Credit Card Info Sheet PDF Form

What is the credit card information sheet?

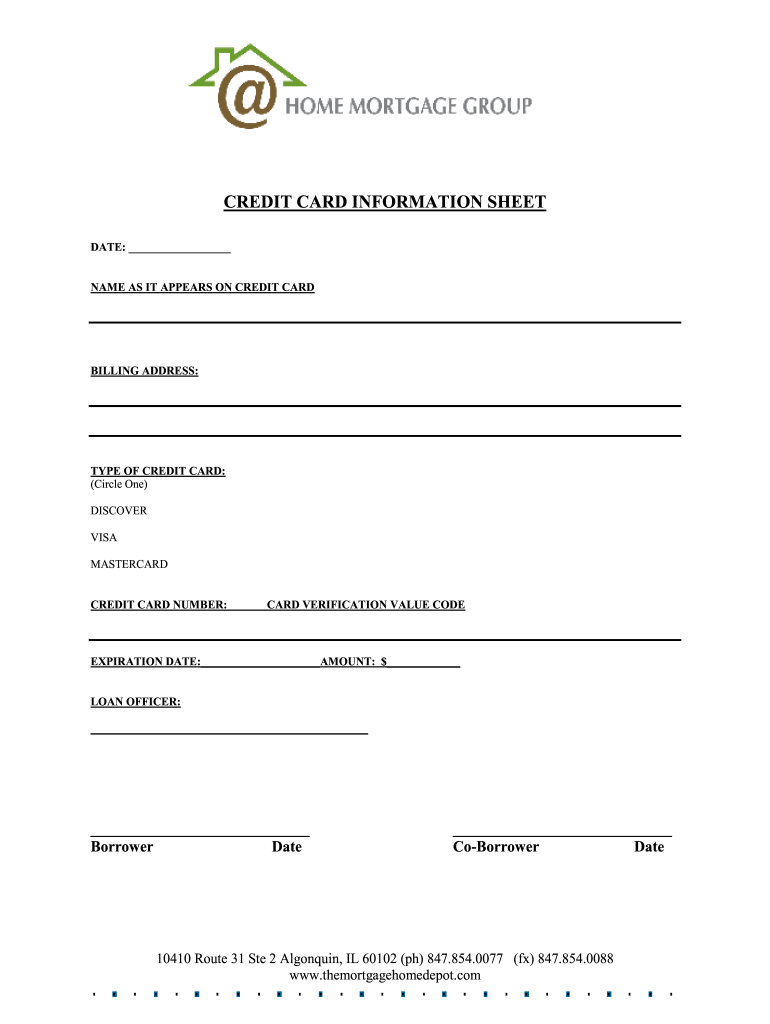

The credit card information sheet is a document that collects essential details regarding a credit card. This form typically includes fields for the cardholder's name, card number, expiration date, security code, and billing address. It serves various purposes, such as facilitating transactions, maintaining records, or authorizing payments. Understanding this document is crucial for both individuals and businesses that handle credit card transactions.

Key elements of the credit card information sheet

A well-structured credit card information sheet contains several key elements that ensure clarity and security. These elements include:

- Cardholder Name: The name of the individual or entity that owns the credit card.

- Card Number: The unique number assigned to the credit card, typically 16 digits.

- Expiration Date: The date when the card is no longer valid, usually formatted as month/year.

- Security Code: A three or four-digit code found on the back of the card, used for verification.

- Billing Address: The address associated with the credit card account, which may be required for verification during transactions.

Steps to complete the credit card information sheet

Completing a credit card information sheet involves several straightforward steps to ensure accuracy and security:

- Gather all relevant credit card details, including the card number, expiration date, and security code.

- Fill in the cardholder's name and billing address accurately.

- Review the information entered to ensure there are no errors.

- Submit the completed form securely, ensuring that it is sent through a safe digital platform.

Legal use of the credit card information sheet

The legal use of a credit card information sheet is governed by various regulations to protect consumers and businesses. It is essential to handle this document with care, ensuring compliance with laws such as the Fair Credit Reporting Act (FCRA) and the Payment Card Industry Data Security Standard (PCI DSS). These regulations mandate secure handling and storage of credit card information to prevent fraud and identity theft.

Examples of using the credit card information sheet

The credit card information sheet can be utilized in various scenarios, such as:

- Online purchases where payment authorization is required.

