Living Trust for Individual Who is Single, Divorced or Widow or Widower with No Children Delaware Form

What is the Living Trust for Individuals Who Are Single, Divorced, or Widowed with No Children in Delaware

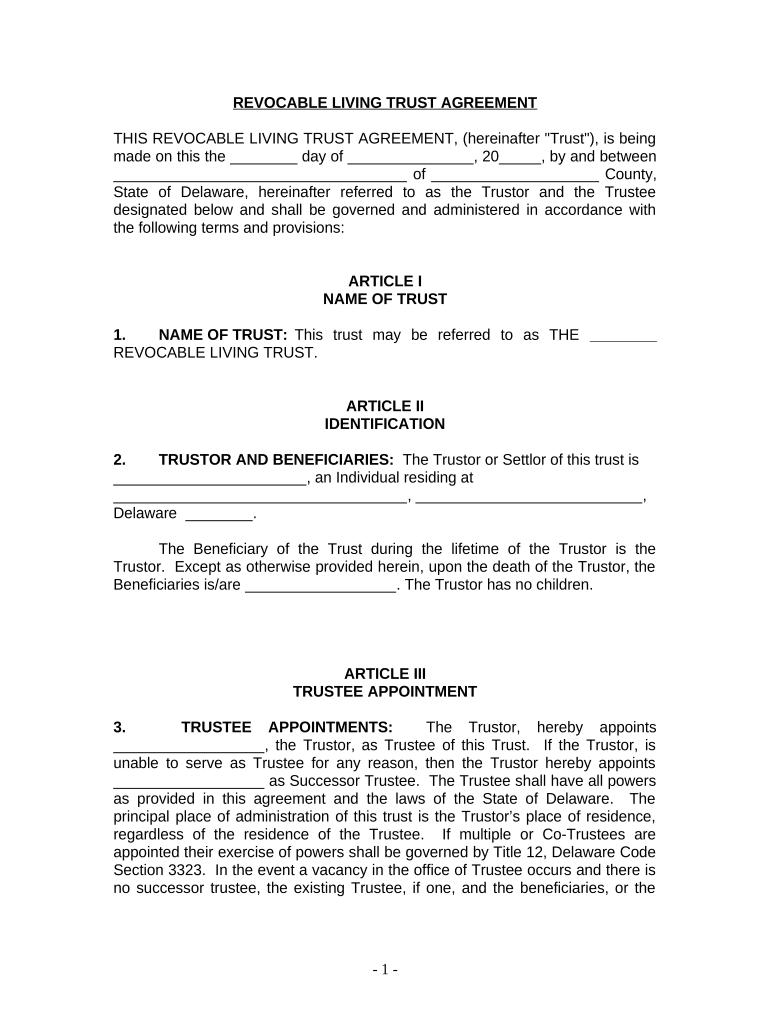

A living trust for individuals who are single, divorced, or widowed with no children in Delaware is a legal document that allows a person to manage their assets during their lifetime and specify how those assets will be distributed after their death. This type of trust is particularly useful for individuals without children, as it provides a clear plan for asset distribution, ensuring that their wishes are honored. The trust can be revocable, meaning the individual can alter or dissolve it at any time, or irrevocable, which offers certain tax benefits and asset protection.

How to Use the Living Trust for Individuals Who Are Single, Divorced, or Widowed with No Children in Delaware

Using a living trust involves several steps. First, the individual must decide which assets to include in the trust, such as real estate, bank accounts, and investments. Next, they will need to create the trust document, which outlines the terms of the trust, including the trustee's powers and the beneficiaries. After drafting the document, the individual must transfer the chosen assets into the trust, a process known as funding the trust. This ensures that the assets are managed according to the terms set forth in the trust document.

Steps to Complete the Living Trust for Individuals Who Are Single, Divorced, or Widowed with No Children in Delaware

Completing a living trust involves a systematic approach:

- Determine the assets to be included in the trust.

- Select a trustee, who will manage the trust assets.

- Draft the trust document, specifying the terms and conditions.

- Sign the document in the presence of a notary public to ensure its legal validity.

- Fund the trust by transferring ownership of the selected assets to the trust.

Legal Use of the Living Trust for Individuals Who Are Single, Divorced, or Widowed with No Children in Delaware

The legal use of a living trust in Delaware allows individuals to bypass probate, a lengthy court process required for asset distribution after death. By establishing a living trust, individuals can ensure a smoother transition of their assets to beneficiaries. Additionally, a living trust can provide privacy, as the terms of the trust do not become public record like a will does. It is important to comply with Delaware laws when creating the trust to ensure it is enforceable and meets all legal requirements.

Key Elements of the Living Trust for Individuals Who Are Single, Divorced, or Widowed with No Children in Delaware

Key elements of this living trust include:

- Trustee: The individual or institution responsible for managing the trust.

- Beneficiaries: Individuals or entities that will receive the assets from the trust.

- Trust document: The legal document outlining the terms of the trust.

