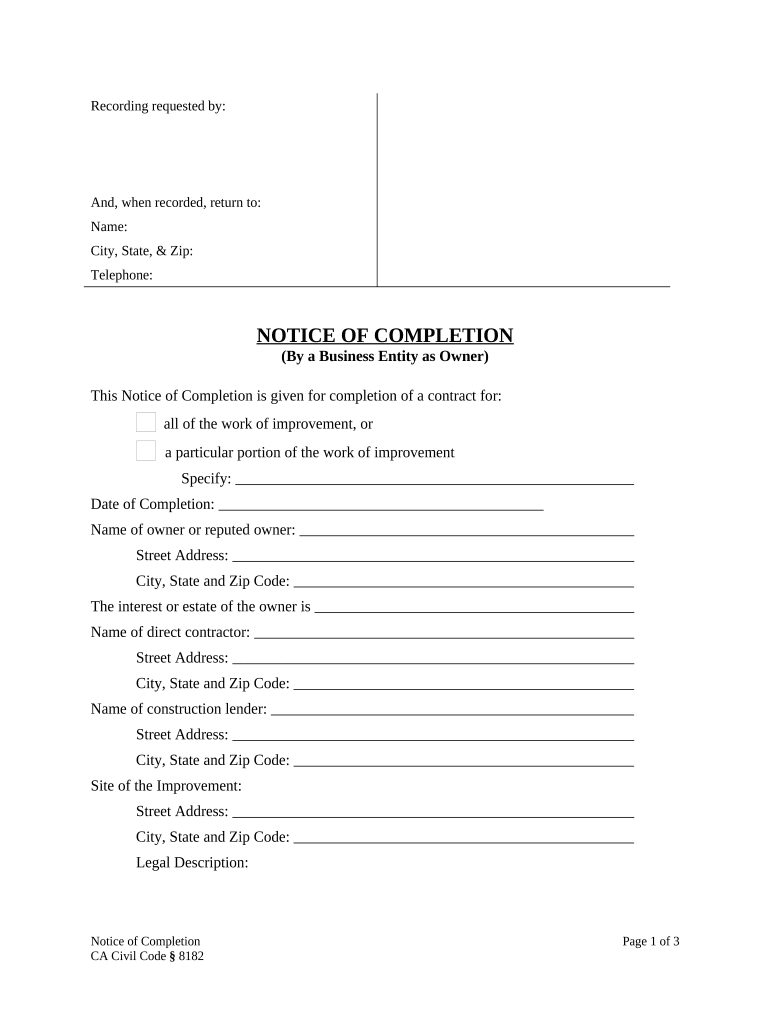

Ca Business Entity Form

What is the CA Business Entity

The CA business entity refers to a legal structure established under California state law for conducting business activities. This can include various forms such as Limited Liability Companies (LLCs), Corporations, Partnerships, and Sole Proprietorships. Each type of business entity has distinct characteristics, benefits, and regulatory requirements. Understanding these differences is crucial for entrepreneurs and business owners as they determine the best structure for their operations.

How to Use the CA Business Entity

Utilizing a CA business entity involves several steps, including registration, compliance with state regulations, and maintaining good standing. First, choose the appropriate business entity type based on your business goals. Next, complete the necessary registration forms with the California Secretary of State. This process often requires a filing fee and specific documentation, such as articles of incorporation or organization. Once registered, ensure compliance with ongoing requirements, such as annual reports and tax filings, to keep your entity in good standing.

Steps to Complete the CA Business Entity

Completing the CA business entity registration involves a series of steps:

- Determine the type of business entity that best suits your needs.

- Choose a unique business name and check its availability through the California Secretary of State's database.

- Prepare the necessary formation documents, such as articles of incorporation for corporations or articles of organization for LLCs.

- File the documents with the California Secretary of State, including payment of the required filing fee.

- Obtain any necessary licenses or permits specific to your business type and location.

- Set up a business bank account to separate personal and business finances.

