Colorado Trust Form

What is the Colorado Trust

The Colorado Trust is a legal arrangement that allows individuals to manage their assets while potentially avoiding probate. This type of trust can be beneficial for estate planning, as it provides a structured way to distribute assets according to the grantor's wishes. The trust is established by a grantor who transfers ownership of their property into the trust, which is then managed by a trustee. This arrangement can help streamline the process of asset distribution upon the grantor's death, ensuring that beneficiaries receive their inheritance without the delays associated with probate court.

How to use the Colorado Trust

Using the Colorado Trust involves several key steps. First, the grantor must clearly define their intentions regarding asset distribution and select a trustworthy individual or institution to serve as the trustee. Next, the grantor transfers assets into the trust, which may include real estate, bank accounts, or investments. It is essential to properly document these transfers to ensure legal validity. The trustee then manages the assets according to the trust's terms, maintaining records and providing updates to beneficiaries as needed. This process can simplify financial management and provide peace of mind for the grantor.

Steps to complete the Colorado Trust

Completing the Colorado Trust involves a series of organized steps:

- Define your goals: Determine what you want to achieve with the trust, including how you wish to distribute your assets.

- Select a trustee: Choose someone reliable who will act in the best interest of the beneficiaries.

- Draft the trust document: Work with a legal professional to create a trust document that outlines the terms and conditions.

- Fund the trust: Transfer assets into the trust, ensuring all necessary legal documentation is completed.

- Review and update: Regularly review the trust to ensure it aligns with your current wishes and legal requirements.

Legal use of the Colorado Trust

The legal use of the Colorado Trust is governed by state laws that outline the requirements for establishing and maintaining a trust. It is crucial for the trust to be properly executed to ensure its validity. This includes having the trust document signed, dated, and notarized, if necessary. Additionally, the grantor must be of sound mind and legal age when creating the trust. Compliance with Colorado state laws helps protect the trust from potential challenges and ensures that the grantor's wishes are honored.

Key elements of the Colorado Trust

Several key elements define the Colorado Trust:

- Grantor: The individual who creates the trust and transfers assets into it.

- Trustee: The person or entity responsible for managing the trust and its assets.

- Beneficiaries: Individuals or entities designated to receive benefits from the trust.

- Trust document: A legal document that outlines the terms, conditions, and intentions of the trust.

- Funding: The process of transferring assets into the trust to ensure it is operational.

State-specific rules for the Colorado Trust

Colorado has specific rules that govern the establishment and operation of trusts. These rules include requirements for the trust document, such as the need for clear language regarding the grantor's intentions and the identification of beneficiaries. Additionally, Colorado law allows for various types of trusts, including revocable and irrevocable trusts, each with different implications for asset management and distribution. Understanding these state-specific rules is essential for ensuring the trust is legally compliant and effectively serves its intended purpose.

Quick guide on how to complete colorado trust 497300747

Complete Colorado Trust effortlessly on any device

Digital document management has become favored by both businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed materials, allowing you to obtain the necessary form and securely save it online. airSlate SignNow equips you with all the resources needed to create, alter, and eSign your documents swiftly without any delays. Manage Colorado Trust on any platform with airSlate SignNow’s Android or iOS applications and enhance any document-related process today.

The most efficient way to modify and eSign Colorado Trust without hassle

- Find Colorado Trust and click Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Emphasize important portions of the documents or conceal sensitive information using the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign feature, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details, then click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misfiled documents, tedious form navigation, or errors that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign Colorado Trust and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