- Funding: The process of transferring assets into the trust.

- Revocability: The ability to change or dissolve the trust during the grantor's lifetime.

State-Specific Rules for the Living Trust for Individuals Who Are Single, Divorced, or Widowed with No Children in Delaware

In Delaware, specific rules govern the creation and management of living trusts. These include requirements for the trust document, such as the need for the grantor's signature and notarization. Additionally, Delaware law allows for both revocable and irrevocable trusts, each with distinct benefits. Understanding these state-specific rules is crucial for ensuring that the trust is valid and meets the individual's needs.

Quick guide on how to complete living trust for individual who is single divorced or widow or widower with no children delaware

Complete Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children Delaware effortlessly on any device

Digital document management has gained popularity among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can easily find the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents promptly without delays. Manage Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children Delaware on any device using the airSlate SignNow Android or iOS applications and streamline any document-centric process today.

How to edit and eSign Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children Delaware with ease

- Find Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children Delaware and click on Get Form to begin.

- Make use of the tools we offer to fill out your document.

- Highlight pertinent sections of your documents or obscure sensitive information using tools that airSlate SignNow provides specifically for that function.

- Create your signature with the Sign tool, which takes just seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that necessitate printing additional document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Edit and eSign Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children Delaware and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust for an Individual Who Is Single, Divorced, or a Widow/Widower with No Children in Delaware?

A Living Trust for an Individual Who Is Single, Divorced, or a Widow/Widower with No Children in Delaware is a legal document that allows you to manage your assets during your lifetime and specify how they should be distributed after your passing. This estate planning tool provides flexibility and control, allowing you to avoid probate and ensure your wishes are honored.

-

How much does it cost to create a Living Trust in Delaware?

The cost of creating a Living Trust for an Individual Who Is Single, Divorced, or a Widow/Widower with No Children in Delaware can vary based on complexity and the provider you choose. Generally, attorney fees can range from a few hundred to several thousand dollars, while online services may offer more affordable options, often under a thousand dollars.

-

What are the benefits of setting up a Living Trust in Delaware?

Setting up a Living Trust for an Individual Who Is Single, Divorced, or a Widow/Widower with No Children in Delaware offers several benefits, including avoiding probate, maintaining privacy regarding your assets, and providing for the management of your assets should you become incapacitated. Moreover, this trust structure ensures that your estate planning is in alignment with your specific situation.

-

Can I manage my Living Trust without an attorney in Delaware?

Yes, you can manage your Living Trust for an Individual Who Is Single, Divorced, or a Widow/Widower with No Children in Delaware without an attorney, especially if you utilize online legal services that guide you through the process. However, consulting a professional can help ensure that all legal requirements are met and your trust is structured correctly.

-

What assets can be included in a Living Trust in Delaware?

You can include various assets in a Living Trust for an Individual Who Is Single, Divorced, or a Widow/Widower with No Children in Delaware, such as bank accounts, real estate, investments, and personal property. By transferring ownership of these assets to the trust, you can effectively manage how they will be distributed after your death.

-

How does a Living Trust differ from a Will in Delaware?

A Living Trust for an Individual Who Is Single, Divorced, or a Widow/Widower with No Children in Delaware differs from a Will primarily in that it takes effect immediately upon creation and avoids probate. A Will only comes into effect after your death and must go through the probate process, which can be lengthy and public.

-

Can I amend my Living Trust in Delaware?

Yes, you can amend your Living Trust for an Individual Who Is Single, Divorced, or a Widow/Widower with No Children in Delaware at any time while you are alive and of sound mind. This flexibility allows you to make changes to reflect new circumstances or wishes without needing to create a new trust.

Get more for Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children Delaware

- Printable high blood pressure log sheet form

- Employment verification release form

- Registration for water and sewer billing form

- Sample letter to judge for missing court date form

- Telefoonmemo word form

- Marriage hall project report ppt form

- Houston donation request form

- State of new hampshire 778 dhhs nh form

Find out other Living Trust For Individual Who Is Single, Divorced Or Widow Or Widower With No Children Delaware

- eSign Kentucky Healthcare / Medical Living Will Secure

- eSign Maine Government LLC Operating Agreement Fast

- eSign Kentucky Healthcare / Medical Last Will And Testament Free

- eSign Maine Healthcare / Medical LLC Operating Agreement Now

- eSign Louisiana High Tech LLC Operating Agreement Safe

- eSign Massachusetts Government Quitclaim Deed Fast

- How Do I eSign Massachusetts Government Arbitration Agreement

- eSign Maryland High Tech Claim Fast

- eSign Maine High Tech Affidavit Of Heirship Now

- eSign Michigan Government LLC Operating Agreement Online

- eSign Minnesota High Tech Rental Lease Agreement Myself

- eSign Minnesota High Tech Rental Lease Agreement Free

- eSign Michigan Healthcare / Medical Permission Slip Now

- eSign Montana High Tech Lease Agreement Online

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple