Assignment of Mortgage by Individual Mortgage Holder Florida Form

What is the assignment of mortgage by individual mortgage holder Florida?

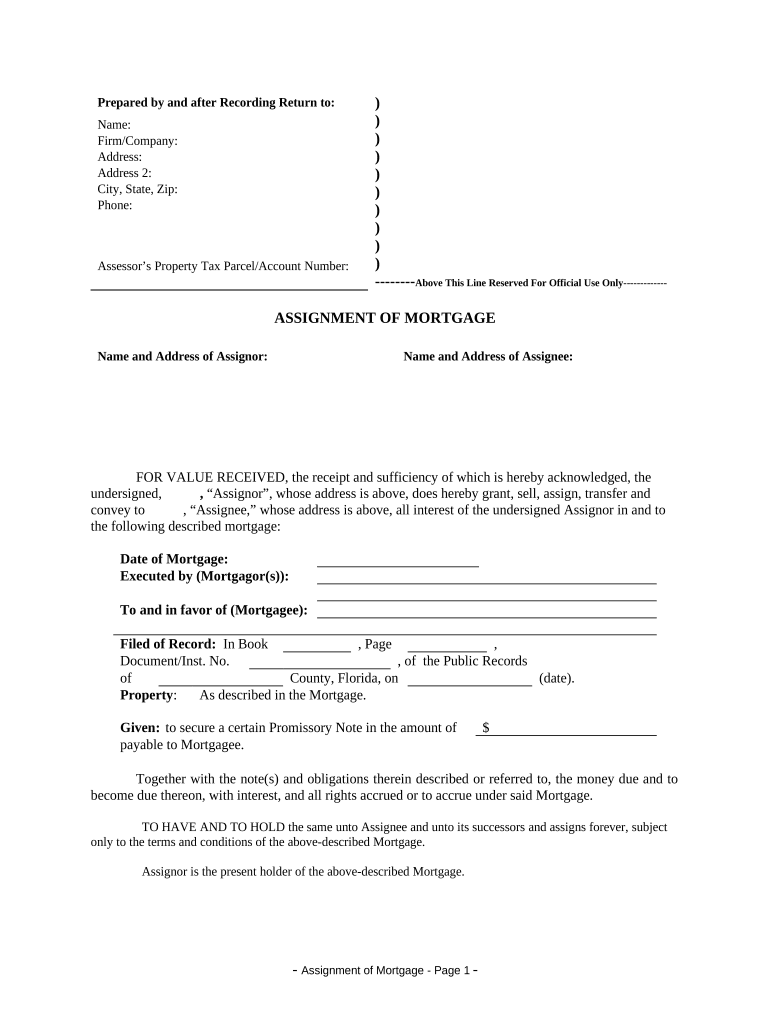

The assignment of mortgage by individual mortgage holder Florida is a legal document that transfers the rights and obligations of a mortgage from one party to another. This document is essential for ensuring that the new mortgage holder has the authority to collect payments and manage the mortgage. In Florida, this assignment must be executed according to state laws to be valid. The document typically includes details such as the names of the original and new mortgage holders, the property address, and the mortgage details, including the loan amount and terms.

Steps to complete the assignment of mortgage by individual mortgage holder Florida

Completing the assignment of mortgage by individual mortgage holder Florida involves several key steps:

- Gather necessary information: Collect all relevant details about the mortgage, including the loan number, property address, and the names of all parties involved.

- Draft the assignment document: Create the assignment of mortgage document, ensuring it includes all required information and complies with Florida state laws.

- Sign the document: Both the original mortgage holder and the new mortgage holder must sign the document. Electronic signatures are valid in Florida, provided they meet legal requirements.

- Notarize the document: Although not always required, having the document notarized can provide additional legal protection and credibility.

- Record the assignment: File the completed assignment with the county clerk’s office where the property is located to ensure it is publicly recorded.

Legal use of the assignment of mortgage by individual mortgage holder Florida

The legal use of the assignment of mortgage by individual mortgage holder Florida is governed by state law. This document is essential for the transfer of mortgage rights and must be executed properly to be enforceable. The assignment must clearly state the intent to transfer the mortgage, include the original mortgage details, and be signed by the parties involved. Failure to comply with legal requirements can result in disputes over mortgage payments and ownership rights.

Key elements of the assignment of mortgage by individual mortgage holder Florida

Several key elements must be included in the assignment of mortgage by individual mortgage holder Florida to ensure its validity:

- Parties involved: Clearly identify the original mortgage holder and the new mortgage holder.

- Property description: Provide a detailed description of the property associated with the mortgage.