- Recurring billing setups for subscription services.

- Business transactions that necessitate credit card details for invoicing.

These examples highlight the versatility of the credit card information sheet in both personal and business contexts.

Digital vs. paper version of the credit card information sheet

Both digital and paper versions of the credit card information sheet have their advantages. The digital version allows for easier storage, faster processing, and enhanced security features, such as encryption. In contrast, the paper version may be preferred in situations where digital access is limited or for those who are more comfortable with traditional methods. Regardless of the format, ensuring the security of the information is paramount.

Quick guide on how to complete credit card information sheet

The optimal method to obtain and sign Credit Card Info Sheet Pdf

Across the entirety of your enterprise, unproductive workflows regarding document authorization can consume a signNow amount of working hours. Executing documents such as Credit Card Info Sheet Pdf is an integral component of operations in every sector, which is why the effectiveness of each agreement’s lifecycle signNowly impacts the overall productivity of the organization. With airSlate SignNow, signing your Credit Card Info Sheet Pdf is as simple and quick as it gets. This platform offers you the latest version of nearly any document. Even better, you can sign it immediately without the requirement of installing external software on your computer or printing hard copies.

Steps to obtain and sign your Credit Card Info Sheet Pdf

- Browse our collection by category or use the search box to locate the document you require.

- Examine the document preview by clicking on Learn more to confirm it’s the correct one.

- Hit Get form to begin editing without delay.

- Fill out your document and enter any required details using the toolbar.

- Upon completion, click the Sign tool to sign your Credit Card Info Sheet Pdf.

- Select the signature method that suits you best: Draw, Generate initials, or upload an image of your handwritten signature.

- Press Done to conclude editing and proceed to document-sharing options as necessary.

With airSlate SignNow, you have everything you need to manage your documents effectively. You can find, complete, edit, and even send your Credit Card Info Sheet Pdf in one tab without any trouble. Enhance your workflows by utilizing a singular, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

What people skills should everyone know?

I googled it and I found the right answer for this. I read it enjoyed it and now would like to pass it for everyone. You must asking about skills that each human being should know and understand. Here is the that will help you doing things in right way-:Home and Personal Care Skills• How to use basic kitchen appliances• Wash/Dry clothes• Determine which clothes to take to the dry cleaners• Make a bed (with clean sheets)• Fold laundry• How to properly clean a toilet, shower, bathroom floor, etc.• How to unclog a toilet• Set an alarm and wake yourself up on time• Get rid of spiders and bugs (without help)Life-Management and Organization Skills• Create a budget• Keep your finances records organized• Organize all passwords, accounts and important documents in a safe place for reference• Use a credit card responsibly, avoiding debt• When/how to pay taxes• Time management• Keep a daily calendar• How to set up internet/cable• Calculate a tip• How to split a check amongst friends• Address an envelope• Write a check• Balance a checkbook• Pack smarter• Change the battery in a fire alarm• Back-up information on your computer and other devices• Manage/clean-up your social media accountsStudent-Specific Skills• Shop smarter for books• Keep track of your grades• Keep track of assignments due• Sign up/register for classes• Maintain healthy study habits• Contact professors for help• Navigate to classes• Discuss living guidelines with your roommate• Locate the student section of your university’s web site• Taking clear, readable notes• Essay writing• Create an outline• Public speaking• Seek out extracurricular activities you enjoy• Create a schedule that works for you• Maintain a healthy balance between your academic and social livesProfessional Skills• Write a resume• Draft a cover letter• Professionally formatting your emails• Write thank you notes• NetworkTransportation Savvy• Read a map• Fill up a car with gas• Change a tire• Hail a taxi• Bike maintenance• Utilize and navigate public transitGeneral Conscientiousness• Awareness of your surroundings• Recognizing a potentially dangerous situation• Have personal medical information and keep up with appointments• Emergency preparedness• Avoid drugs and alcohol• Be sexually responsible• How to say “no,” respectfully• How to ask for help• Be open-minded• Accept constructive criticismThe original article is here Basic Life Skills You Should KnowAnd you should try these articles too which are very inspiring and learn-able 11 Essential Skills You Should Know For Survival and this one too 40 Skills Every Adult Should Master - Daring to Live Fully

-

How are Square and Stripe able to accept payments on merchants' behalf without requiring them to hold their own merchant accounts with a banking/financial institution?

This answer still gets a lot of attention, so I want to point out that it was written in 2011. A lot has changed in the payments industry since then.Square is what is known as an "aggregator", meaning they are the Merchant of Record (MOR) for the transactions they process. They are essentially allowing their customers to use their merchant account for the purposes of collecting credit card payments. PayPal employs essentially the same model.Stripe may also be acting as an aggregator, but appear to be going about it in a different way. Their terms of service state "Stripe may use your information to apply for card merchant acquiring accounts on your behalf…" (https://stripe.com/terms). Also, Ross Boucher from Stripe has said "Stripe is not the merchant of record" in For payment processing, how do Stripe and Samurai (FeeFighters) compare?.As the original question points out, the advantage to the above payment models is the somewhat faster sign-up process. Merchants can begin accepting credit cards right after they fill out the form. The downside for payments companies like Square, PayPal and presumably Stripe (and others who would embrace the aggregator model) is that they take on substantial risk from their merchants, which creates some side effects. In particular, they wind up with an unusually high burden of loss prevention.Due to the lightweight due diligence that facilitated the abbreviated sign-up process, the aggregator fundamentally knows less about the merchants they are working with, but they have a strong financial incentive to err on the side of their own safety. So if the aggregator sees something that they think could present an increased risk to them (e.g. a change in the merchant’s business model, larger than expected transactions, higher than expected sales volumes, international sales, or chargebacks) they may be compelled to immediately mitigate the risk by changing conditions for the merchant. This can put the aggregator in an adversarial relationship with the merchant, as they put into place reserves or limits, withhold payout, or even shut down a merchant’s ability to collect payments, all without negotiation or warning.PayPal has earned a particularly negative reputation in this regard - try googling for "PayPal shut me down" or "PayPal steals Christmas". To be clear, I have not heard any stories of Square or Stripe behaving in this manner toward merchants, I'm just pointing out that their model appears to have the same incentives built-in as PayPal's.As the risk falls to the aggregator, to become one is a bit difficult. The banks are very careful about who they would work with in this type of model. They would probably look for a company with both risk management experience and a strong balance sheet (i.e. a lot of cash). For a startup, that would almost certainly mean backing from a major institutional investor. It's worth noting that PayPal, Square, and Stripe all had early backing from investors with deep pockets.The alternate approach is for a payment company to help merchants get their own merchant account, so they can be their own MOR. This is the approach that Braintree takes (DISCLOSURE: I work at Braintree). While this approach requires a little more effort from the merchant during the application process, it enables Braintree to have a much better understanding of our customers, which greatly reduces the chance that a merchant will encounter problems processing payments as their business grows.

-

How I can give virtual assistant money to fill orders? Should I give them my credit card informations?

There are a few ways to ask your VA to fill orders:With Amazon.com, you can create a business account that has capability to share payment methods with multiple accounts.For other online store that does not have business account, you might want to fill-in your credit card ahead of time, and you can use LastPass or Dashlane (password management software) to share your password with other your VA. Once your credit card is saved, user can only see the last 4 digits.Prepaid credit card, but watch out for those fees.Some companies allow you to purchase with line of credit, where they bill your company on monthly basis.

-

How do people steal identities using social security numbers and use them to obtain loans and creditcards? Why aren't they caught immediately?

