Fl Financing Statement Form

What is the Florida Financing Statement?

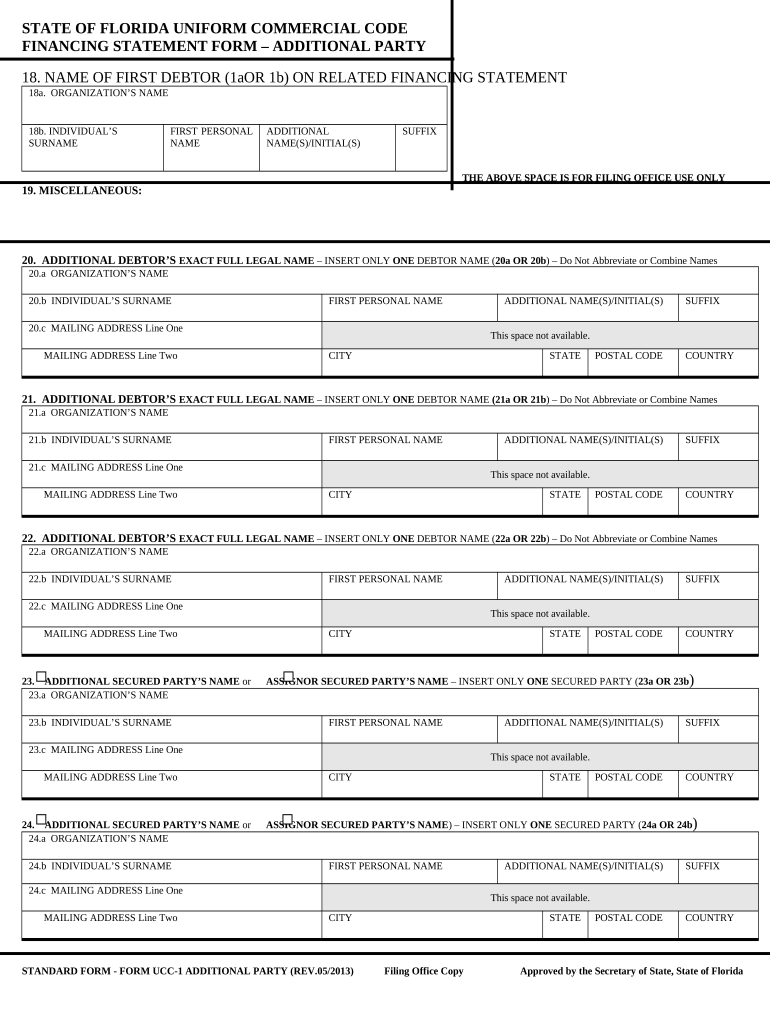

The Florida financing statement, often referred to as the FL UCC1, is a legal document used to secure interests in personal property. This form is essential for creditors to establish their rights to collateral in the event of a debtor's default. By filing this statement, a creditor provides public notice of their security interest, which can help protect their investment. The information contained in the FL financing statement includes the names of the debtor and creditor, a description of the collateral, and the filing details.

Steps to Complete the Florida Financing Statement

Completing the Florida financing statement involves several key steps to ensure accuracy and compliance. First, gather the necessary information, including the full legal names and addresses of both the debtor and creditor. Next, provide a detailed description of the collateral being secured. It's important to be as specific as possible to avoid any ambiguity. Once the form is filled out, review it for accuracy before submission. Finally, file the completed FL UCC1 with the appropriate state office, typically the Florida Department of State, Division of Corporations.

Legal Use of the Florida Financing Statement

The legal use of the Florida financing statement is governed by the Uniform Commercial Code (UCC), which provides a standardized framework for secured transactions across the United States. This document serves as a public record, establishing the priority of the creditor's claim over the collateral. To be legally binding, the statement must be properly completed and filed. Failure to do so may result in the loss of priority rights in the event of bankruptcy or liquidation of the debtor's assets.

Key Elements of the Florida Financing Statement

Understanding the key elements of the Florida financing statement is crucial for effective use. The form typically includes:

- Debtor Information: Full name and address of the debtor.

- Secured Party Information: Full name and address of the creditor.

- Collateral Description: A clear and specific description of the collateral securing the loan.

- Filing Information: Details on where and how the form is filed.

Accurate completion of these elements ensures that the financing statement is valid and enforceable.

How to Obtain the Florida Financing Statement

Obtaining the Florida financing statement is a straightforward process. The form is available online through the Florida Department of State's website or can be acquired from local government offices. It is essential to ensure that you are using the most current version of the form to comply with legal requirements. Additionally, many legal and financial service providers offer templates and guidance for completing the FL UCC1, which can simplify the process.

