Colorado Beneficiary Deed Form

What is the Colorado Beneficiary Deed Form

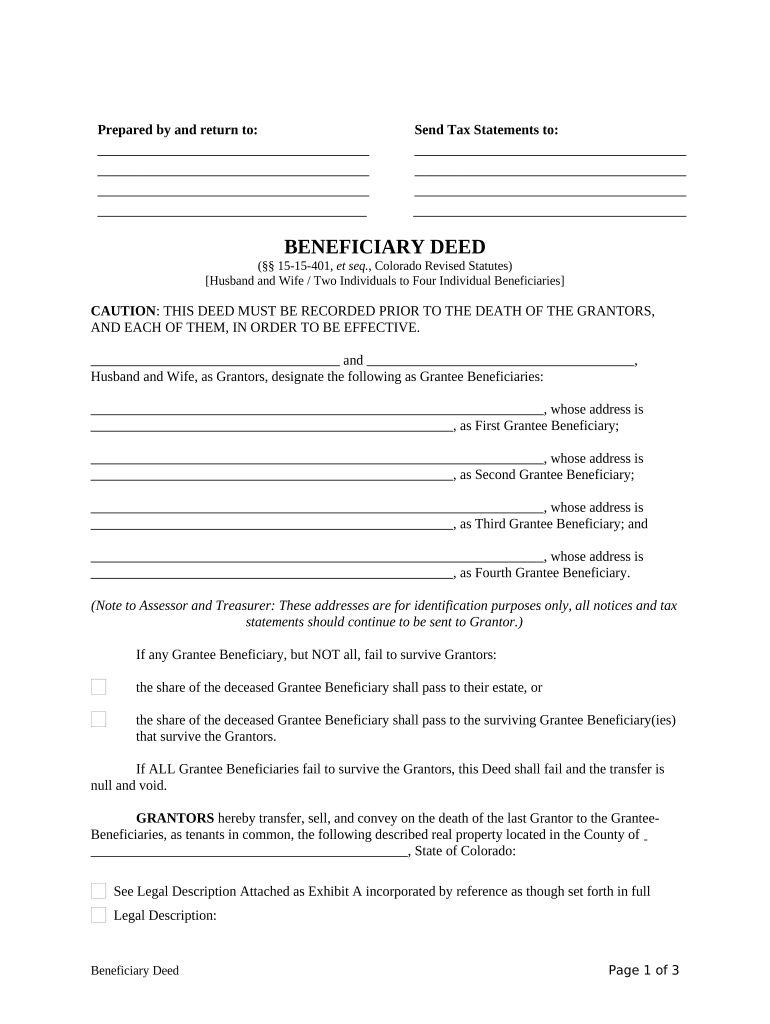

The Colorado beneficiary deed is a legal document that allows property owners to transfer their real estate to designated beneficiaries upon their death, without the need for probate. This deed is also referred to as a transfer on death (TOD) deed. It simplifies the transfer process, ensuring that the property passes directly to the beneficiaries without the complications typically associated with estate settlement.

How to use the Colorado Beneficiary Deed Form

To use the Colorado beneficiary deed form, property owners must complete the document with accurate information regarding the property and the beneficiaries. The form should include details such as the legal description of the property, the names of the beneficiaries, and the signature of the property owner. Once completed, the deed must be recorded with the county clerk and recorder in the county where the property is located to be legally effective.

Steps to complete the Colorado Beneficiary Deed Form

Completing the Colorado beneficiary deed form involves several key steps:

- Obtain the appropriate form, which can be found online or at local legal offices.

- Fill in the property details, including the legal description and address.

- List the names and addresses of the beneficiaries who will receive the property.

- Sign the form in the presence of a notary public to ensure its validity.

- File the completed deed with the county clerk and recorder to make it effective.