- Mortgage details: Include the original loan amount, interest rate, and terms of the mortgage.

- Effective date: Specify the date on which the assignment takes effect.

- Signatures: Ensure that both parties sign the document, and consider notarization for added security.

State-specific rules for the assignment of mortgage by individual mortgage holder Florida

In Florida, specific rules govern the assignment of mortgage to ensure compliance with state laws. The assignment must be in writing and signed by the assignor (original mortgage holder). Additionally, Florida law requires that the assignment be recorded in the public records of the county where the property is located. This recording provides notice to third parties and protects the rights of the new mortgage holder. Failure to record the assignment may result in challenges to the enforceability of the mortgage.

How to obtain the assignment of mortgage by individual mortgage holder Florida

Obtaining the assignment of mortgage by individual mortgage holder Florida can be accomplished through several methods. Individuals can draft the document themselves using templates available online or seek assistance from a legal professional. It is crucial to ensure that the document meets all legal requirements outlined by Florida law. Once the assignment is completed, it must be signed, and if necessary, notarized before being recorded with the county clerk’s office. This process helps ensure that the assignment is legally binding and recognized.

Quick guide on how to complete assignment of mortgage by individual mortgage holder florida

Complete Assignment Of Mortgage By Individual Mortgage Holder Florida effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally-friendly alternative to traditional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents rapidly without delays. Manage Assignment Of Mortgage By Individual Mortgage Holder Florida on any system with airSlate SignNow's Android or iOS applications and enhance any document-based process today.

The easiest way to modify and eSign Assignment Of Mortgage By Individual Mortgage Holder Florida seamlessly

- Find Assignment Of Mortgage By Individual Mortgage Holder Florida and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or obscure sensitive details with tools offered by airSlate SignNow specifically designed for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose your preferred method to submit your form, via email, SMS, or invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Edit and eSign Assignment Of Mortgage By Individual Mortgage Holder Florida to guarantee exceptional communication at every phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an assignment of mortgage in Florida?

An assignment of mortgage in Florida is a legal document that transfers the rights and obligations of a mortgage from one lender to another. This process is crucial for maintaining accurate records of property ownership and loan obligations. By using airSlate SignNow, you can easily create and eSign assignments of mortgage in Florida, ensuring that all parties are legally compliant.

-

How can airSlate SignNow help with assignments of mortgage in Florida?

airSlate SignNow streamlines the process of creating and eSigning assignments of mortgage in Florida. Our platform offers templates, automated workflows, and secure storage, making it easy for you to manage your documents efficiently. With just a few clicks, you can complete the assignment, saving both time and resources.

-

Is there a cost associated with using airSlate SignNow for mortgage assignments?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Our cost-effective solutions allow you to eSign assignments of mortgage in Florida without breaking the bank. You can choose a plan that fits your volume of documents and administrative needs, ensuring great value for your investment.

-

Are there any features specifically beneficial for mortgage assignments?

Absolutely! airSlate SignNow provides features like custom workflows, real-time tracking, and secure document storage, all of which are valuable when handling assignments of mortgage in Florida. These features enhance collaboration and ensure that all parties are informed and updated throughout the signing process.

-

Can I integrate airSlate SignNow with my existing software for handling mortgages?

Yes, airSlate SignNow offers seamless integrations with popular CRM and document management systems, making it easy to manage assignments of mortgage in Florida alongside your existing software. By integrating, you can streamline your workflows and enhance efficiency across your operations.

-

What are the benefits of using eSigning for mortgage assignments?

Using eSigning for mortgage assignments in Florida can signNowly reduce processing times and increase compliance rates. airSlate SignNow ensures that all signatures are legally binding and securely stored, meaning less paperwork and more focus on closing deals. This digital approach speeds up transactions and improves customer satisfaction.

-

How secure is the process of eSigning an assignment of mortgage?

The security of your documents is our top priority at airSlate SignNow. Our platform employs industry-standard encryption and authentication methods to ensure that every assignment of mortgage in Florida is protected. You can trust that your sensitive information will be secure throughout the eSigning process.

Get more for Assignment Of Mortgage By Individual Mortgage Holder Florida

- Videography confirmation agreement work for hire pdf ppva form

- Tipers answer key form

- Dizziness handicap inventory printable form

- I a t s e annuity fund withdrawal form

- Sample letter requesting iep evaluation form

- Bmv 5721 form

- Lab equipment activity answer key part b form

- Warren township small claims court indy gov form

Find out other Assignment Of Mortgage By Individual Mortgage Holder Florida

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple