Hawaii Installments Fixed Rate Promissory Note Secured by Residential Real Estate Hawaii Form

What is the Hawaii Installments Fixed Rate Promissory Note Secured By Residential Real Estate Hawaii

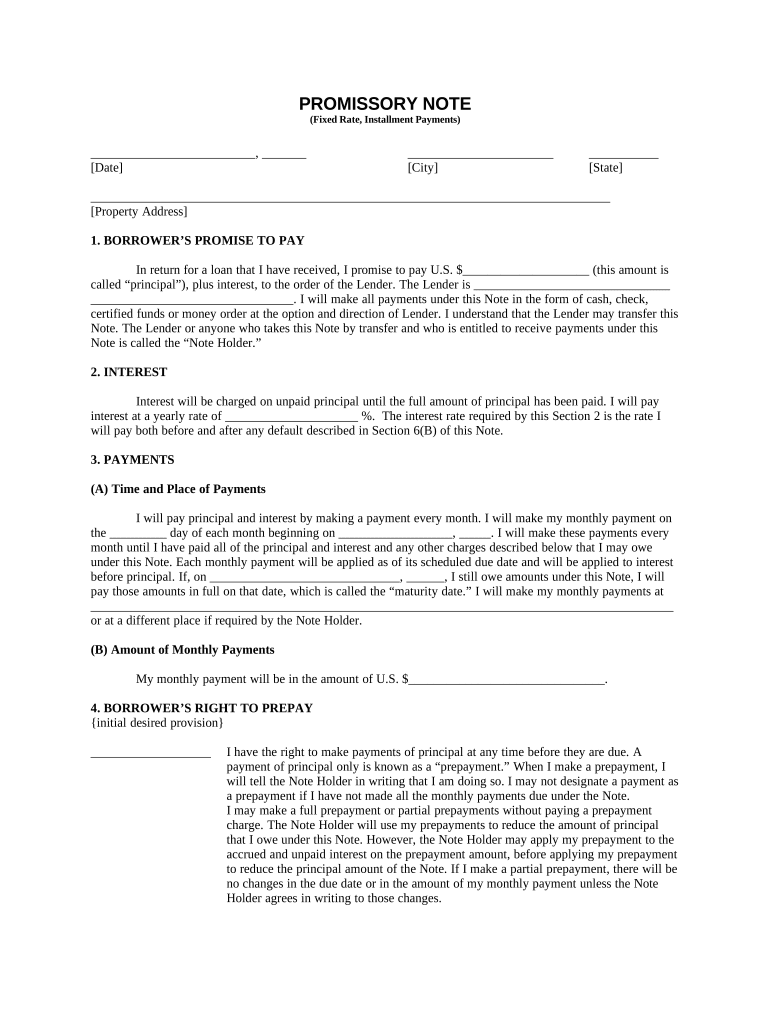

The Hawaii Installments Fixed Rate Promissory Note Secured By Residential Real Estate is a legal document that outlines a borrower's promise to repay a loan in fixed installments over a specified period. This note is secured by residential real estate, meaning the property serves as collateral for the loan. If the borrower fails to make payments, the lender has the right to take possession of the property through foreclosure. This document is essential for both lenders and borrowers as it establishes the terms of the loan, including interest rates, payment schedules, and consequences of default.

How to Use the Hawaii Installments Fixed Rate Promissory Note Secured By Residential Real Estate Hawaii

Using the Hawaii Installments Fixed Rate Promissory Note involves several steps. First, both parties must agree on the loan amount, interest rate, and repayment schedule. Once these terms are established, the borrower fills out the note, ensuring all required information is accurate. After completing the document, both parties must sign it, preferably in the presence of a witness or notary to enhance its legal standing. Utilizing electronic signature solutions can streamline this process, allowing for quick and secure signing from anywhere.

Steps to Complete the Hawaii Installments Fixed Rate Promissory Note Secured By Residential Real Estate Hawaii

Completing the Hawaii Installments Fixed Rate Promissory Note requires attention to detail. Follow these steps:

- Identify the parties involved: Clearly state the names and addresses of the borrower and lender.

- Specify the loan amount: Clearly indicate the total amount being borrowed.

- Set the interest rate: Determine and document the fixed interest rate applicable to the loan.

- Outline the repayment schedule: Include details on how often payments will be made and the duration of the loan.

- Include collateral details: Describe the residential real estate being used as security for the loan.

- Sign and date the document: Ensure both parties sign the note, with dates for clarity.

Legal Use of the Hawaii Installments Fixed Rate Promissory Note Secured By Residential Real Estate Hawaii

The legal use of the Hawaii Installments Fixed Rate Promissory Note is governed by state laws and regulations. It is crucial for both parties to understand their rights and obligations as outlined in the document. The note must comply with the Hawaii Uniform Commercial Code and other relevant statutes to be enforceable in a court of law. Proper execution, including signatures and any required notarization, is essential to uphold the document's legality.

Key Elements of the Hawaii Installments Fixed Rate Promissory Note Secured By Residential Real Estate Hawaii

Key elements of the Hawaii Installments Fixed Rate Promissory Note include:

- Loan amount: The total sum borrowed by the borrower.

- Interest rate: The fixed rate charged on the borrowed amount.

- Repayment terms: Details on the frequency and amount of payments due.

- Collateral description: Information about the residential real estate securing the loan.

- Default consequences: Stipulations outlining what happens if payments are missed.

State-Specific Rules for the Hawaii Installments Fixed Rate Promissory Note Secured By Residential Real Estate Hawaii

In Hawaii, specific rules govern the execution and enforcement of promissory notes. These include requirements for notarization and witness signatures, which can vary based on the loan amount. It is essential to ensure compliance with Hawaii's laws regarding interest rates, as usury laws may apply. Additionally, understanding the foreclosure process in Hawaii is vital for lenders, as it dictates how they can reclaim property in the event of default.

Quick guide on how to complete hawaii installments fixed rate promissory note secured by residential real estate hawaii

Easily Prepare Hawaii Installments Fixed Rate Promissory Note Secured By Residential Real Estate Hawaii on Any Device

Digital document management has become increasingly favored by businesses and individuals. It offers a superb eco-friendly substitute to traditional printed and signed documents, as you can access the right forms and securely store them online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage Hawaii Installments Fixed Rate Promissory Note Secured By Residential Real Estate Hawaii on any device with airSlate SignNow's Android or iOS applications and enhance any document-related workflow today.

How to Edit and eSign Hawaii Installments Fixed Rate Promissory Note Secured By Residential Real Estate Hawaii with Ease

- Obtain Hawaii Installments Fixed Rate Promissory Note Secured By Residential Real Estate Hawaii and click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Highlight important sections of the documents or conceal confidential information using tools specifically designed by airSlate SignNow for this purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to store your changes.

- Select your preferred method to send your form, whether by email, text message (SMS), or invite link, or download it directly to your computer.

Say goodbye to lost or misplaced files, tedious form searching, and mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Hawaii Installments Fixed Rate Promissory Note Secured By Residential Real Estate Hawaii and ensure effective communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Hawaii Installments Fixed Rate Promissory Note Secured By Residential Real Estate Hawaii?

A Hawaii Installments Fixed Rate Promissory Note Secured By Residential Real Estate Hawaii is a legal document that outlines a borrower's promise to pay a fixed interest rate over time, secured by residential property. This type of promissory note provides lenders with a reliable form of security, offering peace of mind through collateral. It is commonly used in real estate transactions in Hawaii.

-

What are the benefits of using a Hawaii Installments Fixed Rate Promissory Note?

The benefits of a Hawaii Installments Fixed Rate Promissory Note Secured By Residential Real Estate Hawaii include predictable payment schedules and fixed interest rates, making budgeting easier for borrowers. Lenders benefit from the security of having physical property collateral backing the loan. Additionally, this arrangement fosters a clear understanding of obligations for both parties.

-

How does the pricing work for the Hawaii Installments Fixed Rate Promissory Note?

Pricing for a Hawaii Installments Fixed Rate Promissory Note Secured By Residential Real Estate Hawaii typically involves an interest rate that is fixed over the life of the loan. This fixed rate alleviates the risks associated with fluctuating interest rates and assures borrowers of consistent payment amounts. Consult with your lender to ensure clarity on all associated costs.

-

Can I customize the terms of my Hawaii Installments Fixed Rate Promissory Note?

Yes, you can customize the terms of your Hawaii Installments Fixed Rate Promissory Note Secured By Residential Real Estate Hawaii to better fit your financial situation. This includes establishing the payment schedule, interest rate, and loan duration. However, all terms must comply with Hawaii's legal requirements, so it’s advisable to work with a knowledgeable legal or financial professional.

-

Are there any integrations available with eSigning a Hawaii Installments Fixed Rate Promissory Note?

Yes, airSlate SignNow offers seamless integrations that allow you to easily eSign a Hawaii Installments Fixed Rate Promissory Note Secured By Residential Real Estate Hawaii within your preferred document management systems. This feature streamlines the process, ensuring that all parties involved can sign and store documents digitally, reducing paperwork and saving time.

-

How do I ensure legality when using a Hawaii Installments Fixed Rate Promissory Note?

To ensure legality when using a Hawaii Installments Fixed Rate Promissory Note Secured By Residential Real Estate Hawaii, it is crucial to adhere to Hawaii's lending laws and regulations. Consider consulting with a real estate attorney to review your document and process. This will help you prevent any legal issues and ensure that the promissory note is enforceable in court if necessary.

-

What is the typical duration for a Hawaii Installments Fixed Rate Promissory Note?

The typical duration for a Hawaii Installments Fixed Rate Promissory Note Secured By Residential Real Estate Hawaii can range from a few years to several decades, depending on the agreement between the lender and borrower. Common terms include 10, 15, or 30 years, providing flexibility for borrowers to choose a timeframe that aligns with their financial goals. Discuss your options with your lender for the best fit.

Get more for Hawaii Installments Fixed Rate Promissory Note Secured By Residential Real Estate Hawaii

Find out other Hawaii Installments Fixed Rate Promissory Note Secured By Residential Real Estate Hawaii

- Help Me With Sign Tennessee Residential lease agreement

- Sign Vermont Residential lease agreement Safe

- Sign Rhode Island Residential lease agreement form Simple

- Can I Sign Pennsylvania Residential lease agreement form

- Can I Sign Wyoming Residential lease agreement form

- How Can I Sign Wyoming Room lease agreement

- Sign Michigan Standard rental agreement Online

- Sign Minnesota Standard residential lease agreement Simple

- How To Sign Minnesota Standard residential lease agreement

- Sign West Virginia Standard residential lease agreement Safe

- Sign Wyoming Standard residential lease agreement Online

- Sign Vermont Apartment lease contract Online

- Sign Rhode Island Tenant lease agreement Myself

- Sign Wyoming Tenant lease agreement Now

- Sign Florida Contract Safe

- Sign Nebraska Contract Safe

- How To Sign North Carolina Contract

- How Can I Sign Alabama Personal loan contract template

- Can I Sign Arizona Personal loan contract template

- How To Sign Arkansas Personal loan contract template