Legal use of the Colorado Beneficiary Deed Form

The legal use of the Colorado beneficiary deed form is governed by state law. It is essential to ensure that the deed complies with the Colorado Revised Statutes to be enforceable. The form must clearly state the intent to transfer the property upon death and must be signed and notarized. Failure to adhere to these requirements may result in the deed being invalidated, leading to complications in the transfer process.

Key elements of the Colorado Beneficiary Deed Form

Key elements of the Colorado beneficiary deed form include:

- Property Description: A detailed legal description of the property being transferred.

- Beneficiary Information: Names and addresses of the beneficiaries who will inherit the property.

- Owner's Signature: The signature of the property owner, which must be notarized.

- Effective Date: The date on which the transfer will take effect, typically upon the owner's death.

State-specific rules for the Colorado Beneficiary Deed Form

Colorado has specific rules regarding the use of beneficiary deeds. The form must comply with the state's requirements, including the necessity for notarization and proper recording. Additionally, property owners should be aware of any limitations on the number of beneficiaries and the types of property that can be transferred using this deed. Understanding these state-specific rules is crucial to ensure a smooth transfer process.

Quick guide on how to complete colorado beneficiary deed form

Prepare Colorado Beneficiary Deed Form seamlessly on any device

Digital document management has gained traction among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, modify, and electronically sign your documents swiftly without any hold-ups. Manage Colorado Beneficiary Deed Form on any platform with the airSlate SignNow applications for Android or iOS, and streamline any document-related process today.

The simplest method to alter and electronically sign Colorado Beneficiary Deed Form with ease

- Locate Colorado Beneficiary Deed Form and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight important sections of the documents or mask sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to finalize your changes.

- Choose how you wish to send your form: via email, SMS, or invitation link, or download it to your PC.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors requiring the reprinting of new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from your preferred device. Edit and electronically sign Colorado Beneficiary Deed Form to ensure exceptional communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a beneficiary deed in Colorado real estate?

A beneficiary deed in Colorado real estate is a legal document that allows property owners to transfer their real estate assets to beneficiaries upon their death without going through probate. This deed ensures a smooth transition of property ownership and can help avoid lengthy legal processes.

-

How does a beneficiary deed work in Colorado?

In Colorado, a beneficiary deed allows the property owner to retain full control over the property during their lifetime while designating one or more beneficiaries to receive the property automatically upon their death. The deed must be recorded with the county clerk, and it becomes effective immediately upon the owner's death.

-

What are the benefits of using a beneficiary deed in Colorado real estate?

Using a beneficiary deed in Colorado real estate provides several benefits, including avoiding probate, reducing estate administration costs, and allowing for a straightforward transfer of property to heirs. Additionally, it helps maintain privacy, as the property transfer does not become a matter of public record until the owner passes away.

-

Are there any costs associated with creating a beneficiary deed in Colorado?

Yes, creating a beneficiary deed in Colorado typically involves costs such as legal fees if you hire an attorney and recording fees charged by the county to file the deed. However, compared to traditional probate processes, these costs are signNowly lower, making it a cost-effective solution.

-

Can I revoke a beneficiary deed in Colorado?

Yes, a beneficiary deed in Colorado can be revoked at any time by the grantor, as long as they are alive and competent. The revocation process involves executing a new deed or a formal declaration stating the intention to revoke the beneficiary deed, which then must be recorded.

-

Who should consider using a beneficiary deed in Colorado real estate?

Property owners in Colorado who wish to ensure a seamless transfer of real estate to their beneficiaries upon death should consider using a beneficiary deed. This includes individuals looking to avoid probate, simplify their estate planning, and provide clarity to their heirs regarding property distribution.

-

What information is needed to create a beneficiary deed in Colorado?

To create a beneficiary deed in Colorado, you will need specific information such as the legal description of the property, the names and addresses of the beneficiaries, and the name of the property owner. This information ensures that the deed is correctly executed and recorded.

Get more for Colorado Beneficiary Deed Form

Find out other Colorado Beneficiary Deed Form

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe