Ct Mortgage Deed Form

What is the Connecticut Mortgage Deed?

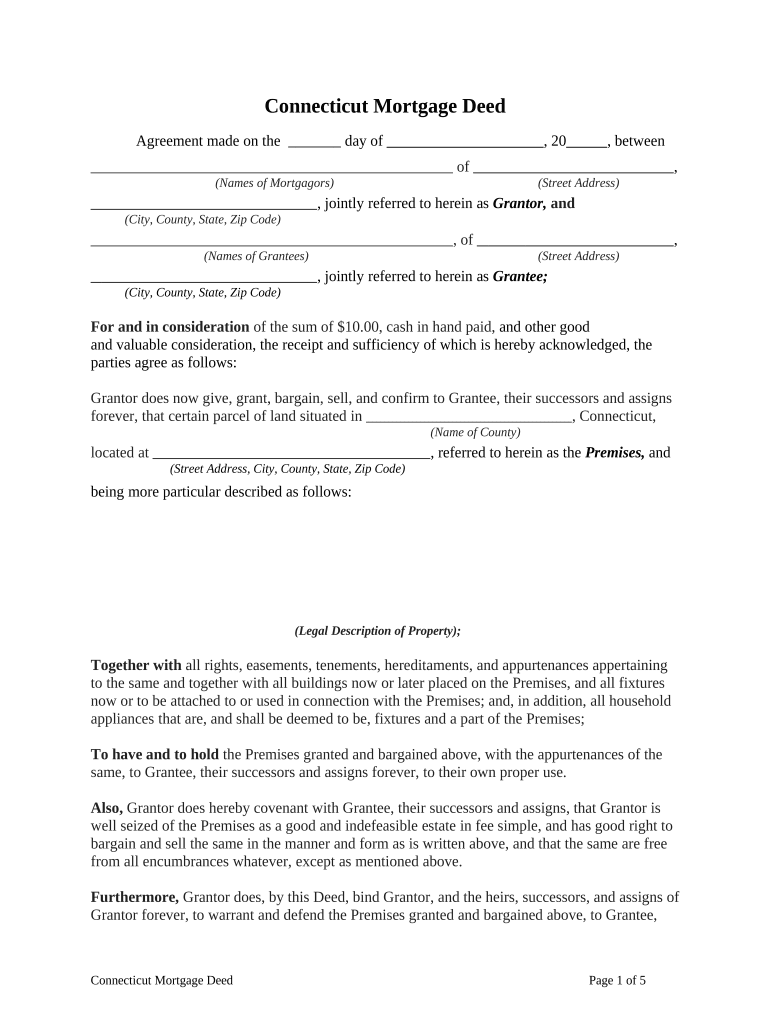

The Connecticut mortgage deed is a legal document used to secure a loan by placing a lien on real property. This form serves as evidence of the borrower's obligation to repay the loan and outlines the rights of both the lender and the borrower. The mortgage deed includes essential details such as the names of the parties involved, a description of the property, and the terms of the loan. It is a crucial element in real estate transactions in Connecticut, ensuring that lenders have a legal claim to the property should the borrower default on the loan.

Steps to Complete the Connecticut Mortgage Deed

Completing the Connecticut mortgage deed involves several important steps. First, gather all necessary information, including the property description, loan amount, and the names of all parties involved. Next, accurately fill out the form, ensuring that all details are correct and complete. After filling out the form, both the borrower and lender must sign the document in the presence of a notary public. Finally, the completed deed must be recorded with the local town clerk's office to ensure its legality and enforceability.

Key Elements of the Connecticut Mortgage Deed

The Connecticut mortgage deed contains several key elements that are essential for its validity. These include:

- Parties Involved: Names and addresses of the borrower and lender.

- Property Description: A detailed description of the property being mortgaged, including its address and legal description.

- Loan Amount: The total amount of the loan being secured by the mortgage deed.

- Terms of the Loan: Information regarding interest rates, payment schedules, and any conditions or covenants.

- Signatures: Signatures of both parties, along with a notary acknowledgment.

Legal Use of the Connecticut Mortgage Deed

The Connecticut mortgage deed is legally binding once it is properly executed and recorded. It serves to protect the lender's interests by establishing a lien on the property. In the event of default, the lender has the right to initiate foreclosure proceedings to recover the outstanding loan amount. Compliance with state laws and regulations regarding mortgage deeds is essential to ensure that the document is enforceable in court.

Form Submission Methods for the Connecticut Mortgage Deed

Submitting the Connecticut mortgage deed can be done through various methods. The most common method is to record the deed in person at the local town clerk's office. Alternatively, some jurisdictions may allow for submission via mail. It is important to check with the local clerk's office for specific submission guidelines and any associated fees. Additionally, electronic recording may be available in some areas, providing a convenient option for submitting the mortgage deed digitally.

State-Specific Rules for the Connecticut Mortgage Deed

Connecticut has specific rules governing the execution and recording of mortgage deeds. These rules include requirements for notarization, the necessity of providing a legal description of the property, and adherence to state laws regarding interest rates and loan terms. Understanding these regulations is crucial for ensuring that the mortgage deed is valid and enforceable. Failure to comply with state-specific rules may result in delays or complications in the mortgage process.

Quick guide on how to complete ct mortgage deed

Effortlessly Prepare Ct Mortgage Deed on Any Device

Digital document management has gained popularity among businesses and individuals alike. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow provides you with all the tools needed to create, edit, and electronically sign your documents swiftly without delays. Handle Ct Mortgage Deed on any device using the airSlate SignNow apps for Android or iOS and enhance your document-related processes today.

How to Edit and eSign Ct Mortgage Deed with Ease

- Locate Ct Mortgage Deed and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or conceal sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Generate your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select your preferred method to deliver your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Edit and eSign Ct Mortgage Deed to ensure outstanding communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a mortgage deed form?

A mortgage deed form is a legal document that outlines the terms of loan agreements secured against real property. This form is essential for establishing a lien on the property, allowing lenders to reclaim the property if the borrower defaults. Understanding this document is crucial for both lenders and borrowers in the mortgage process.

-

How can airSlate SignNow help with mortgage deed forms?

airSlate SignNow provides an efficient platform to create, send, and eSign mortgage deed forms securely. The user-friendly interface allows you to customize templates and streamline the signing process, making it simple and quick for all parties involved. Plus, you can track document status in real time.

-

Is airSlate SignNow cost-effective for managing mortgage deed forms?

Yes, airSlate SignNow offers a cost-effective solution for managing mortgage deed forms. With various pricing plans available, businesses can choose an option that best fits their needs without compromising on features. This affordability helps streamline operations while staying within budget.

-

What features does airSlate SignNow offer for mortgage deed forms?

airSlate SignNow includes multiple features for managing mortgage deed forms, like customizable templates, real-time tracking, secure storage, and automated reminders. These tools enhance efficiency and reduce errors in the document signing process. Additionally, you can easily collaborate with multiple parties.

-

Are there any integrations available for mortgage deed forms with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with various applications, enhancing the management of mortgage deed forms. You can link it with CRMs, cloud storage services, and productivity apps to streamline workflows. This integration ensures that your documents are easily accessible and manageable across platforms.

-

Can I customize my mortgage deed forms using airSlate SignNow?

Absolutely! airSlate SignNow allows you to customize your mortgage deed forms according to specific requirements. You can add logos, adjust fields, and modify text to meet legal standards and personal preferences. Customization tools ensure your forms are compliant and professional.

-

What security measures does airSlate SignNow employ for mortgage deed forms?

Security is a priority for airSlate SignNow when it comes to mortgage deed forms. The platform employs advanced encryption to protect sensitive information and ensures compliance with industry standards. Features like secure sign-on and audit trails provide additional layers of protection.

Get more for Ct Mortgage Deed

Find out other Ct Mortgage Deed

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed

- How To eSign South Dakota Plumbing Affidavit Of Heirship