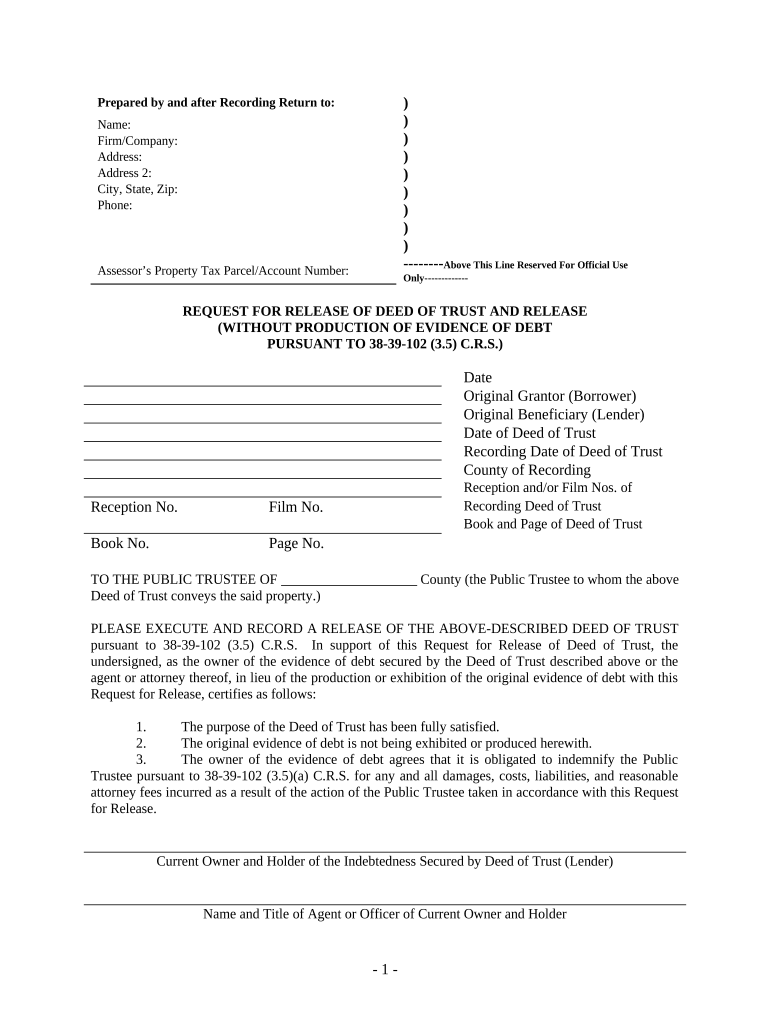

What is a Colorado release deed trust?

A Colorado release deed trust is a legal document that allows property owners to remove a lien from their property once certain obligations are fulfilled. This document serves to ensure the rightful transfer of property interests, establishing clear ownership. It's essential for both personal and commercial property transactions in Colorado.

-

How can airSlate SignNow help with managing a Colorado release deed trust?

airSlate SignNow offers an intuitive platform for creating, sending, and eSigning your Colorado release deed trust documents securely. With its straightforward design, users can efficiently manage and execute deeds with minimal hassle. This ensures that your legal documents are processed timely and accurately.

-

What are the costs associated with using airSlate SignNow for a Colorado release deed trust?

airSlate SignNow provides competitive pricing plans that cater to different needs, making it cost-effective for managing a Colorado release deed trust. You can choose from monthly or annual subscriptions depending on your usage. Additionally, the platform offers a free trial, allowing you to evaluate its services before committing.

-

What features does airSlate SignNow offer for Colorado release deed trust documents?

Key features of airSlate SignNow include customizable templates for Colorado release deed trust documents, an easy eSigning process, and secure cloud storage. The platform also allows for real-time collaboration and tracking of document status, ensuring all parties are informed throughout the transaction. These features enhance the overall efficiency of document management.

-

Can I integrate airSlate SignNow with other software for managing a Colorado release deed trust?

Yes, airSlate SignNow seamlessly integrates with various software applications, enhancing your ability to manage a Colorado release deed trust effectively. You can connect it with CRM systems, cloud storage solutions, and other business tools to streamline your workflow. This integration helps maintain all related documents in one accessible location.

-

What are the benefits of using airSlate SignNow for a Colorado release deed trust?

Using airSlate SignNow for your Colorado release deed trust offers numerous benefits, including enhanced security, faster transaction times, and improved organization. The platform reduces the need for physical paperwork, which contributes to a more sustainable business practice. Additionally, it ensures compliance with legal standards when executing your deeds.

-

Is it easy to eSign a Colorado release deed trust with airSlate SignNow?

Absolutely! eSigning a Colorado release deed trust with airSlate SignNow is quick and user-friendly. Your signers can easily access the document from anywhere, sign it digitally, and return it within moments. This convenience accelerates the signing process, benefiting all parties involved.

Get more for Colorado Trust

- Accuro forms

- Equine surgery consent form warwick vet clinic

- Letterman jacket order form

- Pdf cpd 31509pdf chicago police department directives system form

- Poinsettia order form holycrosschurchorg

- Wwwuslegalformscom111913 wine order formwine order form fill and sign printable us legal forms

- Citizenship application form

- Fill in the blank bakery plan form

Find out other Colorado Trust

- Can I Electronic signature Missouri Rental lease contract

- Electronic signature New Jersey Rental lease agreement template Free

- Electronic signature New Jersey Rental lease agreement template Secure

- Electronic signature Vermont Rental lease agreement Mobile

- Electronic signature Maine Residential lease agreement Online

- Electronic signature Minnesota Residential lease agreement Easy

- Electronic signature Wyoming Rental lease agreement template Simple

- Electronic signature Rhode Island Residential lease agreement Online

- Electronic signature Florida Rental property lease agreement Free

- Can I Electronic signature Mississippi Rental property lease agreement

- Can I Electronic signature New York Residential lease agreement form

- eSignature Pennsylvania Letter Bankruptcy Inquiry Computer

- Electronic signature Virginia Residential lease form Free

- eSignature North Dakota Guarantee Agreement Easy

- Can I Electronic signature Indiana Simple confidentiality agreement

- Can I eSignature Iowa Standstill Agreement

- How To Electronic signature Tennessee Standard residential lease agreement

- How To Electronic signature Alabama Tenant lease agreement

- Electronic signature Maine Contract for work Secure

- Electronic signature Utah Contract Myself