I am actually not sure how it is that they don’t get caught once they use the card information, but I have a strong suspicion its because rarely does any authority actually search for them. Someone stole my debit card out of my purse and made 7 or 8 purchases, nearly all at places where there would be security video; when I reported it to my bank, the had me sign some forms stating I did not make the purchases, and then claimed they would do the investigating. I figured they worked with the FTC or something, but when I followed up, they had just put the money back in my account and had no further info. I was pretty sure I knew who took my card, and I wanted him arrested; I guess a couple hundred bucks wasn’t worth the work to them.Also, less than a year ago, my boyfriend noticed a bunch of small transactions followed by a few large purchases on his bank account. The thieves do a little trial and error with the information, by making small donations to charities (about $10) to see if the payment clears. Once they know the account is active, and the information is correct, they make online purchases. They didn’t buy gift certificates or account credits, they went shopping for shoes and electronics. Obviously these products would have needed an address to be delivered, but we couldn’t track anything down. His bank did the same as my bank, have him sign some paperwork and give him his money back.When I worked in collections, a debtors would call us claiming we stole their money, or they didn’t authorize the transaction, and they were irate. Usually they had simply forgotten they set up the payment, or didn’t know that the payment was processed under our company name instead of the creditor; these calls were easy to resolve because we could pull the recording of the conversation as well as provide details about the account with the creditor. However, there was a time when someone called in claiming we used their account information to order a pizza. I think they determined it was us because it was a new bank account, or the delivery address was within a 2 hour drive of our business (they lived on the Pacific coast, we are on the Atlantic). The customer had tracked down the address, not the police. We didn’t have any other customers saying their information was used fraudulently, and I was super strict in my department about shredding anything written down because it could be taken from the trash. The young lady was suspended and eventually fired, but there really was no proof she actually had taken or misused the information. It wasn’t my decision, but I don’t think she did it; after all, a recorded or live call could be listened to by any supervisor.I am really curious if the police, FTC, or FBI routinely investigate these situations. Perhaps they set a minimum dollar amount stolen before they get involved, or a certain number of claimants.

-

Is it possible to find out how my credit card information got stolen?

Yes,it is. I once had an issue when my credit card was tampered with. I was seeing debits.With the help of Gal Rimon ,I was able to get full control my credit card details. Feel free to contact him.

-

Why is Ikea requiring me to email them my credit card information in order to make a lousy appointment to see a kitchen planner? They’re requiring me to fill out forms, scan them, and email back.

The reason they are requiring your credit card information is because Ikea’s kitchen planning service isn’t free. In some cases, a portion of the planning and/or measuring fees may be reimbursed when you place your kitchen purchase, but the details may vary from store to store.

-

What step-by-step process should I follow to file a Canadian PR application without any external help from a consultant?

