Financial Account Transfer to Living Trust Illinois Form

What is the Financial Account Transfer To Living Trust Illinois

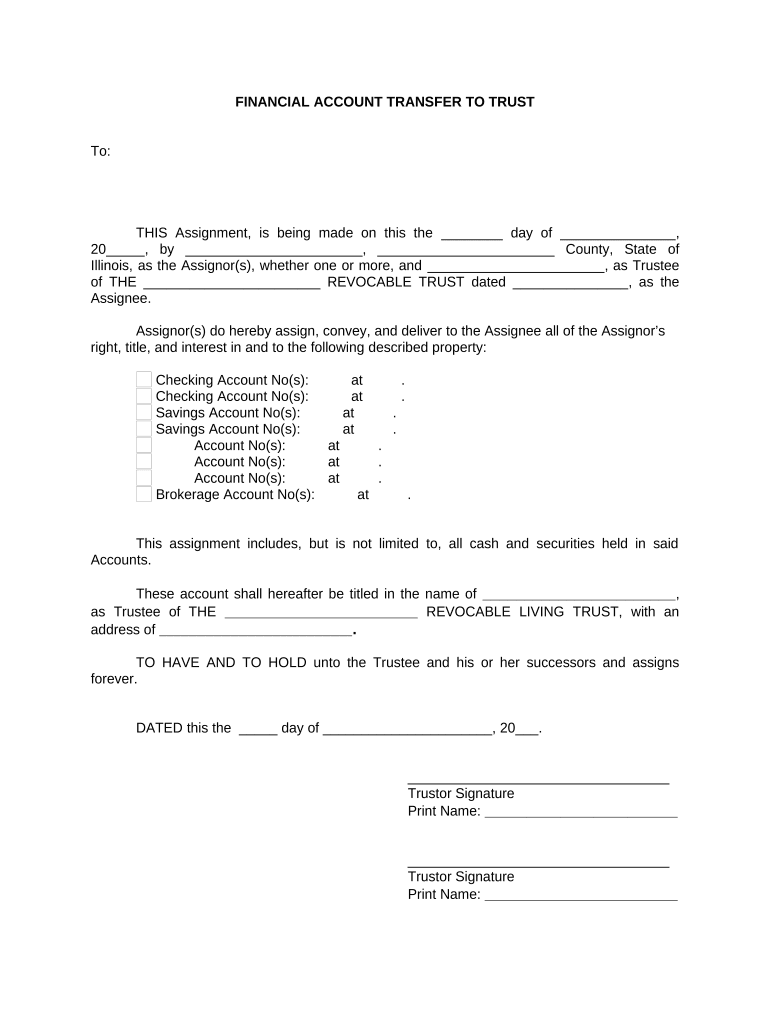

The Financial Account Transfer To Living Trust Illinois is a legal document used to transfer ownership of financial accounts into a living trust in the state of Illinois. This process allows individuals to manage their assets during their lifetime and ensure a smoother transition of those assets to beneficiaries upon their death. By transferring financial accounts, such as bank accounts, investment accounts, and retirement accounts, into a living trust, individuals can avoid probate, maintain privacy, and provide clear instructions for asset distribution.

Steps to complete the Financial Account Transfer To Living Trust Illinois

Completing the Financial Account Transfer To Living Trust Illinois involves several important steps to ensure that the transfer is executed correctly. Here are the key steps:

- Review the living trust document to confirm it is valid and up to date.

- Gather all relevant financial account information, including account numbers and financial institution details.

- Contact each financial institution to inquire about their specific requirements for transferring accounts to a living trust.

- Complete any necessary forms provided by the financial institutions, which may include a specific transfer form or a copy of the trust document.

- Submit the completed forms along with any required documentation to the financial institutions.

- Confirm the transfer has been processed by checking account statements or contacting the institutions directly.

Legal use of the Financial Account Transfer To Living Trust Illinois

The legal use of the Financial Account Transfer To Living Trust Illinois is grounded in state law, which recognizes living trusts as valid estate planning tools. For the transfer to be legally binding, it must comply with Illinois laws regarding trusts and estate planning. This includes ensuring that the trust document is properly executed, signed, and notarized if required. Additionally, the financial institution must accept the transfer, which often involves providing them with a copy of the trust document and any specific forms they require.

State-specific rules for the Financial Account Transfer To Living Trust Illinois

In Illinois, specific rules govern the transfer of financial accounts to a living trust. These include:

- The trust must be revocable and created while the individual is alive.

- All parties involved must have the legal capacity to enter into the trust agreement.

- The trust document must clearly outline the terms of the trust and the assets included.

- Financial institutions may have their own policies regarding the transfer process, which must be followed.

