Quitclaim Deed from Husband and Wife to LLC Illinois Form

What is the Quitclaim Deed From Husband And Wife To LLC Illinois

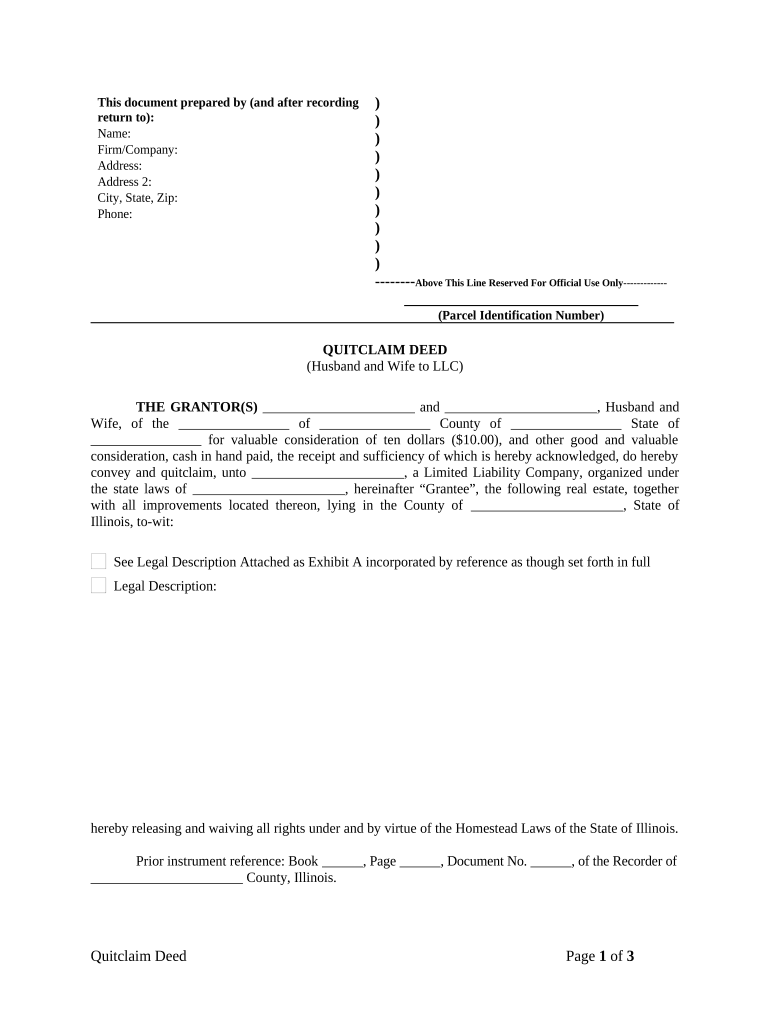

A quitclaim deed from husband and wife to an LLC in Illinois is a legal document that allows a married couple to transfer their ownership interest in a property to a limited liability company. This type of deed does not guarantee that the title is free of claims; it simply conveys whatever interest the couple holds in the property to the LLC. It is commonly used for estate planning, asset protection, or business purposes, allowing the couple to separate their personal assets from their business liabilities.

Steps to Complete the Quitclaim Deed From Husband And Wife To LLC Illinois

Completing a quitclaim deed involves several important steps:

- Identify the property: Clearly describe the property being transferred, including its legal description.

- Gather necessary information: Collect the names of the grantors (husband and wife) and the grantee (the LLC).

- Draft the deed: Prepare the quitclaim deed document, ensuring all required elements are included, such as the date and signatures.

- Sign the document: Both spouses must sign the deed in the presence of a notary public to ensure its validity.

- File the deed: Submit the completed quitclaim deed to the appropriate county recorder's office to make the transfer official.

Legal Use of the Quitclaim Deed From Husband And Wife To LLC Illinois

The quitclaim deed from husband and wife to an LLC is legally recognized in Illinois as a valid method for transferring property. However, it is crucial to ensure that the deed meets all state requirements, including proper notarization and filing. Using this deed can help protect personal assets from business liabilities, making it a popular choice for couples who own property and wish to operate a business through an LLC.

Key Elements of the Quitclaim Deed From Husband And Wife To LLC Illinois

When creating a quitclaim deed in Illinois, certain key elements must be included:

- Grantors' names: The full legal names of both spouses must be listed.

- Grantee's name: The name of the LLC receiving the property must be clearly stated.

- Property description: A detailed legal description of the property being transferred is necessary.

- Signatures: Both spouses must sign the document in front of a notary public.

- Date: The date of the transfer should be included to establish the timeline of ownership.

State-Specific Rules for the Quitclaim Deed From Husband And Wife To LLC Illinois

Illinois has specific regulations governing quitclaim deeds. These include requirements for notarization and recording the deed with the county recorder's office. Additionally, the deed must comply with Illinois law regarding property transfers, including any applicable tax implications. It is advisable to consult with a legal professional to ensure compliance with all state-specific rules when executing this type of deed.

How to Use the Quitclaim Deed From Husband And Wife To LLC Illinois

To effectively use a quitclaim deed from husband and wife to an LLC, the couple should follow the legal steps for preparation and execution. After drafting the deed and obtaining the necessary signatures, the couple should file the document with the county recorder's office. This process officially transfers ownership and ensures that the LLC is recognized as the new owner of the property. Proper use of this deed can help in asset management and liability protection.

Quick guide on how to complete quitclaim deed from husband and wife to llc illinois

Complete Quitclaim Deed From Husband And Wife To LLC Illinois effortlessly on any device

Digital document management has gained traction among organizations and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the tools necessary for creating, modifying, and electronically signing your documents quickly and without delays. Manage Quitclaim Deed From Husband And Wife To LLC Illinois on any platform with airSlate SignNow’s Android or iOS applications and streamline your document-centric processes today.

How to adjust and eSign Quitclaim Deed From Husband And Wife To LLC Illinois with ease

- Obtain Quitclaim Deed From Husband And Wife To LLC Illinois and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form—via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing additional copies. airSlate SignNow meets your needs in document management with just a few clicks from your device of choice. Edit and eSign Quitclaim Deed From Husband And Wife To LLC Illinois while ensuring excellent communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is a Quitclaim Deed From Husband And Wife To LLC in Illinois?

A Quitclaim Deed From Husband And Wife To LLC in Illinois is a legal document that allows married couples to transfer their shared ownership interest in a property to a limited liability company (LLC). This type of deed offers a quick and straightforward way to convey property rights without warranties, making it popular among couples entering business partnerships.

-

How do I create a Quitclaim Deed From Husband And Wife To LLC in Illinois?

To create a Quitclaim Deed From Husband And Wife To LLC in Illinois, you will need to gather information about the property, both spouses' names, and the LLC details. Using an online document service like airSlate SignNow can simplify this process, ensuring compliance with state legal requirements for a valid deed.

-

What are the benefits of using airSlate SignNow for a Quitclaim Deed From Husband And Wife To LLC in Illinois?

Using airSlate SignNow to complete a Quitclaim Deed From Husband And Wife To LLC in Illinois streamlines the signing process, allowing both parties to eSign the document securely and efficiently. This eliminates the need for paper documents and physical meetings, saving time and reducing errors.

-

Are there any costs associated with filing a Quitclaim Deed From Husband And Wife To LLC in Illinois?

Yes, there are costs associated with filing a Quitclaim Deed From Husband And Wife To LLC in Illinois, which may include recording fees charged by the county recorder's office. Additionally, using airSlate SignNow may come with subscription or per-document fees, but the ease of use often justifies the investment.

-

Can I modify the Quitclaim Deed From Husband And Wife To LLC in Illinois after signing?

Once a Quitclaim Deed From Husband And Wife To LLC in Illinois is signed and recorded, it becomes a public document. To make any changes, you typically need to execute a new deed unless the original deed specifically allows for amendments under certain conditions.

-

What information is needed on the Quitclaim Deed From Husband And Wife To LLC in Illinois?

A Quitclaim Deed From Husband And Wife To LLC in Illinois should include the names and addresses of the grantors (the spouses), the LLC's name, a legal description of the property, and the date of transfer. It's essential to ensure that all details are accurate to avoid legal complications.

-

Is legal assistance required to complete a Quitclaim Deed From Husband And Wife To LLC in Illinois?

While it's possible to draft a Quitclaim Deed From Husband And Wife To LLC in Illinois without legal assistance, consulting with an attorney is recommended for first-time filers. Legal experts can provide guidance on ensuring compliance with state laws and protect your interests in the transaction.

Get more for Quitclaim Deed From Husband And Wife To LLC Illinois

Find out other Quitclaim Deed From Husband And Wife To LLC Illinois

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- How Can I Sign Arizona Banking Form

- Can I Sign Colorado Banking PPT

- How Do I Sign Idaho Banking Presentation

- Can I Sign Indiana Banking Document

- How Can I Sign Indiana Banking PPT

- How To Sign Maine Banking PPT

- Help Me With Sign Massachusetts Banking Presentation

- Can I Sign Michigan Banking PDF