Let me start this answer by saying ‘External Consultant is not at all required to apply for Canada PR under Express Entry (Federal Skilled Workers Programme or Provincial Nominee Programme)’.Following are the steps to apply for Canada PR via Express Entry Programme. Steps for PNP are not included below.Step 1:Identify whether you are eligible for Canada PR or not. This can be checked via a free Comprehensive Ranking System (CRS) Tool available on the official website of the Canada Immigration website.Here is the link - Eligibility to apply as a Federal Skilled Worker (Express Entry)Step 2:Once you find yourself eligible for Express Entry Programme, check your comprehensive score (CRS) at the following linkComprehensive Ranking System (CRS) tool: skilled immigrants (Express Entry)Minimum CLB 7 is required to be eligible for Canada PR. i.e for IELTS, 6 in each module and for CELPIP, 7 in each module is required.However, make sure to put 8777 (Listening, Reading, Writing, Speaking) score while checking your CRS. If you are selecting CELPIP, put 9 each. I will explain the reason to this in the answer later.If your score is 440 or above, assuming that you have entered authentic information in the CRS free tool, you have high chances to immigrate to Canada under Express Entry Programme.Step 3:You need to get your credential documents assessed by an authorised and listed organisation. Following is the list of those organisations. Identify which one suits you the best. WES is highly recommended.Comparative Education Service HomepageICASEvaluations for Immigration (ECA) - World Education ServicesIQAS assessment for immigration purposesInternational Credential Evaluation Service (ICES)Before you decide to take up IELTS/CELPIP/TEF, kindly initiate the process for Education Credential Assessment (ECA) as collecting documents for this process is time-consuming. You will need transcripts for all degree certificates from your universities.If your spouse possesses an undergraduate or postgraduate degree, it is advisable to get his/her credentials assessed. This will give you additional points in CRS and will increase your chances of getting an invite (ITA) for permanent residency.Step 4:Appear for any linguistic skills such as IELTS, CELPIP or TEF.Step 5:Once you have your linguistic test results and ECA result, create an Express Entry Profile. Keep your degree certificates and transcripts handy while creating your EE Profile as exact start and end date of the course will be required.Below is the link where you can initiate creating your EE Profile.Create an account or sign inGo to the bottom of the page where you will see ‘Continue to GCKey’. Select this option and ‘Sign Up’ with the required information. There is no cost involved to create an EE Profile.Note that without Linguistic Test Results and Educational Credential Assessment (ECA) results, Express Entry Profile cannot be created.Step 6:Once you have created and submitted your Express Entry Profile with a score of 440 or above, kindly initiate arranging required documents for the invite. Arranging certain documents will be cumbersome and time-consuming, hence it is advisable (highly recommended) to arrange the majority of them prior to receiving ITA.Following is the list of documents required;Passport/Travel DocumentLanguage Test ResultsECA ResultProvincial Nomination (If you have one)Reference Letters for current and past employmentPolice Clearance Certificate/s (for all those countries where you have stayed more than 6 months)Proof of Funds/Proof of Means of Financial SupportMarriage CertificateBirth Certificate of ChildEducational Documents (Diplomas/Degrees)Photographs (Digital)Legal Name Change/Difference Affidavit (If the name differs in documents)Medical Exam Proof (It is advisable to go for medicals after you receive the invite)Translation of Documents (if the document is in a language other than English)Translator’s Affidavit (Only if #14 mentioned above is applicable)For all the above-listed documents, the requirements are clearly mentioned on the following link;Applications for permanent residence programs subject to the Express Entry completeness checkStep 7:Scan all the above documents at a proper resolution (legible) to a laptop or desktop. Make sure the format of all documents is PDF with size less than 4MB.Digital photographs (35mm x 45mm) should be of JPEG/JPG format with an ideal size of 240 KB, but not less than 60 KB.Step 8:Once you receive the ITA, login to your Express Entry Profile and Accept the invitation. Upon acceptance, you will be able to see different tabs, where you have to provide detailed information of all applicants (including spouse and minor).Fill out all the forms with accuracy and authentic information. Make sure, you do not change any detail in the application which was provided earlier in Express Entry Profile. If required, take expert advice.Step 9:Get your medical examination done from a Panel Physician only. Check the below link about the list of Panel Physicians.Panel PhysiciansCall the hospital and take the appoint for medical examination. Medical of spouse and child/children is also required. Ask the hospital about documents required for medicals.You will have received a PDF in your EE Profile mailbox upon receiving the invite, which is a confirmation of your ITA. Take that print along with 3 passport copies (each applicant) to the hospital. You should also have a credit card/debit card handy in case if you wish to pay by card.The hospital will provide you with a ‘Medical Information Sheet’ for each applicant, which is required to be uploaded in the PR application. Do not forget to ask the hospital about this, as it is a mandatory document. The hospital may provide you with test results copy - upload that too. The hospital might not provide you documents to you on the same day of examination. They will mail you in 2–3 days.Step 10:Start filling out the forms of the PR application. Once you fill out all the forms, click ‘Next’. this will take you to a page where you will find tabs to upload documents for each applicant in your profile.If you have multiple documents (e.g.: Reference Letters from different companies), merge them in a single PDF and upload. If required, create a ‘Table of Contents’ at the first page and include ‘Page Separators’. This is highly recommended, as you would not want to confuse the Case Officer.Upload all your documents in corresponding tabs. Check multiple times whether you have uploaded the right document or not. Furnishing incorrect document may result in delay or sometimes rejection.You will get an additional tab for uploading the ‘Letter of Explanation’. This is a letter where you can clarify about any document if required. For instance, if there is a gap in your employment, explain it in this letter with justification. Keep this letter very short and use concise language.Step 11:Once you have uploaded all the documents, press the ‘Continue’ button, where you will be guided to the Fees Payment Page. Agree to the terms and conditions and click ‘Transmit and Pay’. Enter your credit or debit card details and that’s it - Your application is submitted.Following are the fees to be paid to transmit your application;Permanent Resident Application Fees - 550 CAD (for each adult in the application)Right of Permanent Residence Fee (RPRF) - 490 CAD (for each adult in the application)Permanent Resident Application Fees for Child - 150 CAD (per child)Step 12:Sit back and relax. Do not think much about ‘When I will receive the PR?’ It may take 1 month or may take 6 months for receiving PR depending upon the case. However, login to your EE profile frequently to know at what stage are you in.There are certain stages involved after submitting the application and paying the fees, such as ;eAOR - electronic Acknowledgement of ReceiptMEP - Medicals PassedBG IP(1) - Background Check in Progress for the first timeBG NA - Background Check Not ApplicableBG IP(2) - Background Check in Progress for the second timePPR - Passport Request email - Ready for VisaOnce the PPR e-mail is received, you will be requested to send the passport to the nearest VFS. The passport will be stamped and a COPR letter will be provided confirming that you are a Permanent Resident of Canada.Voila! You are ready to fly to your dream country.Elaborated Step 2 :CLB 7 is required to be eligible for Express Entry; however, CLB 7 does not give you enough points to qualify for the invitation. For CRS 440 and above, one needs to have at least CLB 9, i.e. 8777 (Listening, Reading, Writing, Speaking) in IELTS General Training or 9 each in CELPIP-G. This will boost the CRS by 50 to 60 points.Important Note:I personally followed all the above steps to apply for Canada PR via Express Entry Programme (FSW) and did not contact any consultant. Majority of the consultants will charge hefty fees for this process and on top of it, they may commit a mistake while filing your application on your behalf. I strongly encourage you to apply by yourself.If your case is complicated and you need expert advice, contact only ICCRC or CRCIC approved consultants. You can find them over here https://iccrc-crcic.ca/If you want to increase your chances of getting ITA early, get CLB 9 or above in IELTS or above 9 each in CELPIP-G. This is the key to your high CRS. Higher the CRS, better the chances to be invited early. The second best option is PNP, which will give you 600 additional points.I wish you all the best for Canada PR Application.-Gaurang