Required Documents

To complete the Financial Account Transfer To Living Trust Illinois, several documents are typically required:

- A copy of the living trust document.

- Completed transfer forms from each financial institution.

- Identification documents, such as a driver's license or passport, to verify identity.

- Any additional documentation requested by the financial institutions.

Examples of using the Financial Account Transfer To Living Trust Illinois

Examples of using the Financial Account Transfer To Living Trust Illinois include:

- Transferring a personal checking account into the living trust to ensure funds are managed according to the trust's terms.

- Moving investment accounts, such as brokerage accounts, to facilitate easier management and distribution of assets.

- Including retirement accounts, like IRAs, in the trust to avoid probate and provide clear instructions for beneficiaries.

Quick guide on how to complete financial account transfer to living trust illinois

Effortlessly Prepare Financial Account Transfer To Living Trust Illinois on Any Gadget

Digital document management has gained popularity among both businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can access the necessary forms and securely store them online. airSlate SignNow provides all the tools required to quickly create, modify, and eSign your documents without delays. Manage Financial Account Transfer To Living Trust Illinois on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

How to Modify and eSign Financial Account Transfer To Living Trust Illinois with Ease

- Locate Financial Account Transfer To Living Trust Illinois and click Get Form to begin.

- Utilize the tools available to complete your document.

- Highlight important sections of the documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or errors that require printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from your preferred device. Modify and eSign Financial Account Transfer To Living Trust Illinois and ensure effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

People also ask

-

What is the process for Financial Account Transfer To Living Trust in Illinois?

The process for Financial Account Transfer To Living Trust in Illinois typically starts by creating a trust document that outlines the terms of the trust. Once the trust is established, assets, including financial accounts, must be retitled in the name of the trust. Using services like airSlate SignNow can make the document preparation and signing process simpler and more efficient.

-

How much does it cost to transfer financial accounts to a living trust in Illinois?

The costs associated with Financial Account Transfer To Living Trust in Illinois can vary based on the complexity of your trust and the financial institutions involved. Some trust creation services may charge a flat fee, while others may charge hourly. Additionally, using airSlate SignNow for document signing and management can signNowly reduce costs through its affordable pricing plans.

-

What benefits does creating a living trust provide in Illinois?

Creating a living trust in Illinois offers several benefits, including asset protection, avoiding probate, and providing for a seamless financial account transfer. A living trust can ensure that your financial accounts are managed according to your wishes, even if you become incapacitated. Utilizing airSlate SignNow can streamline the documentation process for greater convenience.

-

Can I use airSlate SignNow for Financial Account Transfer To Living Trust in Illinois?

Yes, airSlate SignNow is a great tool for Financial Account Transfer To Living Trust in Illinois. It allows you to easily prepare, sign, and manage all necessary documents securely. By using airSlate SignNow, you can ensure that your trust documents are handled professionally, quickly, and in compliance with Illinois law.

-

What documents are needed for Financial Account Transfer To Living Trust in Illinois?

To complete a Financial Account Transfer To Living Trust in Illinois, you will typically need the trust document, financial account statements, and potentially aCertificate of Trust. These documents will provide the necessary proof to establish that the accounts are now part of the living trust. airSlate SignNow can help you organize and manage these documents efficiently.

-

How long does it take to complete a Financial Account Transfer To Living Trust in Illinois?

The duration for completing a Financial Account Transfer To Living Trust in Illinois can vary. Generally, once you have all the required documents prepared, the transfer may take just a few days to weeks depending on the financial institutions involved. Using airSlate SignNow can expedite the process by enabling quick e-signature and document exchange.

-

Are there any tax implications of transferring financial accounts to a living trust in Illinois?

Generally, transferring financial accounts to a living trust in Illinois does not trigger any immediate tax implications as it is considered a change of ownership or title. However, it's important to consult a tax professional to understand any potential long-term effects. Utilizing airSlate SignNow to keep your documentation in order can facilitate discussions with your tax advisor.

Get more for Financial Account Transfer To Living Trust Illinois

- Registration form penn state world campus worldcampus psu

- Staff communication log portal alliesnj org form

- Inc 12 form

- Dl 410 fo form

- Parent taught drivers ed packet pdf 448577352 form

- Binary covalent compounds form

- 212 3 offeror representations and form

- Form or 20 ins oregon insurance excise tax return

Find out other Financial Account Transfer To Living Trust Illinois

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile

- eSignature Courts Word Oregon Secure

- Electronic signature Indiana Banking Contract Safe

- Electronic signature Banking Document Iowa Online

- Can I eSignature West Virginia Sports Warranty Deed

- eSignature Utah Courts Contract Safe