSign New Hampshire Church Donation Giving Form

- eSign North Dakota Award Nomination Form Free

- eSignature Mississippi Demand for Extension of Payment Date Secure

- Can I eSign Oklahoma Online Donation Form

- How Can I Electronic signature North Dakota Claim

- How Do I eSignature Virginia Notice to Stop Credit Charge

- How Do I eSignature Michigan Expense Statement

- How Can I Electronic signature North Dakota Profit Sharing Agreement Template

- Electronic signature Ohio Profit Sharing Agreement Template Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Secure

- Electronic signature Florida Amendment to an LLC Operating Agreement Fast

- Electronic signature Florida Amendment to an LLC Operating Agreement Simple