Living Trust Property Record Hawaii Form

What is the Living Trust Property Record Hawaii

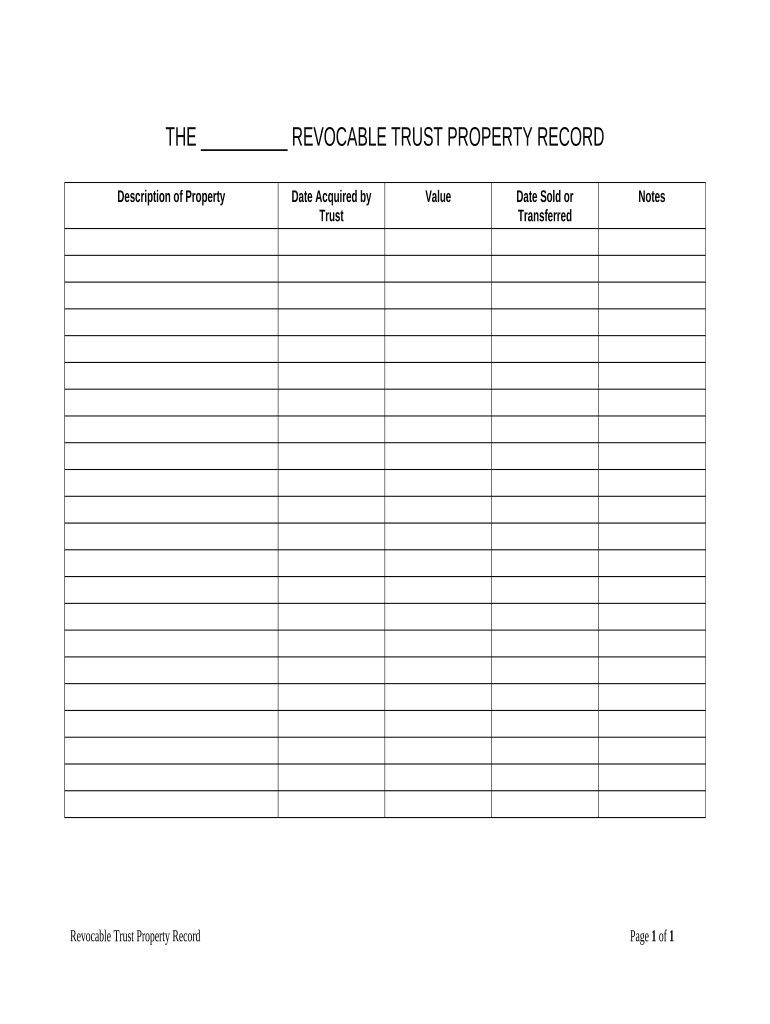

The Living Trust Property Record in Hawaii is a legal document that outlines the assets placed into a living trust. This record serves as a formal declaration of ownership and management of property during a person's lifetime and after their death. A living trust allows individuals to transfer their assets to a trust, which is managed by a trustee for the benefit of designated beneficiaries. This process helps avoid probate, ensuring a smoother transition of assets upon the grantor's passing.

How to use the Living Trust Property Record Hawaii

Using the Living Trust Property Record involves several steps. First, individuals must gather all relevant information about the assets they wish to include in the trust. This includes property deeds, bank account details, and any other pertinent financial documents. Next, the individual must complete the Living Trust Property Record form accurately, ensuring all information is correct and up-to-date. Once completed, the form should be signed in accordance with state laws to validate the trust. It is advisable to keep a copy of the record with other important documents for easy access.

Steps to complete the Living Trust Property Record Hawaii

Completing the Living Trust Property Record requires careful attention to detail. Here are the essential steps:

- Gather all necessary documents related to the assets being placed in the trust.

- Fill out the Living Trust Property Record form with accurate information.

- Ensure the form is signed by the grantor and any required witnesses.

- Store the completed form in a secure location, such as a safe or with a trusted attorney.

- Review the trust periodically to ensure it reflects any changes in assets or beneficiaries.

Legal use of the Living Trust Property Record Hawaii

The Living Trust Property Record is legally binding when executed correctly. To ensure its legal standing, it must comply with Hawaii state laws regarding living trusts. This includes proper signing, witnessing, and notarization, if required. The trust must also meet specific legal criteria, such as clearly defining the grantor, trustee, and beneficiaries. Legal use of this document helps protect the grantor's assets and ensures that their wishes are honored after their death.

State-specific rules for the Living Trust Property Record Hawaii

Hawaii has specific rules governing the creation and management of living trusts. These rules include requirements for the trust document to be in writing, the identification of the grantor and trustee, and the specification of beneficiaries. Additionally, Hawaii law mandates that the trust must be funded with assets to be effective. It is essential for individuals to be aware of these regulations to ensure their living trust is valid and enforceable in the state.

Required Documents

To complete the Living Trust Property Record in Hawaii, several documents are typically required:

- Property deeds for real estate assets.

- Bank statements for financial accounts.

- Titles for vehicles or other significant assets.

- Any existing wills or estate planning documents.

- Identification documents for the grantor and trustee.

Quick guide on how to complete living trust property record hawaii

Prepare Living Trust Property Record Hawaii effortlessly on any device

Online document management has become increasingly popular among businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and signed papers, as you can access the correct format and securely save it online. airSlate SignNow equips you with all the necessary tools to create, edit, and eSign your documents quickly and without delays. Manage Living Trust Property Record Hawaii on any device with the airSlate SignNow Android or iOS applications and streamline any document-related process today.

The easiest way to edit and eSign Living Trust Property Record Hawaii with ease

- Locate Living Trust Property Record Hawaii and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of your documents or redact sensitive information using the tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to send your form, either via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow takes care of all your document management needs in a few clicks from any device of your choosing. Edit and eSign Living Trust Property Record Hawaii and ensure outstanding communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Living Trust Property Record in Hawaii?

A Living Trust Property Record in Hawaii is a legal document that outlines the ownership and transfer of real estate assets held in a living trust. This document helps ensure a smooth transition of property to beneficiaries upon the trustor's passing. Understanding your Living Trust Property Record in Hawaii is essential for estate planning.

-

How can airSlate SignNow assist with Living Trust Property Records in Hawaii?

airSlate SignNow offers a user-friendly platform that allows you to easily create, send, and eSign Living Trust Property Records in Hawaii. Our features enhance efficiency and ensure all documents are legally binding. With our solution, handling your legal paperwork becomes a streamlined process.

-

What are the pricing options for using airSlate SignNow for Living Trust Property Records in Hawaii?

airSlate SignNow provides flexible pricing plans to accommodate various needs when dealing with Living Trust Property Records in Hawaii. You can choose from monthly or annual subscriptions depending on your usage and requirements. Our plans are cost-effective, ensuring value for businesses and individuals alike.

-

What features does airSlate SignNow offer for managing Living Trust Property Records in Hawaii?

Our platform includes features such as customizable templates, secure cloud storage, and real-time tracking to manage your Living Trust Property Records in Hawaii effectively. Additionally, electronic signatures are legally accepted, making it simple to finalize documentation. These features enhance productivity and compliance.

-

Can airSlate SignNow integrate with other tools for managing Living Trust Property Records in Hawaii?

Yes, airSlate SignNow seamlessly integrates with various applications, which allows for efficient management of Living Trust Property Records in Hawaii. This means you can connect with tools like Google Drive, Dropbox, and other popular platforms to streamline your document workflows. Integrations help centralize your document management.

-

What benefits come with using airSlate SignNow for Living Trust Property Records in Hawaii?

Using airSlate SignNow for Living Trust Property Records in Hawaii provides numerous benefits, including faster document turnaround, improved security through encryption, and reduced paper usage. Our platform is designed to simplify the legal documentation process, making your estate planning more efficient. Also, our user support is readily available to assist customers.

-

Is electronic signing valid for Living Trust Property Records in Hawaii?

Yes, electronic signatures are legally valid for Living Trust Property Records in Hawaii, thanks to the state's acceptance of eSignatures under the Uniform Electronic Transactions Act (UETA). Using airSlate SignNow, you can create legally binding documents with confidence. This makes it easier and faster to sign and execute important records.

Get more for Living Trust Property Record Hawaii

Find out other Living Trust Property Record Hawaii

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online

- eSign Alaska Legal Contract Safe

- How To eSign Alaska Legal Warranty Deed

- eSign Alaska Legal Cease And Desist Letter Simple

- eSign Arkansas Legal LLC Operating Agreement Simple

- eSign Alabama Life Sciences Residential Lease Agreement Fast

- How To eSign Arkansas Legal Residential Lease Agreement

- Help Me With eSign California Legal Promissory Note Template

- eSign Colorado Legal Operating Agreement Safe

- How To eSign Colorado Legal POA

- eSign Insurance Document New Jersey Online

- eSign Insurance Form New Jersey Online

- eSign Colorado Life Sciences LLC Operating Agreement Now

- eSign Hawaii Life Sciences Letter Of Intent Easy

- Help Me With eSign Hawaii Life Sciences Cease And Desist Letter

- eSign Hawaii Life Sciences Lease Termination Letter Mobile

- eSign Hawaii Life Sciences Permission Slip Free