Transfer Property Form

What is the transfer property?

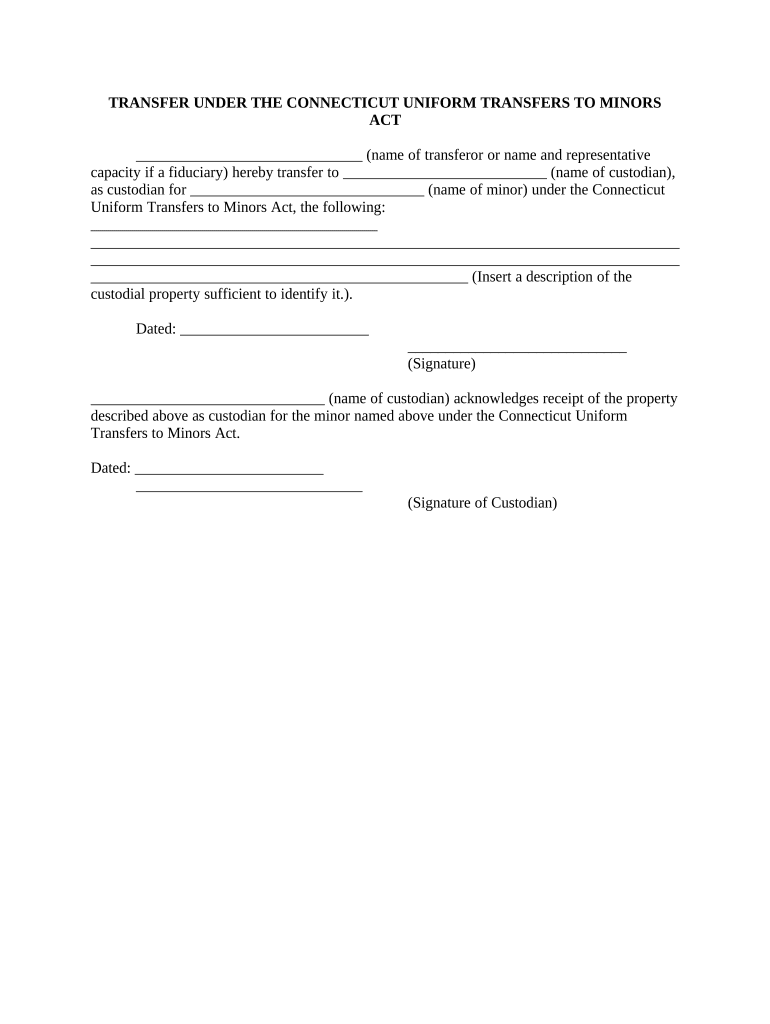

The transfer property is a legal document used in Connecticut to facilitate the transfer of real estate ownership from one party to another. This document serves as a formal declaration of the change in ownership and outlines the rights and responsibilities associated with the property. It is essential for ensuring that the transfer is recognized by local authorities and is legally binding.

In Connecticut, the transfer property form must include specific details such as the names of the grantor (the person transferring the property) and the grantee (the person receiving the property), a description of the property being transferred, and any relevant terms or conditions of the transfer. Properly completing this form is crucial for the legal validity of the transaction.

Steps to complete the transfer property

Completing the transfer property form involves several key steps to ensure accuracy and compliance with Connecticut laws. Here are the essential steps:

- Gather necessary information about the property, including its legal description and any existing liens or encumbrances.

- Obtain the full names and addresses of both the grantor and grantee.

- Fill out the transfer property form, ensuring that all required fields are completed accurately.

- Review the form for any errors or omissions before signing.

- Sign the document in the presence of a notary public to ensure its legal validity.

- Submit the completed form to the appropriate local government office, such as the town clerk's office, for recording.

Legal use of the transfer property

The legal use of the transfer property form is essential for ensuring that the transfer of real estate is recognized by the state of Connecticut. This document must adhere to state laws governing property transfers, including compliance with the Connecticut General Statutes. The form serves as proof of ownership transfer and is critical for protecting the rights of both the grantor and the grantee.

Additionally, the transfer property form may be subject to specific local regulations, so it is important for individuals to familiarize themselves with any additional requirements that may apply in their municipality. Failing to comply with legal standards can result in disputes over property ownership and potential financial liabilities.

Key elements of the transfer property

Understanding the key elements of the transfer property form is vital for anyone involved in a real estate transaction in Connecticut. The essential components include:

- Grantor Information: Full name and address of the current property owner.

- Grantee Information: Full name and address of the new property owner.

- Property Description: A detailed legal description of the property being transferred, including any parcel numbers.

- Consideration: The amount of money or other value exchanged for the property.

- Signatures: Signatures of both the grantor and grantee, along with a notary public seal.

Required documents

When completing the transfer property form, several documents may be required to support the transaction. These documents typically include:

- Current Deed: The existing deed for the property, which provides proof of ownership.

- Identification: Valid identification for both the grantor and grantee, such as a driver's license or passport.

- Title Search Results: Documentation showing the results of a title search to confirm there are no outstanding liens or claims against the property.

- Tax Information: Any relevant tax documents, including proof of payment for property taxes.

Form submission methods

In Connecticut, the transfer property form can be submitted through various methods, ensuring flexibility for individuals involved in property transactions. The primary submission methods include:

- Online Submission: Some municipalities may offer online services for submitting property transfer forms, streamlining the process.

- Mail: The completed form can be mailed to the appropriate local government office for recording.

- In-Person: Individuals can also submit the form in person at the local town clerk's office, allowing for immediate verification and processing.

Quick guide on how to complete transfer property

Complete Transfer Property effortlessly on any device

Managing documents online has gained traction among businesses and individuals alike. It offers an excellent sustainable alternative to traditional printed and signed paperwork, allowing you to access the necessary form and securely save it online. airSlate SignNow provides all the tools required to generate, modify, and electronically sign your documents swiftly without any hold-ups. Handle Transfer Property on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

The simplest method to modify and electronically sign Transfer Property with ease

- Find Transfer Property and select Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize key sections of your documents or black out sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your electronic signature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Decide how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate the concerns of lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow caters to all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Transfer Property and maintain outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process of ct transfer property using airSlate SignNow?

The ct transfer property process with airSlate SignNow is streamlined and straightforward. Users can easily upload their property transfer documents, eSign them, and send them to the parties involved. Our user-friendly interface ensures that even those unfamiliar with technology can manage the process effortlessly.

-

How does airSlate SignNow ensure the security of ct transfer property documents?

Security is a top priority at airSlate SignNow. We use advanced encryption methods and secure servers to ensure that all ct transfer property documents are protected. Our compliance with industry standards provides peace of mind for users sending sensitive information.

-

Are there any costs associated with using airSlate SignNow for ct transfer property?

Yes, airSlate SignNow offers various pricing plans tailored to different needs, including options for individuals and businesses. Our rates are competitive, providing value for those managing ct transfer property documents, with the cost often being lower than traditional methods. You can choose a plan based on your signing volume and features required.

-

What features does airSlate SignNow offer for ct transfer property?

AirSlate SignNow includes features such as customizable templates, in-app messaging, and status tracking to enhance your ct transfer property experience. Additionally, the platform allows for easy integration with other tools you use, making document handling even more efficient.

-

Can I use airSlate SignNow to manage multiple ct transfer property documents at once?

Absolutely! airSlate SignNow enables you to manage and send multiple ct transfer property documents simultaneously. This feature saves time and ensures that all related documents are handled efficiently, allowing for a smoother workflow.

-

What are the benefits of using airSlate SignNow for ct transfer property?

Using airSlate SignNow for ct transfer property offers signNow benefits, including time savings and increased productivity. The platform eliminates the need for printing and mailing, allowing users to complete transactions quickly and efficiently while also reducing costs associated with traditional methods.

-

Is it possible to integrate airSlate SignNow with other applications for ct transfer property?

Yes, airSlate SignNow allows seamless integration with various applications and platforms, which is particularly beneficial when managing ct transfer property documents. This capability helps streamline your operations, making it easier to connect with CRM software, document management systems, and more.

Get more for Transfer Property

Find out other Transfer Property

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online