Form Submission Methods

The Florida financing statement can be submitted through various methods, including online filing, mail, or in-person submission. Online filing is often the most efficient option, allowing for immediate processing and confirmation. If choosing to file by mail, ensure that the form is sent to the correct office and that sufficient postage is included. In-person filing may be available at designated state offices, providing an opportunity to ask questions and receive assistance directly.

Quick guide on how to complete fl financing statement

Complete Fl Financing Statement seamlessly on any device

Online document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed materials, allowing you to access the required form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly and efficiently. Handle Fl Financing Statement on any device with airSlate SignNow's Android or iOS applications and enhance any document-driven procedure today.

How to edit and eSign Fl Financing Statement effortlessly

- Locate Fl Financing Statement and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or obscure confidential information with tools specifically offered by airSlate SignNow for that purpose.

- Generate your eSignature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select how you wish to submit your form, whether by email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form navigation, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Edit and eSign Fl Financing Statement and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is an FL financing statement?

An FL financing statement is a legal document that a secured party files to perfect a security interest in collateral under Florida law. This statement is essential for businesses looking to secure loans, as it informs the public of the lender's interest in the collateral.

-

How does airSlate SignNow simplify filing FL financing statements?

airSlate SignNow streamlines the process of preparing and filing FL financing statements by providing a user-friendly interface that allows for easy document creation and electronic signing. This efficiency helps businesses save time and reduce errors, ensuring that their financing statements are filed correctly.

-

What are the pricing options for using airSlate SignNow for FL financing statements?

airSlate SignNow offers a range of pricing plans tailored to meet different business needs, including options particularly for those needing to file FL financing statements. By choosing the plan that suits your workflow, you can effectively manage document signing without overspending.

-

Are there any special features for handling FL financing statements with airSlate SignNow?

Yes, airSlate SignNow includes features that cater specifically to the needs of those filing FL financing statements. These features include templates, automated workflows for signing, and secure cloud storage to keep your documents organized and readily accessible.

-

What are the benefits of using airSlate SignNow for FL financing statements?

Using airSlate SignNow for FL financing statements offers numerous benefits, such as enhanced security, speed of transaction, and a signNow reduction in paper usage. With digital signing, your documents are processed faster, allowing you to focus on growing your business.

-

Can I integrate airSlate SignNow with other software for managing FL financing statements?

Absolutely! airSlate SignNow supports integrations with various business applications, allowing you to seamlessly manage FL financing statements alongside your other processes. This interoperability can greatly enhance your workflow efficiency.

-

Is it secure to sign FL financing statements using airSlate SignNow?

Yes, airSlate SignNow prioritizes security and complies with industry standards to ensure that your FL financing statements are signed safely. With features like encryption, secure data storage, and user authentication, you can trust that your sensitive documents are protected.

Get more for Fl Financing Statement

- Safety care training manual answers form

- Professionalism in the workplace worksheet form

- Landscape with flatiron pdf form

- Corrected claim form

- Reinforcement worksheet properties of water answer key form

- Oklahoma notary application online form

- United kingdom england banknote form

- Fillable online pension credit benefits claim form

Find out other Fl Financing Statement

- Electronic signature Vermont Insurance Arbitration Agreement Safe

- Electronic signature Massachusetts High Tech Quitclaim Deed Fast

- Electronic signature Vermont Insurance Limited Power Of Attorney Easy

- Electronic signature Washington Insurance Last Will And Testament Later

- Electronic signature Washington Insurance Last Will And Testament Secure

- Electronic signature Wyoming Insurance LLC Operating Agreement Computer

- How To Electronic signature Missouri High Tech Lease Termination Letter

- Electronic signature Montana High Tech Warranty Deed Mobile

- Electronic signature Florida Lawers Cease And Desist Letter Fast

- Electronic signature Lawers Form Idaho Fast

- Electronic signature Georgia Lawers Rental Lease Agreement Online

- How Do I Electronic signature Indiana Lawers Quitclaim Deed

- How To Electronic signature Maryland Lawers Month To Month Lease

- Electronic signature North Carolina High Tech IOU Fast

- How Do I Electronic signature Michigan Lawers Warranty Deed

- Help Me With Electronic signature Minnesota Lawers Moving Checklist

- Can I Electronic signature Michigan Lawers Last Will And Testament

- Electronic signature Minnesota Lawers Lease Termination Letter Free

- Electronic signature Michigan Lawers Stock Certificate Mobile

- How Can I Electronic signature Ohio High Tech Job Offer