Warranty Deed from Husband and Wife to a Trust Illinois Form

What is the Warranty Deed From Husband And Wife To A Trust Illinois

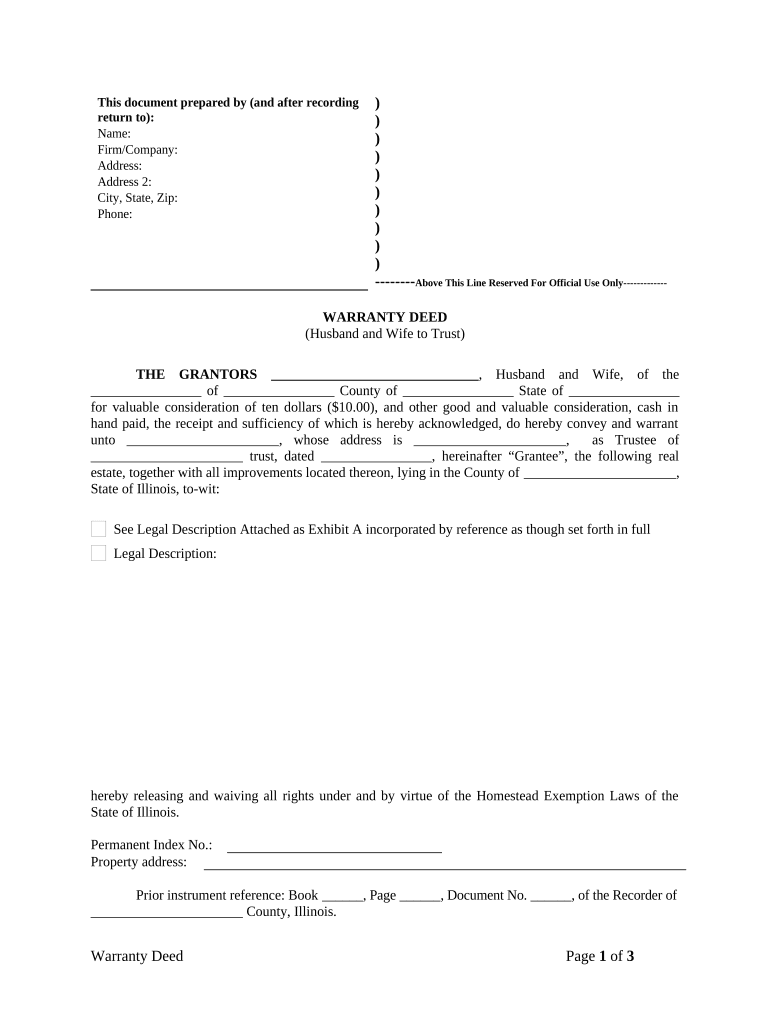

A warranty deed from husband and wife to a trust in Illinois is a legal document that transfers ownership of real property from a married couple to a trust. This type of deed provides a guarantee that the couple holds clear title to the property and has the right to transfer it. The trust then becomes the new owner, allowing for effective estate planning and asset management. This document is particularly useful for couples looking to protect their assets and ensure a smooth transition of property upon death or incapacity.

Key Elements of the Warranty Deed From Husband And Wife To A Trust Illinois

Several key elements must be included in a warranty deed from husband and wife to a trust in Illinois to ensure its validity:

- Names of the Grantors: The full legal names of both spouses must be included.

- Trust Information: The name of the trust and the trustee's details should be clearly stated.

- Property Description: A complete legal description of the property being transferred is necessary.

- Consideration: The deed should mention any consideration given for the transfer, even if it is nominal.

- Signatures: Both spouses must sign the document in the presence of a notary public.

- Notary Acknowledgment: A notary public must acknowledge the signatures to validate the deed.

Steps to Complete the Warranty Deed From Husband And Wife To A Trust Illinois

Completing a warranty deed from husband and wife to a trust in Illinois involves several steps:

- Gather necessary information about the property and the trust.

- Obtain a blank warranty deed form specific to Illinois.

- Fill out the form, ensuring all required details are accurately included.

- Both spouses must sign the document in the presence of a notary public.

- File the completed deed with the appropriate county recorder's office to make it a matter of public record.

How to Use the Warranty Deed From Husband And Wife To A Trust Illinois

Using a warranty deed from husband and wife to a trust in Illinois is straightforward. Once the deed is completed and signed, it should be filed with the county recorder's office where the property is located. This filing creates a public record of the transfer, which is essential for legal recognition. The trust now holds title to the property, allowing the trustee to manage it according to the terms of the trust agreement. This process helps in avoiding probate and can provide tax benefits.

