Connecticut Certificate Lien Form

What is the Connecticut Certificate Lien

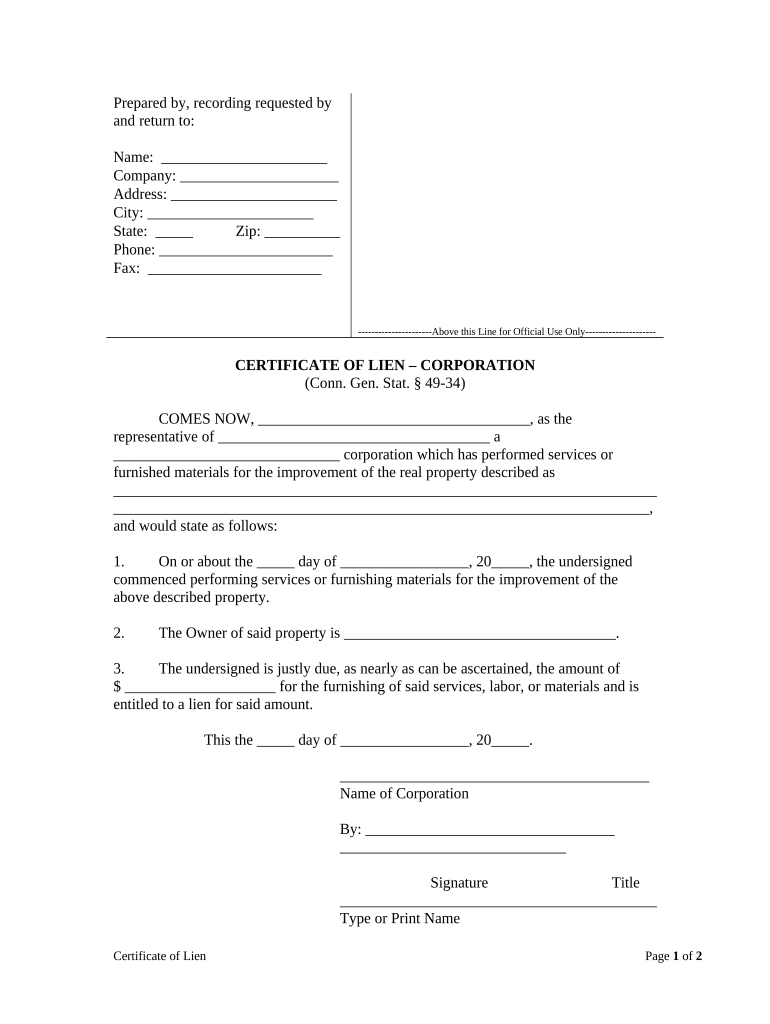

The Connecticut certificate lien is a legal document that establishes a claim against a property, typically used to secure payment for debts or obligations. This form is essential for creditors who wish to protect their interests when a debtor fails to fulfill financial commitments. By filing this lien, creditors can assert their rights to the property, which may include real estate or personal property, ensuring they have a legal avenue for recovering owed amounts.

How to obtain the Connecticut Certificate Lien

To obtain a Connecticut certificate lien, you need to follow a straightforward process. First, identify the specific debt or obligation that warrants the lien. Next, gather all necessary documentation that supports your claim, including contracts, invoices, or other relevant records. After preparing the required documents, you can file the certificate lien with the appropriate state or local authority, typically the town clerk's office where the property is located. Ensure that you pay any applicable filing fees to complete the process.

Steps to complete the Connecticut Certificate Lien

Completing the Connecticut certificate lien involves several key steps:

- Identify the debtor and the property subject to the lien.

- Gather necessary documentation, such as contracts and proof of debt.

- Fill out the certificate lien form accurately, ensuring all required information is included.

- File the completed form with the appropriate local authority, typically the town clerk's office.

- Pay any required filing fees to finalize the submission.

Legal use of the Connecticut Certificate Lien

The legal use of the Connecticut certificate lien is crucial for protecting creditors' rights. This document serves as a public notice of the creditor's claim against the property, which can prevent the debtor from selling or refinancing the property without addressing the lien. It is essential to ensure that the lien is filed correctly and complies with state laws to maintain its enforceability.

Key elements of the Connecticut Certificate Lien

Several key elements are essential for a valid Connecticut certificate lien. These include:

- The name and address of the debtor.

- A description of the property subject to the lien.

- The amount of the debt owed.

- The date the debt was incurred.

- The signature of the creditor or authorized representative.

State-specific rules for the Connecticut Certificate Lien

Connecticut has specific rules governing the filing and enforcement of certificate liens. It is important to be aware of the time limits for filing, the required forms, and any associated fees. Additionally, understanding the priority of liens and how they may affect property transactions is crucial for creditors and debtors alike.

Quick guide on how to complete connecticut certificate lien

Complete Connecticut Certificate Lien seamlessly on any device

Online document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documentation, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, edit, and eSign your documents swiftly without delays. Handle Connecticut Certificate Lien on any device using the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The most efficient way to modify and eSign Connecticut Certificate Lien effortlessly

- Obtain Connecticut Certificate Lien and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that require printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from a device of your selection. Edit and eSign Connecticut Certificate Lien and ensure excellent communication at any point in your form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Connecticut certificate lien, and why do I need it?

A Connecticut certificate lien is a legal document that secures a debt against a property or asset in the state of Connecticut. It is essential for businesses and individuals looking to protect their financial interests and assert their claims legally. By using airSlate SignNow, you can easily create and manage certificate liens, ensuring compliance with local regulations.

-

How can airSlate SignNow help me manage my Connecticut certificate lien documents?

airSlate SignNow provides a user-friendly platform to create, send, and e-sign Connecticut certificate lien documents. With its intuitive features, you can easily track the status of your liens and ensure that all parties sign the necessary documents promptly. This streamlines your workflow and reduces the risk of delays in lien processing.

-

What pricing options does airSlate SignNow offer for managing Connecticut certificate liens?

airSlate SignNow offers flexible pricing plans to accommodate various business needs when managing Connecticut certificate liens. You can choose from a range of subscription options that provide access to all essential features, including document storage and eSigning capabilities. This helps businesses save on costs while ensuring they have the necessary tools for their certificate lien management.

-

Are there any special features for handling Connecticut certificate liens on airSlate SignNow?

Yes, airSlate SignNow offers specific features tailored for handling Connecticut certificate liens, including customizable templates and automated reminders. These functionalities help ensure that all required signatures are collected, and documents are completed in a timely fashion. Additionally, the platform allows for secure document storage and easy retrieval, streamlining your lien management process.

-

What are the benefits of using airSlate SignNow for Connecticut certificate liens?

Using airSlate SignNow for Connecticut certificate liens provides numerous benefits, including increased efficiency, improved compliance, and reduced paper usage. The platform's eSignature capabilities simplify the signing process, allowing for quick and legally binding agreements. Furthermore, your documents are secured and can be accessed anytime, which enhances your overall operational productivity.

-

Can I integrate airSlate SignNow with other software for managing Connecticut certificate liens?

Absolutely! airSlate SignNow offers integrations with various popular software platforms that can enhance your document management processes, including CRM systems and accounting software. By integrating these tools, you can streamline your workflow and manage Connecticut certificate lien documents more effectively. This facilitates better communication and collaboration within your team.

-

Is it easy to eSign Connecticut certificate lien documents using airSlate SignNow?

Yes, eSigning Connecticut certificate lien documents with airSlate SignNow is straightforward and user-friendly. The platform allows you and your clients to sign documents digitally from any device, saving time and ensuring convenience. This feature is crucial for quick turnaround times when dealing with lien-related paperwork.

Get more for Connecticut Certificate Lien

Find out other Connecticut Certificate Lien

- Electronic signature California Finance & Tax Accounting Warranty Deed Fast

- Can I Electronic signature Georgia Education Quitclaim Deed

- Electronic signature California Finance & Tax Accounting LLC Operating Agreement Now

- Electronic signature Connecticut Finance & Tax Accounting Executive Summary Template Myself

- Can I Electronic signature California Government Stock Certificate

- Electronic signature California Government POA Simple

- Electronic signature Illinois Education Business Plan Template Secure

- How Do I Electronic signature Colorado Government POA

- Electronic signature Government Word Illinois Now

- Can I Electronic signature Illinois Government Rental Lease Agreement

- Electronic signature Kentucky Government Promissory Note Template Fast

- Electronic signature Kansas Government Last Will And Testament Computer

- Help Me With Electronic signature Maine Government Limited Power Of Attorney

- How To Electronic signature Massachusetts Government Job Offer

- Electronic signature Michigan Government LLC Operating Agreement Online

- How To Electronic signature Minnesota Government Lease Agreement

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application