Legal Use of the CA Business Entity

The legal use of a CA business entity is governed by state laws and regulations. Each entity type provides different legal protections and obligations. For example, LLCs and corporations offer limited liability protection, meaning personal assets are generally protected from business debts. Compliance with state and federal laws is essential, including tax obligations and employment regulations. Understanding these legal frameworks helps ensure that businesses operate within the law and mitigate potential risks.

Required Documents

When establishing a CA business entity, several documents are typically required:

- Articles of Incorporation or Articles of Organization, depending on the entity type.

- Operating Agreement for LLCs, outlining management structure and operational procedures.

- Bylaws for corporations, detailing governance and operational rules.

- Fictitious Business Name Statement, if operating under a name different from the legal entity name.

- Employer Identification Number (EIN) from the IRS for tax purposes.

Form Submission Methods (Online / Mail / In-Person)

Submitting the CA business entity registration can be done through various methods:

- Online: Many forms can be filed electronically through the California Secretary of State's website, providing a quick and efficient option.

- Mail: Completed forms and payment can be sent via postal service to the appropriate address listed on the Secretary of State’s website.

- In-Person: Individuals may also choose to file documents in person at designated state offices, allowing for immediate confirmation of submission.

Quick guide on how to complete ca business entity 497298364

Complete Ca Business Entity with ease on any device

Digital document management has become increasingly favored by organizations and individuals. It serves as an excellent eco-friendly alternative to conventional printed and signed papers, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the resources you need to create, edit, and eSign your documents quickly and efficiently. Manage Ca Business Entity on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to edit and eSign Ca Business Entity effortlessly

- Locate Ca Business Entity and then click Get Form to begin.

- Use the tools we offer to complete your form.

- Emphasize key parts of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes only seconds and holds the same legal validity as a traditional ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device. Edit and eSign Ca Business Entity and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a CA business entity?

A CA business entity refers to any legal structure that is recognized by the state of California, including corporations, LLCs, and partnerships. Each type of entity has its own benefits, tax implications, and legal responsibilities. Understanding the different types of CA business entities is crucial for compliance and effective business management.

-

How does airSlate SignNow help with CA business entity transactions?

airSlate SignNow streamlines the process of managing documents related to your CA business entity. Our platform allows businesses to easily send, receive, and eSign essential documents, ensuring your transactions are secure and compliant. This not only saves time but also reduces errors commonly associated with paper-based processes.

-

What pricing plans are available for managing CA business entities?

airSlate SignNow offers a variety of pricing plans tailored to the needs of CA business entities, ensuring that businesses of all sizes can find an option that fits their budget. Our plans include features like unlimited document sending, advanced eSignature options, and integration capabilities. You can compare our plans on our website to find the best fit for your entity.

-

What features does airSlate SignNow offer to CA business entities?

Key features of airSlate SignNow for CA business entities include customizable templates, secure cloud storage, and real-time tracking of document status. Additionally, our platform supports multiple file formats and integrates seamlessly with popular business tools. These features make it easier for CA business entities to operate efficiently and securely.

-

Are there specific benefits for CA business entities using airSlate SignNow?

Using airSlate SignNow provides CA business entities with enhanced security, compliance, and efficiency in document management. Our eSignature solution is legally binding, ensuring that your agreements are valid and protected. Moreover, businesses can save time and reduce administrative costs by utilizing a digital solution rather than traditional paperwork.

-

Can airSlate SignNow integrate with other tools for CA business entities?

Yes, airSlate SignNow offers integrations with various business applications that are commonly used by CA business entities, such as CRM systems, project management software, and cloud storage solutions. These integrations facilitate a smooth workflow and allow businesses to manage their documents more effectively. Check our integrations page for a comprehensive list of compatible tools.

-

Is airSlate SignNow compliant with California business regulations?

Yes, airSlate SignNow complies with all relevant California business regulations regarding eSignatures and electronic document management. Our platform adheres to the UETA and ESIGN acts, ensuring that your documents are legally recognized in California. This compliance provides peace of mind for CA business entities looking to transition to digital solutions.

Get more for Ca Business Entity

Find out other Ca Business Entity

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer