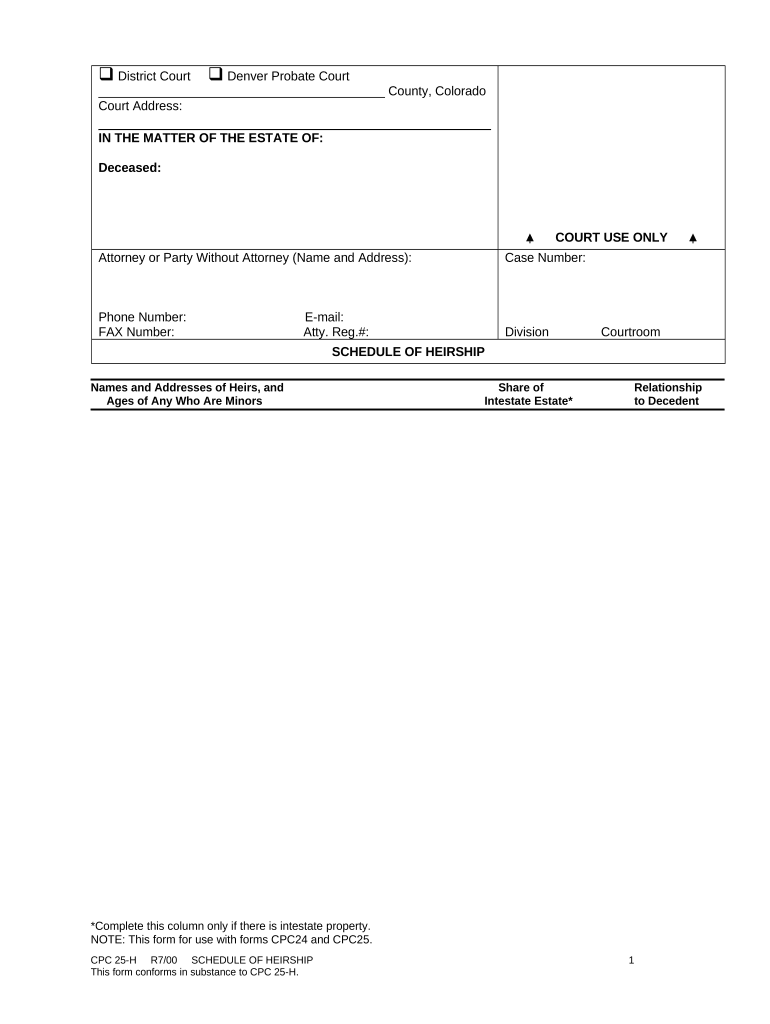

Schedule of Heirship Descent Colorado Form

What is the Schedule Of Heirship Descent Colorado

The Schedule Of Heirship Descent Colorado is a legal document used to outline the distribution of an estate when a person passes away. This form identifies the heirs of the deceased and specifies their respective shares of the estate. It is essential for ensuring that the wishes of the deceased are honored and that the distribution of assets complies with Colorado law. The form serves as a crucial part of the probate process, helping to clarify the lineage and rights of heirs.

How to use the Schedule Of Heirship Descent Colorado

Using the Schedule Of Heirship Descent Colorado involves several steps. First, gather necessary information about the deceased, including their full name, date of birth, and date of death. Next, identify all potential heirs, which may include children, spouses, siblings, and other relatives. Fill out the form with accurate details regarding each heir, including their relationship to the deceased and the percentage of the estate they are entitled to receive. Once completed, the form must be signed and dated by the appropriate parties to ensure its validity.

Steps to complete the Schedule Of Heirship Descent Colorado

Completing the Schedule Of Heirship Descent Colorado requires careful attention to detail. Follow these steps:

- Gather personal information about the deceased, including legal documents like the will, if available.

- List all potential heirs, ensuring you include their full names and relationships to the deceased.

- Determine the share of the estate each heir will receive based on Colorado inheritance laws.

- Fill out the form accurately, ensuring all information is correct and complete.

- Review the completed form for any errors before signing.

- Obtain the necessary signatures from all heirs, if required.

- Submit the form to the appropriate court or agency as part of the probate process.

Key elements of the Schedule Of Heirship Descent Colorado

Several key elements must be included in the Schedule Of Heirship Descent Colorado to ensure its effectiveness:

- Decedent Information: Full name, date of birth, and date of death.

- Heir Information: Names, addresses, and relationships of all heirs.

- Distribution Shares: Clear percentages or fractions indicating how the estate will be divided among heirs.

- Signatures: Required signatures of heirs or witnesses to validate the form.

- Notarization: May be necessary to ensure the document's authenticity.

Legal use of the Schedule Of Heirship Descent Colorado

The legal use of the Schedule Of Heirship Descent Colorado is critical in the probate process. This document must be filed with the probate court to initiate the distribution of the deceased's assets. It provides a clear record of who is entitled to inherit, which helps prevent disputes among potential heirs. Adhering to Colorado laws regarding inheritance and estate distribution is essential to ensure that the form is legally recognized and enforceable.

Quick guide on how to complete schedule of heirship descent colorado

Complete Schedule Of Heirship Descent Colorado effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documentation, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, edit, and eSign your documents quickly without delays. Manage Schedule Of Heirship Descent Colorado on any device using airSlate SignNow’s Android or iOS applications and simplify any document-driven process today.

How to modify and eSign Schedule Of Heirship Descent Colorado with ease

- Find Schedule Of Heirship Descent Colorado and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or obscure confidential information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your signature using the Sign tool, which takes seconds and carries the same legal validity as a conventional handwritten signature.

- Review the details and then click the Done button to save your updates.

- Choose how you want to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Edit and eSign Schedule Of Heirship Descent Colorado and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Schedule Of Heirship Descent Colorado?

A Schedule Of Heirship Descent Colorado is a document that outlines the rightful heirs of a deceased person under Colorado law. This document is crucial for estate administration as it helps determine how assets should be distributed among heirs. By having this schedule, you can ensure clarity and legality in the inheritance process.

-

How can airSlate SignNow help with the Schedule Of Heirship Descent Colorado?

airSlate SignNow offers a streamlined platform for creating and eSigning the Schedule Of Heirship Descent Colorado. Through our user-friendly interface, you can easily input necessary information and send documents for signatures, minimizing the time and effort required for estate management. This ensures compliance with Colorado laws while saving you resources.

-

What are the pricing options for using airSlate SignNow for legal documents?

airSlate SignNow provides competitive pricing plans to cater to various needs, including options that are well-suited for those needing to draft a Schedule Of Heirship Descent Colorado. You'll find plans that offer flexible usage, allowing access to essential features without breaking the bank. Check our pricing page for detailed options tailored to your requirements.

-

Are there specific features included in airSlate SignNow for templates like the Schedule Of Heirship Descent Colorado?

Yes, airSlate SignNow includes customizable templates specifically for documents such as the Schedule Of Heirship Descent Colorado. You can easily modify templates to suit your specific circumstances, ensuring that all necessary information is captured correctly. Additional features include secure document storage and tracking capabilities.

-

Is airSlate SignNow compliant with Colorado regulations for heirship documents?

Absolutely, airSlate SignNow is designed to be fully compliant with Colorado regulations concerning documents like the Schedule Of Heirship Descent Colorado. Our platform takes into consideration local laws, ensuring that documents created through our service meet the necessary legal criteria for acceptance. This focus on compliance protects you and your clients when managing estates.

-

Can I integrate airSlate SignNow with other software for efficient document management?

Yes, airSlate SignNow can seamlessly integrate with various software solutions, making it easier to manage documents like a Schedule Of Heirship Descent Colorado. Integrations with CRM tools, cloud storage services, and productivity applications enhance your document workflows, reducing redundancy and improving efficiency. This functionality allows for smooth data transfer and document handling.

-

What benefits does using airSlate SignNow provide for handling estate documents?

By using airSlate SignNow for managing estate documents, including the Schedule Of Heirship Descent Colorado, you gain efficiency and reliability. The platform offers electronic signatures, reducing the time spent on paperwork, while ensuring secure transactions. Additionally, our advanced features facilitate easy collaboration among stakeholders, thus expediting the overall process.

Get more for Schedule Of Heirship Descent Colorado

Find out other Schedule Of Heirship Descent Colorado

- How Can I eSign Connecticut Lawers Presentation

- Help Me With eSign Hawaii Lawers Word

- How Can I eSign Hawaii Lawers Document

- How To eSign Hawaii Lawers PPT

- Help Me With eSign Hawaii Insurance PPT

- Help Me With eSign Idaho Insurance Presentation

- Can I eSign Indiana Insurance Form

- How To eSign Maryland Insurance PPT

- Can I eSign Arkansas Life Sciences PDF

- How Can I eSign Arkansas Life Sciences PDF

- Can I eSign Connecticut Legal Form

- How Do I eSign Connecticut Legal Form

- How Do I eSign Hawaii Life Sciences Word

- Can I eSign Hawaii Life Sciences Word

- How Do I eSign Hawaii Life Sciences Document

- How Do I eSign North Carolina Insurance Document

- How Can I eSign Hawaii Legal Word

- Help Me With eSign Hawaii Legal Document

- How To eSign Hawaii Legal Form

- Help Me With eSign Hawaii Legal Form