State-Specific Rules for the Warranty Deed From Husband And Wife To A Trust Illinois

Illinois has specific rules governing warranty deeds, including requirements for execution and recording. The deed must be signed by both spouses and notarized. Additionally, Illinois law requires that the deed be recorded within a certain timeframe after execution to ensure its validity. Failure to comply with these rules may result in complications regarding the ownership of the property. It's important to consult with a legal professional to ensure compliance with all state regulations.

Legal Use of the Warranty Deed From Husband And Wife To A Trust Illinois

The warranty deed from husband and wife to a trust in Illinois is legally binding when executed correctly. It serves as a formal transfer of property ownership and provides legal protection for the trust. This deed can be used in various scenarios, such as estate planning, asset protection, and ensuring that property is managed according to the wishes of the grantors. It is advisable to keep a copy of the deed for personal records and to provide it to the trustee for their files.

Quick guide on how to complete warranty deed from husband and wife to a trust illinois

Complete Warranty Deed From Husband And Wife To A Trust Illinois effortlessly on any device

Managing documents online has gained popularity among companies and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow provides all the resources you require to create, adjust, and eSign your documents quickly without hindrance. Handle Warranty Deed From Husband And Wife To A Trust Illinois on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centered workflow today.

The easiest way to modify and eSign Warranty Deed From Husband And Wife To A Trust Illinois effortlessly

- Find Warranty Deed From Husband And Wife To A Trust Illinois and click on Get Form to begin.

- Utilize the features we provide to finish your document.

- Select key sections of the documents or redact sensitive information with tools that airSlate SignNow offers explicitly for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Choose your preferred method to share your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and eSign Warranty Deed From Husband And Wife To A Trust Illinois and ensure effective communication at every stage of your form preparation workflow with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Warranty Deed From Husband And Wife To A Trust in Illinois?

A Warranty Deed From Husband And Wife To A Trust in Illinois is a legal document that transfers property ownership from a married couple to a trust they establish. This deed guarantees that the couple holds clear title to the property, ensuring the trust operates smoothly for estate planning purposes. Utilizing this deed can help protect assets and simplify the transfer process in the event of death or incapacity.

-

How do I create a Warranty Deed From Husband And Wife To A Trust in Illinois?

To create a Warranty Deed From Husband And Wife To A Trust in Illinois, you will need to draft the document including specific details such as the parties involved, property description, and the name of the trust. It is advisable to consult with a legal professional to ensure compliance with Illinois laws and regulations. Once drafted, both spouses must sign and the deed should be filed with the county recorder's office.

-

What are the benefits of using a Warranty Deed From Husband And Wife To A Trust in Illinois?

The main benefits of using a Warranty Deed From Husband And Wife To A Trust in Illinois include asset protection, simplified estate administration, and potential tax advantages. This deed ensures that property is managed according to the trust's terms, safeguarding it from probate. It also allows for a smoother transition of assets to beneficiaries, aligning with your estate planning goals.

-

What is the cost of preparing a Warranty Deed From Husband And Wife To A Trust in Illinois?

The cost of preparing a Warranty Deed From Husband And Wife To A Trust in Illinois can vary depending on whether you hire an attorney or use an online service. On average, legal fees may range from $100 to $300, while online platforms may provide cost-effective options starting at around $50. Consider the value of professional guidance to ensure correctness and compliance.

-

Can I eSign a Warranty Deed From Husband And Wife To A Trust in Illinois?

Yes, you can eSign a Warranty Deed From Husband And Wife To A Trust in Illinois using platforms like airSlate SignNow. eSigning is legally recognized in Illinois, making the process convenient and efficient. Ensure that both parties' signatures are captured electronically before filing the deed with the county office.

-

Is a Warranty Deed From Husband And Wife To A Trust in Illinois revocable?

Yes, a Warranty Deed From Husband And Wife To A Trust in Illinois can be revocable, allowing the couples to change the terms of the trust or reclaim property if needed. When establishing the trust, it's crucial to outline whether the trust is revocable or irrefutable, as this affects how assets are managed and distributed. Consulting with a legal expert can offer clarity on the flexibility of your trust.

-

Are there any tax implications when transferring property with a Warranty Deed From Husband And Wife To A Trust in Illinois?

Transferring property with a Warranty Deed From Husband And Wife To A Trust in Illinois may have tax implications, including potential gift taxes if the property is valued above a certain threshold. However, many transfers into a revocable trust do not trigger immediate tax consequences. Consulting with a tax advisor can help clarify any responsibilities you may face during the transfer.

Get more for Warranty Deed From Husband And Wife To A Trust Illinois

Find out other Warranty Deed From Husband And Wife To A Trust Illinois

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document

- How Can I eSignature New Jersey Real Estate Word

- Can I eSignature Tennessee Police Form

- How Can I eSignature Vermont Police Presentation

- How Do I eSignature Pennsylvania Real Estate Document

- How Do I eSignature Texas Real Estate Document