Create this form in 5 minutes!

How to create an eSignature for the credit card information sheet

How to make an eSignature for your Credit Card Information Sheet online

How to make an electronic signature for the Credit Card Information Sheet in Google Chrome

How to make an electronic signature for putting it on the Credit Card Information Sheet in Gmail

How to make an eSignature for the Credit Card Information Sheet from your smartphone

How to generate an electronic signature for the Credit Card Information Sheet on iOS devices

How to create an eSignature for the Credit Card Information Sheet on Android OS

People also ask

-

What is a credit card sign out sheet template?

A credit card sign out sheet template is a document designed to track the distribution and return of company credit cards. It helps organizations maintain accountability and ensure that only authorized personnel have access to the cards. This template can be easily customized to meet specific business needs.

-

How can I create a credit card sign out sheet template using airSlate SignNow?

Creating a credit card sign out sheet template with airSlate SignNow is simple and efficient. Our platform allows users to easily design and customize their templates, incorporating fields for signatures and important information. You can start by uploading an existing document or using our pre-made templates.

-

Is the credit card sign out sheet template customizable?

Yes, the credit card sign out sheet template available on airSlate SignNow is fully customizable. You can modify the layout, add or remove fields, and incorporate your company’s branding to make the document fit your specific requirements. This flexibility ensures that the template meets your organization's needs.

-

What are the benefits of using a credit card sign out sheet template?

Using a credit card sign out sheet template streamlines the process of tracking credit card usage, improving accountability and security. It reduces the chances of misuse or loss of company cards while ensuring that all transactions are properly documented. Additionally, it saves time by providing a clear and organized format for record-keeping.

-

How does airSlate SignNow ensure the security of my credit card sign out sheet template?

airSlate SignNow prioritizes the security of your documents, including your credit card sign out sheet template. Our platform employs advanced encryption measures and secure access controls to protect sensitive information. You can also enable auditing features to monitor user activity and maintain compliance.

-

Can I integrate the credit card sign out sheet template with other software?

Yes, airSlate SignNow allows for seamless integrations with various business software, making your credit card sign out sheet template even more efficient. You can connect it to accounting systems, CRM platforms, or project management tools to ensure a unified workflow. This integration facilitates easier tracking and management of company expenditures.

-

What pricing options are available for the credit card sign out sheet template?

airSlate SignNow offers competitive pricing options based on your business's needs. You can choose from various plans that include access to the credit card sign out sheet template along with additional features. We provide flexible subscription options to accommodate businesses of all sizes.

Get more for Credit Card Info Sheet Pdf

- Divorce and dissolution certificatesvermont department of form

- Instructions for filers form

- There are three different ways to change a birth certificate in vermont form

- Vermont probate forms state specificus legal forms

- Worker adjustment and retraining notification new york form

- Interrogatories 4 sample interrogatories from plaintiff and form

- 7 do you have any information

- Fillable online physics okstate and oral physics okstate form

Find out other Credit Card Info Sheet Pdf

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template